This post is an excerpt from our 2024 Geography of Cryptocurrency Report. Download your copy now!

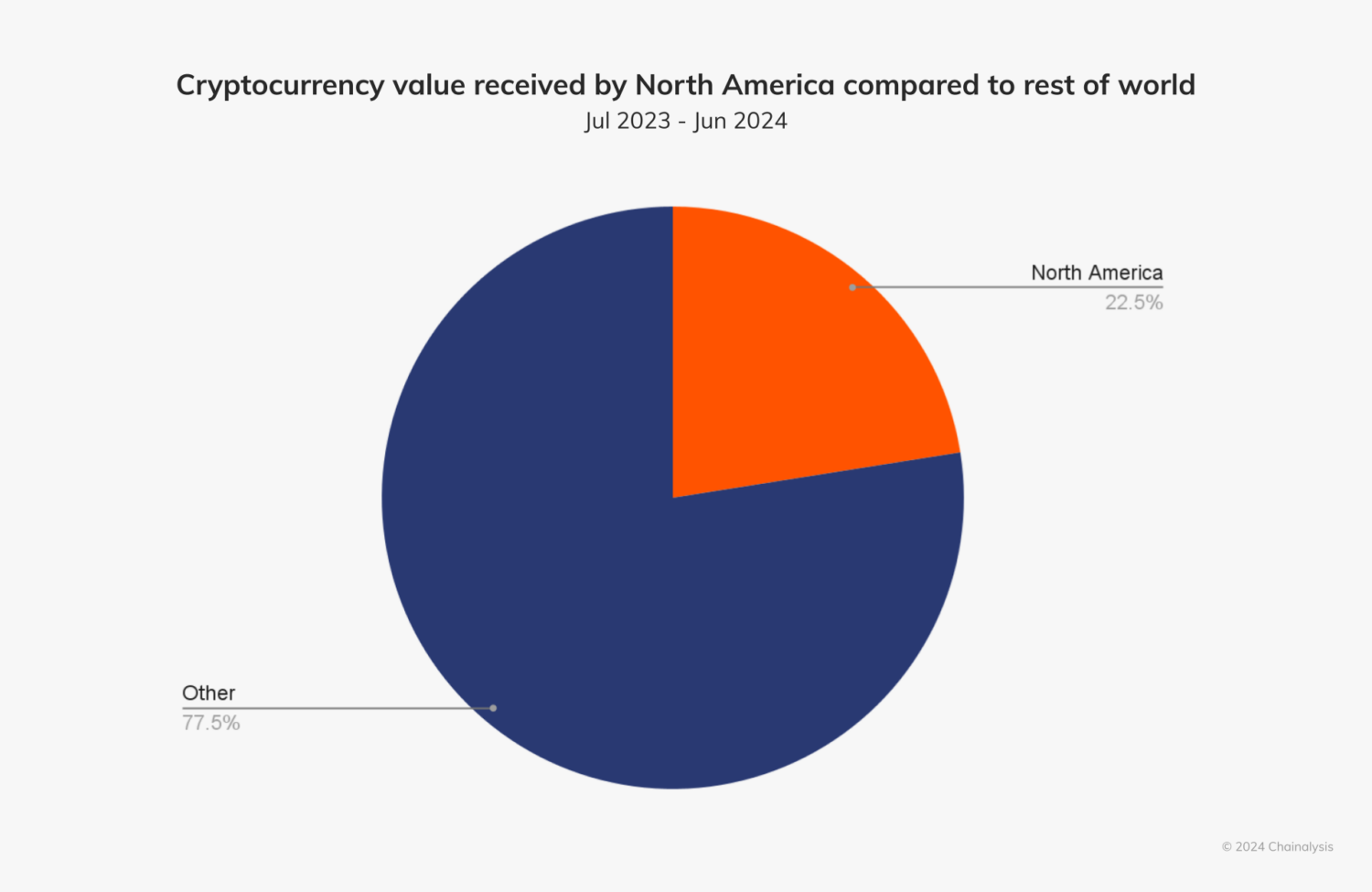

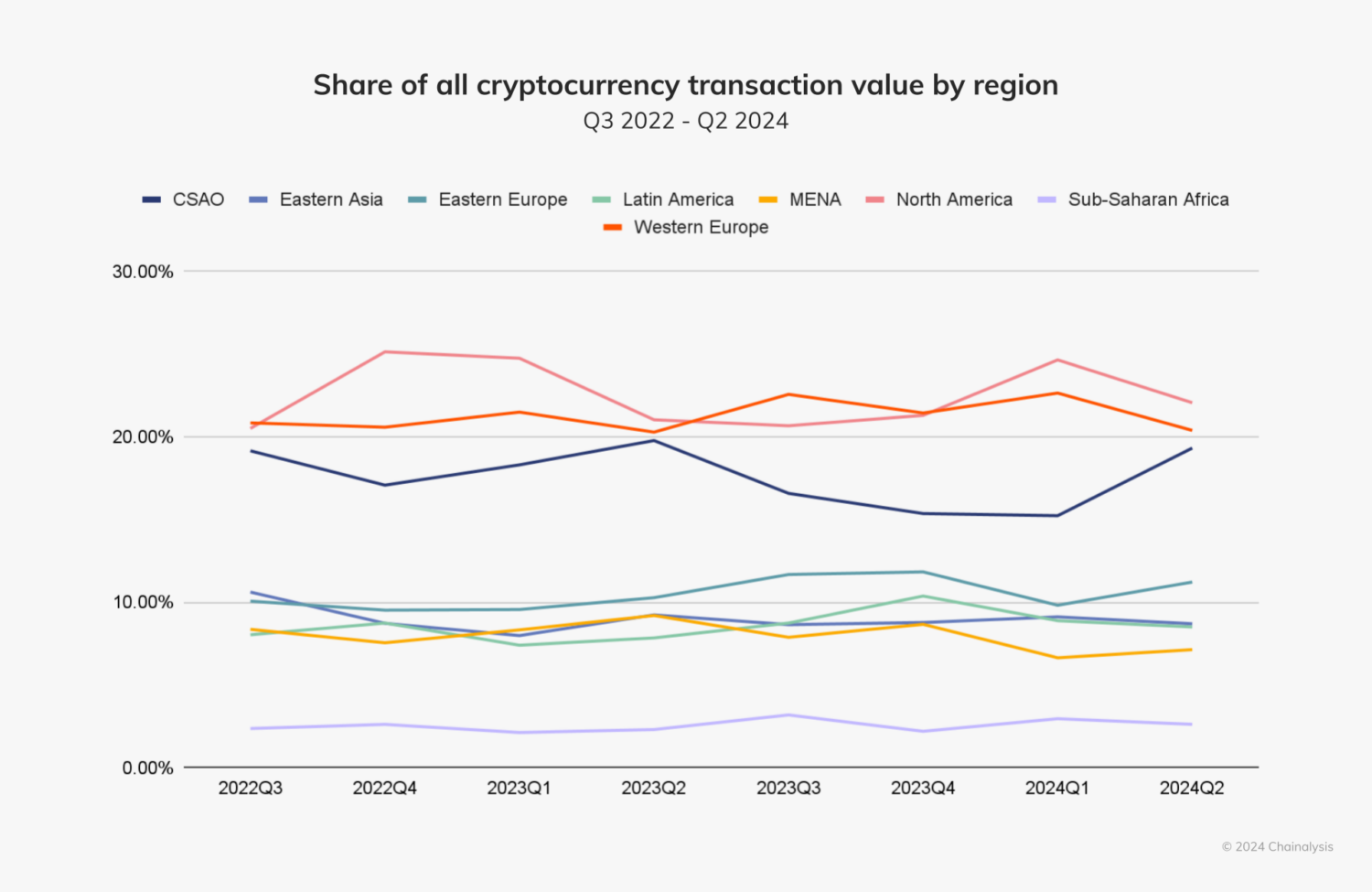

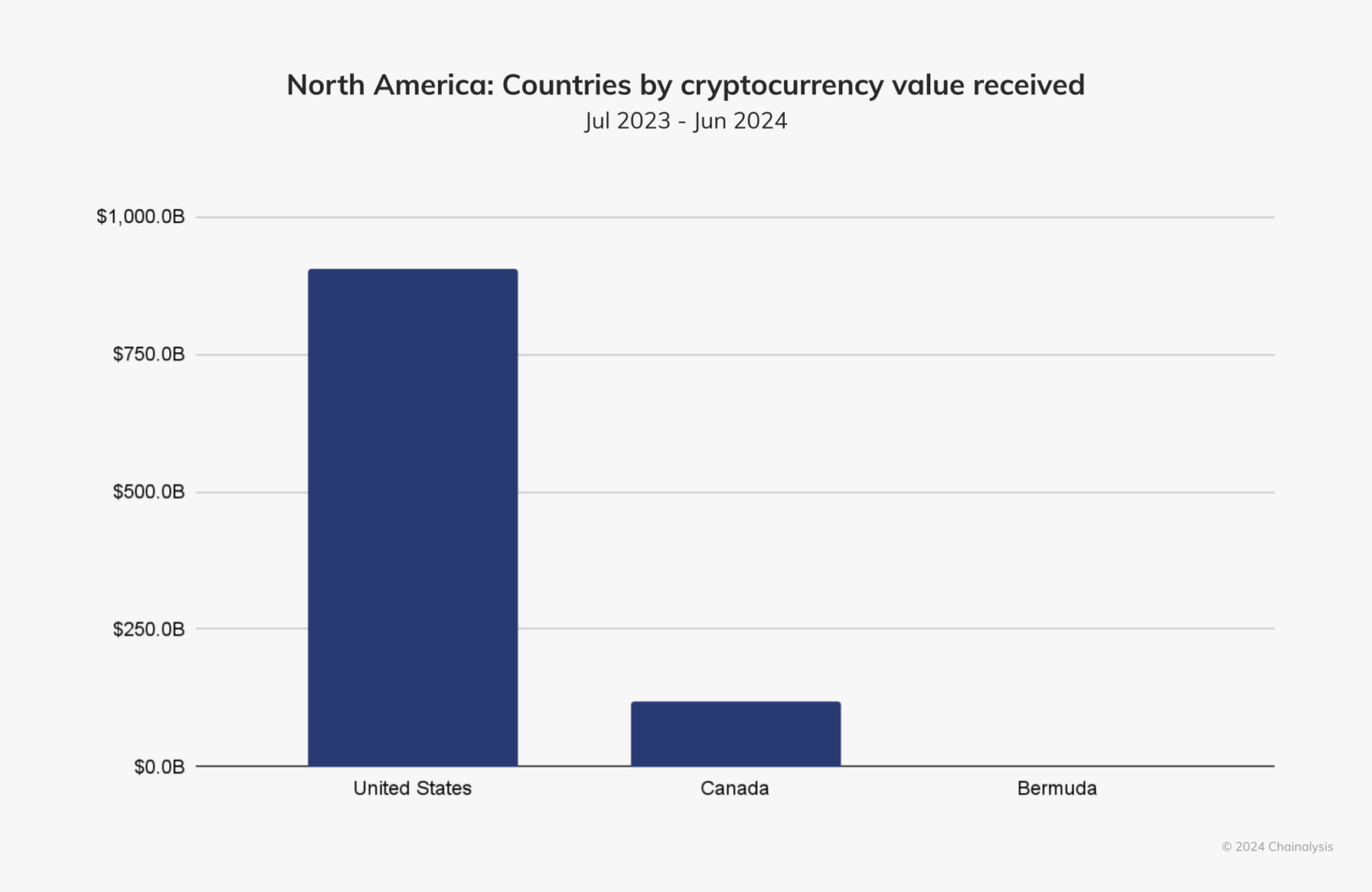

Like previous years, North America remains the largest cryptocurrency market globally, with an estimated $1.3 trillion in on-chain value received between July 2023 and June 2024, representing about 22.5% of global activity.

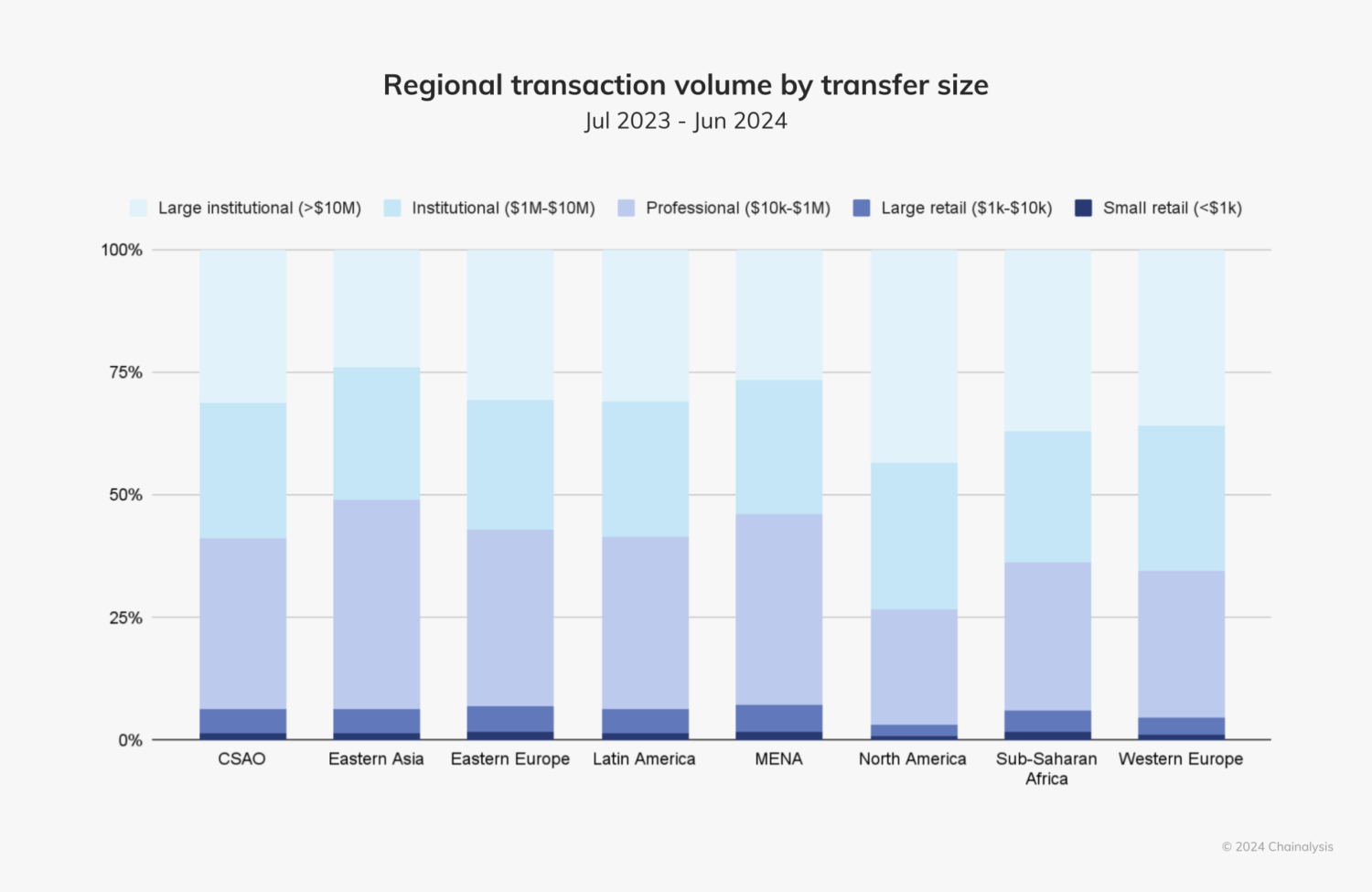

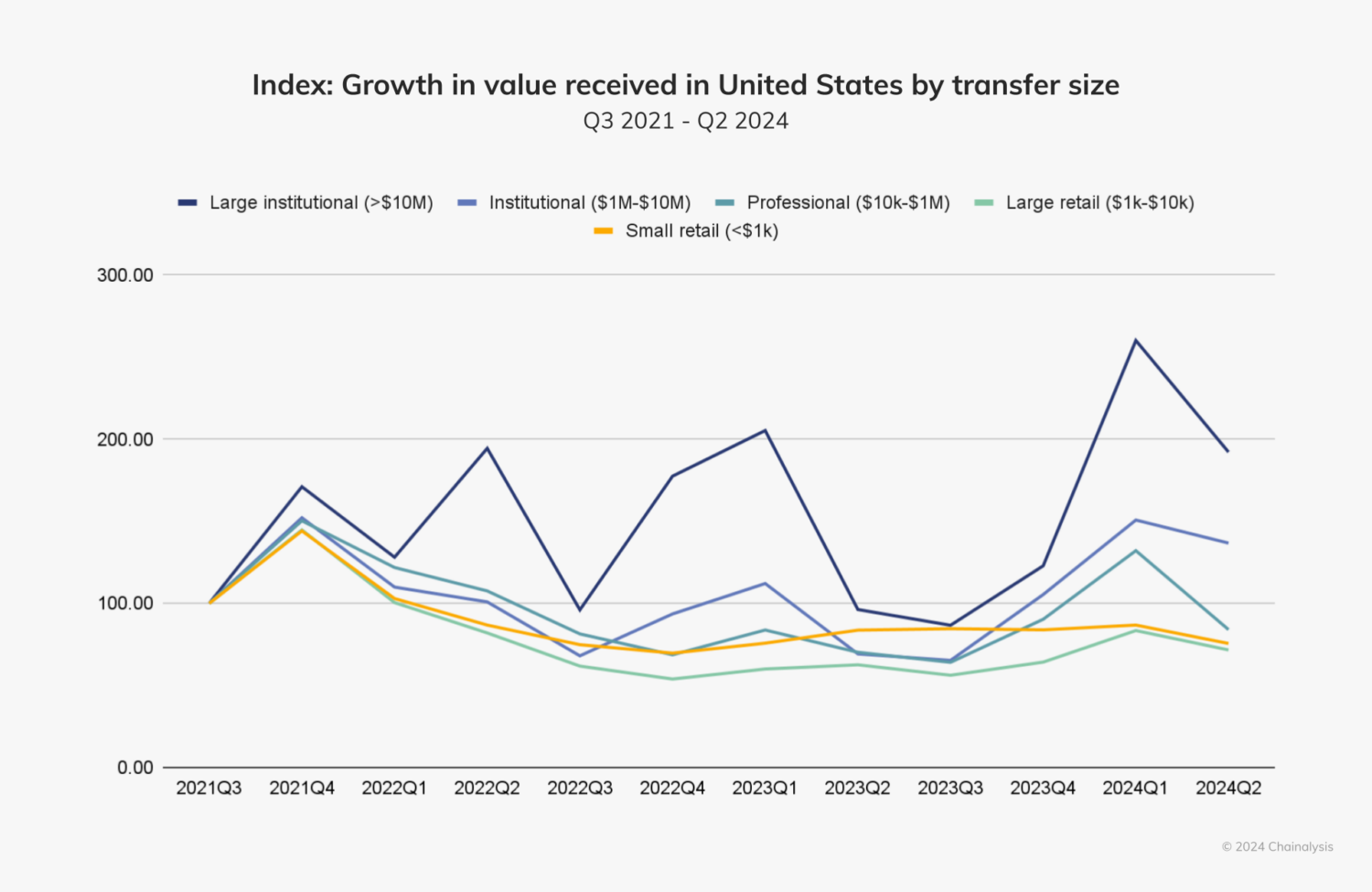

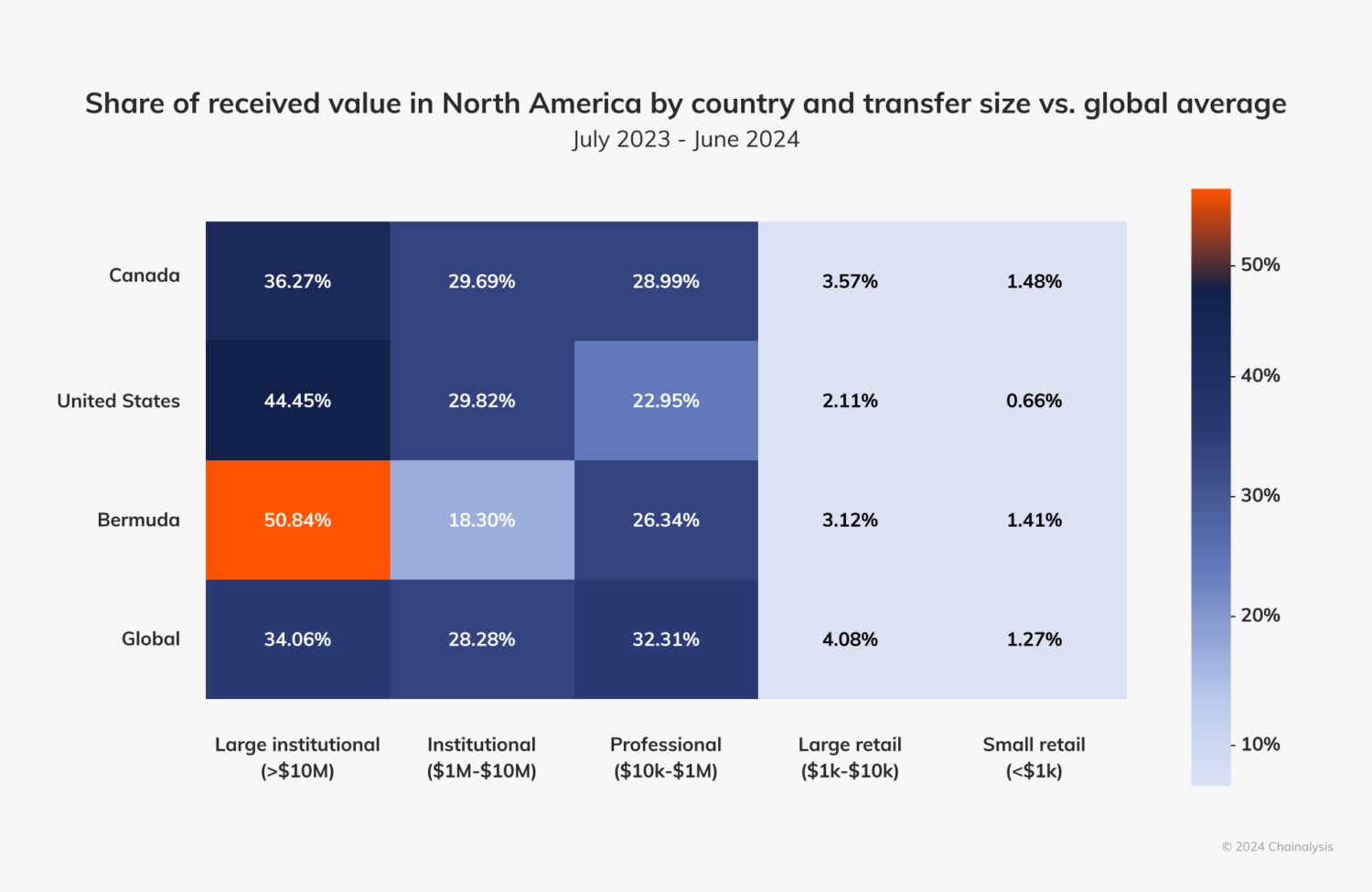

North America’s dominance in the cryptocurrency market is largely fueled by institutional activity — more so than any other region. Approximately 70% of the region’s crypto activity consisted of transfers exceeding $1 million, reflecting the growing influence of major financial players in the region’s crypto market.

The overwhelming majority of this activity is driven by the United States, where 2024 has proven to be a pivotal year for crypto adoption and industry growth.

After a bear market spurred in part by the late 2022 collapse of FTX and the March 2023 failure of Silicon Valley Bank, the North American crypto sector has made a remarkable recovery. In March of 2024, the price of bitcoin (BTC) broke $73,000 – a new all-time high – signaling a resurgence from a period of sustained volatility that ultimately strengthened the ecosystem’s integrity and resilience.

In 2024, the convergence of traditional finance (TradFi) and crypto was cemented, with institutional enthusiasm amplified by the introduction of spot bitcoin exchange-traded products (ETPs) in U.S. markets. Exchange-traded funds (ETFs) in particular — which are the most popular and well-known type of ETP — have captured the attention of retail and institutional investors alike.

More than ever, North America’s crypto climate is marked by substantive institutional momentum. Established legacy financial entities such as Goldman Sachs, Fidelity, and BlackRock — who have shaped financial markets in the U.S. and globally for decades — are now taking serious positions in the crypto space. This marks a critical maturation point for the industry, as cryptocurrency is increasingly integrated into the mainstream.

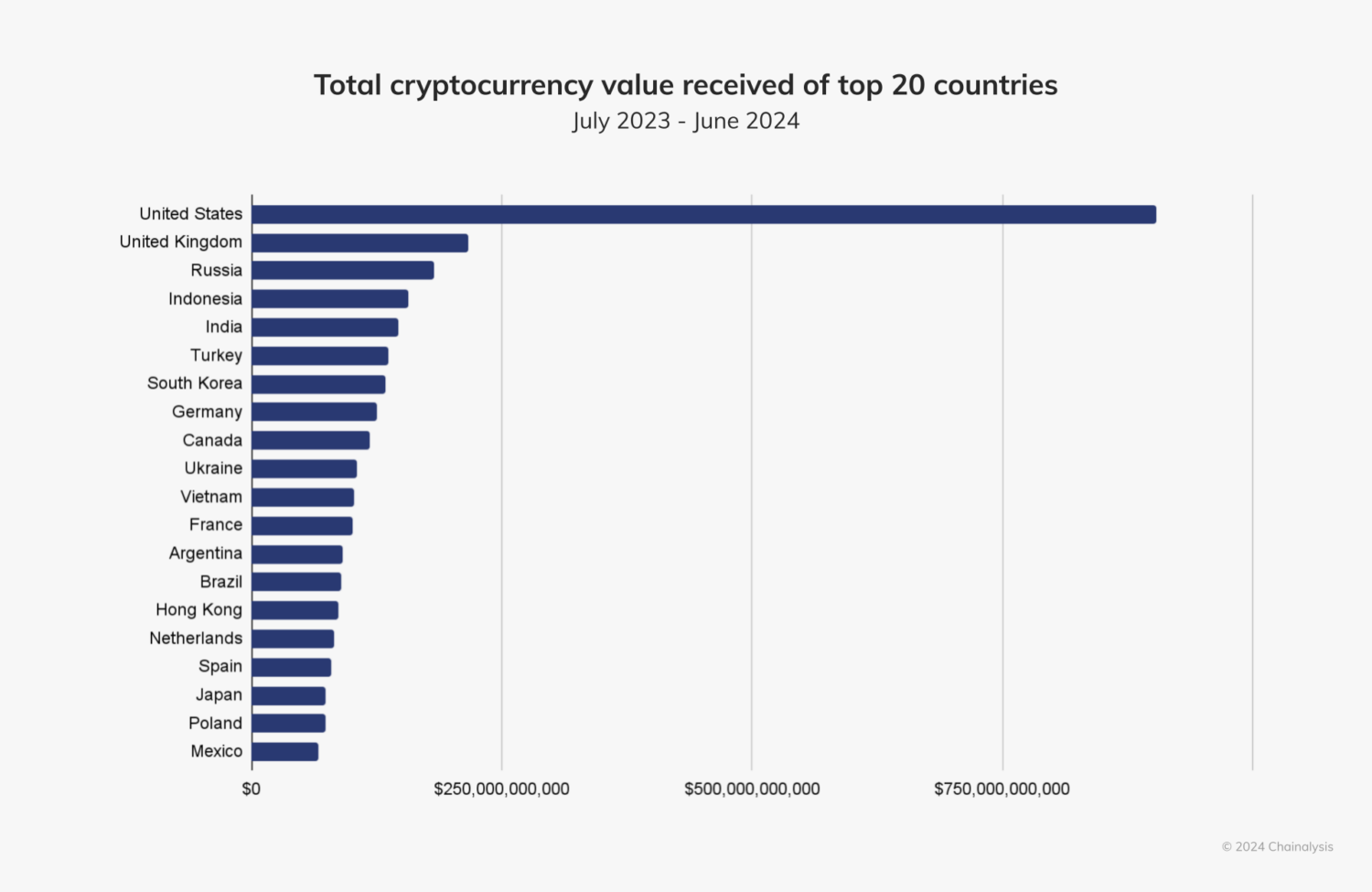

The United States is the foremost pillar of global crypto adoption

The United States’ cryptocurrency markets are the largest and most influential in the world, standing out globally by a large margin.

This prominence stems in no small part from the country’s immense wealth, large population, deep and liquid capital markets, and thriving innovation ecosystem. The U.S. also benefits from political stability, a favorable investment climate, and the U.S. dollar’s present role as the principal reserve currency of the international financial system. Fortified by these factors, the U.S. is a global leader in cryptocurrency adoption, ranking fourth in our annual global adoption index.

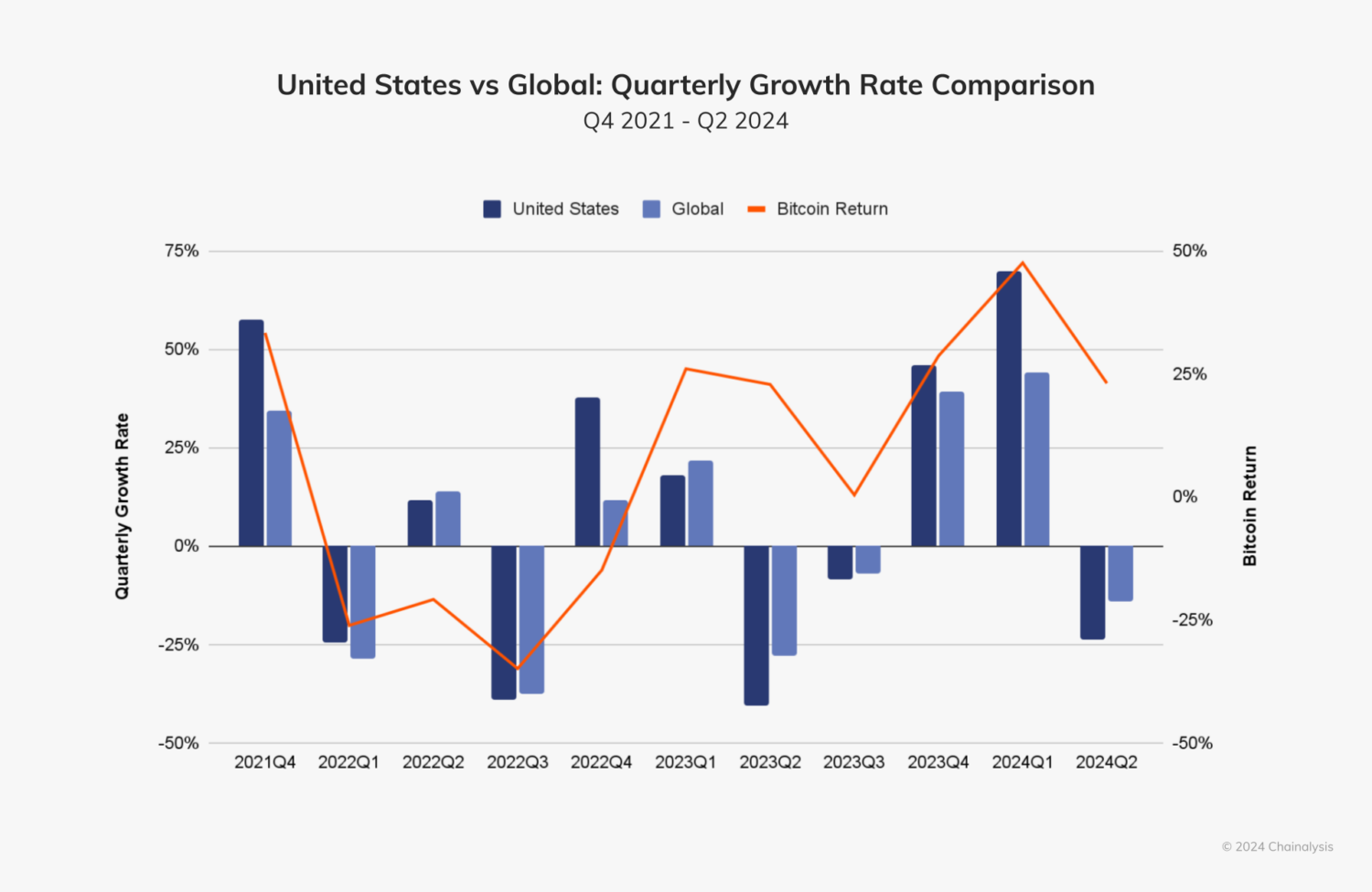

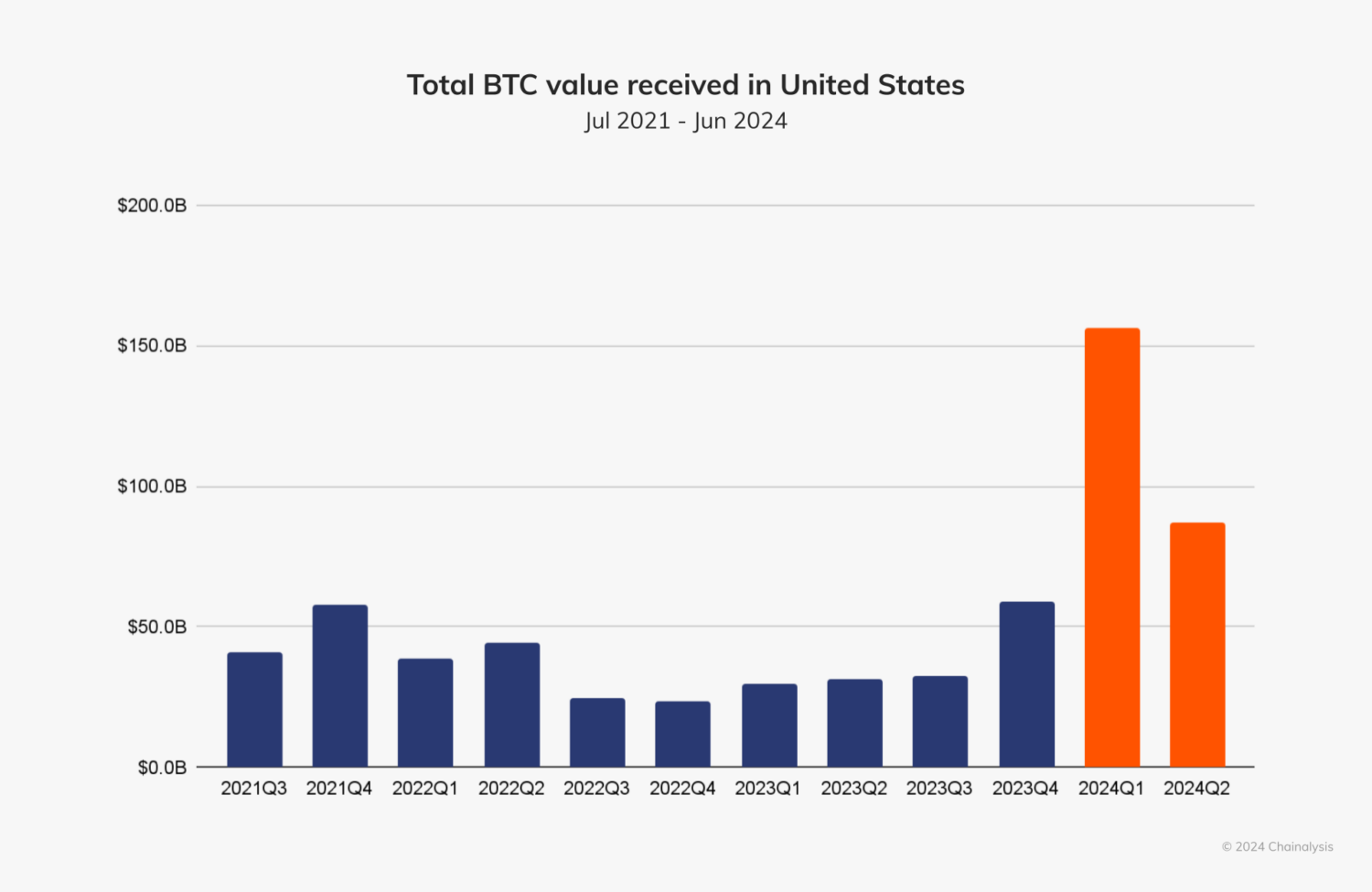

U.S. markets are notably more volatile than global markets in terms of growth. In recent quarters, the U.S. has demonstrated heightened sensitivity to both bull and bear markets. When cryptocurrency prices rise, the U.S. market shows larger increases in growth than the global market — and the inverse is true when cryptocurrency markets decline. We can see this movement below, comparing the rate of growth in U.S. and global markets with returns on bitcoin.

This volatility can largely be attributed to the significant levels of institutional activity within the country, a trend that positions the U.S. market as a key driver of global financial trends in both cryptocurrency and TradFi alike.

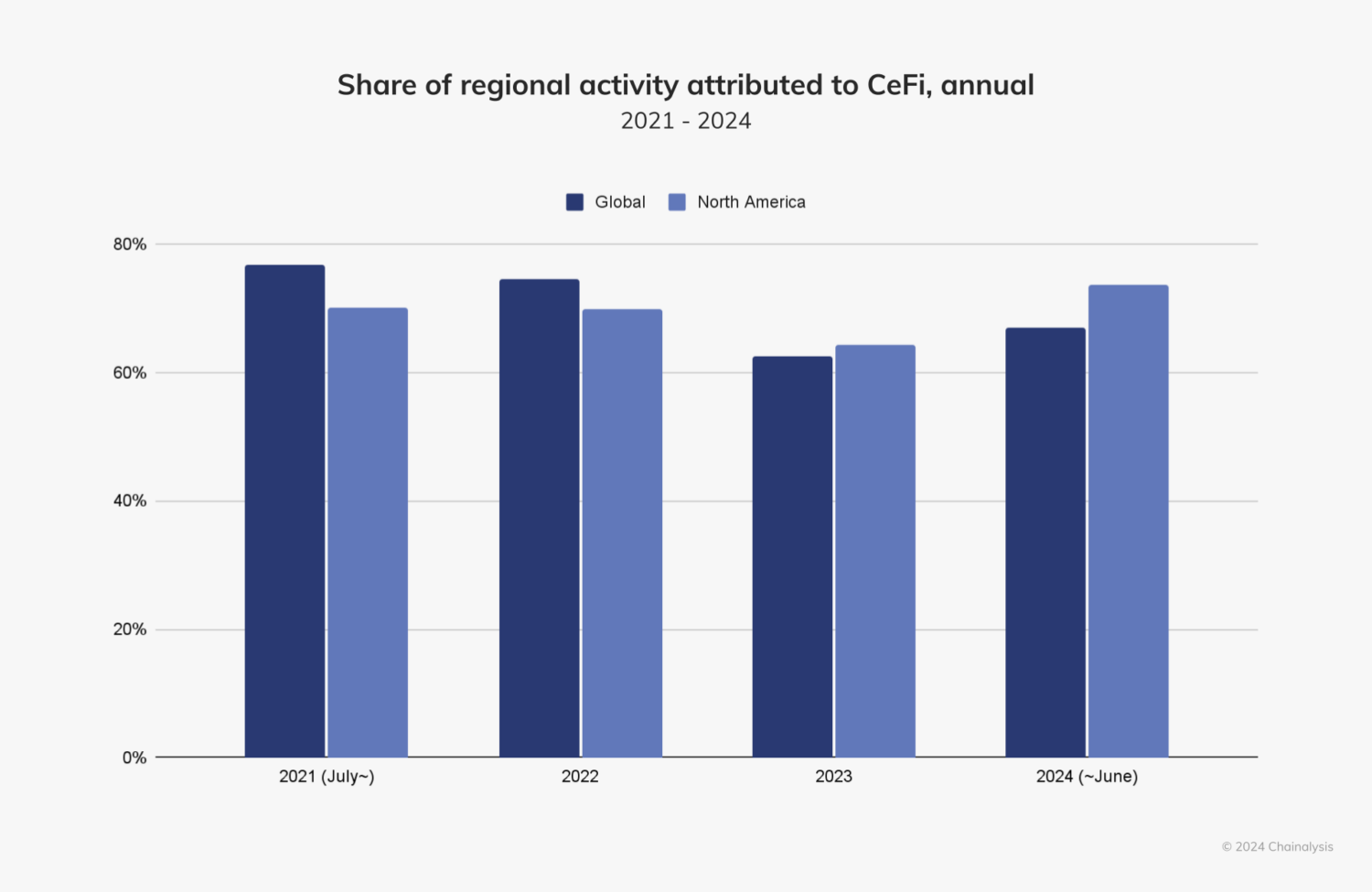

Concurrently, the U.S. is emerging as a dominant global user of centralized services in the crypto space, reflecting the growing reliance on centralized finance (CeFi) platforms, such as Coinbase and Gemini, for custody and asset management.

The rising demand for crypto-related financial products like ETPs — which we’ll explore in greater detail below — is likely to drive the demand for CeFi.

Claire Ching, Head of Institutional at centralized exchange and custodian Gemini, emphasized the importance of making digital assets accessible to everyday users through centralized platforms. “At Gemini, we are in the business of abstraction — it’s our job to simplify the crypto-native know-how so that anyone with a mobile phone can safely access digital assets,” she explained.

Furthermore, the entry of institutional giants like BlackRock into the crypto space underscores the growing convergence of TradFi and crypto. To gain insight into this development, we spoke with Kevin Tang from BlackRock’s Digital Assets team. BlackRock’s foray into digital assets has been carefully planned — which includes their BTC and ETH ETPs as well as tokenization – with strategic CeFi partnerships laying the foundation for its success. For example, in 2022, BlackRock partnered with Coinbase to integrate Coinbase Prime capabilities into Aladdin, the firm’s proprietary investment management platform. This integration allowed BlackRock and its clients to manage bitcoin and ether exposures seamlessly alongside those of traditional assets. “The platform integration was critical in building the foundational capabilities that would ultimately pave the way for the build-out of IBIT [iShares Bitcoin Trust],” Tang explained.

Centralized platforms are likely to remain pivotal in driving the ongoing TradFi-crypto convergence. “CeFi and centralized institutions are critical in enabling the evolution and provision of infrastructure that allows firms like BlackRock to operate in the [crypto] space,” Tang emphasized.

United States market drives global prices as ETPs solidify crypto-TradFi nexus

As we have explored in other global cryptocurrency markets, the January 2024 launch of spot bitcoin ETPs in the U.S. has had a transformative impact on both the U.S. and global crypto markets, driving institutional interest and bringing unprecedented inflows into BTC.

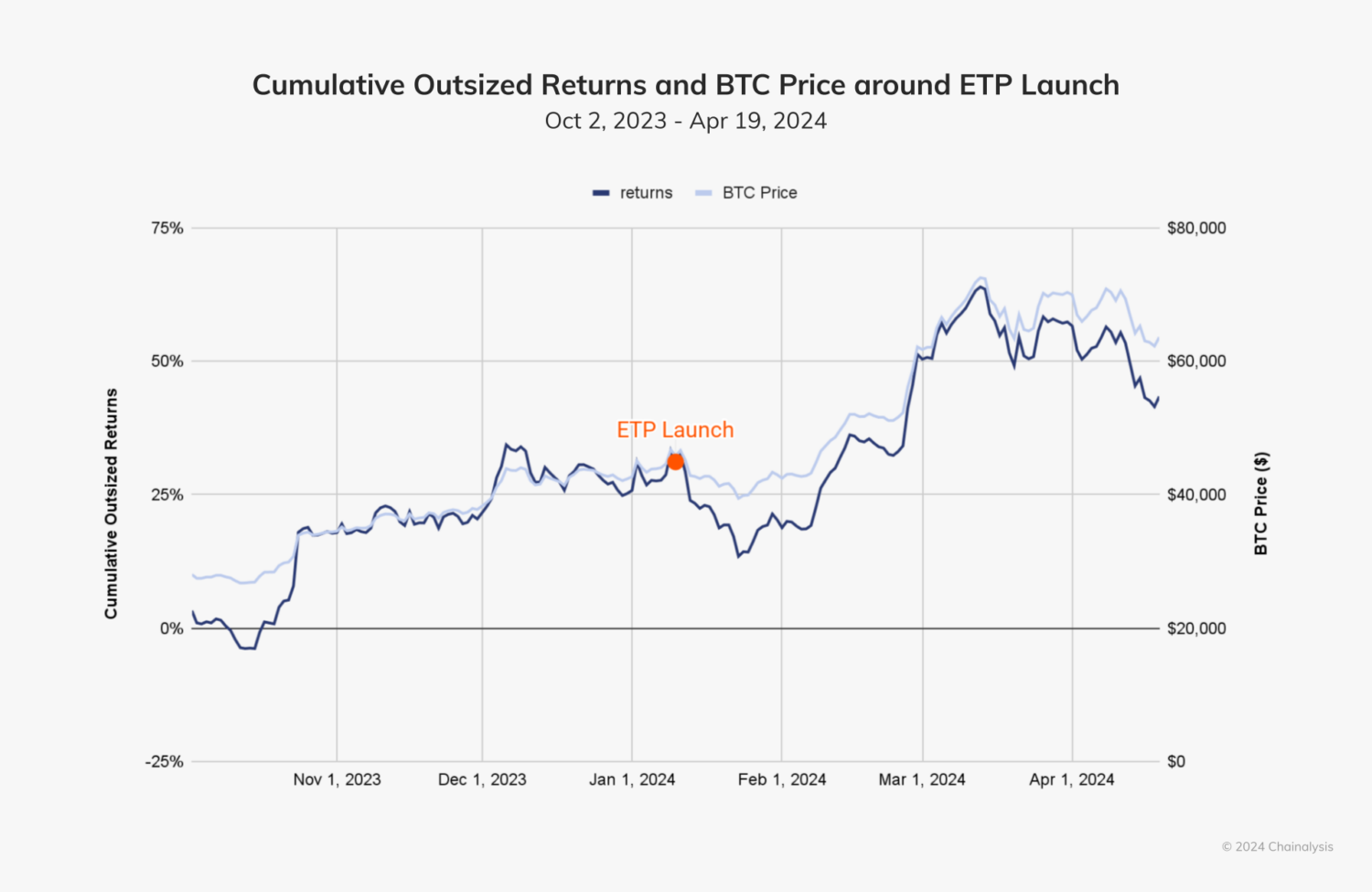

Immediately following the SEC’s approval, the market experienced a global bull run in price, accompanied by positive outsized returns a few weeks after the launch.

While it is not possible to fully isolate the impact of the launch of the U.S. bitcoin ETPs, there is broad recognition that the ETP contributed to a bullish market sentiment and increased institutional BTC exposure. This wave of demand has been attributed to ETPs’ abilities to simultaneously meet the needs of both retail and institutional investors, providing a familiar, regulated vehicle for gaining BTC exposure while avoiding the complexities of managing private wallets or navigating crypto-native infrastructure.

The U.S. launch of bitcoin ETPs — and spot ether ETPs months later — marks a pivotal moment in the TradFi-crypto convergence, primarily because it influenced institutional interest and broader market sentiment. Following the approval of the bitcoin ETP in the U.S., the crypto market experienced a notable uptick.

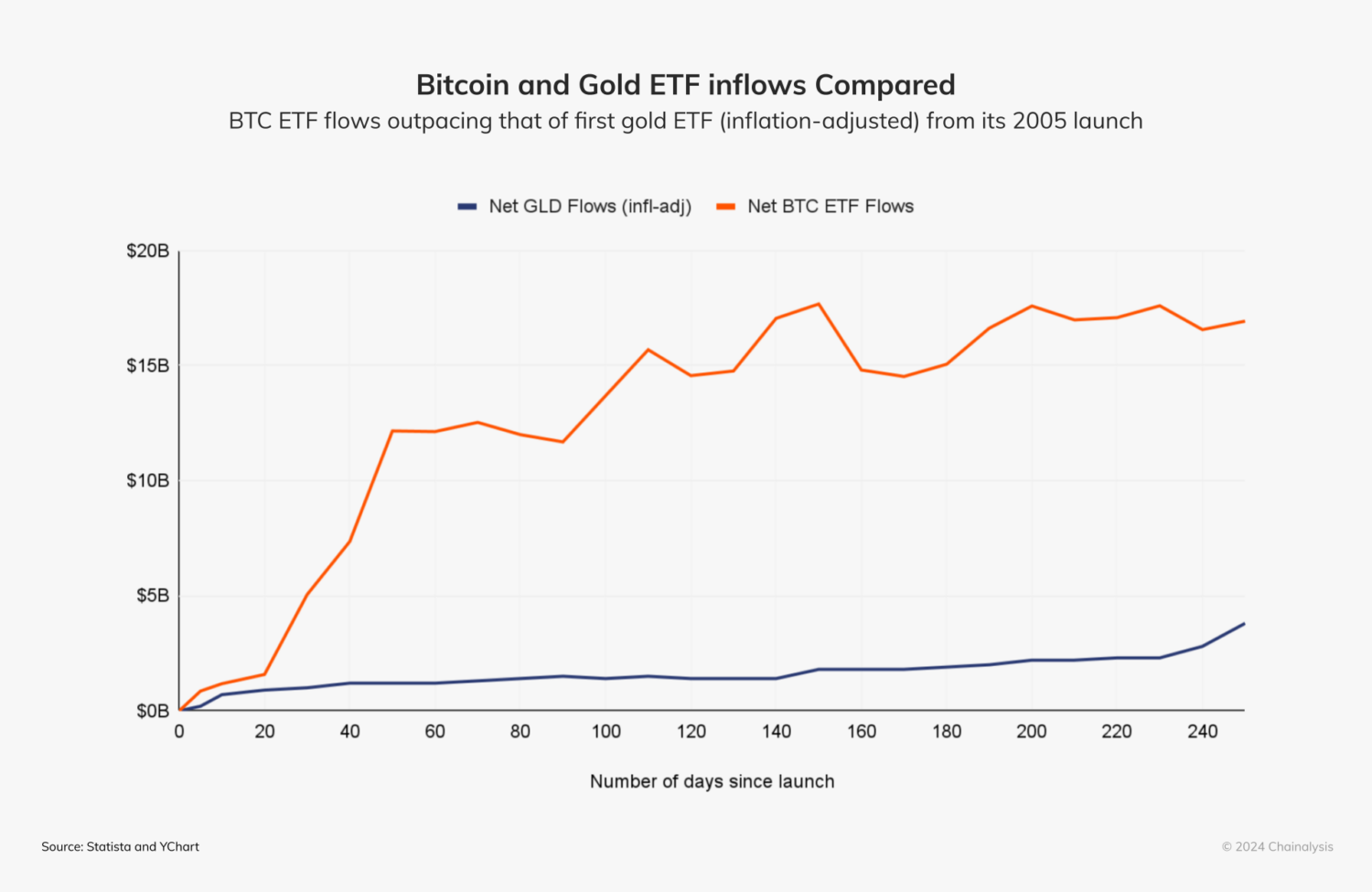

For deeper insight into the implications of this milestone, we asked Kevin Tang of BlackRock — whose iShares Bitcoin Trust (IBIT) has emerged as the most popular BTC ETP — to discuss its impact. “The launch of the U.S. bitcoin ETPs has been historic and speaks to the pent-up demand among investors for a low-cost, efficient, and secure way to invest in bitcoin.” IBIT broke several records, including being the fastest ETP to reach $10 billion and $20 billion in assets under management (AUM). “We had high expectations for asset gathering with the bitcoin ETP, the strong client interest we have seen so far represents a win for the ETF wrapper,” Tang remarked.

Within its first two hundred days, inflows to the U.S. bitcoin ETFs wildly outpaced even the historically popular gold ETF, making it the most popular class of ETP in history.

The rapid adoption affirms the strong, latent demand for a regulated, institutional-grade product that offers access to BTC.

The impact of the U.S. bitcoin ETPs is not just a U.S. phenomenon; it has far-reaching implications, setting the stage for a broader wave of adoption internationally, as well. Tang pointed out that the product has attracted investments from Asia, Europe, and Latin America. “The global impact of these ETPs is undeniable,” he said. Tang further emphasized that BTC is increasingly being viewed as a global monetary alternative and a unique diversifier in portfolios especially as a potential hedge against inflation or geopolitical instability — a point echoed in BlackRock’s recent whitepaper on the unique value proposition that bitcoin affords to investors.

This growing acceptance of BTC and ETH as assets worthy of serious investment is paving the way for broader institutional adoption. Tang noted that many investors are now engaging in deeper discussions about the role of BTC and other crypto assets in portfolios. “They’re asking how bitcoin fits in a portfolio alongside other traditional investments,” he said, noting that the launch of the ETPs has opened the door for broader access to crypto. “ETPs have shifted the conversation to focus on the investment merits and the value proposition of BTC and ETH, rather than just the logistical challenges of how to gain access to them,” Tang explained.

For many institutions, bitcoin ETPs serve as a first step toward deeper engagement with the crypto market. This exposure could eventually lead to broader investments in blockchain technology and decentralized finance (DeFi) well beyond exposure to the price of BTC and ETH. “Right now, we’re focused on BTC and ETH because that’s where we’re seeing demand and regulatory clarity,” he explained. “We’re always looking to meet our clients’ needs as the market evolves.”

With ongoing efforts to educate investors and build trust in the space, traditional financial institutions (FIs) like BlackRock are playing an important role in reshaping how institutions approach cryptocurrency, laying the foundation for broader adoption in the future. As Tang put it, “We firmly believe in the potential of blockchain technology, and tokenization specifically, to potentially disrupt traditional finance.”

Stablecoin growth stalls in U.S. markets

Despite record activity, U.S. markets have also faced some challenges over the past year, including a noticeable shift in stablecoin activity away from U.S.-regulated platforms. This trend may reflect barriers imposed by sputtering regulatory progress on stablecoins and digital assets more broadly.

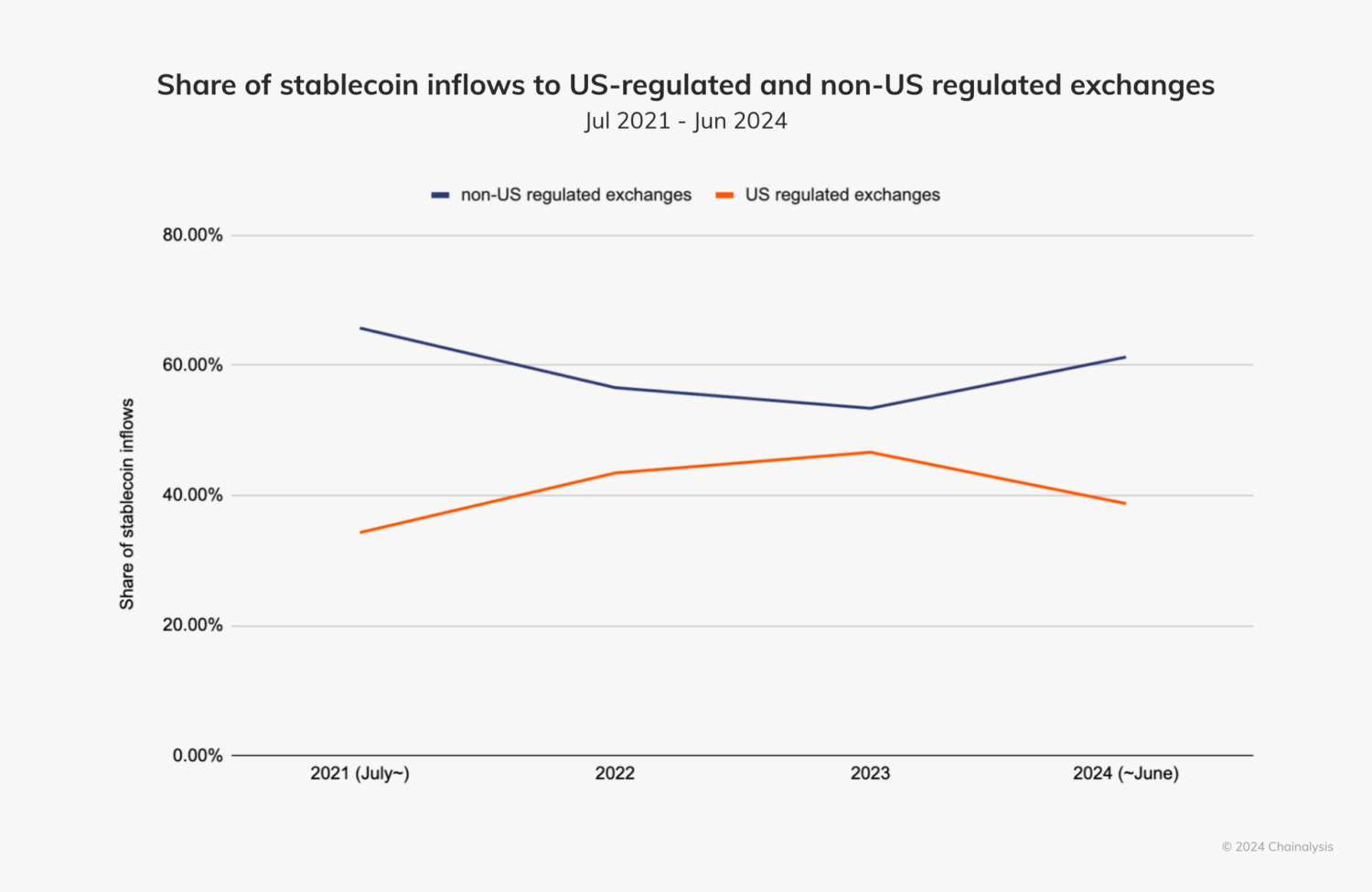

Up through 2023, the share of stablecoin transactions on U.S.-regulated exchanges had been steadily increasing, consistent with increased stablecoin adoption globally. However, in 2024, this trend began to reverse, as we see below.

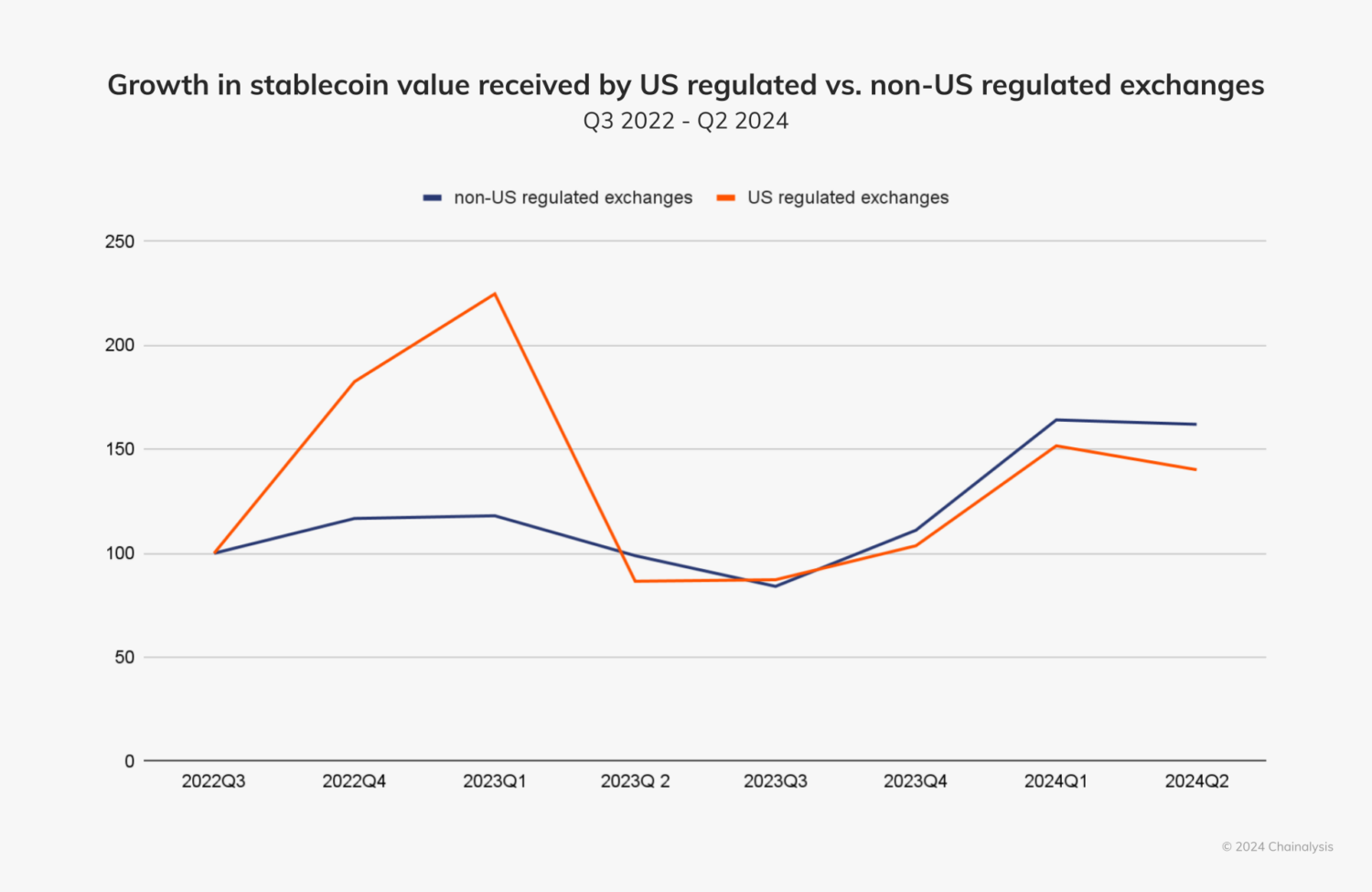

This shift likely reflects a relative, rather than absolute, decline in stablecoin usage within U.S. markets, given the surge in stablecoin adoption across emerging and global markets. More stablecoin transactions are now happening on non-U.S.-regulated exchanges, suggesting that global stablecoin adoption is outpacing U.S. growth. Below, we can see that both U.S.-regulated and non-U.S. regulated exchanges are growing, but non-U.S. market stablecoin activity is growing faster.

As noted above, this shift does not necessarily indicate a sharp decline in U.S. market participation, but instead speaks to the rapidly expanding role of stablecoins in emerging markets and non-U.S. jurisdictions.

For further insight into the evolving stablecoin market, we spoke with Circle, the issuer of USDC — a stablecoin pegged to the U.S. dollar. Circle emphasized the growing global demand for U.S. dollar-backed assets, especially among populations outside traditional banking systems where access to stable currency is limited.

“One way to think about the near-term opportunity for USDC is to look at the global demand for fiat dollar cash,” a spokesperson from Circle explained. “The Federal Reserve estimates that nearly $1 trillion in U.S. banknotes — 45% of all banknotes outstanding — are held outside the U.S., with two-thirds of all $100 bills in circulation abroad. This demand exists despite the difficulty people outside the U.S. encounter when trying to source U.S. dollars through their local banking systems.”

The growth in stablecoin usage outside the U.S. reflects a broader trend where international markets, faced with currency volatility, are turning to dollar-denominated stablecoins to preserve value and facilitate faster, cheaper transactions. Stablecoins, such as USDC and USDT (Tether), offer a compelling solution by providing access to the stability of the U.S. dollar without requiring access to traditional banking rails, which are often more difficult to access outside of the United States.

Still, regulatory uncertainty in the U.S. is threatening the country’s leadership in the stablecoin space. Circle pointed out that the absence of clear U.S. regulations has allowed other financial centers — such as the European Union (EU), the United Arab Emirates (UAE), Singapore, and Hong Kong — to attract stablecoin projects with more favorable regulatory frameworks. “Europe, through its MiCA framework, has succeeded in doing what the U.S. has yet to achieve: providing legal and regulatory clarity for the entire digital asset market,” the spokesperson noted. Markets in Crypto-Assets Regulation (MiCA), which began to take effect in June 2024, has created a regulatory foundation for stablecoins in the EU.

This regulatory clarity in regions outside the U.S. is fueling the growth of stablecoins globally, while the U.S. risks falling behind. “The absence of a U.S. regulatory framework for dollar-referenced stablecoins represents a threat to American interests,” the spokesperson from Circle warned. “This vacuum has incentivized the growth of stablecoins outside the U.S., where demand for access to the dollar is greater.” The opportunity cost for the U.S. extends beyond missing out on economic activity tied to stablecoins — it also risks forfeiting influence and authority over the future role of the dollar in on-chain commerce. This is not unlike the historic precedent of Eurodollars, which initially received little attention from U.S. policymakers due to the market’s small size. Eurodollars quickly grew, however, and helped cement the dollar’s international role — fortunately for legislators. The same may not hold true for the stablecoins if the U.S. continues to lag on providing clarity.

Nevertheless, Circle remains optimistic about USDC’s potential in the U.S., despite the regulatory delays. “The U.S. is the home of the dollar — and Circle’s home market — and we are bullish on USDC’s potential here,” they added. However, as more countries develop regulatory frameworks that encourage stablecoin adoption, particularly in regions where inflation and instability spur demand, U.S. policymakers are under increasing pressure to act. “A key question now is whether the U.S. will finally enact stablecoin rules of its own, or maintain the status quo of uncertainty, which policymakers in both U.S. political parties say is unacceptable,” they remarked.

The U.S. is not without progress on stablecoins entirely. Circle referenced the stablecoin bill advanced by the House Financial Services Committee in July 2023, which could provide the regulatory clarity needed for the U.S. market to remain competitive. “Congress should approve this bill on a bipartisan basis,” they urged. Establishing clear AML/CFT and sanctions obligations for stablecoin issuers will be critical to ensuring U.S.-based stablecoins maintain their global relevance.

Canadian markets follow U.S. closely

Although smaller than their U.S. counterparts, the Canadian market remains a key player in North America, receiving approximately $119 billion in value between July 2023 and June 2024.

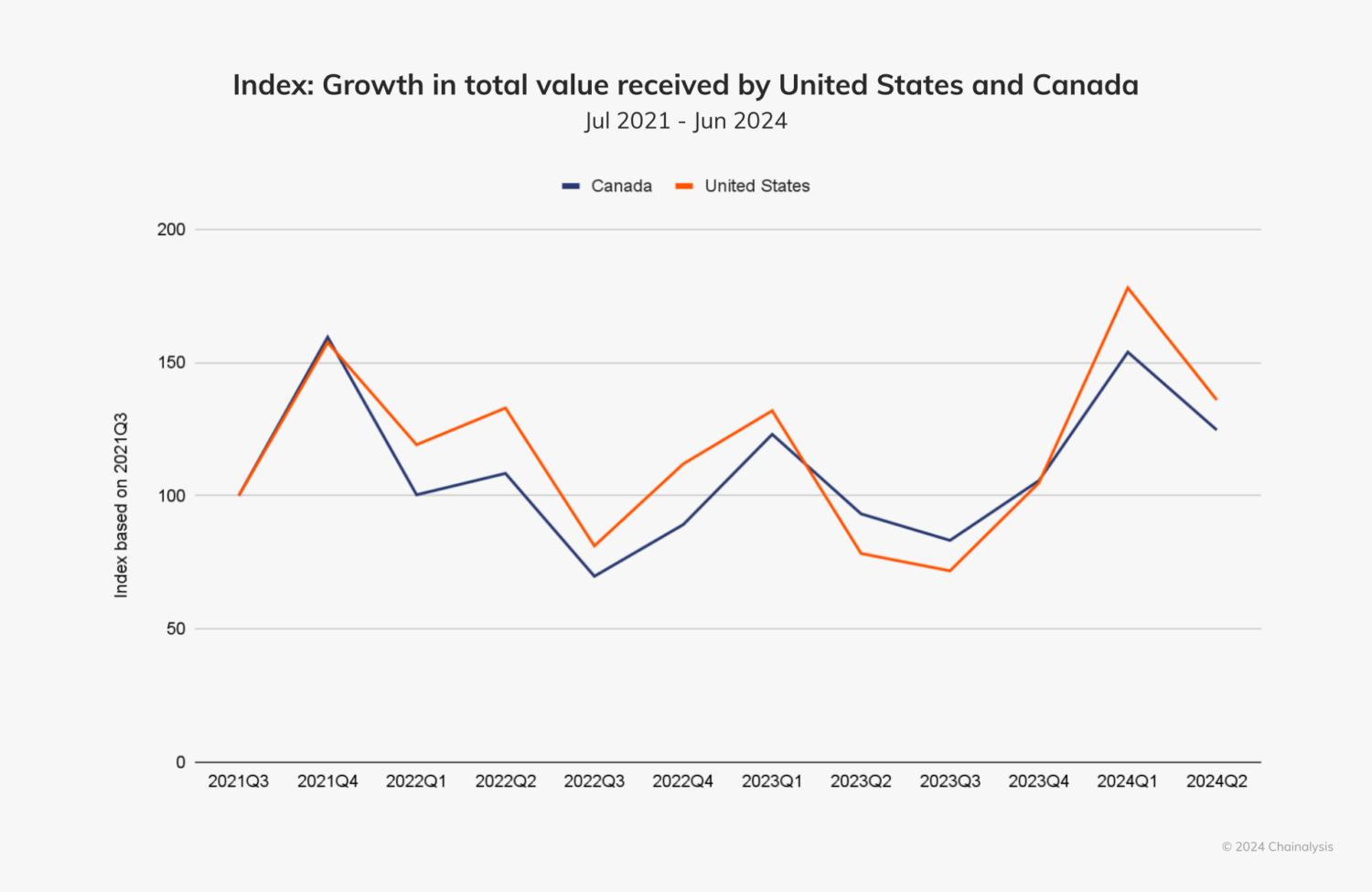

While Canadian markets closely follow U.S. trends, there tends to be less volatility, with more moderate gains during bull markets and milder retractions during bear markets.

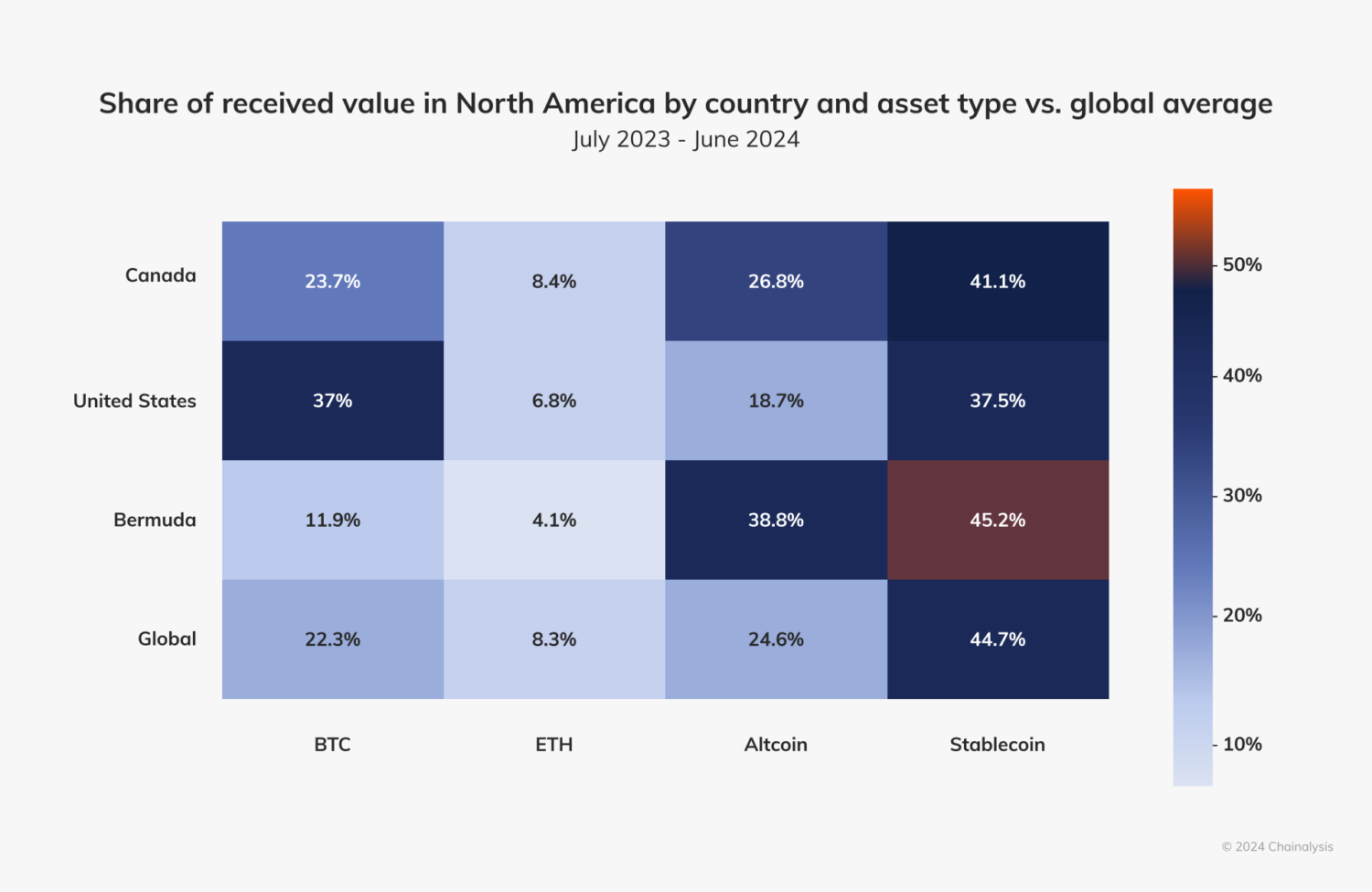

Across the board, Canada tracks closely with global averages in asset distribution and transaction sizes.

For an on-the-ground perspective of the cryptocurrency landscape in Canada, we spoke to Kunal Bhasin, Partner & Co-lead at KPMG’s Digital Assets Center of Excellence, Advisory Services. Bhasin offered insights into crypto adoption in Canada, as well as some of the challenges the industry is facing.

In the wake of regulatory changes implemented last year — which introduced stricter rules around custody, leverage and stablecoins — Canada has seen several major crypto businesses suspend operations within the country, with Gemini joining Binance and OKX as the latest exchanges to exit the market. However, according to Bhasin, this trend is not solely due to regulatory challenges. “Canadian regulators have provided more clarity to crypto exchanges than other North American jurisdictions by introducing the concept of crypto contracts, which clarifies the applicability of securities regulations for crypto platforms,” he explained. The departure of these exchanges, he suggests, might stem from broader business decisions rather than an unworkable framework. Nevertheless, Bhasin emphasized that Canadians still have “lots of regulated venues available to engage with crypto in a meaningful way.”

While Canada’s regulatory framework for trading platforms and investment funds has helped maintain some confidence, gaps remain — particularly in the regulation of stablecoins and DeFi. “The Canadian regulatory approach for stablecoins is somewhat different from the approach taken by other forward-looking jurisdictions such as EU, UAE, Hong Kong and Singapore.” Bhasin explained. “There is not a clear regulatory framework for stablecoins. As a result, you could see stablecoin issuers leave Canada and associated crypto innovation also moving outside Canada,” he said.

Despite these hurdles, Bhasin spoke to promising developments. The pan-Canadian self-regulatory organization, Canadian Investment Regulatory Organization (CIRO), now oversees all investment dealers, mutual fund dealers, and trading activity across Canada’s debt and equity markets. Under this framework, crypto exchanges are required to become CIRO members, bringing them under stricter disclosure, internal control, and regulatory reporting requirements. “This is a sign of the Canadian regulatory landscape maturing for crypto companies,” said Bhasin.

Another challenge in Canada’s crypto adoption is the reluctance of major FIs to engage meaningfully with cryptocurrency. “Major banks globally have taken appropriate steps to understand the unique risks of banking regulated crypto companies and have incorporated an enhanced due diligence program relevant for crypto businesses, which are a source of new deposits for these banks. However, we’re not seeing similar steps from banks in Canada,” Bhasin explained. “This has made it difficult for crypto companies to get banking services, leading to some innovation moving outside of Canada.” Additionally, he pointed out that large Canadian banks have crypto teams and have conducted various pilot programs and proof-of-concepts but, “When it comes time to move beyond these pilots, leadership often pulls back,” he said, attributing this to risk aversion and a preference for maintaining existing business models over disrupting them with new, potentially risky crypto ventures.

A significant driver of crypto adoption worldwide has been the proactive stance of national governments, like those in Singapore and the UAE, who have prioritized crypto as a part of their economic strategies. According to Bhasin, stronger government engagement could stimulate growth and investment. “There needs to be more engagement at the federal level to make digital assets a priority industry for Canada,” he said.

While Canada’s crypto market faces challenges, Bhasin is optimistic about the future, especially given ongoing efforts from both the public and private sectors. “Canada still has a strong regulatory environment for certain crypto activities such as investment funds,” said Bhasin, noting that it was the first country to launch staked ETH ETFs. “There’s potential to grow that further by providing a clear roadmap for primary and secondary markets for tokenized real world assets,” he added. “If the government makes crypto a priority and we continue to progress in the regulatory space, there’s no reason Canada can’t claim a position as a global leader in crypto adoption.”

Future proofing crypto in North America’s lies in the balance between institutional momentum, regularity clarity, and innovation

The immense influence of North America, particularly the United States, on the global cryptocurrency market is undeniable. The region’s dominance this period, fueled by the introduction of ETPs and the growing TradFi-crypto convergence, has significantly shaped the crypto landscape both domestically and internationally. As Claire Ching of Gemini noted, “Institutional adoption has taken on a different flavor this cycle. It is more measured and requires significantly more diligence after last cycle’s spectacular downfall of FTX. With this level of focus and resources, institutional commitment to the space is firmly cemented.”

Institutional giants like BlackRock are no longer merely experimenting — they are fully invested, signaling that cryptocurrency has moved from the fringes to the mainstream financial conversation. Speaking to this paradigm shift, Kevin Tang from BlackRock imparted the importance of “the persistent view of blockchain as a transformative technology with the potential to disrupt traditional paradigms and value chains — not just in finance, but across industries and sectors on a broader scale.”

Despite this momentum, challenges remain. Regulatory uncertainty in the U.S. and Canada, coupled with the shift of stablecoin market share outside North America, emphasizes the need for balanced innovation, clear regulatory frameworks, and sustained institutional support to ensure the continued growth and stability of the crypto industry at large.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.