While several countries around the world are planning to build up a Bitcoin Strategic Reserve (BTC), Norway has not expected to create one to expose its sovereign fund to cryptocurrency. A choice that turned out to be judicious in the short term, and which allowed the Scandinavian country to generate a beautiful added value.

By exposing more to Bitcoin, the Norwegian sovereign fund generates record profits

Last year, the Norwegian sovereign fund would have garnered a profit of $ 222.4 billionbeat his previous record recorded in 2023.

The Norwegian sovereign fund was created in 1990 in order to use the money it gets thanks to the extraction and sale of hydrocarbons (gas and oil) in order to invest in foreign entities. His goal: obtain stable and long term yields To ensure financial stability of the country once its hydrocarbon reserves have been exhausted.

🔎 Find out how to expose themselves to cryptocurrencies without holding with CFDs

In almost 35 years, the fund has invested in many listed groups on the stock market, notably having shares at Apple, Amazon, Google, Meta, Microsoft or Nvidia whose action jumped by more than 50 % in 2024.

Throughout the year 2024, The Norwegian sovereign fundconsidered to be the great of the world, has multiplied investments, focusing in particular on the purchase of actions from foreign companies whose pro crypto position is no longer to prove.

At the end of 2024, its assets included a 1.1 % participation in Tesla and 0.72 % in Microstrategy, as well as actions at Coinbase, Metaplanet or Mara Holdings. All these companies have a common point: They all have a more or less substantial reserve in bitcoins.

Elon Musk's automotive company would have 11,509 BTCor just over $ 1.2 billion according to the current Bitcoin course. In the same way, Microstrategy, Michael Saylor's company which has built its economic model on the accumulation of cryptocurrency, holds to this day at least 218,887 BTC representing a value of more than $ 22 billion.

Buy crypto on binance, exchange n ° 1 in the world

A fine example of the strong institutional scope of Bitcoin

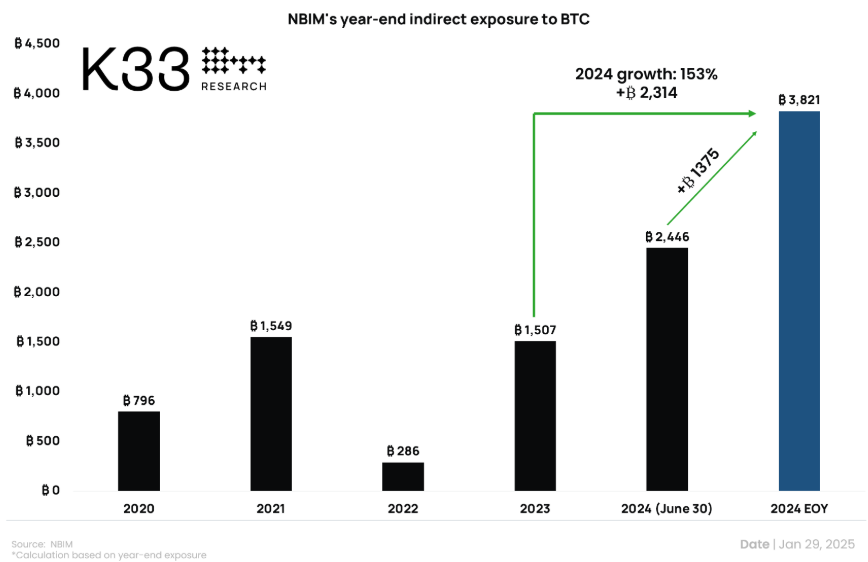

By investing in these firms, the Norwegian sovereign fund has significantly increased its exposure to Bitcoin. According to analyst firm K33 Research, the indirect exposure of Norges Bank Investment Management (NBIM), the entity managing the fund, reached 3,821 BTC$ 356 million at the end of 2024.

In one year, indirect exposure of NBIM to Bitcoin increased by 153 %

For Vetle Lunde, research manager at K33 Research, ” It is important to emphasize that this exposure probably stems from a sectoral weighting based on rules Rather than a deliberate choice to give priority to exposure to the BTC ».

👉 Also read – here are the 11 trends that will explode cryptocurrencies in 2025

Despite everything, the analyst considers that the strategy adopted by the NBIM is very interesting and highlights the strong institutional scope of Bitcoin ::

NBIM's indirect exposure is one of the best examples in the manner whose BTC slips into any well -diverse portfolioand its growth testifies to the maturity of the market and the possibility for the BTC to end up in any well -diverse portfolio, intentionally or not.

Source: Vetle Lunde on x

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital