While the capitalization of Tether's USDT stablecoin continues to increase, it now exceeds $120 billion. How does the market leader position itself against its competitors?

Tether's USDT widens its lead over competing stablecoins

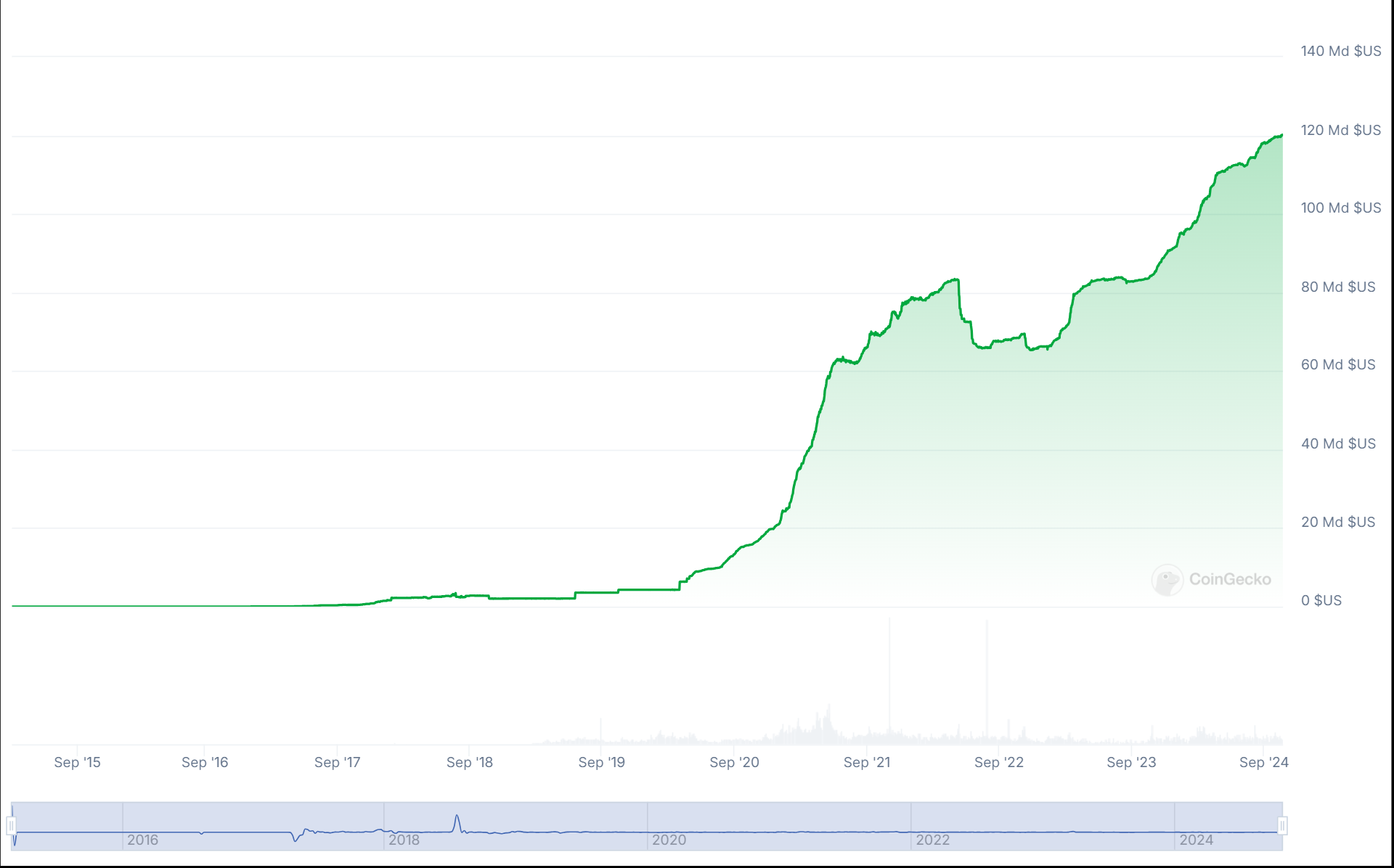

First stablecoin on the market with a considerable lead, Tether's USDT now exceeds $120 billion in capitalization. This year alone, this capitalization has increased by more than 30%:

Figure 1 – Evolution of USDT capitalization

💡 How does Tether’s USDT stablecoin work?

To date, the asset is deployed on 16 different networks, although this liquidity is primarily concentrated on 2 blockchains. Indeed, Tron (TXR) comes first, with 61.5 billion USDT on its network, followed by Ethereum (ETH), with almost 54.5 billion USDT. The 3rd most represented blockchain is Avalanche (AVAX), with “only” 1.57 billion USDT.

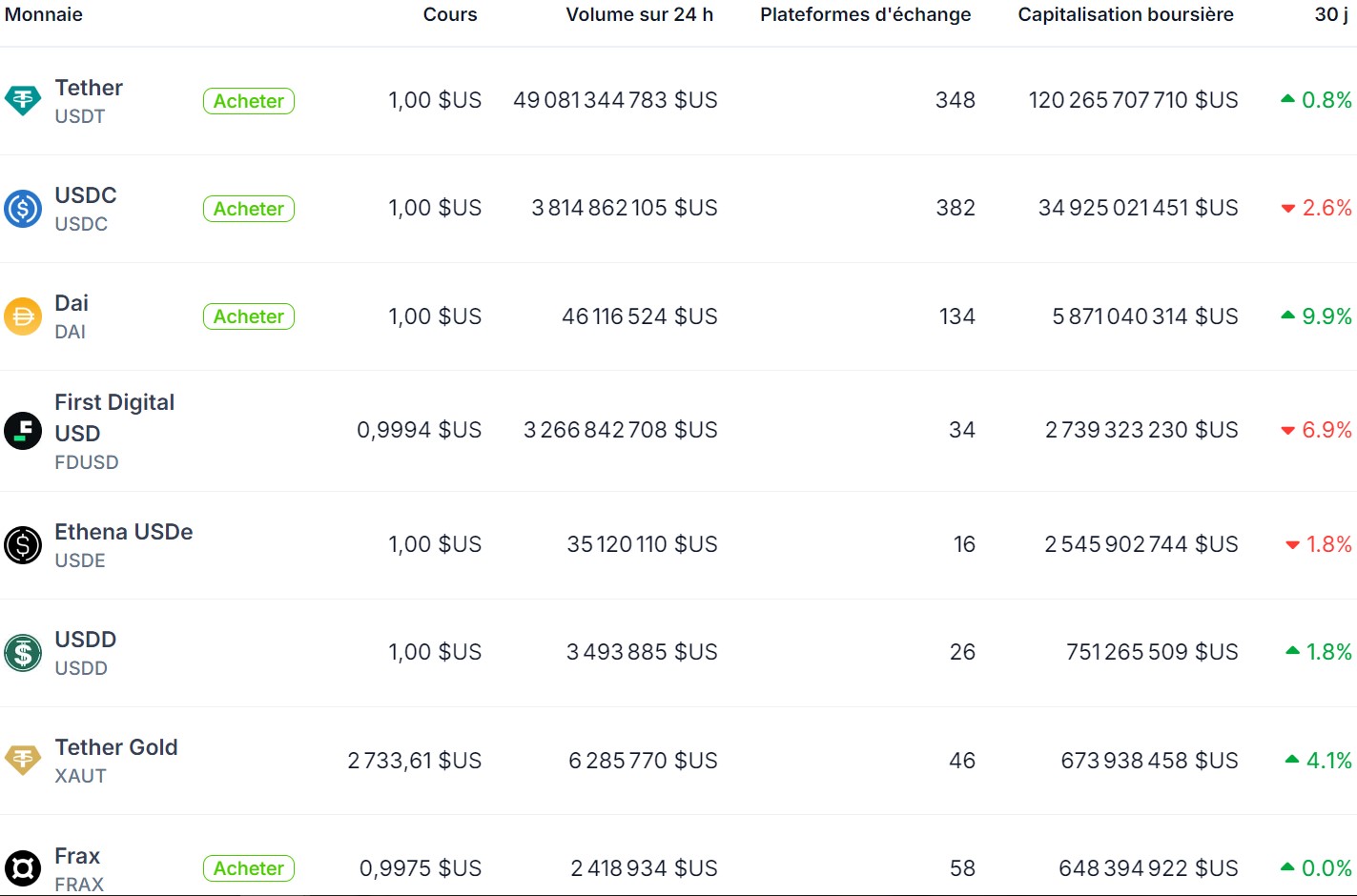

According to CoinGecko data, all stablecoins on the market represent a capitalization of $173.78 billion. So, USDT alone represents 69% of said capitalization. For comparison, its competitor USDC from Circle weighs 20% in this balance:

Figure 2 – Capitalization of the main stablecoins on the market

In terms of its diversification, Tether also offers several stablecoins backed by other values, such as the euro, gold, the yuan or the Mexican peso. As the ranking above shows, it is his XAUT which comes in second positionwith the equivalent of approximately 246,500 ounces of gold for a capitalization of nearly $674 billion.

👉 Also in the news — Stripe makes the biggest crypto acquisition in history by buying Bridge for $1.1 billion

As for its other activities, internal sources revealed to Bloomberg last week that Tether was now exploring investment opportunities in the commodities sector. More broadly, the company has also been actively investing in Bitcoin (BTC) mining for more than a year.

Open an account on N26, the crypto-friendly bank

Source: CoinGecko

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.