In recent weeks, many personalities and media have highlighted Polymarket, reinforcing the excitement around the decentralized prediction market platform. But in reality, is Polymarket that used?

Open interest, global volume: a member of the crypto community is interested in Polymarket statistics

What if we were being lied to about the excitement surrounding Polymarket? This is what Hasu, a member of the crypto ecosystem, indirectly asserts, who looked into the statistics of the decentralized market prediction platform.

Polymarket is good, yes, but I feel like its time to call them out on their bullshit of putting “volume” front and center, while aggressively hiding open interest everywhere on their website. I searched for 10 minutes and couldn't find it.

Here is an external dashboard that… https://t.co/PA4QLtbgsl

— Hasu⚡️🤖 (@hasufl) October 17, 2024

📉 Follow our guide to discover Polymarket and bet cryptocurrency on various events

On X, Hasu would have noticed an unfortunate trend from Polymarket. The platform would highlight the total volume of bets rather than its open interest, a measure used to assess the activity and liquidity of a market. This is why Hasu started in the platform's statistical analyst.

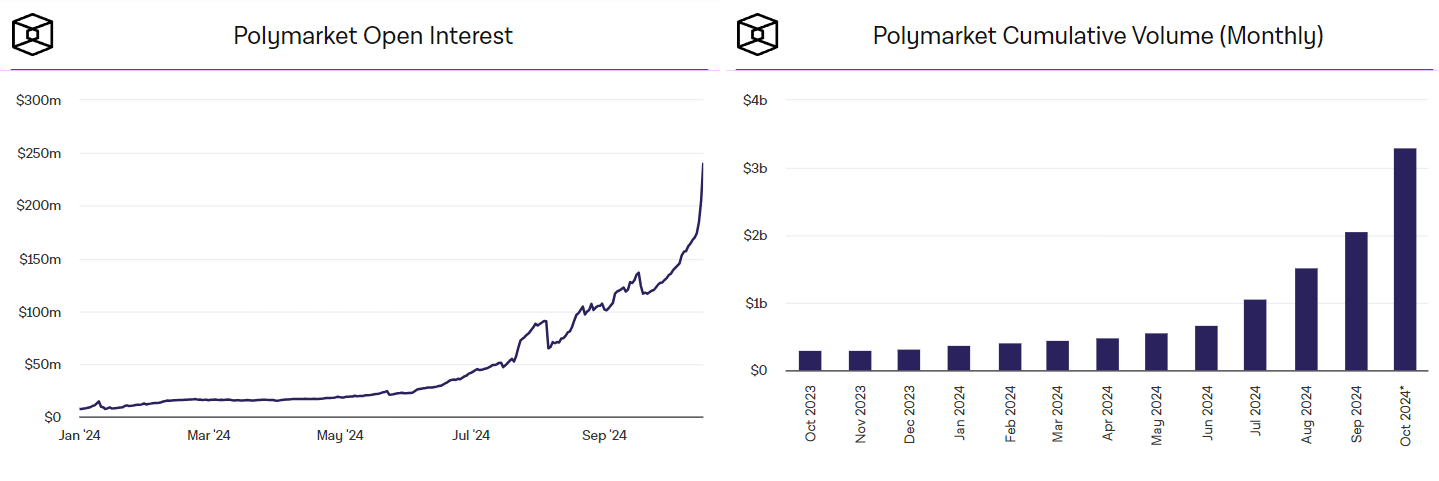

On the left, Polymarket's open interest for the year 2024. On the right, the evolution of the monthly volume of bets made on the platform over the same period

Quite logically, the 2 graphs follow the same growth. However, the numbers are not the same. If in the month of October, Polymarket can boast to have exceeded the threshold of 3 billion dollars in registered bets, Hasu prefers to highlight the open interest of the decentralized prediction market platform :

Here are graphs that show that Polymarket's open interest recently exceeded $200 millionand that a month ago, this metric revolved around of 100 million dollars. This figure concerns all markets taken into account by the platform. […] This proves that this market is not yet very established.

To support his remarks, Hasu discusses the American presidential elections, the theme that helped increase Polymarket's popularity. In total, almost $1.5 billion in crypto bets were carried out in connection with this deadline scheduled for November 5.

However, for Hasu, this figure is of little interest : “ I tried to find out what the market's open interest was in connection with the American presidential elections, but no one knows him, » he explains. For this member of the crypto community, Polymarket does everything to hide its open interest.

Buy cryptos on eToro

The platform is increasingly used as a trend indicator

Hasu paralleled his arguments with the pronounced use of Polymarket as a trend indicatornotably for the American presidential elections:

Even a “smaller” Polymarket remains an interesting platform for the crypto ecosystem, and although I use it myself when thinking about elections, I'm just saying it needs to be put in the right context.. It is completely understandable that Polymarket would like to use the results from their platform to transpose them into a much broader context. But it's also not entirely ethical in my opinion.

🗞️ Also read – Polymarket: only 1 in 10 bettors succeed in making profits thanks to the decentralized prediction market platform

In recent weeks, several media do not hesitate to use the results delivered by Polymarket instead of surveys from specialized institutes.

Elon Musk, known for being one of the closest supporters of Republican candidate for the presidency of the United States Donald Trump, declared on X that the Polymarket results were “ more accurate than surveys [traditionnels]because there is money at stake ».

Cryptoast Academy: Don’t waste this bull run, surround yourself with experts

Source: The Block

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.