MiCA, like all regulations in France, does not have a good press. However, for our friends across the Atlantic, this is the strength of Europe. JPMorgan analysts expect to see euro-based stablecoins take off thanks to this regulatory framework that puts them forward.

JPMorgan provides positive analysis of the MiCA regulation for European companies

While the MiCA regulation is the subject of strong criticism in France and Europe, JPMorgan analysts offer a different perspective. According to them, MiCA is the “ first global regulatory framework for cryptocurrency markets in the world “.

This reading can be easily explained. In the United States, companies have dream of such legislation. Often, in the field of industry and tech, Europe is ironically recognized as the economic zone that “ regulates the fastest “, when China and the United States innovate and produce multi-trillion dollar businesses.

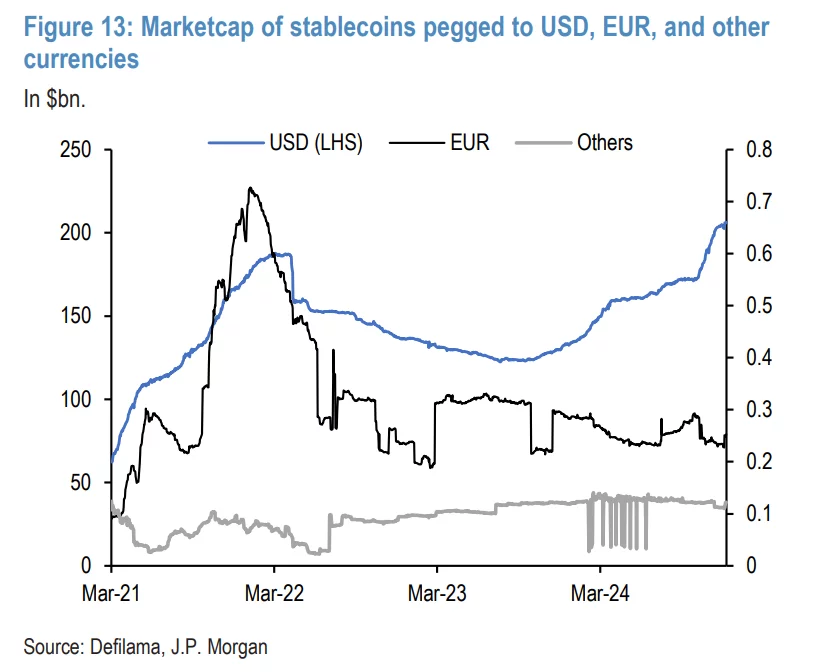

Market capitalizations of stablecoins indexed to the euro, dollar and other currencies. The dominance of the dollar is obvious.

Market capitalizations of stablecoins indexed to the euro, dollar and other currencies. The dominance of the dollar is obvious.

While it is true that Europe has not really exploited this advantage to take the lead in the race for cryptos, this comprehensive framework could nevertheless prove to be an advantage for companies in the Old Continent.

This is what the investment bank JPMorgan notes in a research report intended for its clients.

📈 Discover the crypto trends of the year 202

With MiCA, only compliant stablecoins can be used on regulated markets. Which is not a constraint for individuals, who can easily access DEXs, is on the other hand a condition sine qua non for institutional investors, who should provide hundreds of billions in the market over the next few years.

The balance of power between the undisputed leader of the stablecoin market, Tether (USDT), and its rivals would already be changingnotes JPMorgan:

[MiCA] has allowed regulated stablecoins, like Circle's EURC, to gain power, while non-compliant stablecoins, like Tether's EURT, face a challenge.

In particular because of an obligation of MiCA towards stablecoin issuers: that of “ maintain healthy reserves in EU-based banks and obtain trading licenses “, which Tether refused to do.

The company behind USDT had to suspend its stablecoin EURT and initiate the withdrawal of USDT from regulated exchanges in Europelike Binance and Coinbase. As for EURT, it represents only a tiny fraction of Tether's business, with a market capitalization of just $36 million and a daily volume that rarely exceeds a million.

Open an account on Binance, the world's #1 crypto platform

With MiCA, the advent of a European stablecoin champion?

More generally, this blockage in Europe does not represent a big problem for Tether whose main activity is located in Asia, notes JPMorgan. Additionally, the company has already taken the lead by investing in companies regulated under MiCA, such as Quantoz Payment, which guarantees it to keep a foothold in Europe, even indirectly.

Although this will not change the fate of Tether, MiCA should still have a positive impact for businesses and European stablecoins. For example ” Oddo BHF SCA, Revolut, Deutsche Bank and BBVA which, in collaboration with Visa, is studying the possibility of creating a euro stablecoin “.

🟥 Faustine Fleuret and William O'Rorke explain how MiCA will shake up Europe

France could also do well with Société Générale FORGEWho ” has already launched the stablecoin EURCV for retail investors on public blockchains, such as ethereum, and is planning launches on other blockchains. »

To conclude, JPMorgan points out that the short-term obstacles imposed by MiCA are likely to become long-term advantages:

Although MiCA involves higher compliance costs, its long-term impact on cryptocurrency markets is expected to be positive by providing regulatory clarity, attracting institutional investors, and incentivizing the use of cryptocurrency-pegged stablecoins. euro.

Coinbase: register on the most famous crypto exchange in the world

Source: JPMorgan

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital