A few days ago, we entered the summer season, a period historically marked by a sharp rise in Bitcoin (BTC) in July, followed by multiple corrections in August and September. In order to prepare for the bull run that awaits us, here is a summary of the information you need to know about the cryptocurrency market.

The cryptocurrency market in a downward trend

Since the performance of March 2024, having brought the price of Bitcoin (BTC) to a new all-time high, the cryptocurrency market is experiencing difficultiesOver the past three months, total market capitalization has fallen from $2.9 trillion to $2.35 trillion.

This fall is mainly marked by the decline of altcoins. Outside of the Top 10 cryptocurrencies, whose SOL and BNB prices show significant resilience in the face of market pessimism, a large part of the assets are recording losses. ranging from 30% to 70% since March 2024 :

- – 30% for LINK;

- – 40% for DOT;

- – 46% for MATIC;

- – 55% for AVAX;

- etc.

👉 Discover Solana (SOL), the blockchain with thousands of transactions per second

Despite these collapses, Bitcoin remains resilient. Its trend is neutral over this period, still stuck in its range between $60,000 and $72,000. However, its multiple rebounds on the $60,000 support could ultimately cause a bearish breakout that would impact the entire market.

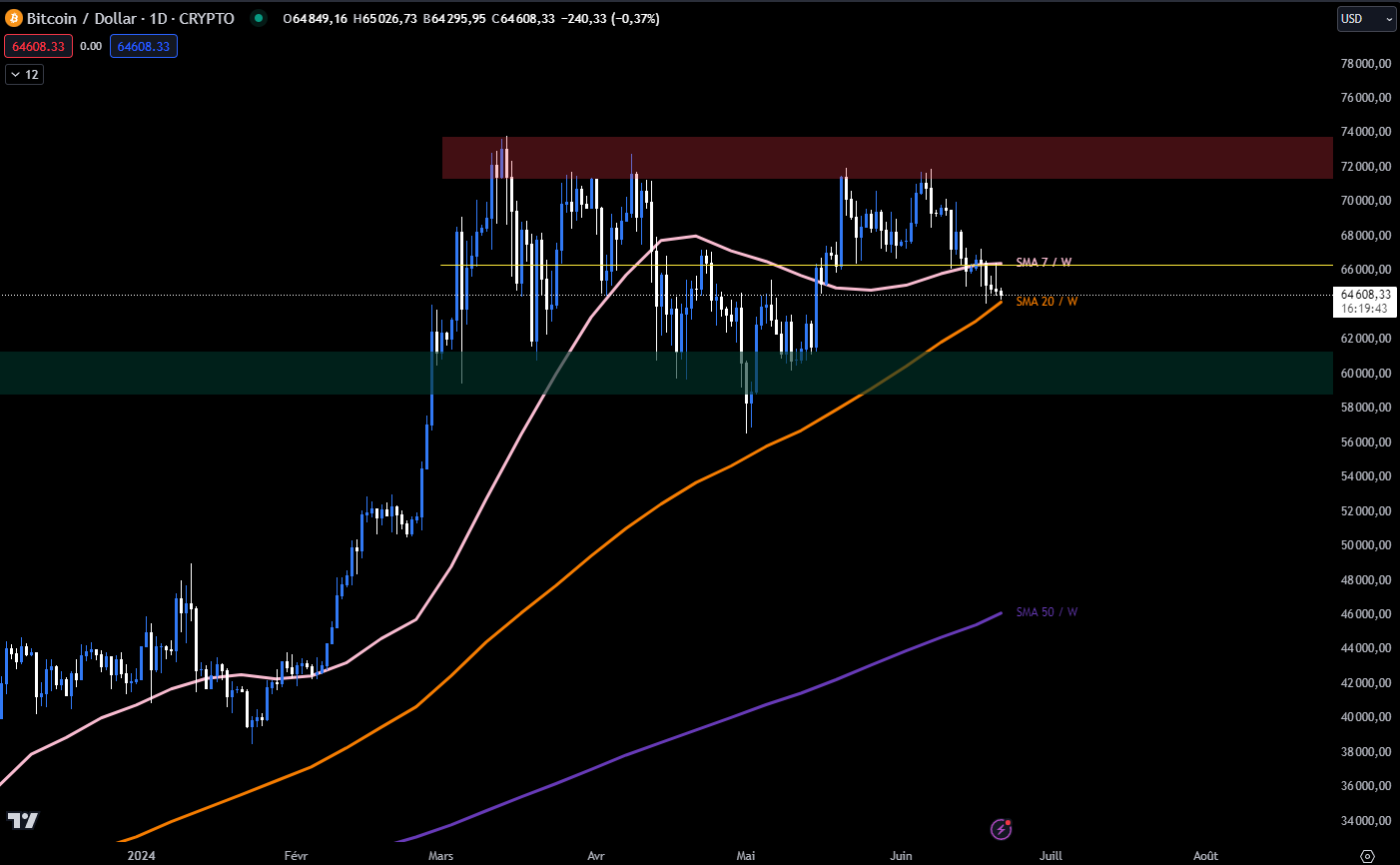

BTC is currently building a bearish flow bounded by the 7-day moving average and the lower Bollinger band. To find a positive polarity in its range, he must win back the $66,000. If so, the probability of a return to 60,000 is very high:

Bitcoin (BTC) performance since January 2024, including 3 7-week, 20-week and 50-week moving averages

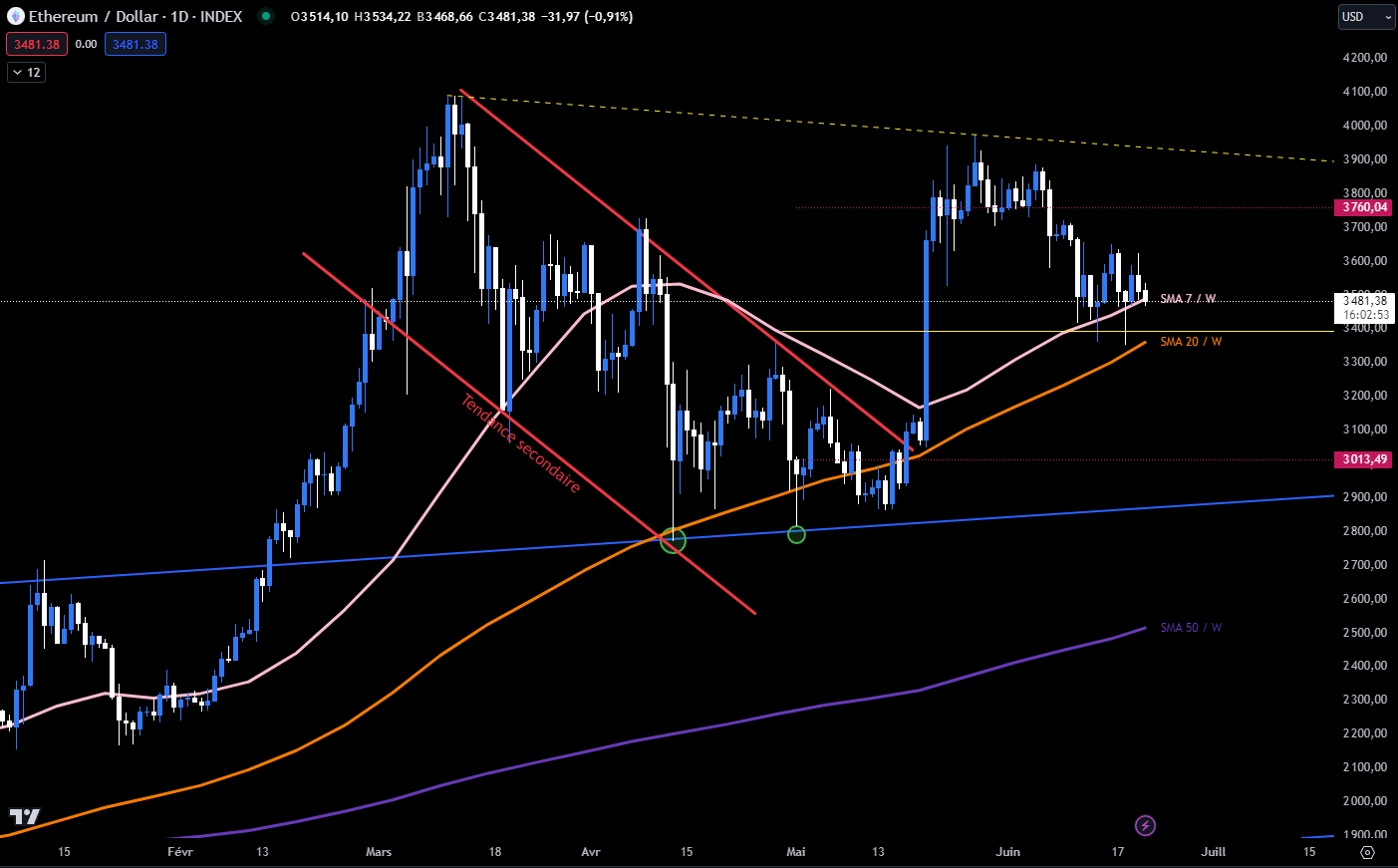

On the Ethereum side, its cryptocurrency is showing greater strength than BTC against the US dollar. In fact, theETH manages to maintain positive polarity across all time units above the 7-week and 20-week moving averages.

If a downward daily trend seems to be starting, mirroring the current market trend, it remains lower than on the majority of assets :

Ethereum (ETH) performance since January 2024, including 3 7-week, 20-week, and 50-week moving averages

The key support to hold for the ETH price is $3,400, at the risk of falling into a negative polarity in the medium term. To restart the rise, optimistic investors must reclaim the $3,600 level.

The performance of Bitcoin and Ethereum will soon be influenced by 2 major events: the figures of… [65% de l’article restant]