MicroStrategy has just made the largest Bitcoin purchase in its history: Michael Saylor's firm paid $4.6 billion to acquire 51,7820 BTC. As of this writing, the company holds nearly $30 billion worth of Bitcoin, and it doesn't plan to stop there.

MicroStrategy now holds nearly $30 billion worth of Bitcoin

Who said that a rise in the price of Bitcoin would worry MicroStrategy? The company's co-founder and executive chairman, Michael Saylor, reported on This is MicroStrategy's largest investment to date in the cryptocurrency king.

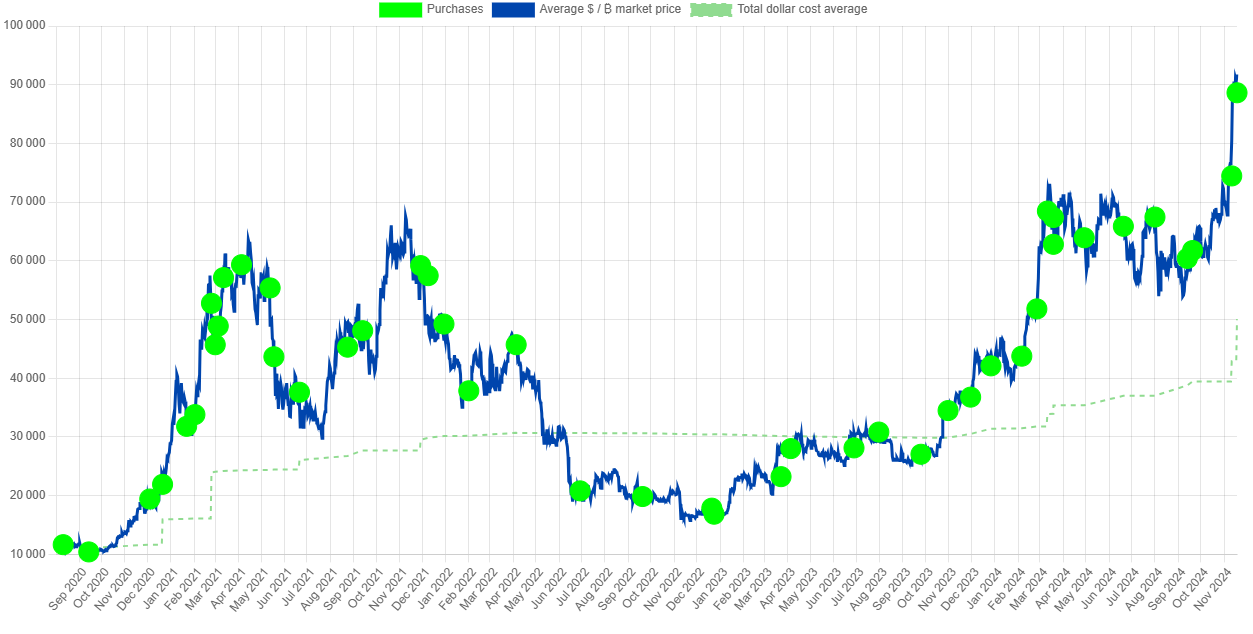

The company's ambitions seem incommensurable: she currently holds a total of 331,200 BTC acquired for approximately $16.5 billion. At the current price of BTC, the firm can boast of having doubled its stake, since its Bitcoins are now worth nearly 30 billion dollars. A more than successful DCA, in short.

💸 Find out how to buy Bitcoin in just a few clicks

Representation of the different Bitcoin purchase points by MicroStrategy

MicroStrategy financed its latest investment by issuing and selling $4.6 billion worth of stock between November 11 and 13. According to the same document attesting to its BTC purchase, the firm still has $15.3 billion in shares available for sale.

Note that these colossal investments in Bitcoin should theoretically continue, on the one hand for its remaining shares to be issued, but also because MicroStrategy recently revealed its “21/21 plan”, which consists of raising 42 billion dollars over 3 years to acquire even more BTC.

👉 Institutionalization Continues – Goldman Sachs Now Holds Over $718 Million in Bitcoin (BTC) ETFs

MicroStrategy is now the company that holds the most BTC in the worldfollowed by MARA Holdings which holds 27,562, then Riot Platforms, which holds 10,928. The strategy of the firm co-founded by Michael Saylor, long shunned, is today copied: the Japanese company Metaplanet is one of them. the best example, multiplying investments in BTC.

Open an account on Binance, the world’s #1 crypto platform

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature assets, products or services relating to investments. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.