During his speech at the Jackson Hole Economic Symposium, Jerome Powell hinted that the US Federal Reserve (FED) could begin a rate cut in September. After a year of stagnation, this would be the first cut after 11 consecutive rate hikes.

Jerome Powell could announce a rate cut on September 18

Speaking Friday at the Jackson Hole Economic Symposium, the annual gathering of central bankers from around the world, Jerome Powell, Chairman of the US Federal Reserve, spoke out in favor of a rate cut.

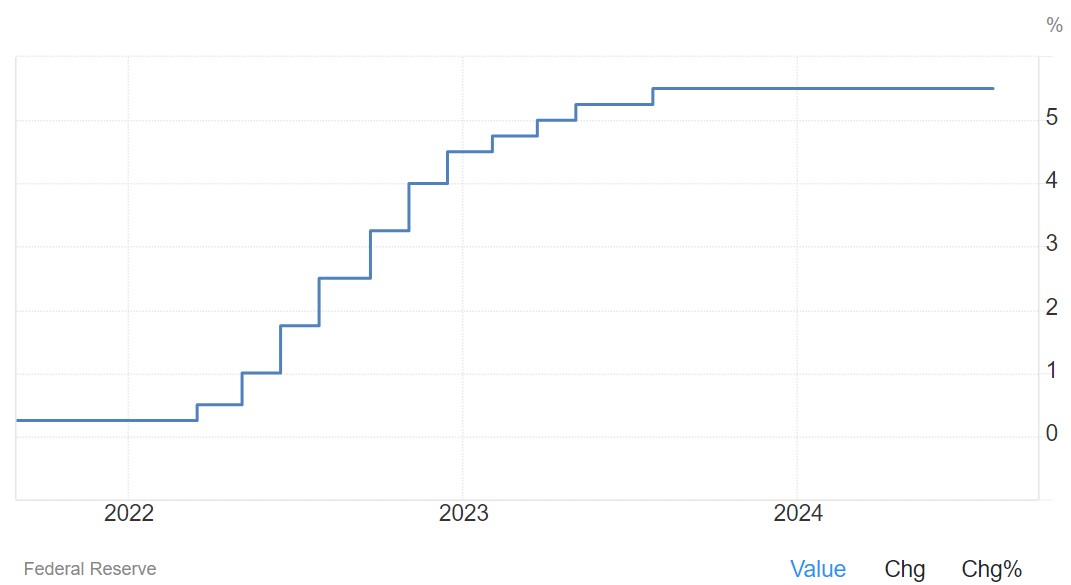

While these key rates have been maintained at 5.5% for over a year now, this follows 11 consecutive increases following the surge in inflation and monetary policy during the Covid-19 pandemic:

Figure 1 – Evolution of Fed rates over the last 3 years

Let's Invest: All the Essential Resources for the Informed Investor

During his speech, Jerome Powell expressed confidence regarding inflation, which is on the ” sustainable path to return to 2% ” according to him. Thus, this would justify future reductions, although these have not yet been acquired:

The time has come for a policy adjustment. […] The direction to take is clear, the pace of rate cuts will depend on upcoming data, the evolution of the outlook and the balance of risks.

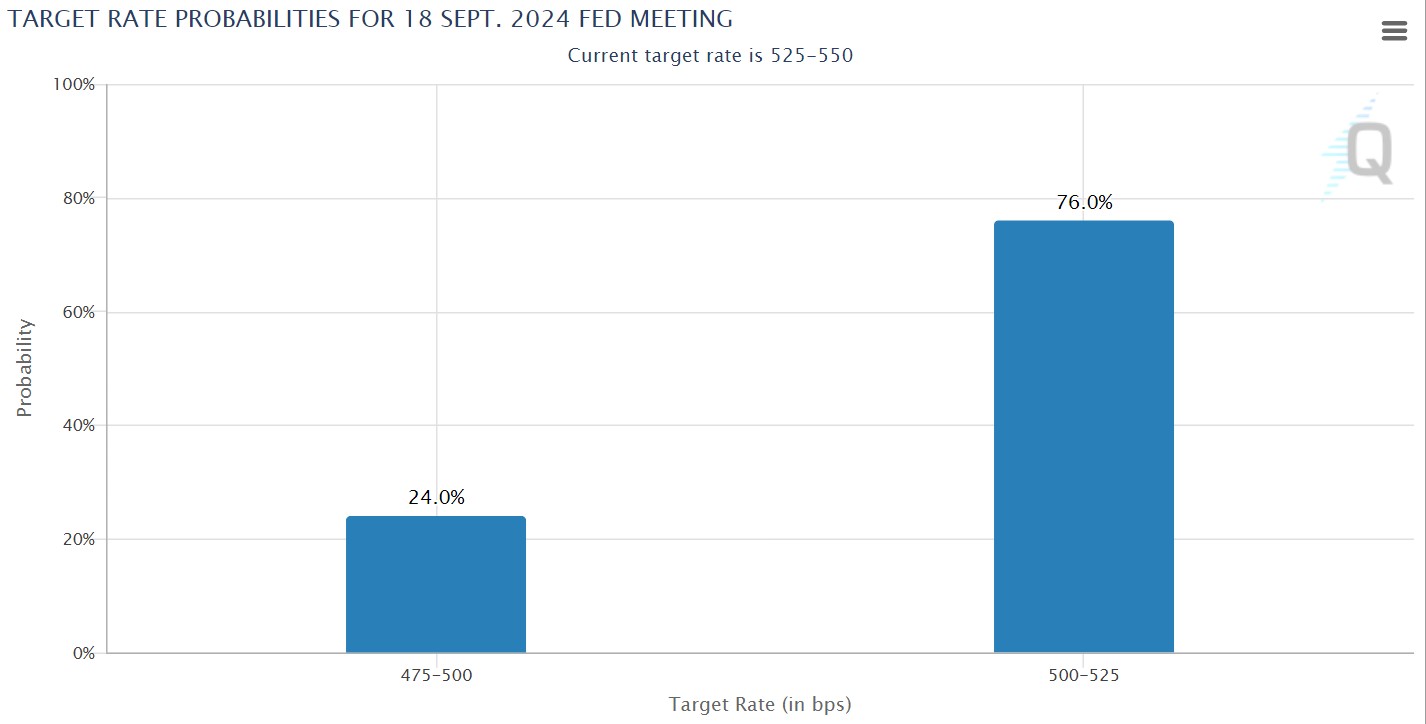

After this intervention, the market now expects a rate cut of 25 to 50 basis points for 76%, and 50 to 75 basis points for 24%. Under this scenario, rates could thus be reduced at a level between 4.75% and 5.25% on September 18 :

Figure 2 – Estimates of the evolution of the FED's key rates on September 18

In terms of inflation, The United States posted a level of 2.9% last July compared to 3% in June. This constitutes the 4th consecutive month of decline.

For comparison, the European Union, for its part, began its first rate cut in 8 years last June. These are now set at 4.25%.

As for the United States, we now have to wait until September 18 to find out the FED's decision.

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

Sources: Trading Economics, CME

The #1 Crypto Newsletter

Receive a daily crypto news recap by email

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.