The SOL token marks the milestone of exceptional relative strength which has carried it over the last 6 months. Back on key supports, price action is torn by the holding of its medium-term upward trend and short-term developments. Will Solana’s cryptocurrency manage to avoid the plunge?

It is Tuesday June 18, 2024 and the price of Solana (SOL) is around 135 dollars.

We have been experiencing consolidation in the crypto market for several days, and Solana does not escape its correlation to the market by showing signs of technical degradation. The SOL token, like many altcoins, is suffering against the dollar but also against Bitcoin, which remains very resilient in this period, a symbol of questioning for many investors.

Ranked 5th in order of market capitalization, Solana remains – with its 67 billion dollars – a major project in the crypto ecosystem. Let’s take a technical look at the SOL token!

| Pairs with Solana | 24 hours | 7 days | 1 month |

| Solana/USDT | -5.90% | -10.50% | -20.50% |

| Solana / Bitcoin | -5.20% | -8.00% | -18.60% |

| Solana / Ethereum | -2.80% | -7.90% | -28.00% |

👉 How to easily buy Solana (SOL) in 2024?

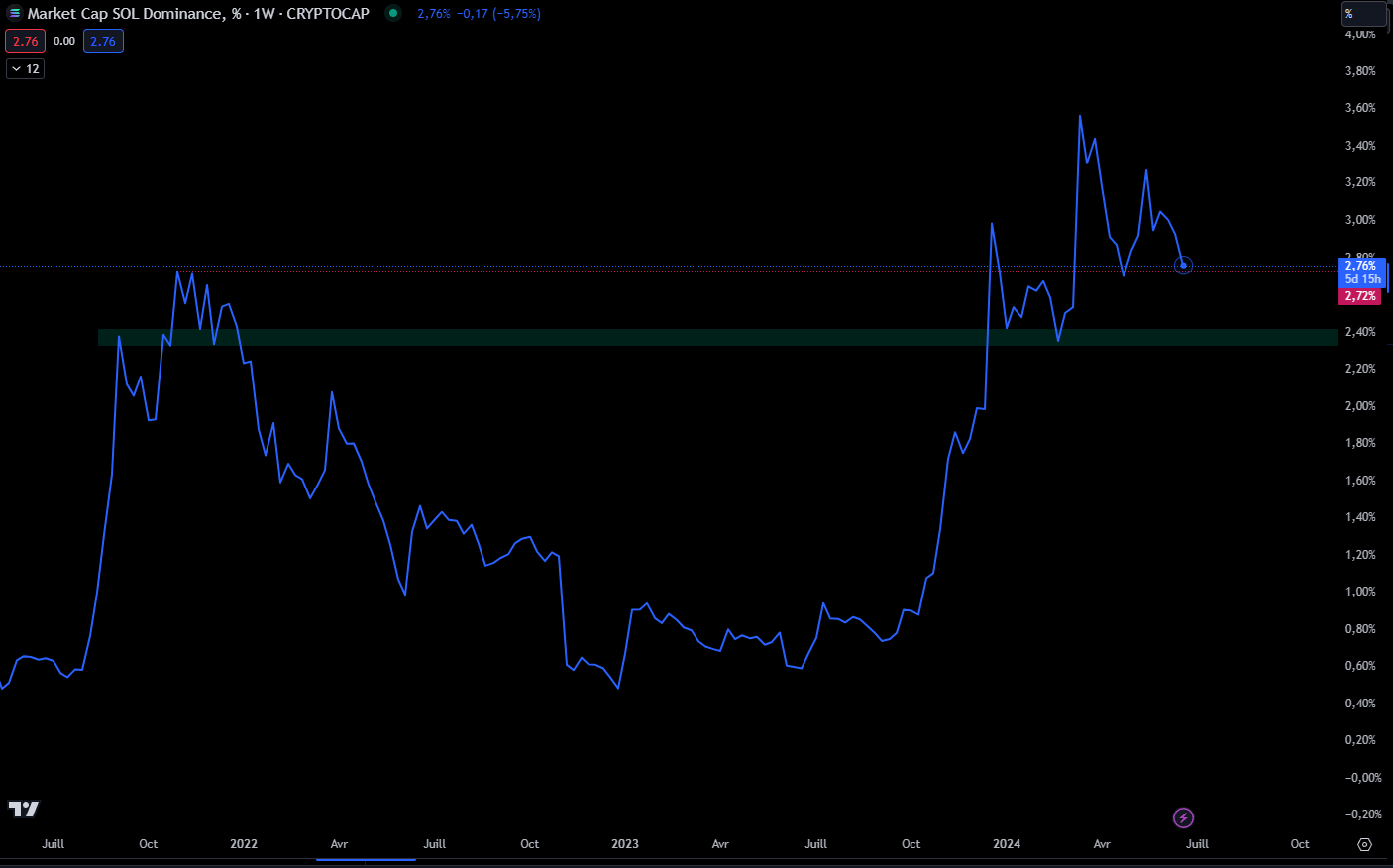

The Solana token did not mark an all-time high in 2024. However, it only failed at 20% of the latter. However, a notable element of this bull cycle is the weight it now occupies in the ecosystem. Indeed, the dominance of SOL reaches a historic high of 3.66% in March 2024.

This dominance is currently defended, since the chart manages to maintain a level higher than the closing highs of the 2021 cycle. The SOL, however, shows some signs of weakness, with a high point achieved in May 2024 lower than the previous one..

It is important to monitor this dominance in the 2.7% zone, which marks the peak of the 2021 cycle, and the zone drawn in green on the graph below around 2.40%.

Graph of Solana dominance within the crypto ecosystem

Cryptoast Research: Don't waste this bull run, surround yourself with experts

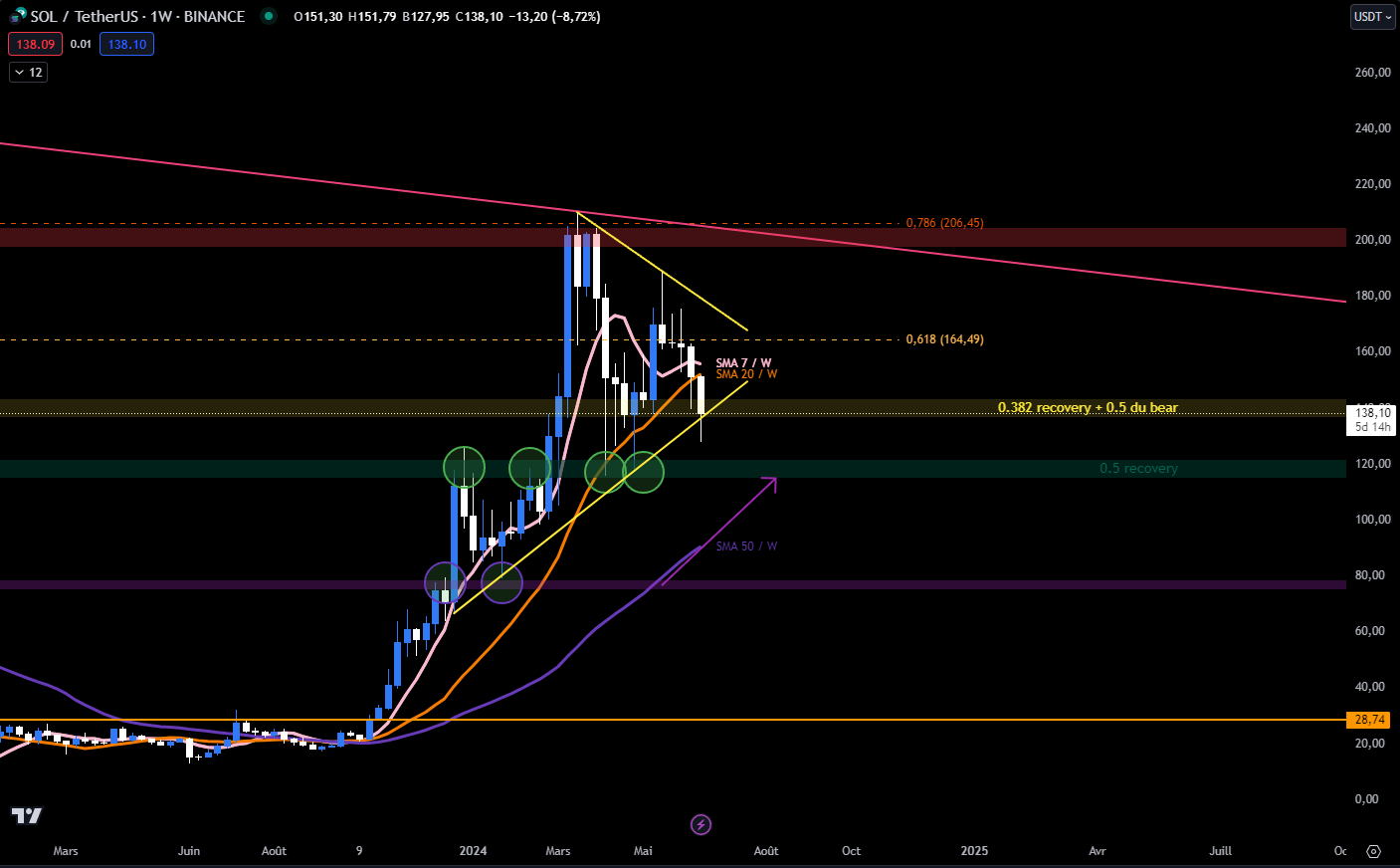

Return to the key level of 135 dollars

The $135 level is a key weekly pivot for Solana. Indeed, we mentioned in our analysis of May 28 a possible scenario of “ dead cat bounce “. The latter would gain in probability in the event of a close below this zone.

This is plotted in yellow on the graph below. It corresponds to the confluence of numerous key levels:

- 0.382 retracement of the bullish leg since October 2023;

- 0.5 bear market retracement;

- compression triangle bottom;

- previous low.

The whole challenge this week is maintaining the level of 135 dollars in order not to achieve a lower low than the previous one, which, according to DOW law, would initiate a weekly downward trend on Solana.

A forceful reaction would be to reconquer the 7 and 20 week moving averages, either before the close this Sunday or in the next 2 weeks.

Weekly Solana price graph

Buy cryptos on eToro

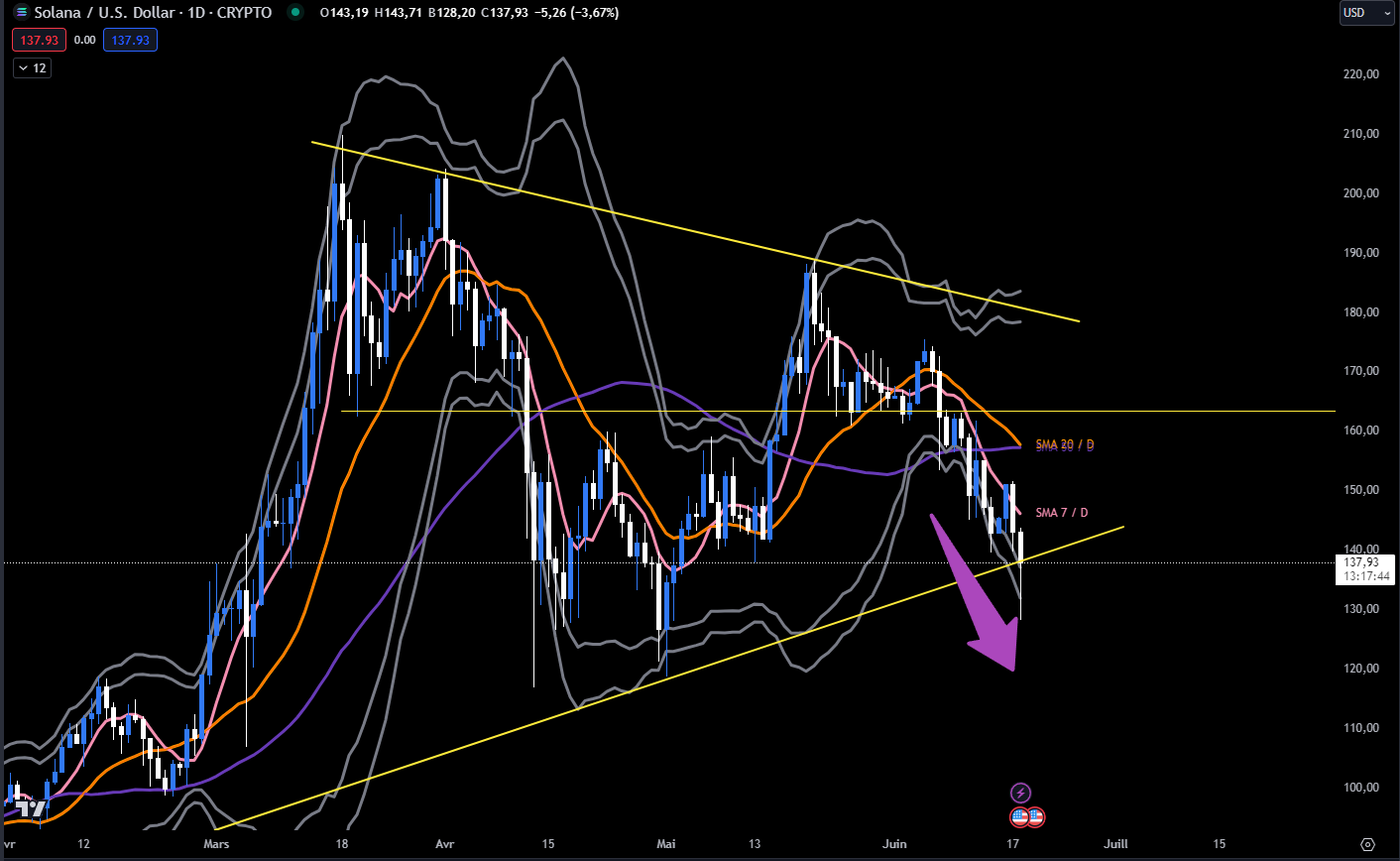

In the shorter term, we can observe a bearish flow whose inertia is pulling prices down. This flow is materialized by the ping-pong between the lower Bollinger band and the 7-day moving average.

These next few days will mark the confrontation between the weekly supports of the SOL and the flow which has started. The bearish camp will wait for a continuation of the back and forth between low BB and 7 and 20 day moving averages. On the contrary, the bullish camp expects a crossing of the 7 moving average and a favorable consolidation in order to subsequently cross the 20-day average.

Solana token price graph on a daily basis

Cryptoast Research: Don't waste this bull run, surround yourself with experts

In summary, Solana is sitting on a key technical level: weekly supports are being tested by a bearish daily flow. The latter must resist the risk of drawing the start of a weekly downward trend at the close this Sunday.

So, do you think SOL can hold its support? Don't hesitate to give us your opinion in the comments.

Have a nice day and we’ll see you next week for a new technical analysis of altcoins.

Sources: TradingView, Coinglass, Glassnode

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to cryptoassets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.