Ethereum spot ETFs continue to disappoint, recording zero volume for the 2nd day this week. While the launch of spot Bitcoin ETFs has been a dazzling success, those based on Ethereum are struggling to convince investors. What factors explain this lack of interest?

Ether struggles to attract investors

Spot Bitcoin ETFs have been very successful since their launch in January 2024, with nearly $19 billion in net inflow volumes and 946,000 BTC under management, or approximately $59 billion. These new products had one of the best starts in the history of ETFs.

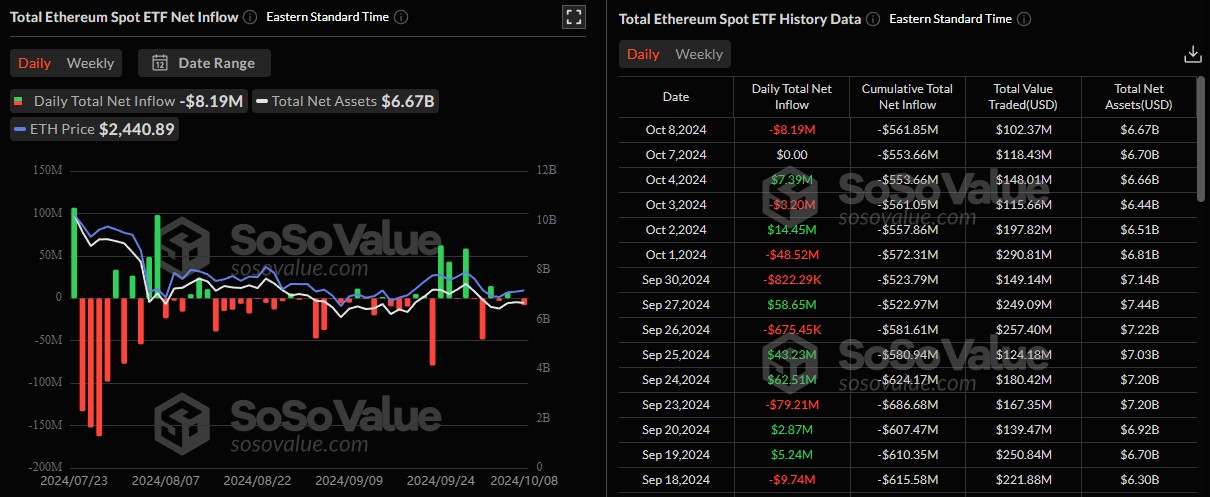

Continuing this, in July the United States Securities and Exchange Commission (SEC) approved ETFs based on the second largest cryptocurrency on the market, ETH. While enthusiastic crypto investors expected similar success, they were disappointed, instead observing a total of $560 million in net outflows.

🪙 To go further – Spot Bitcoin ETFs explained: everything you need to know

This week, volumes on Ethereum spot ETFs were once again not there, recording a total volume of zero.

Spot Ethereum ETF volumes

This is not the 1st, but the 3rd time that this has happened to these ETFsnotably for the first time on August 30, then earlier this week, this Monday, October 7.

It is nevertheless important to remember that the performance of Ethereum spot ETFs since their launch does not prejudge future results, and that a new narrative could (finally) generate interest in these products.

Receive a €50 bonus by creating an account on Bitpanda 🐼!

How do we explain the failure of Ethereum spot ETFs?

This poor performance can be explained by several factors, notably the fact thatEthereum remains unknown to traditional finance.

Indeed, cryptocurrencies are often confused, and the term Bitcoin is frequently used to refer to all of themwhile BTC, ETH and other cryptocurrencies fulfill very different roles.

Additionally, the low volumes of Ethereum ETFs could simply be a continuation of the underperformance of Ether, with a drop of 55% compared to Bitcoin since December 2021and losses of 60% against the S&P 500 since November 2021, and 48% since March 2024.

📰 Also read in the news – The FBI created its own cryptocurrency called NexFundAI — For what purpose?

Finally, one could argue that institutional investors understand neither the usefulness of the token, nor the interest in holding it in the form of an ETF. While the role of BTC as a store of value is clear and clear, that of ETH, serving as “gas” for a “decentralized computer”, is more complex to understand.

A feeling exacerbated by the multiple changes in the Ether emission mechanism and by the impossibility of benefiting from the returns normally offered to long-term holders thanks to staking.

However, this underperformance has the merit of slowing down the centralization of the network. Indeed, being based on a proof of stake (PoS) mechanism, the fact that influential actors take control of a significant portion of the Ethers in circulation could accelerate the centralization of the Ethereum blockchainalready knowing that 54% of its blocks comply with OFAC rules.

Ledger: the best solution to protect your cryptocurrencies 🔒

Sources: SoSoValue, The Block Data, MEVWatch

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.