The Fortune media, which publishes the renowned Fortune 500 ranking, has chosen to focus on the crypto ecosystem. The “Fortune Crypto 40” tries to list the best protocols and companies of the moment, which could conceivably be here to stay. Who are the winners?

Fortune Crypto 40 Winners

Fortune’s ranking takes into account various metrics and characteristics, and industry pundits were also interviewed. This ultimately results in 8 categories (centralized finance, traditional finance, venture capital, NFTs, data, infrastructure, decentralized finance and protocols), with 5 winners per category.

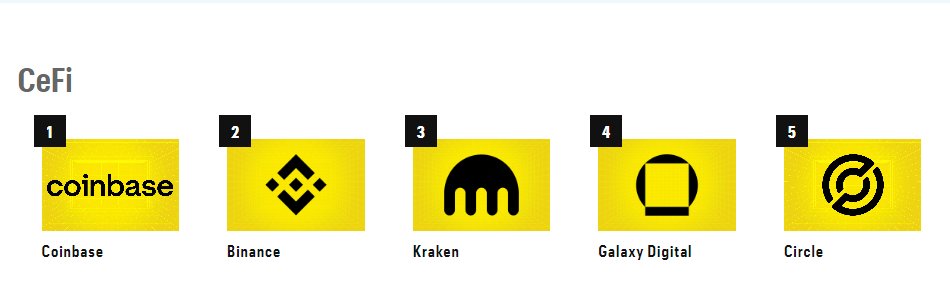

Exchange platforms and centralized finance

In the “centralized finance” category, which notably includes centralized exchange platforms (CEX), Coinbase comes out on top, followed by Binance. The latter does not win first place, Fortune considering that its recent setbacks and lack of transparency favor its competitor:

Exchange Kraken comes in third place, followed by investment manager Galaxy Digital, and finally Circle, the issuer of the USDT stablecoin. This confirms the general feeling that since the fall of FTX, it is Coinbase, Binance and Kraken that are considered like the three “heavyweights” of exchange platforms.

👉 Find our tutorial and opinion on Coinbase

Discover Coinbase

9€ of bitcoin offered for your 1st purchase

Protocols and blockchains

In the “protocols” category, we find the largest blockchains and networks. According to Fortune, Ethereum (ETH) dethrones Bitcoin (BTC) at this stage. The publication believes that the programmability of Ethereum, and the decentralized applications that come with it, make it a major player. Especially since the protocol has successfully transitioned to proof of stake.

Beyond Ethereum and Bitcoin, Polygon Labs (MATIC), the Solana Foundation (SOL) and Offchain Labs, known for offering the second layer solution Arbitrum, are present in the ranking.

👉 More info on how the Arbitrum protocol works

Infrastructure and mining

The “Infrastructure” category is broader, and it brings together players and companies that support crucial parts of the industry. We find there the French unicorn Ledger in first positionthanks to its considerable influence on the hardware wallet market:

In second place, we find the mining company Genesis Digital Assets, followed by its competitor Bitmain. The fourth place in the ranking is attributed to the development platform Alchemy, and the fifth is attributed to the payment manager Moonpay. Beyond the company list, this ranking reflects the diversity of services needed to support a very varied ecosystem.

In second place, we find the mining company Genesis Digital Assets, followed by its competitor Bitmain. The fourth place in the ranking is attributed to the development platform Alchemy, and the fifth is attributed to the payment manager Moonpay. Beyond the company list, this ranking reflects the diversity of services needed to support a very varied ecosystem.

👉 Don’t miss this offer – Get up to $30 in Bitcoin by buying a Ledger

The best way to secure your cryptocurrencies 🔒

🔥 Up to $30 in Bitcoin offered!

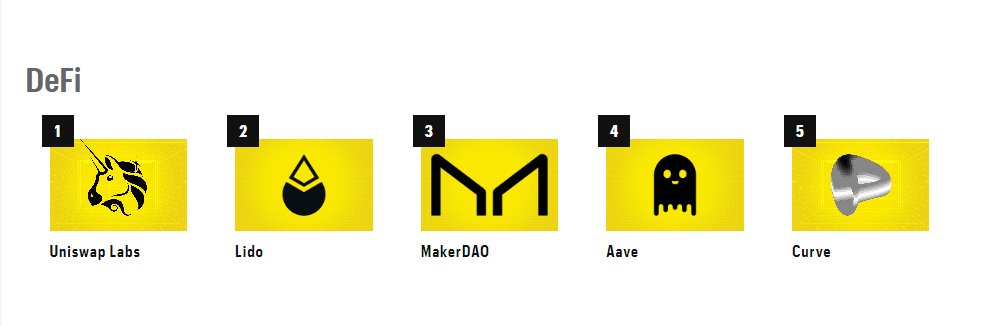

Decentralized finance (DeFi)

On the DeFi side, the big winner is Uniswap Labs according to the Fortune Crypto 40 ranking. The decentralized exchange (DEX) platform is considered the biggest player of the moment in a field of cryptos which remains in full boiling. It is followed by Lido, the staking service linked to Ethereum, which has exploded since last year:

In third position, it is a “old” cryptos, MakerDAO, which continues to show its relevance for the ecosystem. The issuer of the DAI is tracked by the Aave lending and borrowing protocol. Then the decentralized exchange Curve closes this ranking.

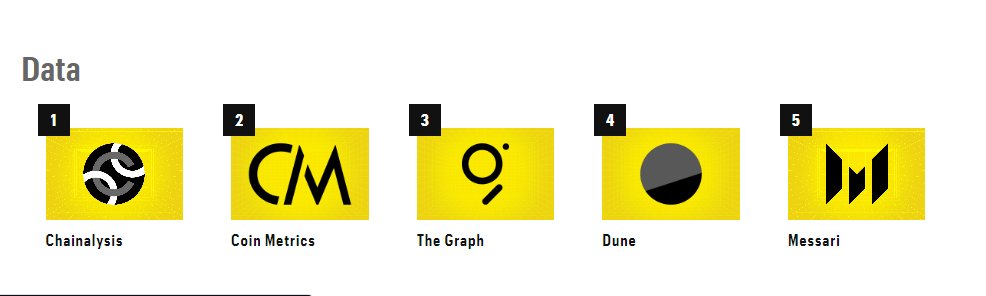

Data and Rankings

The blockchain being a very “data-heavy” sector, it necessarily relies on actors who are able to organize and present data in a reliable manner. In this category, it’s Chainalysis that does best, according to Fortune. The company publishes many recurring reports, which are now seen as references for the ecosystem:

Its competitor Coin Metrics is second in the ranking, followed by The Graph, Dune and Messari. The Graph offers different services from its colleagues, since it is an indexing protocol that is partially based on a cryptocurrency, The Graph (GRT).

Our service dedicated to cryptocurrency investors. Get real-time analytics and optimize your crypto portfolio.

Traditional finance, venture capital and NFTs

To complete these rankings, it should be noted that Fortune also took into account traditional finance players, at least those who offered services related to cryptocurrencies. In this category, PayPal comes first :

The payments giant has made a success of its shift towards the blockchain according to Fortune… Just like Robinhood, which comes in second place. These two major players are followed by the major banking institution JPMorgan, then the asset manager Fidelity, and finally the payment giant Visa.

Two other categories should also be mentioned: venture capital funds, where Polychain Capital is considered the largest, followed by Animoca Brands, Andressen Horowitz, Pantera Capital and Blockchain Capital. In the NFT sector, it is no surprise the giant OpenSea which continues to dominate, followed by the sprawling Yuga Labs, which notably offers Bored Ape Yacht Club collections as well as Cryptopunks. Sky Mavis, Art Blocks and RTFKT, which was acquired by Nike in 2021.

If Fortune’s ranking is not set in stone, it therefore gives a good idea of where the ecosystem is at, at a time when the bear market has been prolonged, and when doubts reign for many actors.

👉 Listen to this article and all other crypto news on Spotify

Source: Fortune

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.