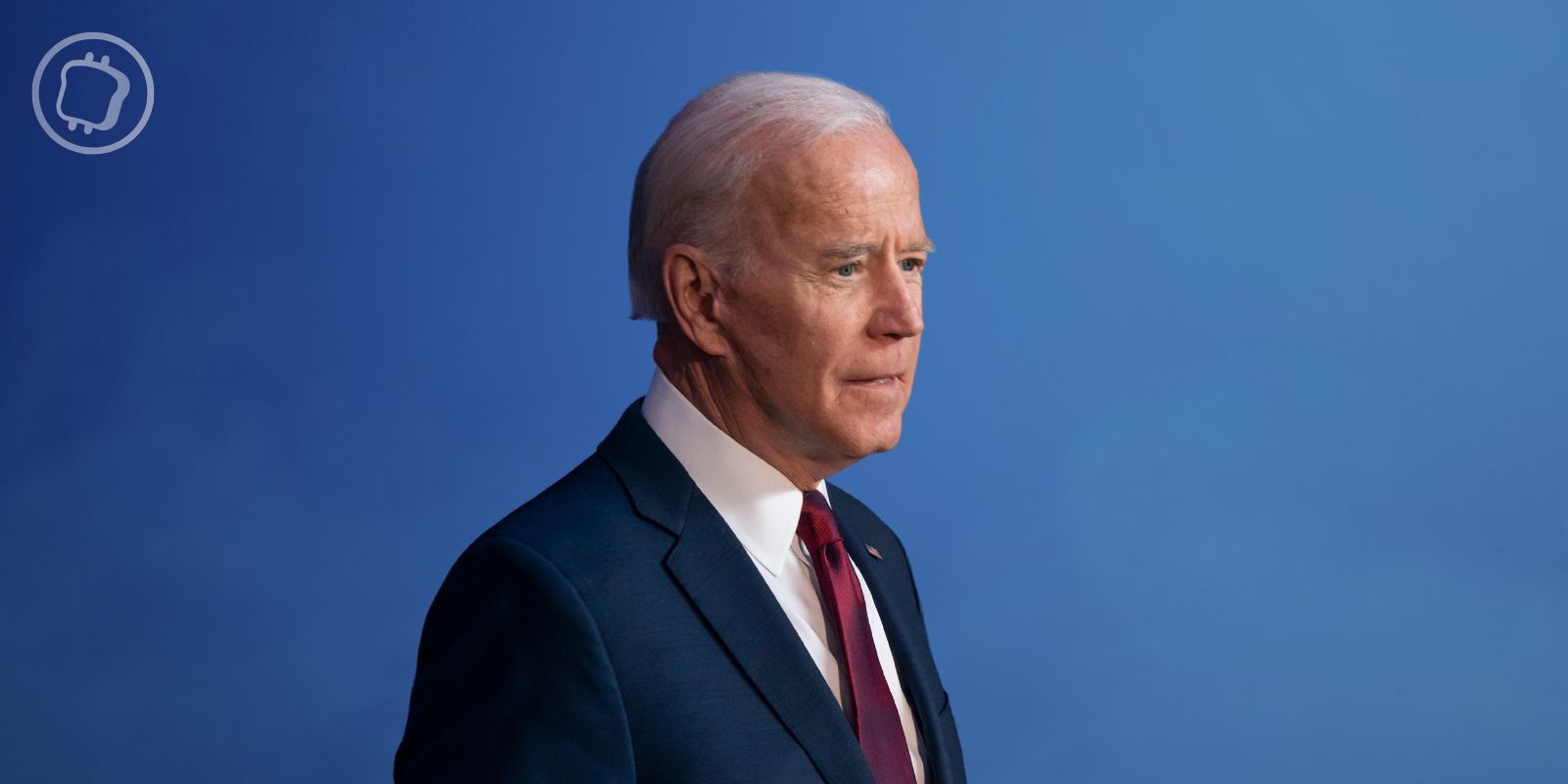

On the sidelines of the G7 in Hiroshima, Joe Biden expressed disconcerting remarks on cryptocurrencies, creating an amalgam with the debt of the United States. We put this quote in context, and take stock of the US government’s strained debt situation.

Joe Biden points the finger at “crypto traders”

During a speech Sunday on the sidelines of the G7 in Hiroshima, Joe Biden, the President of the United States, uttered a phrase that questioned the cryptocurrency ecosystem :

“And I’m not going to accept a deal that protects wealthy tax cheats and crypto traders, while jeopardizing food aid for nearly a hundred, excuse me, nearly a million Americans.” »

Taking this quote out of context, we might think he was referring to regulatory issues, but the subject is actually quite different. In effect, the agreement in question relates to the American debtand the speech preceded a discussion he was to have with Speaker of the House of Representatives Kevin McCarthy.

For its part, the Republican Party would like to see US debt ceiling to be raised. Joe Biden opposes it, and has therefore supported his argument by mixing the tax breaks of the oil industry, the excesses of the pharmaceutical industry, the cuts of posts in the public service and the previous quote.

👉 To go further — Find our guide to buying Bitcoin (BTC)

Buy crypto on eToro

🎧 Listen to this article and all other crypto news on Spotify

Where do cryptocurrencies fit into all of this?

The amalgam and the sophism are common tools in politics : the speaker exposes a fact or an element that has no connection with the subject of his speech, and twists this in such a way as to establish a causality.

The thing is, cryptocurrency traders here have absolutely nothing to do with some Americans’ need for food aid, and even less with the debt of the United States. About the debt, the latter has been climbing almost exponentially for 40 years now in the country.

Over the last 25 years, the graph below shows an increase of around 40%, just since the Covid-19 pandemic, currently valuing the debt at nearly $31.458 billion. And for good reason, the unit used here is not the dollar, but the million dollars:

United States government debt in millions of dollars

It is then appropriate to to question the relevance of reporting cryptocurrencies to such a subject. This thus speaks to the US government’s position on digital assets.

Regarding this debt, if an agreement is not reached by June 1, the United States could theoretically find itself in default of payment, a possibility for which Joe Biden wanted to be reassuring:

“America has never defaulted, never defaulted on its debt, and it never will. »

Indeed, all that is needed is for Congress to raise this debt ceiling year after year as is the trend, allowing the government to borrow almost unlimitedly.

👉 Also in the news — United States: 2 presidential candidates accept Bitcoin (BTC) donations

Our service dedicated to cryptocurrency investors. Get real-time analytics and optimize your crypto portfolio.

Sources: White House, Trading Economics

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.