If the FTX case showed one thing, it’s that the adage “Not your keys, not your cryptos” is more apt than ever. As FTX users see their funds blocked, with little hope of recovering them, the panic is spreading to other services. Centralized exchanges have indeed experienced massive withdrawals from their users. Zoom in on the subject.

Massive withdrawals on exchange platforms

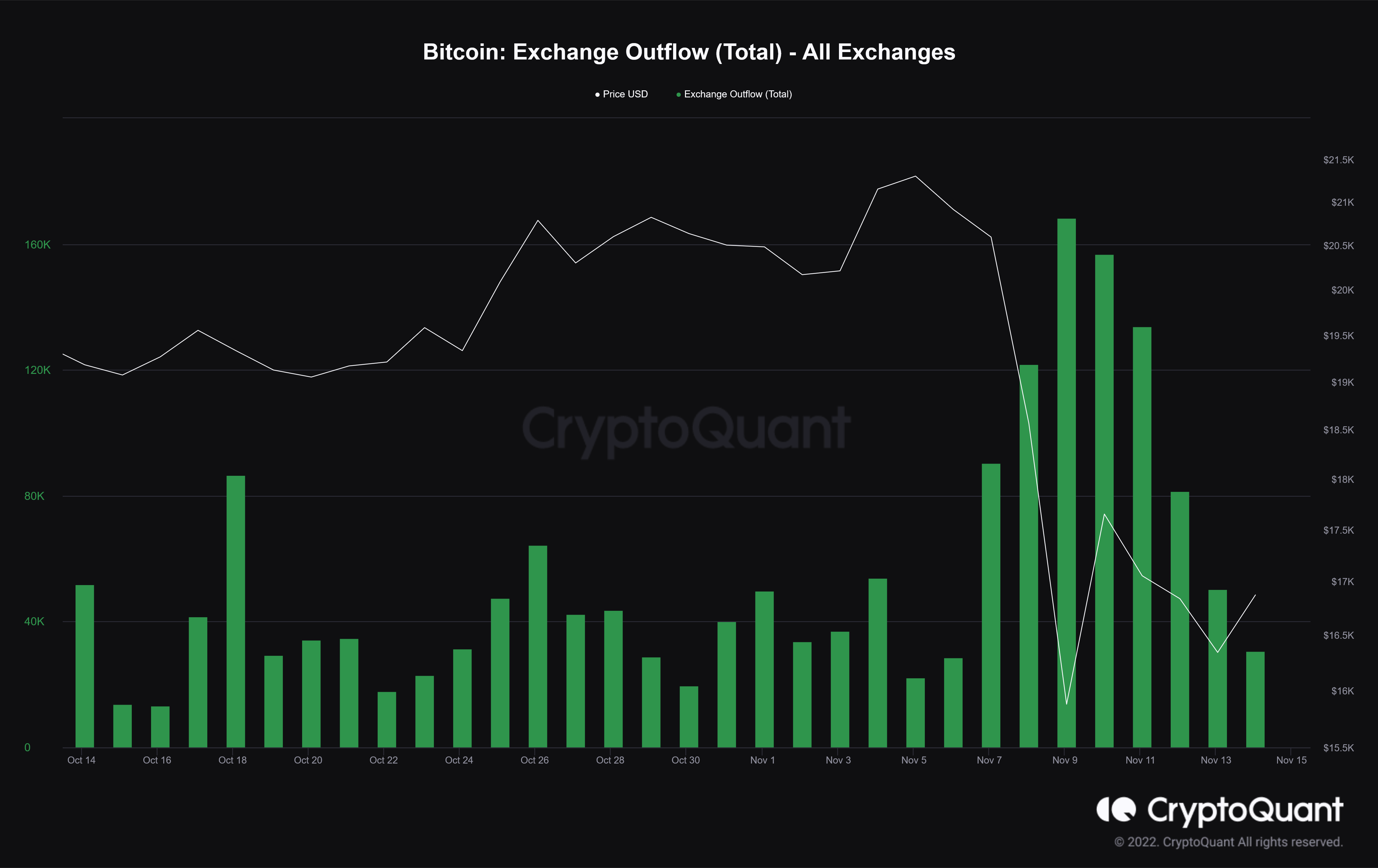

The trend is visible on all exchanges, with massive withdrawals that were triggered around November 7, when the beginnings of the FTX affair were felt. Since then, users continued to transfer their fundscontributing at the same time to the general panic.

According to data published by CryptoQuant, Bitcoin withdrawals from platforms peaked on November 9, with over 168,000 coins withdrawn. That corresponds to more than 2.6 billion dollarsas BTC price bottomed out:

BTC withdrawals exploded following the FTX affair

For Ether (ETH), the trend is the same. November 9, 1.3 million ETH were withdrawn from exchanges, which corresponded to a sum of 1.4 billion dollars. Part of the sums reported are of course from FTX, before withdrawals are blocked for users.

👉 Follow all cryptocurrency courses live

The French unicorn of crypto wallets 🔒

A complete crypto experience, from buying to securing

Transparency, a tool to stop the bleeding?

What options do exchanges have to stop the bleeding? While the ecosystem is in the midst of a crisis, and waits to see if other large companies will be affected, regaining investor confidence is proving to be a challenge. As several commentators have pointed out, the downfall of FTX should serve one thing: make exchange operations more transparent.

Already, Binance has positioned itself as the spearhead of the movement, inviting other platforms to reveal their withdrawal addresses (and showing substantial reserves of more than 70 billion dollars). All the major exchanges have also issued a press release, saying they have no liquidity problem.

🔴 LIVE – Follow the FTX deal in real time

But can the community believe them, when Sam Bankman-Fried denied any liquidity problems a few days before the fall of FTX? It will take hard data to reverse the trend. The proof of reserve systems used in particular by Kraken and soon Binance seem to be a means of proving the reliability of the exchanges.

All that remains is to regain the trust of the ecosystem will definitely take a long time. Without counting on the waves of regulations which should follow, while the institutions have already begun to look into the matter. The fall of FTX is therefore only the beginning of a period of great uncertainty.

👉 Also Read – FTX Employee Speaks Out: “Many Employees Lost Lifetime Savings”

Join Experts and a Premium Community

PRO

Invest in your crypto knowledge for the next bullrun

Source: CryptoQuant

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.