Bitcoin mining company Riot Platforms has doubled its mining power, becoming the second largest mining firm in the world. What is its strategy?

A historic increase for Riot Platforms

Riot Platforms, a pioneer in Bitcoin mining, has increased its hashrate by 50%, propelling it to become the 2nd largest Bitcoin miner in the world behind Marathon Digital.

This increase in its hashrate translated into a 20% increase in the company's Bitcoin production, with a total of 255 BTC mined in June.

👉 Learn more about Bitcoin mining – How does Bitcoin (BTC) mining impact the energy sector?

According to our information, Riot Platforms' hashrate was 14.7 EH/s at the beginning of June. By installing new mining equipment at its Corsicana site and exploiting excess capacity at its existing Rockdale site, the company was able to increase this figure to 22 EH/s.

Now, Riot Platforms has surpassed the hashrate of mining companies CleanSpark and Core Scientific, 2 of its main rivals.

“June was a historic month for Riot Platforms”said Jason Les, CEO of Riot Platforms, in a statement. “Not only did we exceed our mid-year deployed hashrate target of 21.4 EH/s, we also became the second-largest Bitcoin miner by hashrate.”

Feel Mining: generate passive income with your cryptos

Bitcoin Mining: Production Up Despite Halving

Despite Bitcoin's halving that reduced miners' rewards by 50% in April 2024, Riot Platforms managed to increase its Bitcoin production by 20%This is due to the company's significant increase in hashrate, which allowed it to compensate for the decrease in block rewards.

Company CEO Jason Les also spoke about the company's energy strategies:

“Beginning this month, we will also begin providing greater visibility into the results of our unique energy strategy by reporting our monthly cost of electricity, per facility, net of electricity credits. This past June was a concrete illustration of our energy strategy, as Riot Platforms earned $6.2 million in electricity credits. This electricity cost […] ranks among the lowest in the industry and is one of Riot Platforms' key competitive advantages.”

Riot Platforms has retained all 255 Bitcoins mined in June, and now owns a total of 9,334 Bitcoins. With Bitcoin currently priced at around $57,500, this is valued at $536.7 million.

👉 Also in the news – Any return of Bitcoin between $50,000 and $60,000 is a long-term opportunity – Analysis by Vincent Ganne

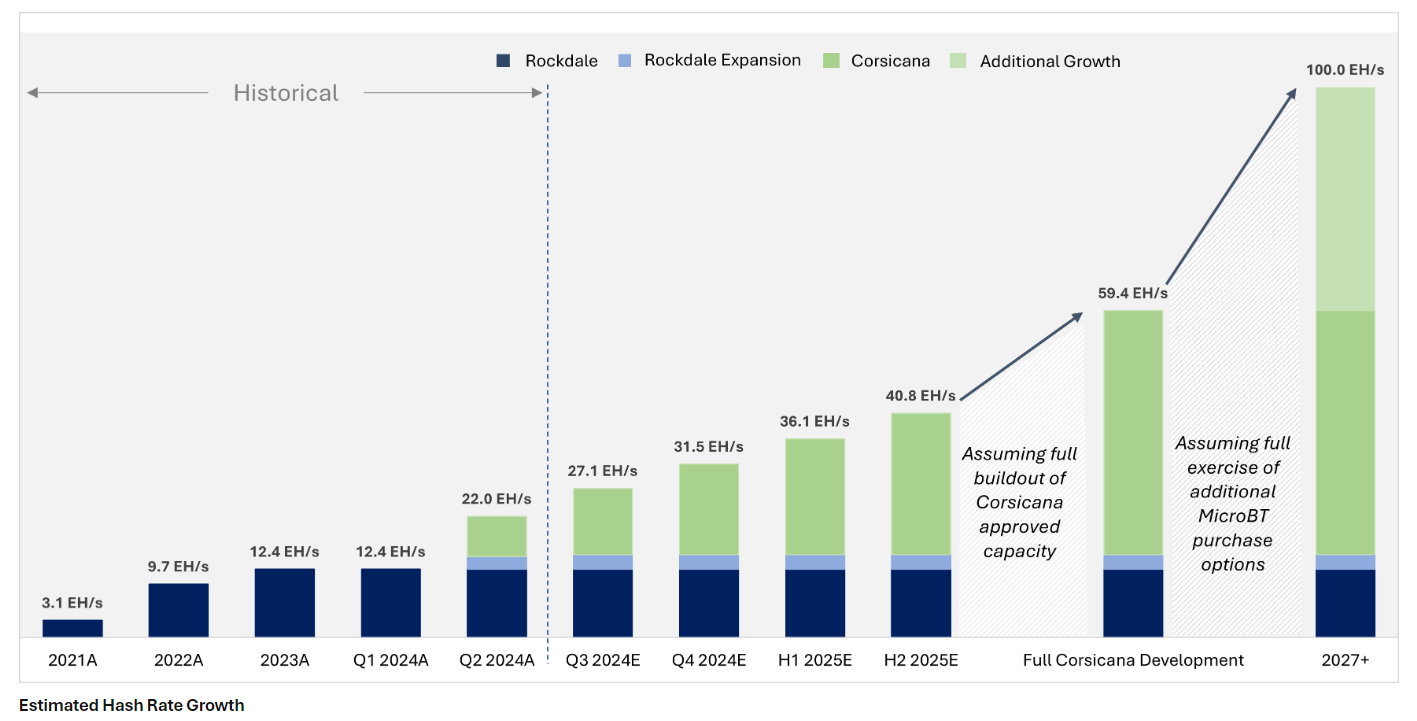

This performance puts Riot Platforms in a strong position to become one of the leaders in the Bitcoin mining market. The company also intends to increase its total hashrate capacity to 31.5 EH/s by the end of 2024, and is targeting a hashrate of 100 EH/s by 2027..

Estimation of hashrate growth at Riot Platforms

Despite this positive news, Riot (RIOT) stock price is down 1.5% over the last 24 hours and is currently trading at $9.57. The stock is down 29% over the past 12 months and down 37.9% year-to-date in 2024.

Get your €50 bonus with Bitpanda!

Source: Riot Platforms

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.