This post is an excerpt from our 2024 Geography of Cryptocurrency Report. Download your copy now!

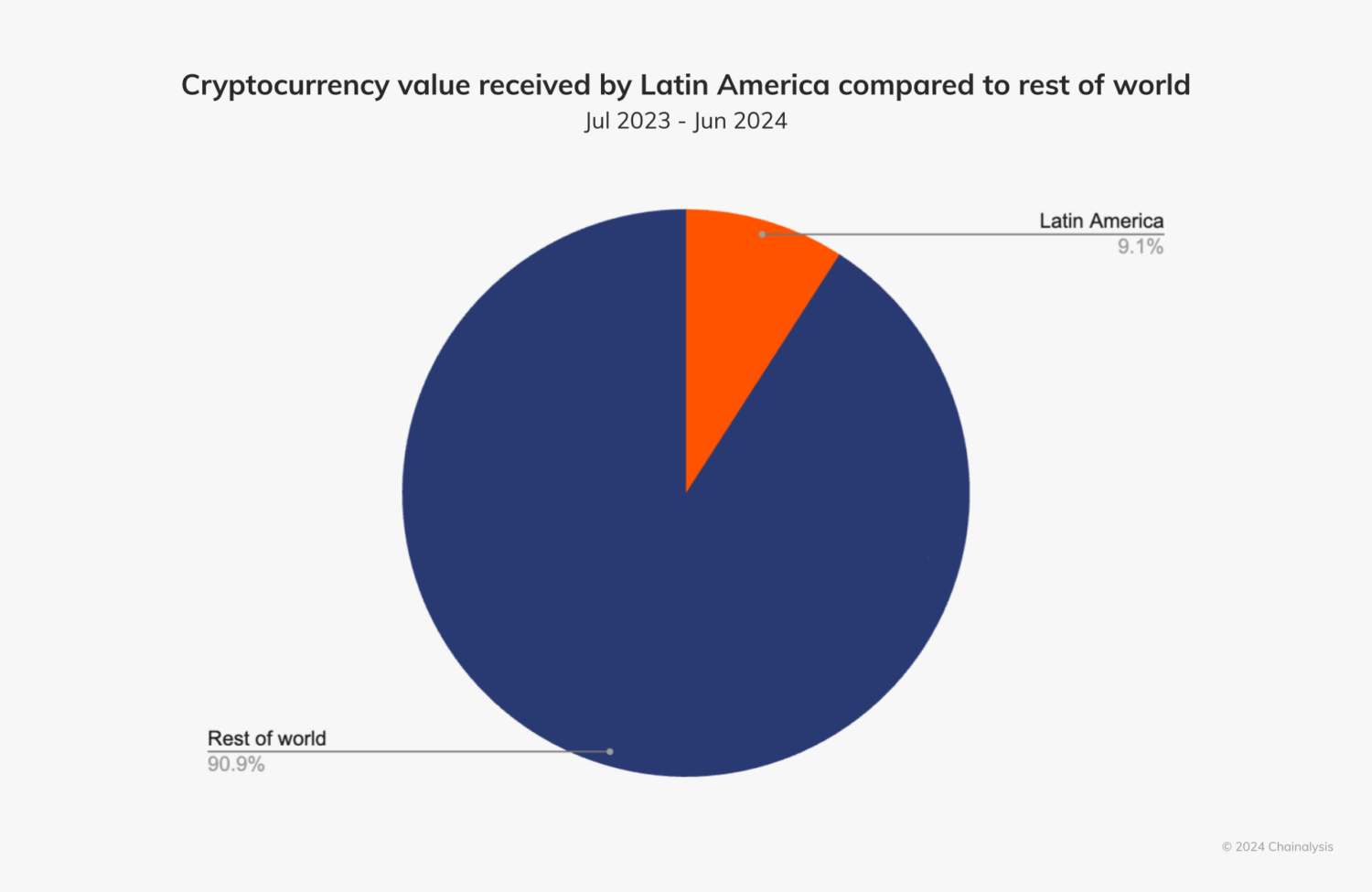

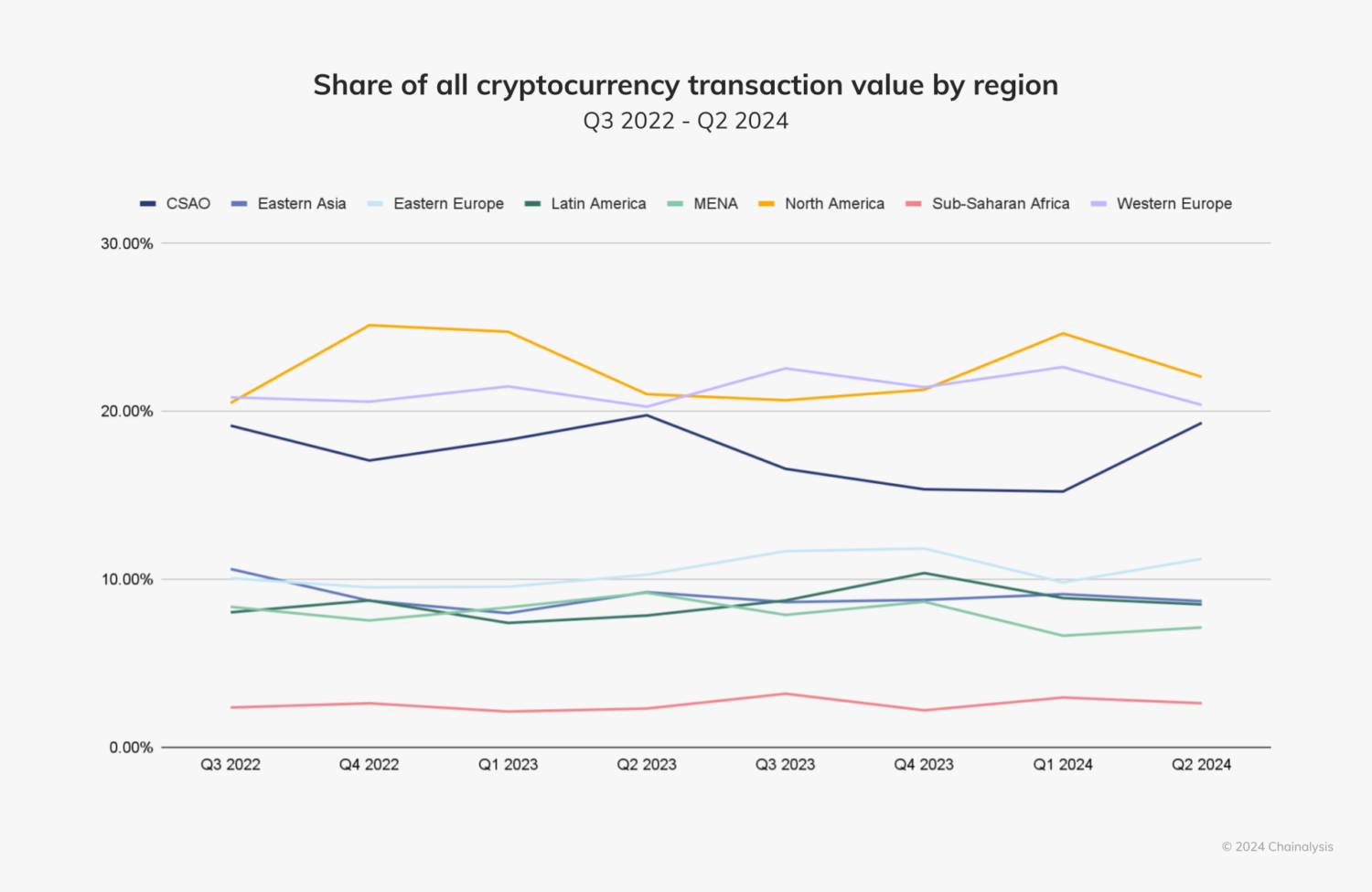

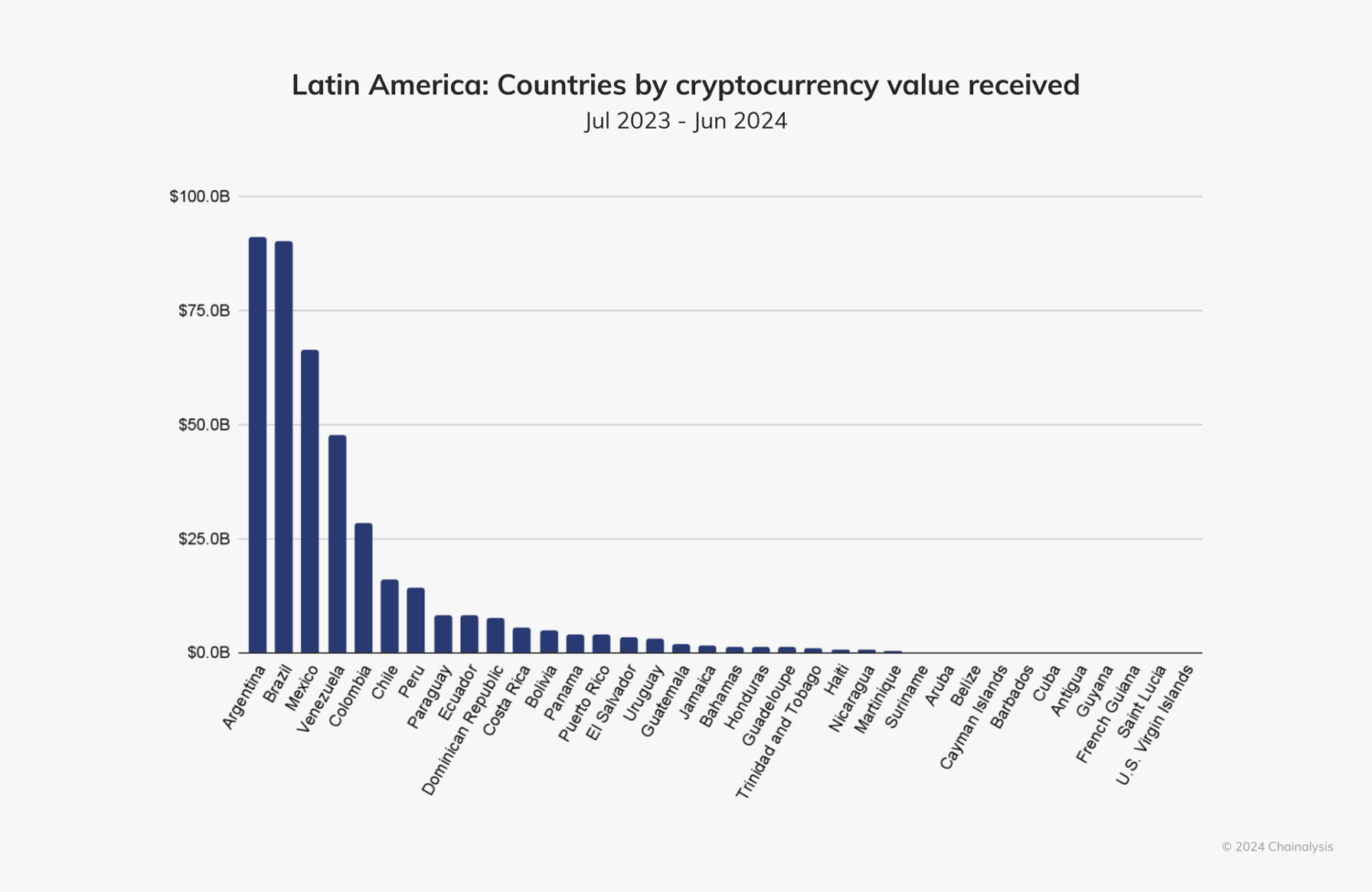

Latin America is the fifth largest region we study, representing 9.1% of cryptocurrency value received between July 2023 and June 2024. During this time period, the region received nearly $415 billion in cryptocurrency, placing it slightly above Eastern Asia.

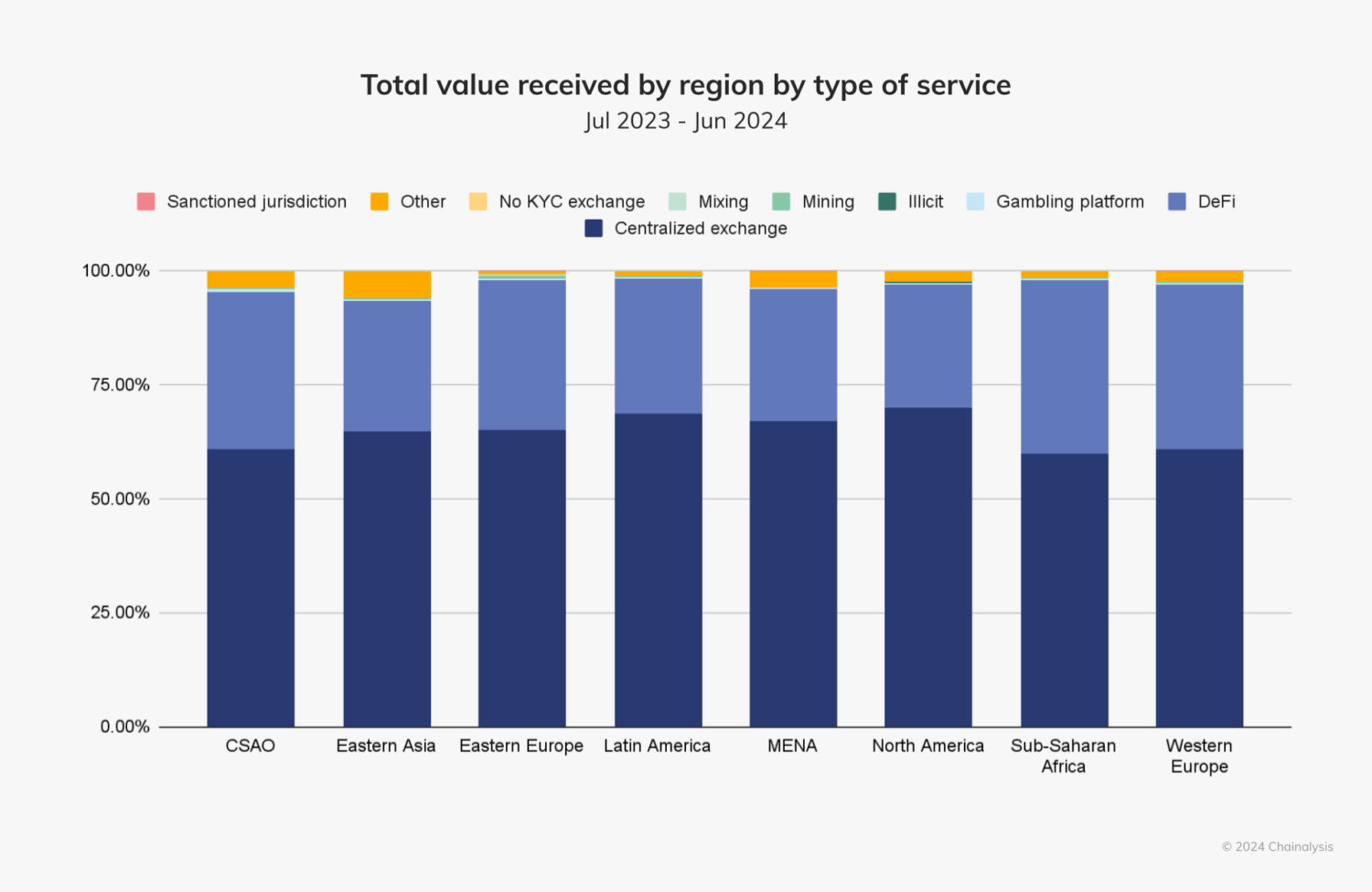

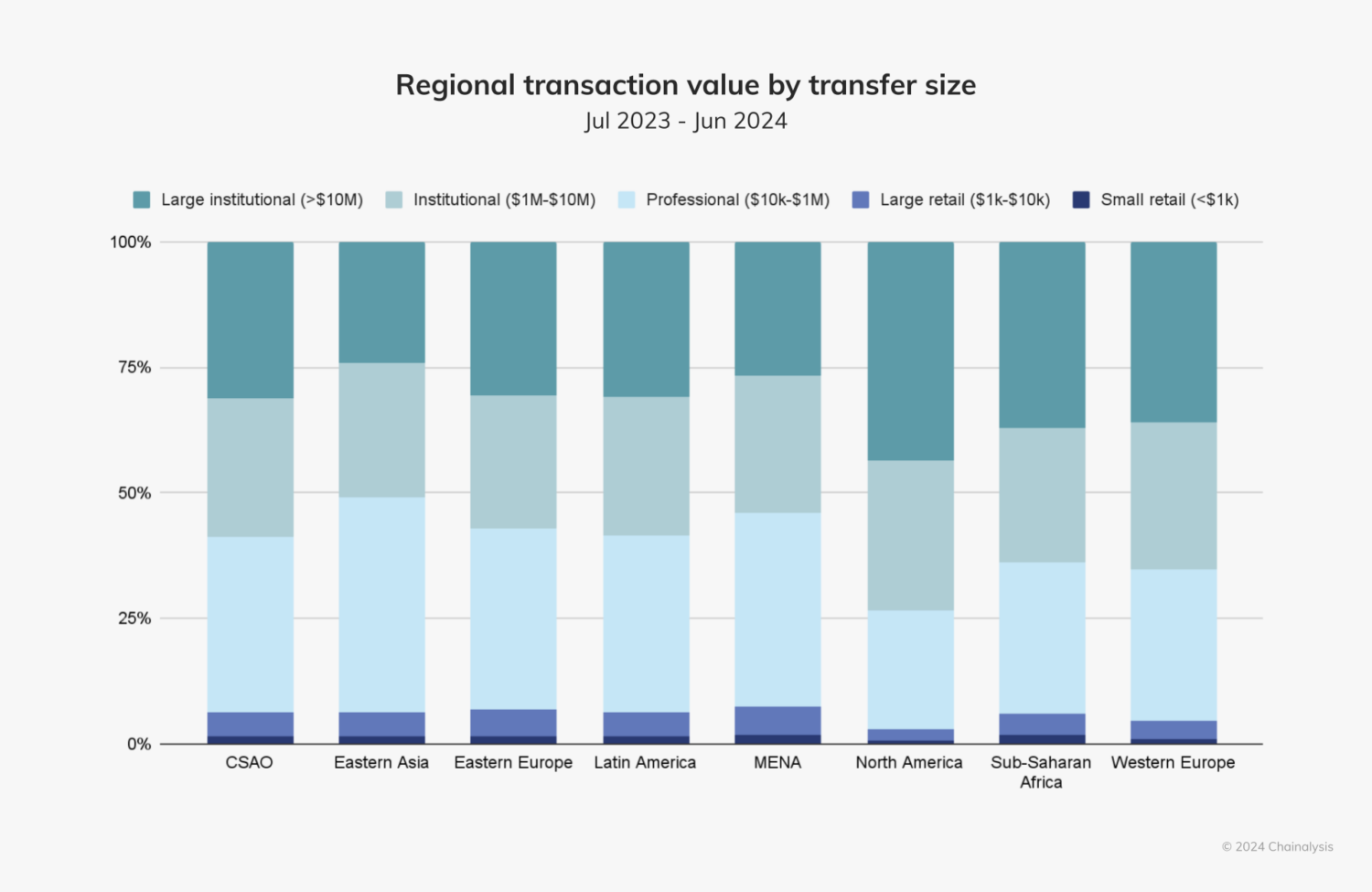

Centralized exchanges (CEXs) are the most popular service used by Latin Americans, at 68.7% — slightly behind CEX use in North America. Regional transaction value in Latin America is primarily driven by institutional and professional investors (i.e. entities transacting more than $10,000).

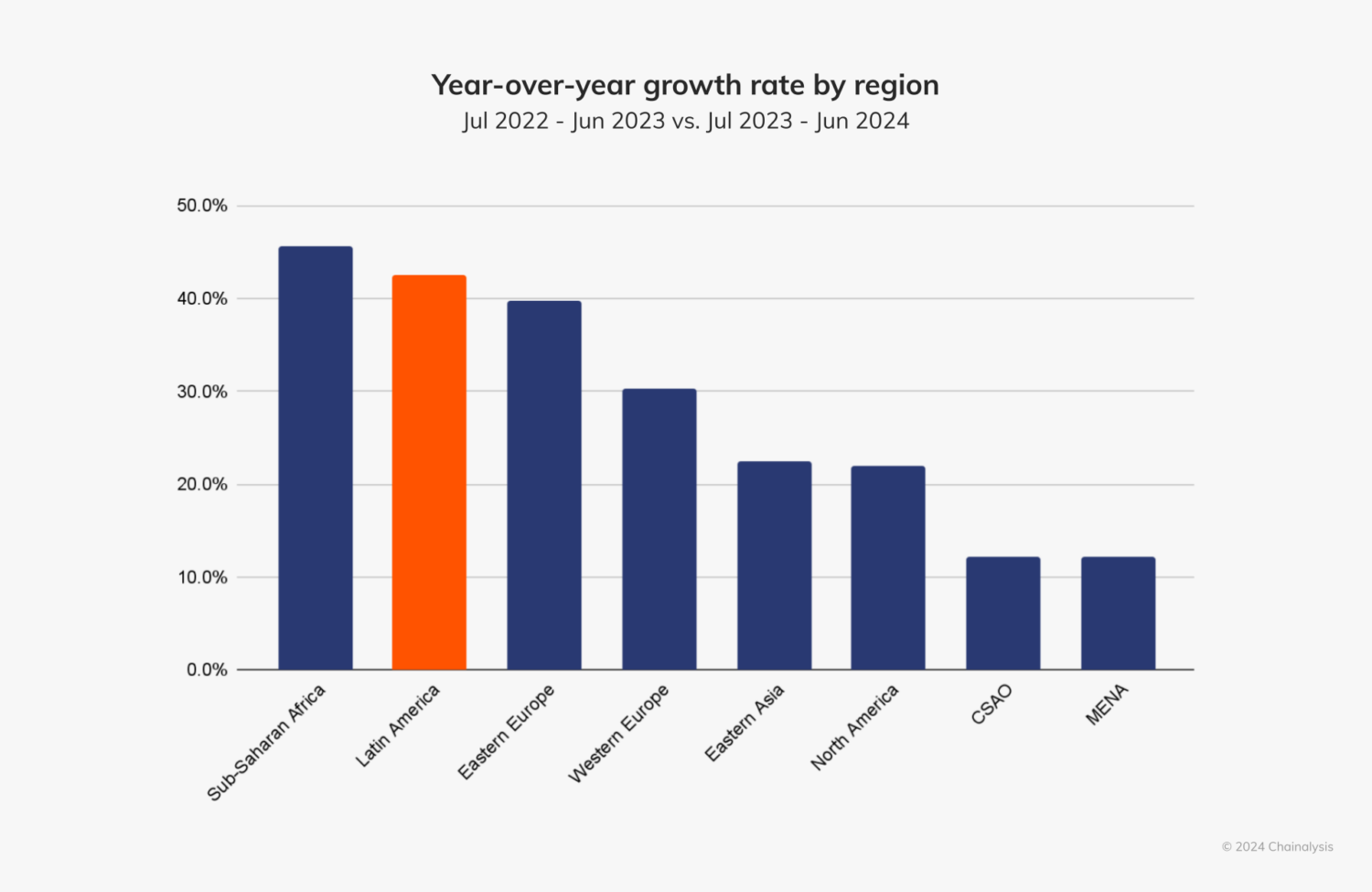

Latin America is the second fastest growing region we study this year, with a year-over-year (YoY) growth rate of approximately 42.5%. As we will explore later, much of this growth has been driven by strong — but decidedly diverse — crypto markets in Venezuela, Argentina, and Brazil.

Argentina leads the region in terms of cryptocurrency value received at an estimated $91.1 billion, only slightly ahead of Brazil’s estimated $90.3 billion.

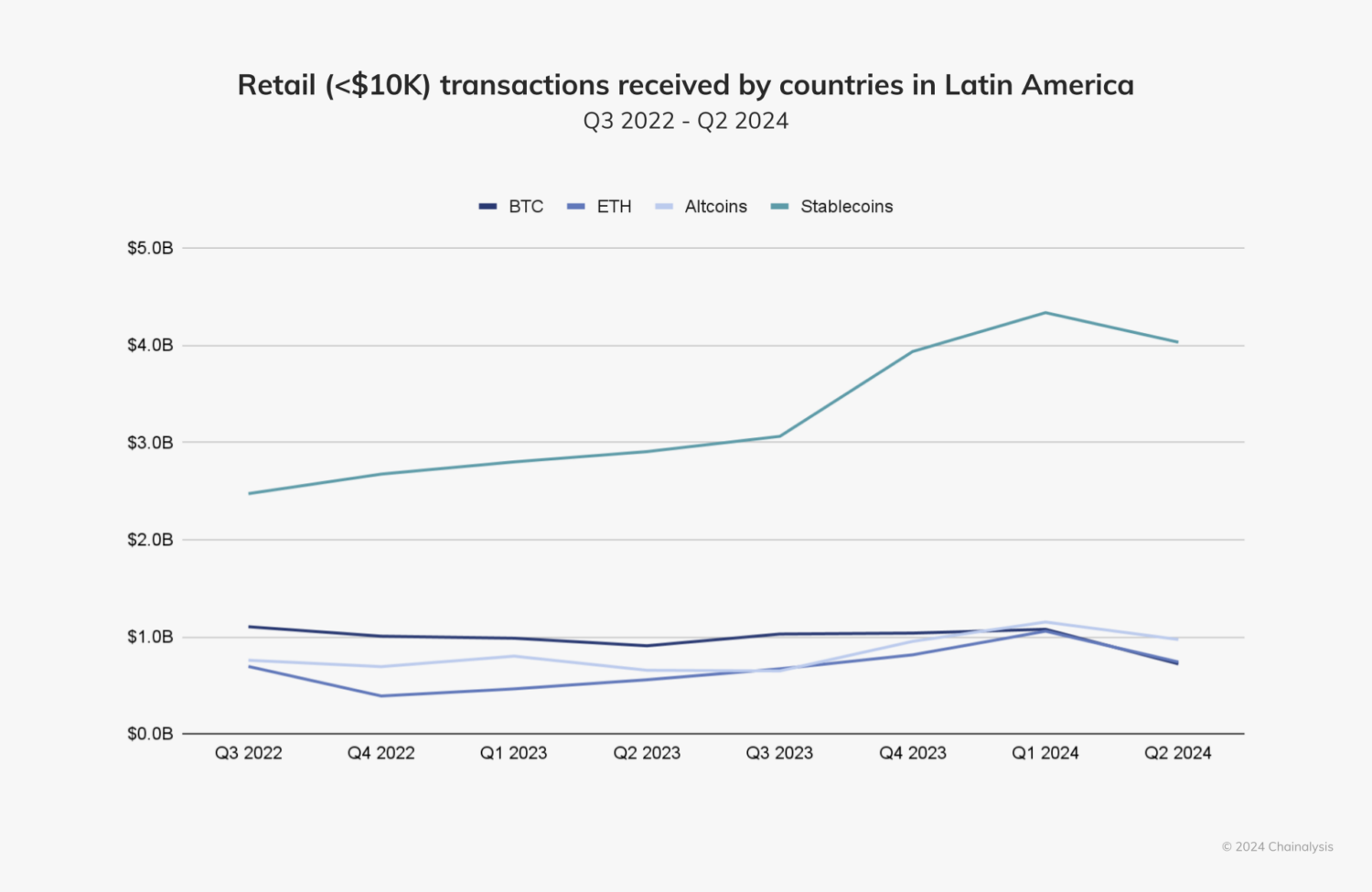

In our Global Adoption Index, four of the top 20 countries are in Latin America: Brazil (9), Mexico (13), Venezuela (14), and Argentina (15). As we will explore in detail below, stablecoin-based remittances are gaining traction in these countries, as well as across Latin America as a whole.

Brazil’s institutional crypto activity suggests renewed interest by major financial entities

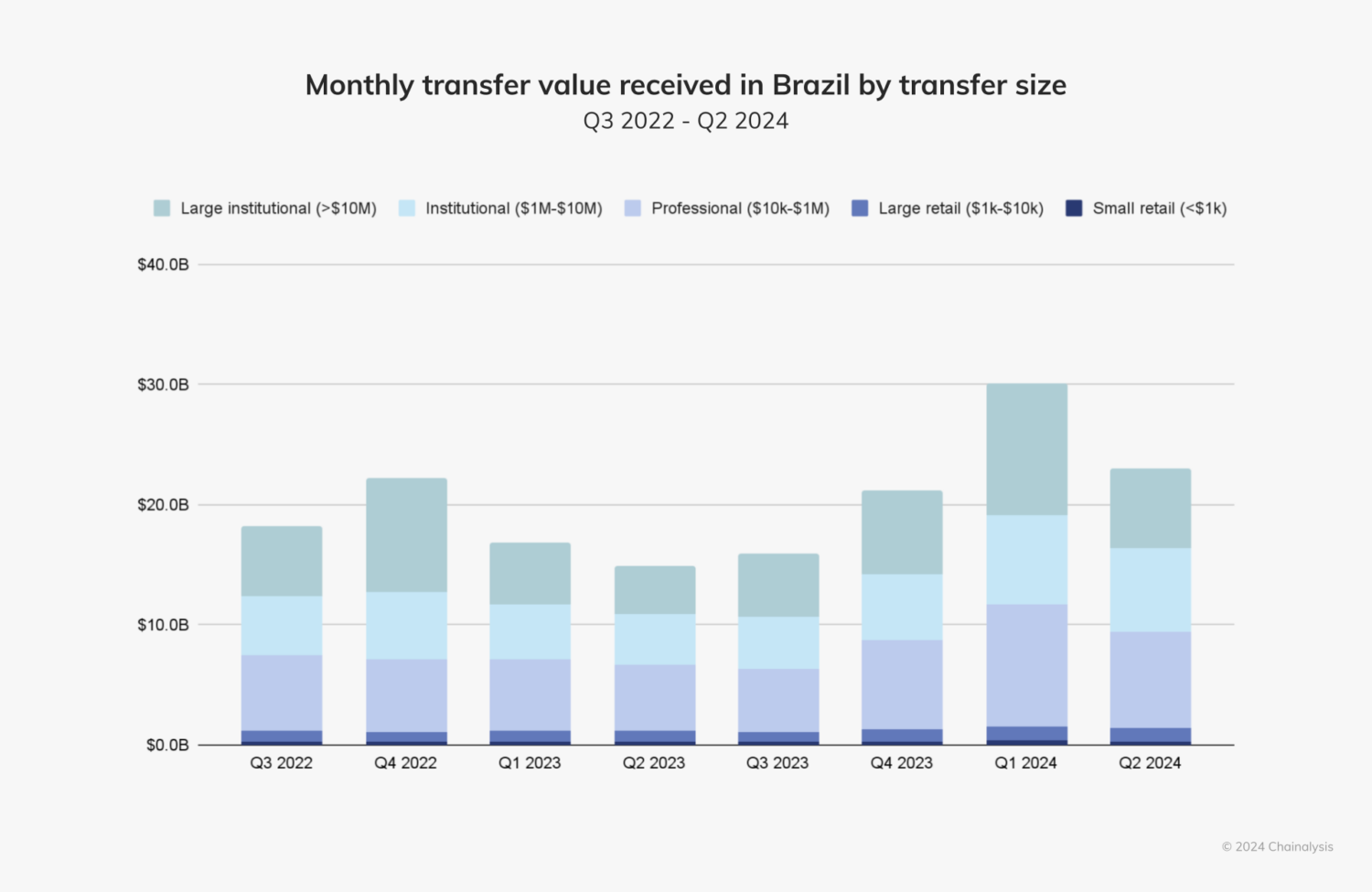

In last year’s Geos report, we noted that, despite Brazil’s historically well-developed institutional crypto market, institutional activity declined in early 2023, which likely coincided with the global crypto bear market. But this trend reversed in the middle of the year and has since increased, suggesting renewed interest by major financial entities. For instance, the monthly value of institutional-sized transactions (i.e. greater than $1 million) increased by approximately 29.2% between the last two quarters of 2023, and approximately 48.4% between Q4 of 2023 and Q1 of 2024.

We spoke to André Portilho, Head of Digital Assets at investment bank BTG Pactual, to learn more about the factors driving this institutional activity. “One key factor is the diversification of portfolios, particularly as the market matures. Investors are increasingly integrating digital assets into their asset allocation strategies, viewing them as valuable alternative investments that offer the potential for enhanced returns. The consolidation of Bitcoin and other cryptocurrencies as established investment options has been crucial in this shift,” he explained. “The notable recovery of institutional activity in crypto assets in Brazil can be partially attributed to regulatory evolution and the entry of American institutions into the cryptocurrency market, especially with the introduction of Bitcoin and Ethereum ETFs.”

Aaron Stanley, Founder of Brazil Crypto Report, a newsletter and podcast that explores the latest trends in the Brazilian crypto ecosystem, noted similar trends in Brazil’s embrace of crypto. “The ecosystem has matured quite significantly. We’ve seen several TradFi banks launch crypto brokerage products (Itaú, the country’s largest bank, for example), and most of the other majors are actively building their own similar products. We saw major global exchanges, such as OKX and Coinbase, hard launch in the country, complete with local teams and entities. The Drex pilot program — a hybrid CBDC/smart contract platform being developed by Brazil’s central bank — has also prompted TradFi banks to be much more forward thinking in their digital asset strategies. This has had downstream benefits on these institutions and their clients as it pertains to crypto adoption.”

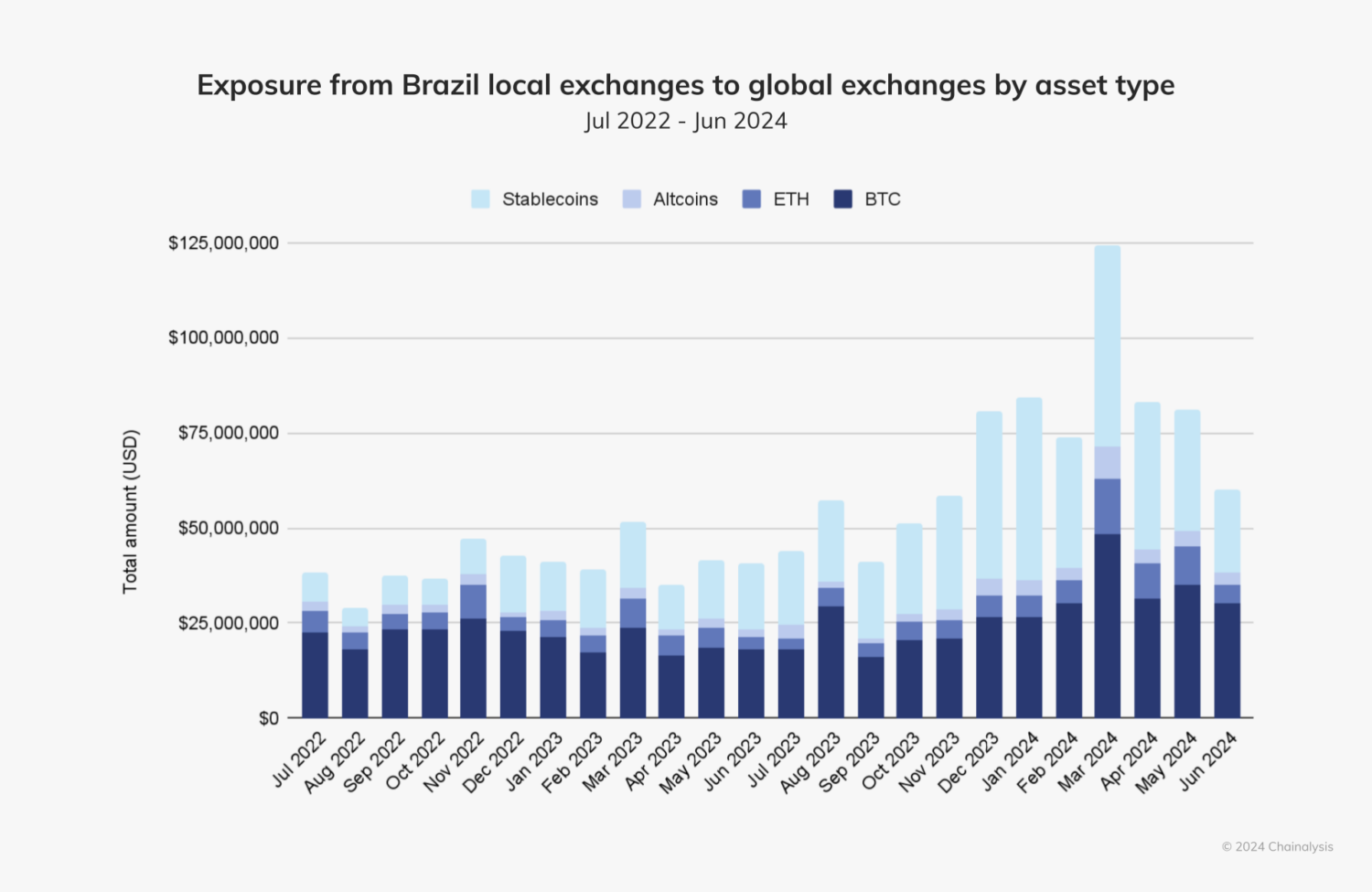

With crypto activity thriving across Brazil, we delved into a detailed analysis of the most popular assets among Brazilians. First, we found that Bitcoin transactions increased the most during the time period studied. There was a particularly sharp increase in Bitcoin transaction value between September 2023 and March 2024, which possibly coincided with the SEC’s approval of spot Bitcoin ETFs in January 2024. It is also noteworthy that the price of Bitcoin almost doubled during this time period, which could have contributed to these higher volumes.

A closer look at this Bitcoin activity reveals that value received by Brazilians on global exchanges is much higher than amounts received on regional local exchanges.

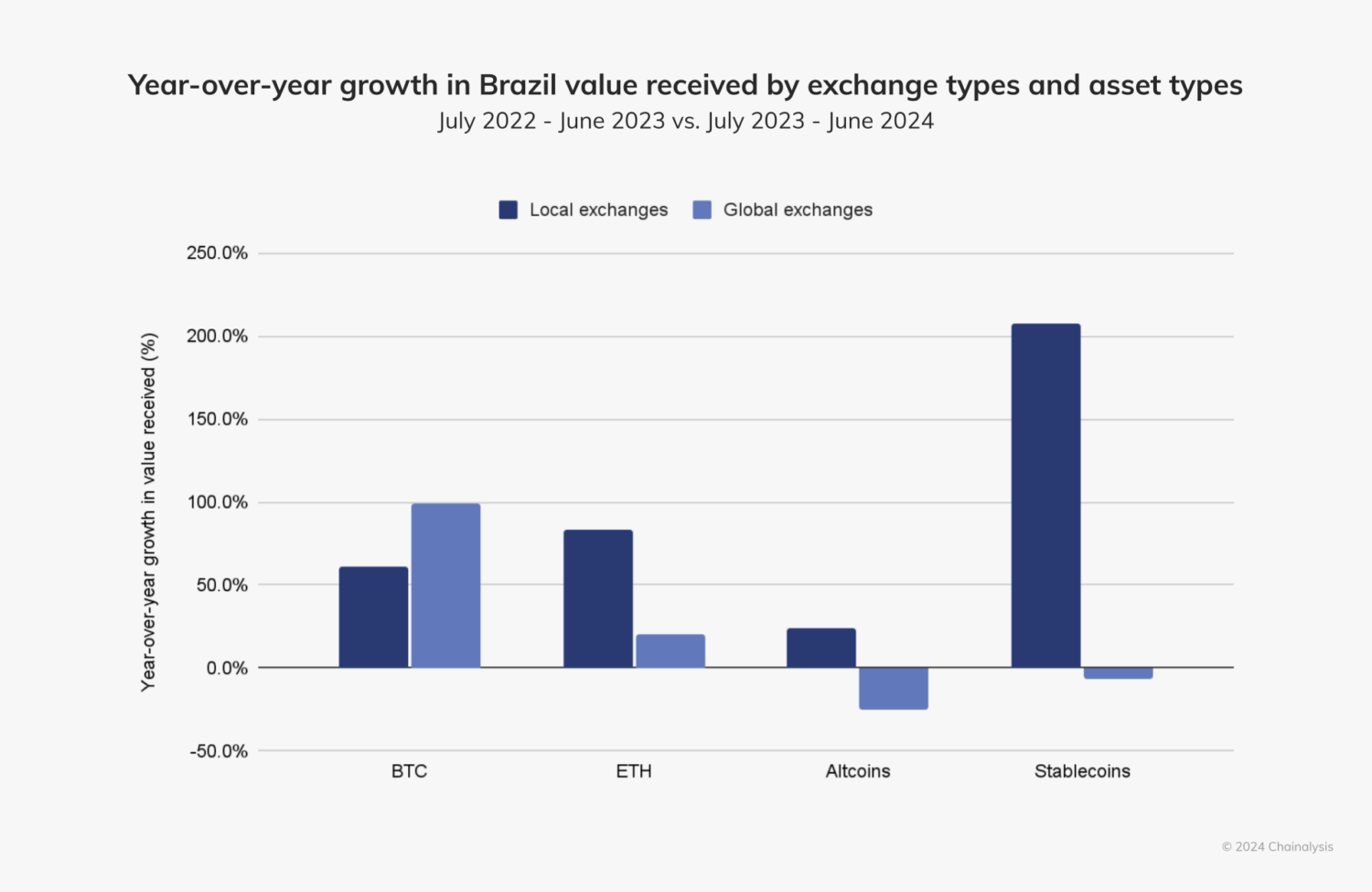

On local exchanges, however, there is a stark contrast in the types of assets being traded. As we see below, YoY stablecoin transaction value on local exchanges (207.7%) has increased significantly more than Bitcoin, Ether, and altcoins. Stanley noted that “many of Brazil’s exchanges and fintech brokerages offer USD-pegged stablecoins to their customers, with the idea of offering USD exposure as a store of value. This has definitely gained traction, but at this stage, it appears that the main use cases for stablecoins are on the B2B cross-border payments side.”

Stablecoins now account for approximately 70% of the share of indirect flows from Brazil’s local exchanges to global exchanges. Brazil’s high levels of stablecoin activity, as well as general interest in digital products and services, are drawing significant interest from major crypto players, notably Circle, which announced its official launch in Brazil in May 2024. According to a Circle spokesperson, “Circle’s engagement in Brazil comes at a time of increased regulatory certainty resulting from pro-innovation policies and initiatives, with additional business-friendly rule-making expected in the near future. We are partnering with leading regional businesses to launch digital asset products and enable near-instant, low-cost, and 24/7 access to USDC for Brazilian users, and are strengthening our local presence to reach an even wider user-base. As a result of this commitment to the region and the partnerships in place, the amount of users transacting with USDC in the region has already increased exponentially.”

What, then, does the future hold for Brazil’s evolving crypto landscape? As Stanley noted, the general Brazilian economy may still present obstacles for mainstream adoption. “Economic growth has slowed; the Brazilian real (BRL) has slumped massively against the dollar this year; there are concerns that taxes will continue to increase. Middle class consumers and families face massive debt burdens. Simply put, there isn’t as much disposable income as one would expect to find in a country of this size.” However, there are still opportunities for crypto growth, especially as regulators open their approach to the technology. “They view it as a tool to be leveraged rather than a threat to be crushed. A regulatory regime that is well-received by the market should provide a stable foundation for the crypto economy here for years to come,” Stanley concluded.

Stablecoins provide a path to stability during Argentina’s long-standing economic turmoil

Argentina’s decades-long battle with inflation and the Argentine peso’s (ARS) devaluation has left many citizens searching for alternatives to protect their savings and secure a more stable economic future. This year, unfortunately, Argentina’s economic situation has been especially volatile. By the second half of 2023, inflation was approximately 143%, the ARS’s value had declined precipitously, and four in 10 Argentinians were living in poverty. In December 2023, newly-elected president, Javier Milei, announced that the ARS would be devalued by 50%, which he described as “shock therapy,” and that the government would cut energy and transportation subsidies.

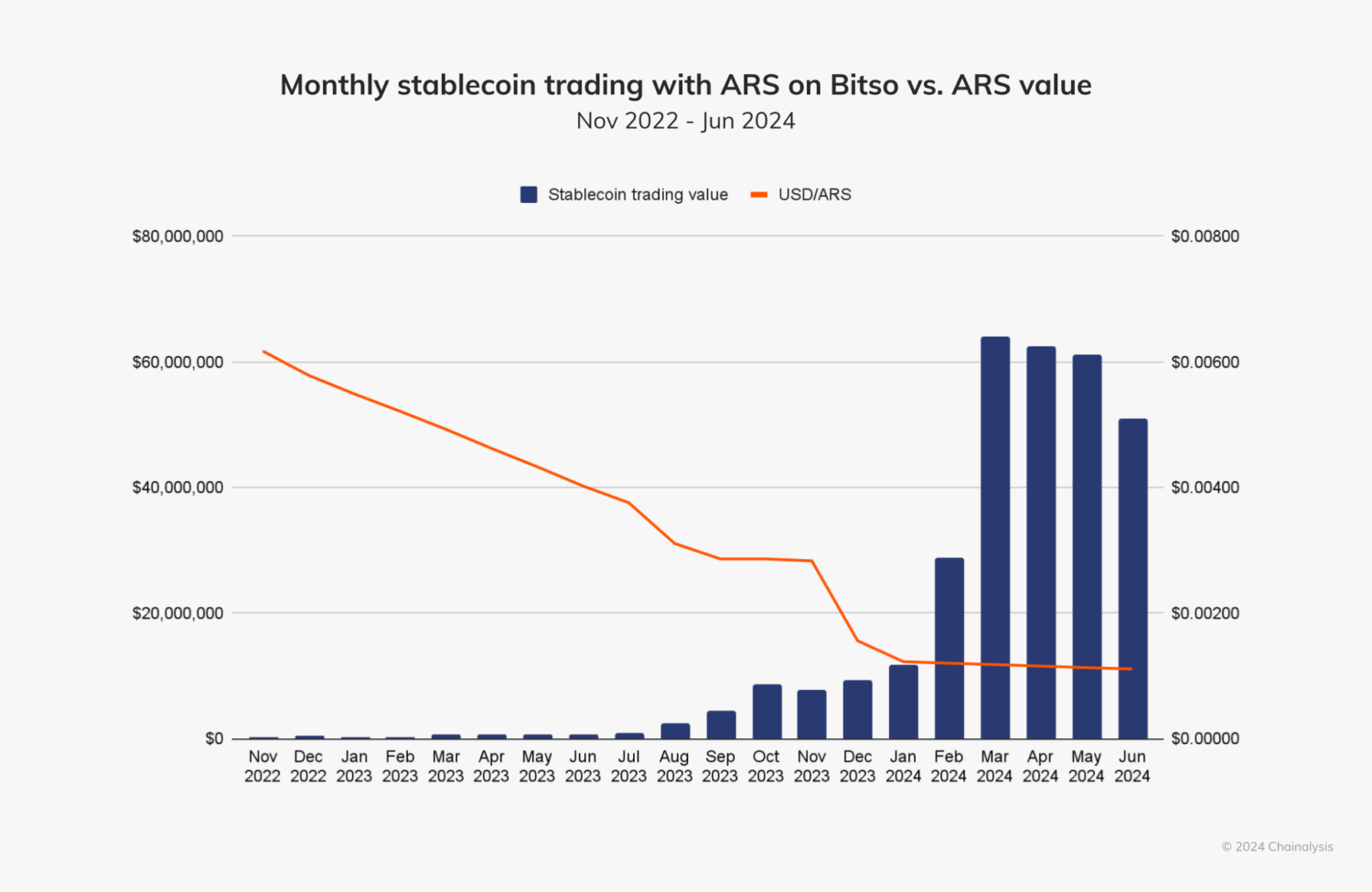

To protect themselves from this economic crisis, some Argentinians have turned to the black market to acquire foreign currencies, most commonly the U.S. dollar (USD). This “blue dollar” is the U.S. dollar traded at a parallel, informal exchange rate, often purchased through clandestine exchange houses called “cuevas,” found throughout the country. Others have explored USD-pegged stablecoins, which is reflected in our data.

We looked at monthly stablecoin trading volume with the ARS on Bitso, a leading regional exchange in Latin America, and saw that the peso’s decreasing value consistently sparked an increase in monthly stablecoin trading. For instance, when the ARS’s value fell below $0.004 in July 2023, the monthly stablecoin trading value surged to over $1 million in the following month. Similarly, when the ARS’s value dropped below $0.002 in December 2023 — when President Milei made his announcement — the stablecoin trading value exceeded $10 million the following month.

Unsurprisingly, Argentina’s stablecoin market is among the leaders in the Latin America region. Argentina’s share of stablecoin transaction volume is 61.8%, placing it slightly above Brazil’s share (59.8%) and well above the global average (44.7%).

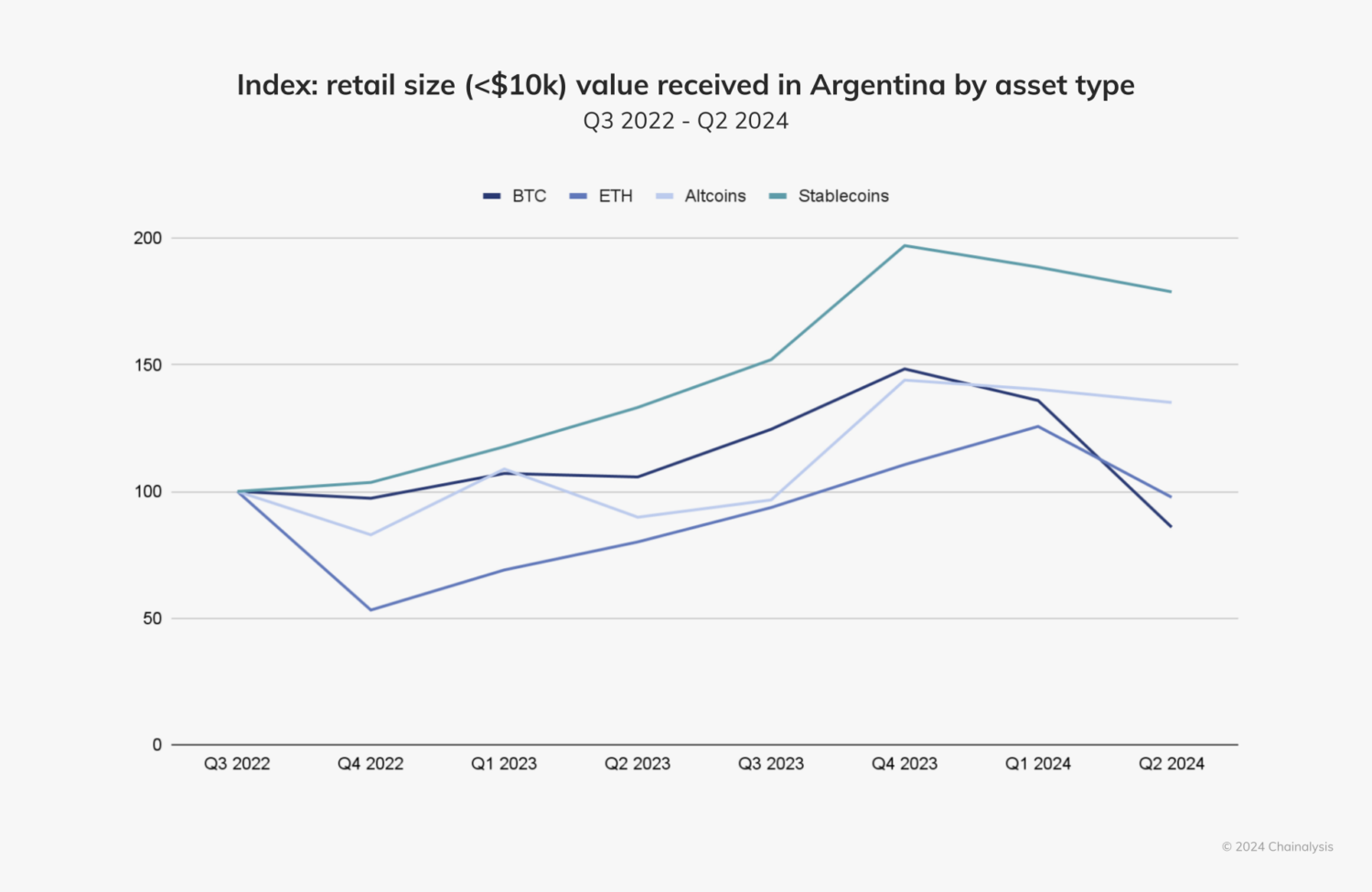

Additionally, retail-sized stablecoin value (i.e. transactions under $10,000) received in Argentina is growing at a faster rate than value received in any other asset type, once again suggesting that Argentinians look to stablecoins as a means of mitigating the effects of inflation and currency devaluation. Their interest in stablecoins highlights the role of crypto in unstable markets and how citizens are able to take better control of their financial futures by embracing cryptocurrency, regardless of official monetary policy.

Crypto adoption remains strong in Venezuela, despite Maduro regime uncertainty

Venezuela’s relationship with cryptocurrency has been nothing short of turbulent, marked by experiments like the launch (2018) and subsequent abrupt termination (2024) of the state-backed petro (PTR) — a stablecoin meant to be backed by Venezuela’s oil and mineral wealth — as well as crackdowns on Bitcoin mining and blocked access to certain mainstream crypto exchanges. At the same time, as the Maduro regime has sought ways to bypass economic sanctions, its illicit oil trade became entangled in crypto dealings, leading to high-profile indictments by the U.S. Department of Justice. These crypto-related events underscore a broader transformation, as the Maduro regime weaponizes it for corruption while citizens turn to it as a means of securing financial independence.

Yet despite this tumult, the Maduro regime has recently hinted at a renewed interest in cryptocurrency without providing concrete plans. Regardless of the outcome of such political developments, Venezuela remains one of Latin America’s fastest-growing crypto markets. Venezuela’s year-over-year growth of 110% far exceeds that of any other country in the region.

What is driving this growth? First, it appears that Venezuelans are drawn to cryptocurrency to combat the plummeting value of the Venezuelan bolívar (VES). As we see below, there is a strong inverse relationship between the VES price in USD and monthly crypto value received. This is corroborated by a body of press reporting, suggesting that ordinary Venezuelans continue to seek stable stores of value and hedges against the country’s economic crisis.

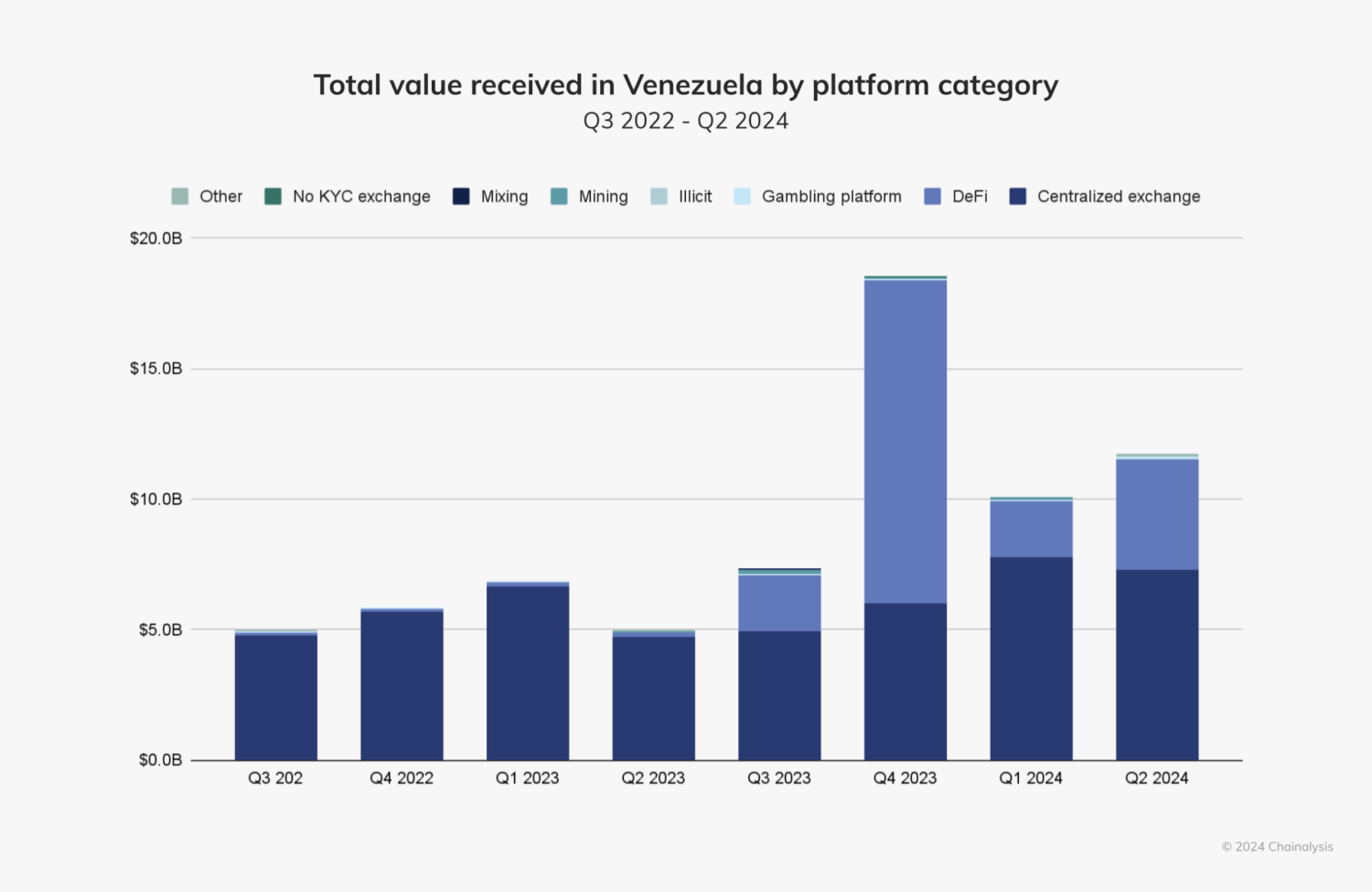

DeFi is another aspect of cryptocurrency growth in Venezuela. Since 2022, centralized services have accounted for the majority of value received in the country. However, interest in DeFi is increasingly taking hold, which was particularly evident at the end of 2023.

Although centralized services are still the most popular so far this year, DeFi’s growing market share will be an area to watch in the country in the near future, and may further accelerate if the Maduro regime explicitly supports crypto innovation.

Crypto activity accelerates in the Caribbean years after FTX bankruptcy

In the years following the collapse of FTX, the Caribbean’s crypto ecosystem experienced a period of uncertainty and slowed activity as trust in crypto platforms waned. However, beginning in late 2023, the Caribbean witnessed a resurgence in crypto activity. Users appear to be turning to mainstream centralized exchanges (CEXs), such as Coinbase and Binance.

We spoke to David Templeman, Specialist Financial Investigator for the Cayman Islands Bureau of Financial Investigation to learn more about how crypto activity in the Caribbean is shifting. In the Cayman Islands specifically, Templeman noted “a significant uptick in the number of overseas clients seeking to set up legal entities in the Web3 and blockchain space in the last year compared to those recently past. These projects typically include Layer 1s or Layer 2s, and have a wide range of applications, from AI, cross-chain infrastructure, gaming and data/cloud storage.”

As Templeman concluded, “The fallout from the various collapses (FTX, TerraUSD/Luna, Celsius Network, and Three Arrows Capital) has placed pressure on the industry to learn from mistakes and put in place better oversight and guardrails. There is a strong community of blockchain and Web3 companies within the Islands both physically present and legally domiciled here.” It appears that crypto activity in the Caribbean is thriving once again, solidifying the sub-region as a key hub for adoption in years to come.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.