The amount of USDT in circulation has been on the rise since the beginning of 2023 and is recovering from the known fall following the FTX affair. This could mark the start of renewed investor interest in the cryptocurrency market.

Tether’s USDT picks up colors

The amount of USDT in circulation has passed a new high in 2023, a strong symbol the return of speculation on a bullish recovery in the cryptocurrency market. After hitting a low around $65.3 billion during the FTX affair, Tether’s stablecoin capitalization soared 4% and is around 68 billion dollars.

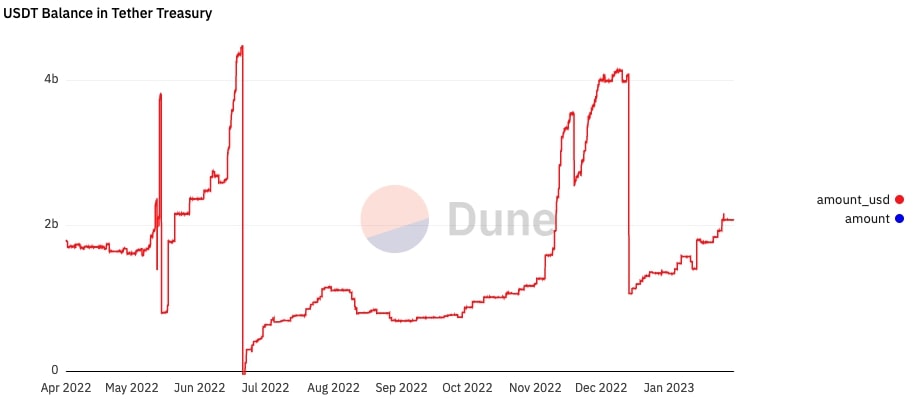

Evolution of Tether’s cash flow

As shown in the figure above, the amount of dollars in Tether coffers drastically decreased during the FTX affairin November 2022. This results both from the tokens lost on the centralized platform but also investors fleeing the market and getting their dollars back.

Indeed, in theory, every dollar deposited in Tether is transformed into USDT that can be spent on the market. Obviously, the reciprocal also works : it is possible to refund its USDT to recover dollars. This is especially what happens during periods of panic.

Right now we are seeing the opposite. The increase in the total amount of USDT in circulation could thus symbolize a return of investors on the market. For analysts, this is an important point to watch for a possible bullish recovery.

The reference platform to buy and trade more than 600 cryptos

10% off your fees with code ZWUFE2S1

USDT, a bullrun indicator?

Looking back, we had seen a start of growth in the amount of USDT in circulation in 2019. This coincided with the start of a bullish rally for Bitcoin (BTC) whose value had gone from around $3,000 to over $13,000.

This was also the case between August 2020 and January 2021. The rate of increase in capitalization was moderate, from $10 billion to $20 billion in 6 months. Subsequently, the slope steepened drastically as the market took off.

Although these observations are purely speculative and do not constitute sufficient indicators to declare a bullish reversal, they remain positive elements to keep in mind.

Note also that this week will be marked by important events that will most certainly give direction to the market in the short term.

On a French scale, we will monitor Tuesday at 8:45 a.m. the announcement of the consumer price indices (CPI). This figure directly reflects the state of inflation in the country. Globally, all investors will have their eyes on Jerome Powell this Wednesday at 8 p.m. which will reveal the new monthly interest rates of the US Federal Reserve (FED).

Take your investments to the next level with the analyzes of Vincent Ganne

Source: Dune

Newsletter

Receive a summary of crypto news every Monday by email

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.