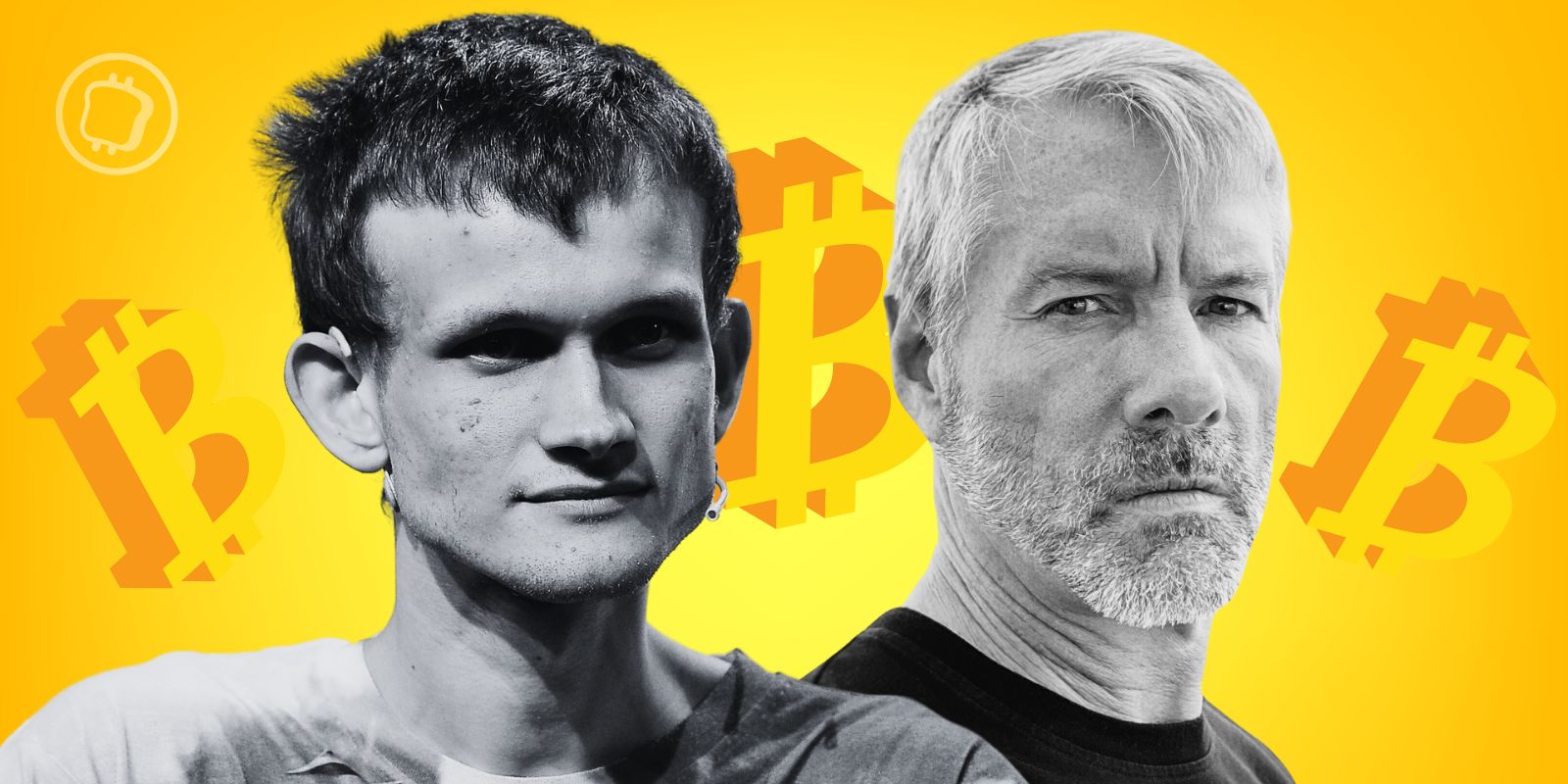

Encouraging Bitcoin (BTC) holders to deposit them with financial institutions, Michael Saylor alienated a large part of the crypto community including the co-founder of Ethereum, Vitalik Buterin. This forced the co-founder of MicroStrategy to clarify his remarks.

On self-custody, Vitalik Buterin, supported by a large part of the crypto community, is ruthless

This week, Michael Saylor surprised the crypto ecosystem by being rather unfavorable to self-care. Bitcoin maximalist and co-founder of MicroStrategy said Bitcoin holders had every interest in entrusting the custody of their cryptocurrencies to large financial institutions like BlackRock, JPMorgan and Fidelity.

🔎 To better understand the concept of self-custody, consult our fact sheet on the differences between a custodial and a non-custodial wallet

Michael Saylor also suggested that “ Bitcoin holders should entrust their cryptocurrencies to too-big-to-fail banksdesigned to be custodians of financial assets » instead of keeping them on non-custodial wallets.

Quickly, a large part of the crypto community criticized Michael Saylor's comments. As leader, Vitalik Buterlin who stated that “ Michael Saylor's comments were completely crazy “.

For the co-founder of Ethereum, “ Bitcoin is more threatened by the authorities from the moment it is held by unregulated “crypto-anarchists” who do not seek to comply with the law “. Vitalik Buterin then took the time to explain why he was against the position taken by Michael Saylor :

He seems to explicitly plead in favor of a regulatory capture approach to protect cryptocurrencies. There are many precedents showing how this strategy can failand for me, that is not the goal of cryptocurrencies.

I probably did more than most to spread the “mountain man” trope (btw I consider those remarks of mine outdated; snarks and AA changed the tradeoff space completely), and I'll happily say that I think @saylor's comments are batshit insane.

He seems to be explicitly arguing for a…

— vitalik.eth (@VitalikButerin) October 22, 2024

Ledger: the best solution to protect your cryptocurrencies 🔒

Michael Saylor walks back his comments, clarifying his initial statement

The crypto community also highlighted the potential IT threats weighing on large financial institutions. In the event that they were to suffer a cyberattack where the private keys of BTC holders were stolen, their funds could disappear overnight.

The founder of the company specializing in the direct exchange of cryptocurrencies ShapeShift, Erik Voorhees, also expressed his disagreementstating that the ability to withdraw BTC to self-custody is “ typically the kind of control that prevents centralization and promotes corruption ».

👉 Also in the news – “Long Bitcoin (BTC)”: This billionaire sees cryptocurrency as a hedge against inflation

For Erik Voorhees, “ For Michael Saylor to so easily reject this fundamental principle is completely inappropriate and deserves these reactions “. Faced with the flood of criticism, Michael Saylor decided to clarify his comments on Xultimately advocating the self-custody of Bitcoin for those who wish it:

I support self-care for those who want and canthe right to self-custody for all and the freedom to choose the form of custody and guardian for individuals and institutions around the world.

I support self-custody for those willing & able, the right to self-custody for all, and freedom to choose the form of custody & custodian for individuals & institutions globally. #Bitcoin benefits from all forms of investment by all types of entities, and should welcome everyone.

— Michael Saylor⚡️ (@saylor) October 23, 2024

The co-founder of MicroStrategy took the opportunity to clarify that “ Bitcoin benefits from all forms of investment by all types of entities, and should welcome everyone ».

Open an account on N26, the crypto-friendly bank

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to cryptoassets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.