Despite the recent fall in the cryptocurrency market, Ethereum spot ETFs are holding up and showing positive net volumes. The market, shaken by escalating tensions in the Middle East, sees some interest in ETH continuing, a surprising dynamic in contrast to the general decline in risk assets.

Ethereum Spot ETFs Attract Investors Despite Market Panic

In recent weeks, tensions between Iran and Israel have continued to intensify, particularly after the assassination of Hezbollah leader Hassan Nasrallah. In response, Iran launched 200 missiles at Israel, causing the S&P 500 and CAC 40 to fall 1%.

The cryptocurrency market was also impacted, with a 5.30% drop in its total capitalization, thus threatening the short-term upward trend that began recently.

🌍 Learn more about BTC adoption in the Middle East – The rise of Bitcoin in Iran: a response to inflation and repression

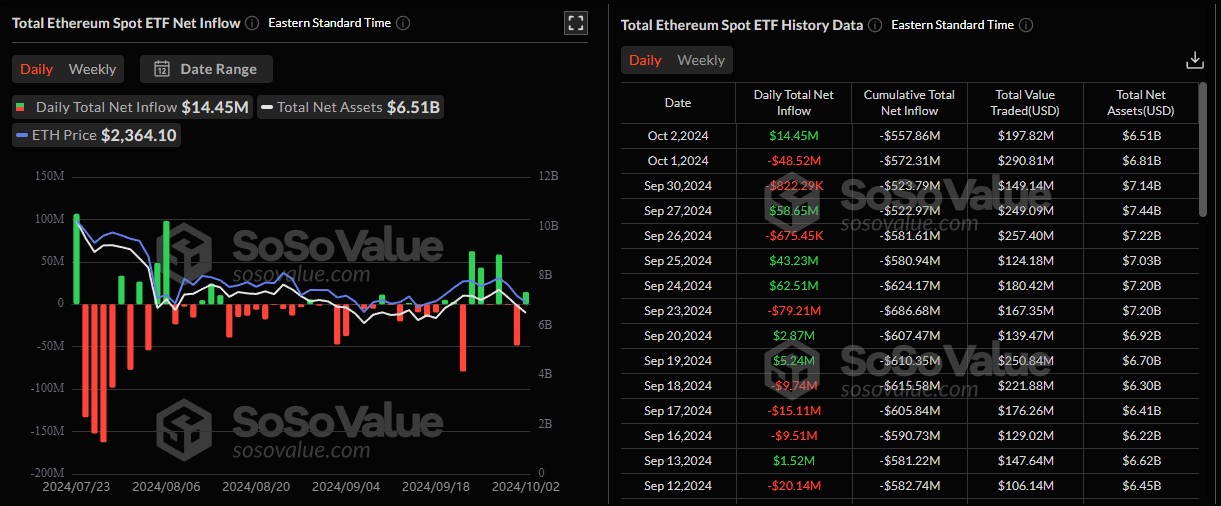

That same day, the Bitcoin and Ethereum spot ETFs saw significant outflows, amounting to $242 million and $48 million respectively, marking one of the worst days since their launch.

Despite this unfavorable context for risky assets, Ethereum spot ETFs posted positive net volumes the following day. This fact is all the more remarkable given the low volumes observed since the launch of Ether-based ETFs.

Ethereum spot ETF volumes since launch

While spot Bitcoin ETFs are very successful, spot Ethereum ETFs have a negative balance of $557 million since their approval in July 2024. A stark contrast to yesterday's volumes, which reached $14.45 million in inflowsdespite the general drop in the price of cryptocurrencies.

Although relatively modest, these flows are almost the opposite of what might have been expected in a tense and uncertain geopolitical context.

Furthermore, the price of Ether does not indicate any renewed interest in the 2nd cryptocurrency on the market. ETH has fallen more than 10% against the dollar since the start of the week, from $2,670 to $2,380, while the ETH/BTC ratio has fallen 3.70% since Monday.

Receive a €50 bonus by creating an account on Bitpanda 🐼!

Spot Ethereum ETFs steal the spotlight from spot Bitcoin ETFs

For their part, spot Bitcoin ETFs recorded net outflows for the 2nd consecutive day, after having experienced one of their best weeks since their launch, with more than a billion dollars net.

Thus, these ETFs suffered outflows of $242 million on Tuesday, the day of the Israeli attack orchestrated by Iran, followed by an additional net outflow of nearly $92 million yesterday, totaling approximately $273 million in outflows since Monday.

📰 Also read in the news – Nayib Bukele meets Victoria Villarruel, the vice-president of Argentina, and talks about Bitcoin

However, traditional markets do not appear to be reacting hastily, with the S&P 500 stabilizing above $5,700. This probably reflects an expectation of investors, looking for a decisive event to clarify the geopolitical situation.

So far, gold and stock prices are stagnating, while the dollar is benefiting, with the DXY index up 1.4% since the start of the week.

Ledger: the best solution to protect your cryptocurrencies 🔒

Source: SoSoValue

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature assets, products or services relating to investments. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.