The consolidation underway since March 2024 has finally been broken on Solana, catalyzed by the results of the American elections. Like Bitcoin, SOL could continue its progression towards its historic peak to move into a price discovery zone. However, a small consolidation phase may be necessary.

Can Solana reach and then surpass its previous all-time high?

It is Friday, November 15, 2024 and the Solana SOL price is around $210.

On October 22, the date of our last analysis, we titled our article: “The 200 dollars in the crosshairs for the crypto SOL? “. Since this article, Donald Trump has been elected President of the United States and the markets have welcomed this result very positively.

As a result, Solana benefits from a bullish catalyst that pushes the price of SOL beyond resistance worked since March 2024. Make no mistake, this is no coincidence. SOL has been one of the strongest cryptos on the market since the end of 2023. It demonstrates strength against the dollar while managing to maintain its strength relative to Bitcoin in a range.

This is why the next step seems appropriate: revisiting its historic high established in November 2021 at $260!

👉 Find out how to buy SOL crypto from Solana

| Pairs with Solana | 24 hours | 7 days | 1 month |

| Solana/USDT | -3.90% | +5.50% | +37.00% |

| Solana / Bitcoin | -1.00% | -8.70% | -10.50% |

| Solana / Ethereum | +0.50% | +0.10% | +16.70% |

Buy cryptos on eToro

Solana, consolidate to relaunch!

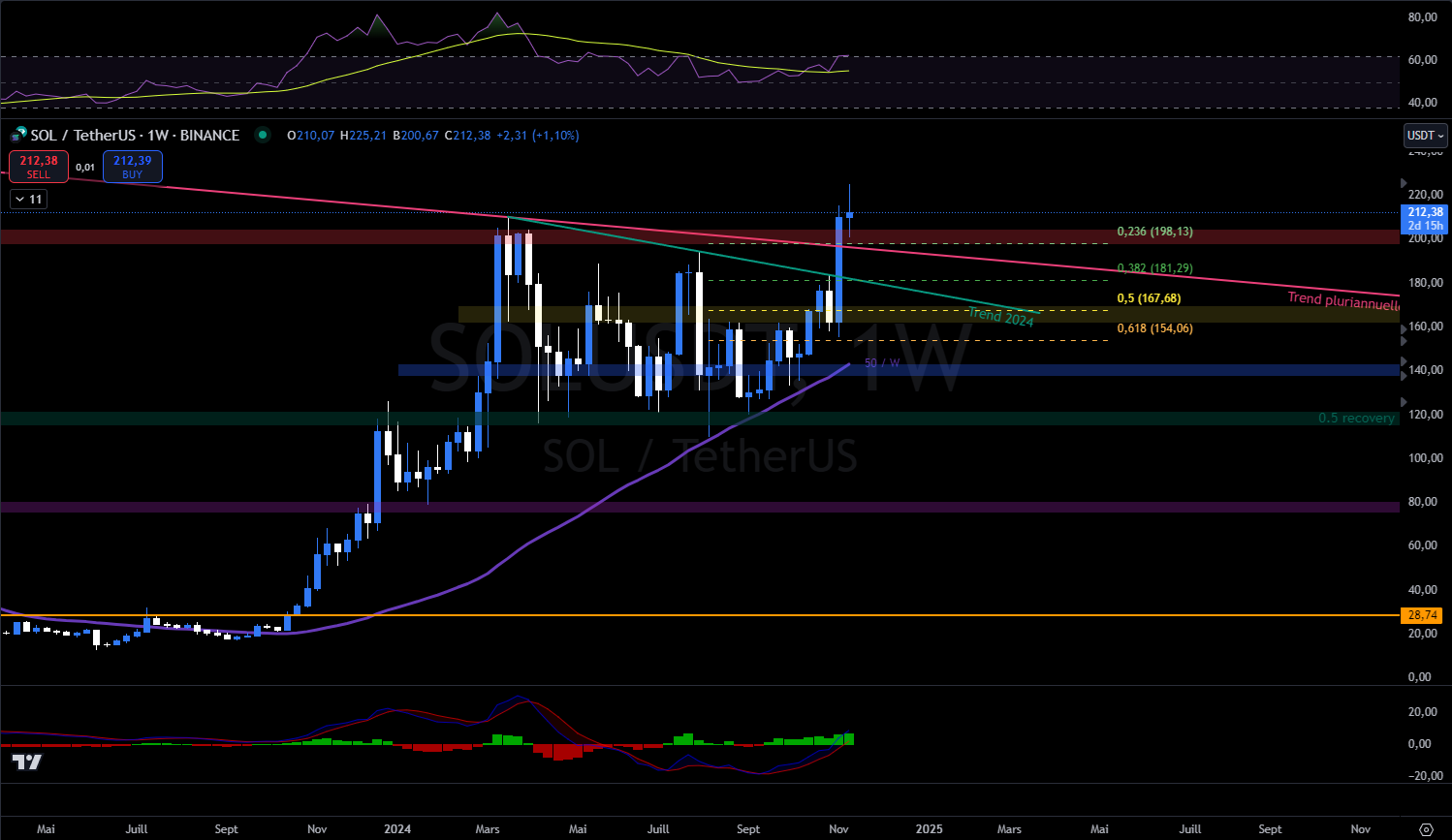

In our last analysis of Solana, we introduced the multi-layer training in which SOL evolves. These supports and resistances remain relevant:

- $137 to $142 (in purple);

- $160 to $170 (in yellow);

- $198 to $205 (in red).

The 50-week moving average continues its upward development. It now converges with the support zone of 140 dollars, making this level very important: it must not be crossed at the close in order to maintain the ongoing upward trend.

Price action has just broken out from the top of a months-long consolidation. What happens next seems set in price action: revisiting its all-time high and entering into price discovery.

Crossing this week's peak, around $225, is the objective that the bulls must set to propel the SOL towards its historic peak.

Open an account on N26, the crypto-friendly bank

This positive development may, however, require consolidation. Indeed, the progression of the market, particularly that of Bitcoin, has strained the momentum indicators, which could require a small cooling off phase.

If we observe the SOL price through the prism of Fibonacci retracements in order to identify confluence zones, we can note more restricted zones of interest:

- Slightly under $200with the confluence of the 0.236 Fibonacci, multi-year downtrend line joining the highs. Maintaining this level at the daily close would favor a scenario of tight consolidation with a rapid resumption of the trend towards historic highs;

- Approaching $180with the confluence between the 0.382 Fibonacci and the downtrend line joining the 2024 highs. This scenario could illustrate an excess below 200 dollars, a touch over 180 dollars, with a close beyond this level, relaunching momentum towards historic highs;

- Around 160 dollarscorresponding to the 50% retracement of the entire rise since the August low, a level that must be preserved at the close. This maintenance would allow a positive polarity to be maintained.

Each of these levels can trigger a price reaction. A touch close to these areas, followed by an absorption and a close on the upper level, would be a good signal of strength for a raise.

At this point, my favorite scenario is building a tight consolidation above 0.236, but I don't rule out quick visits below $200. However, price action has yet to develop a clear structure to indicate its intentions, after making an impression last week with a very powerful rise.

Weekly Solana price graph

Cryptoast Academy: don’t miss the bullrun, join our experts

In summarySolana is very well oriented upwards. However, in a context where Bitcoin could correct, the SOL could revisit support levels that it must validate to continue its progression towards its all-time high.

So, do you think SOL can reach the top of its range again? Don't hesitate to give us your opinion in the comments.

Have a nice day and we’ll see you next week for a new technical analysis of altcoins.

Sources: TradingView, Coinglass, Glassnode

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to cryptoassets are risky by nature, readers should do their own research before taking any action and only invest within their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.