Donald Trump therefore won the presidential election on Tuesday, November 5 and he will become the 47th President of the United States on January 20 for a 4-year term. The latter should support the bull run as Donald Trump has positioned himself in favor of cryptocurrencies. But be careful, there are certain nuances to be made.

On paper, Donald Trump's victory is favorable to Bitcoin

Throughout his electoral campaign, Donald Trump had a widely assumed pro-crypto position to address directly the 50 million Americans who hold crypto.

Bitcoin strategic reserve, dismissal of Gary Gensler (head of the SEC), relaxation of regulation and taxation linked to the crypto market, BTC mining in the United States, so many factors that made Bitcoin a “Trump Trade”.

Added to this is the fact that Donald Trump surrounded himself with political and economic figures promoting Bitcoin like Republican MP Patrick McHenry, Senator Cynthia Lummis and Mick Mulvaney, Trump's former acting chief of staff.

But above all they are Elon Musk, Robert Kennedy Jr and JD Vance who push the most in favor of BTC and cryptocurrencies.

👉 What are the best sites to buy Bitcoin?

Soon to take on leading political responsibilities, these men will clearly contribute to keeping Trump in a pro-Bitcoin position, which will be a major basis for the bull run expected for most of 2025.

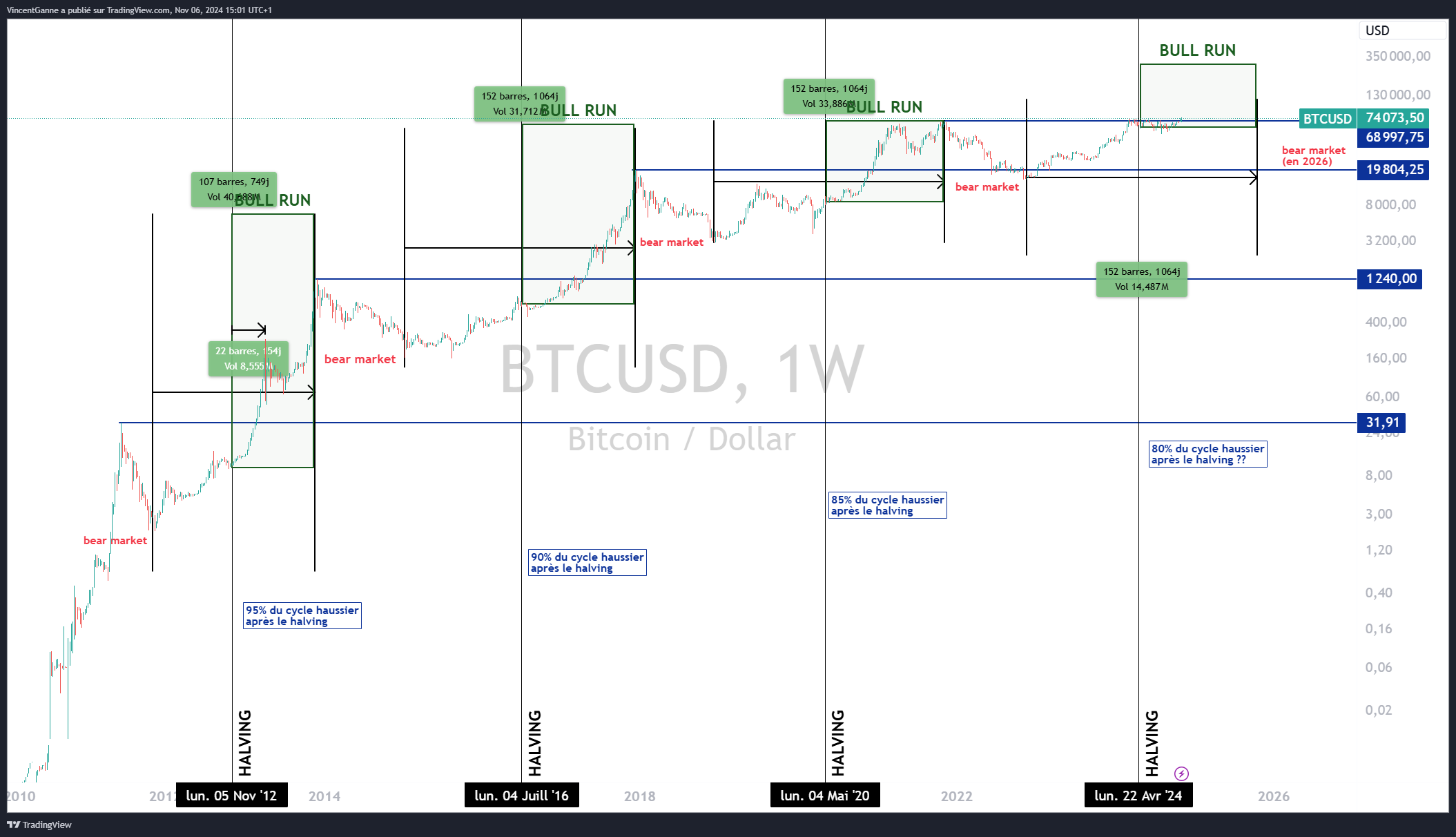

The price of Bitcoin is in fact starting this fall the last phase of its 4-year cycle, the so-called bull run which should see it succeed in clearly exceeding its old historical record.

As far as I am concerned, the target of $200,000 seems to me to be the minimum target to consider for the end of 2025.

So much for the market view over the next 12 months. On the other hand, caution in the short term, it is imperative to achieve a bullish break of the ATH of 73,700 dollars at the daily close to give the bullish signal.

Chart that outlines the 4-year cycle of Bitcoin from its origins to today. My target of $200,000 is planned for October 2025

Chart that outlines the 4-year cycle of Bitcoin from its origins to today. My target of $200,000 is planned for October 2025

🎥 Watch Vincent Ganne’s analysis in video:

Be careful, there are nevertheless nuances that could slow down Bitcoin

Tax cuts, widening budget deficit, trade war with China and Europe… These prospects combined under the next presidency of Donald Trump may represent a risk for Bitcoin and especially for altcoins, due to market correlations.

A second wave of inflation could begin with an upward impact on interest rates and the dollar, and a real threat to the continuation of rate cuts by the United States Federal Reserve.

If the Fed does not extend its rate cuts in 2025 due to the effects of the Trump Administration's fiscal and trade policy, this will be a brake on bitcoin's bull run and above all a real obstacle for altcoins. We must therefore keep the trend in market interest rates under close surveillance because a rise in the 10-year US bond (see graph below) to 5% would be a downward factor for altcoins.

📈 You want to have Vincent Ganne's trading opinion on Bitcoin every morning as well as his best configurations on altcoins, then join the professional Cryptoast Research service! Satisfied or refunded for 15 days, so don't hesitate!

Bitpanda: receive €50 bonus in BTC by creating an account

Chart showing the 10-year US bond rate in daily Japanese candles

Chart showing the 10-year US bond rate in daily Japanese candles

Would you like to have Vincent Ganne's trading opinion on Bitcoin every morning as well as his best configurations on altcoins?

Then join the Cryptoast Academy professional service! You will learn how to position yourself on strategic price levels, spot investment opportunities and anticipate price movements. Join this premium community now and take charge of your crypto investments. Satisfied or refunded for 14 days so don't hesitate any longer!

Bitpanda: receive €50 bonus in BTC by creating an account

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.