Jump to winners | Jump to methodology

America’s leading insurance workplaces

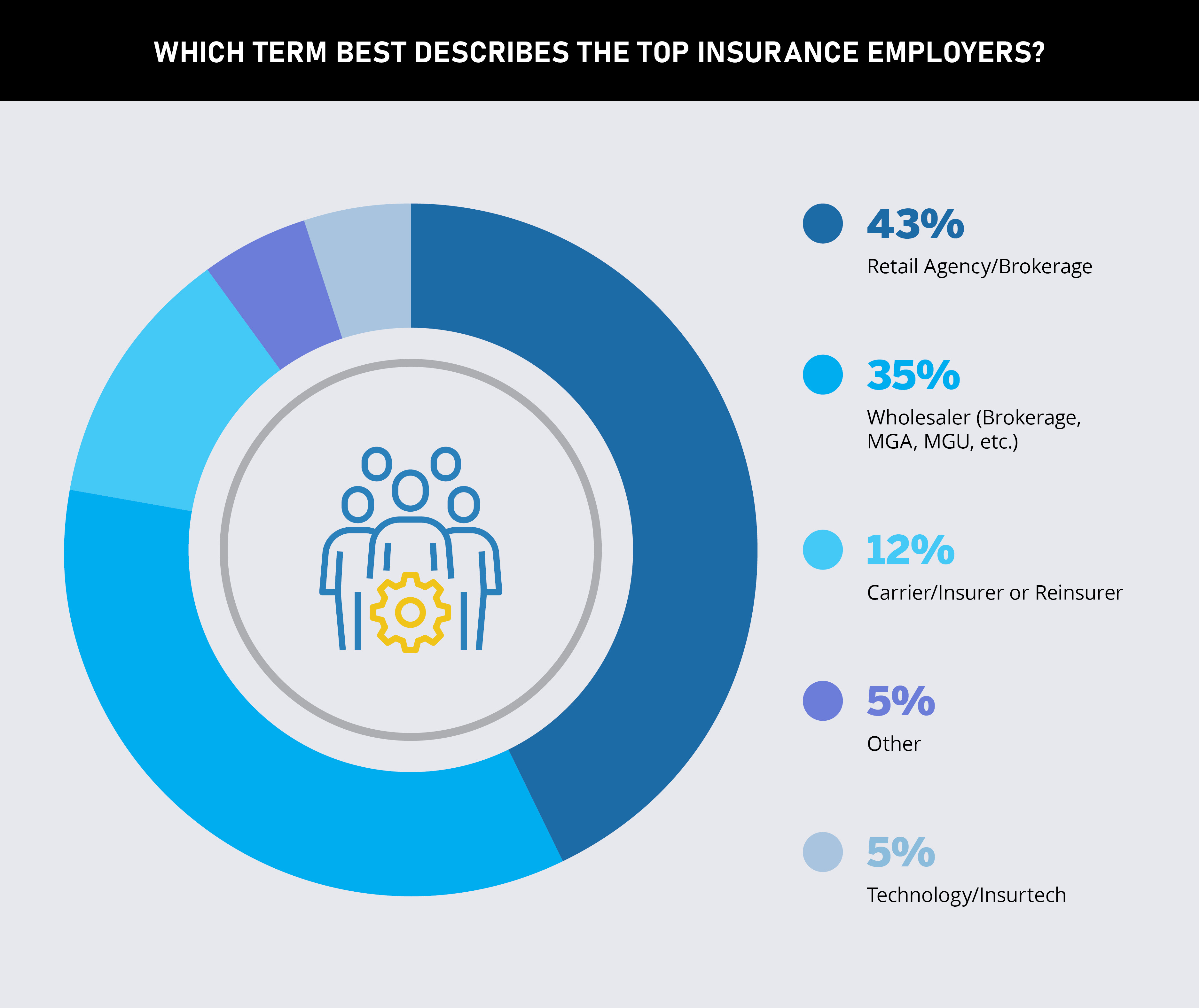

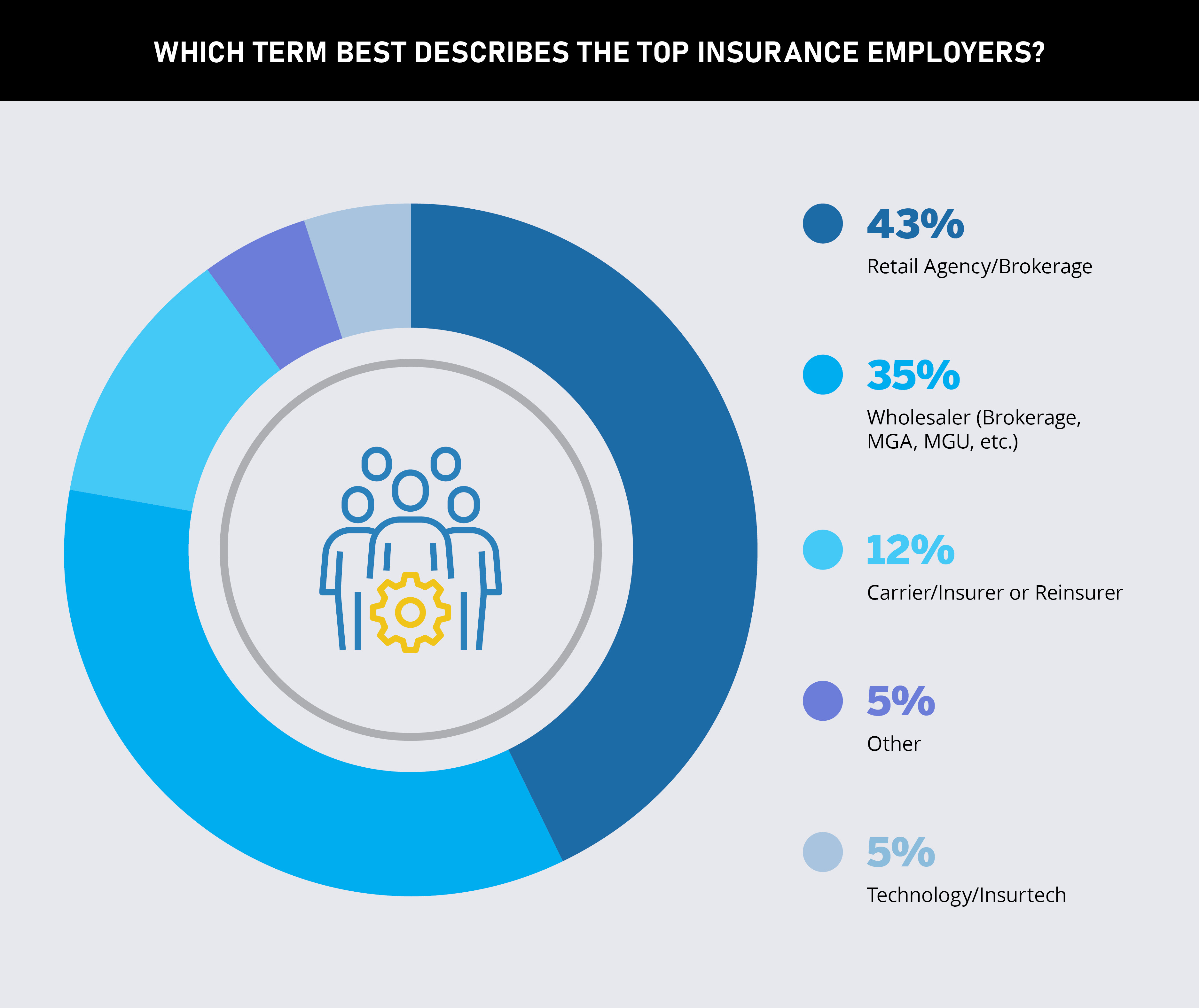

To determine the best employers in the insurance industry, Insurance Business America invited organizations to participate by explaining their various offerings and practices.

Thousands of employees nationwide were then asked to evaluate their workplace on a number of metrics:

-

benefits

-

compensation

-

culture

-

employee development

Each entrant had to reach a minimum number of employee responses based on its overall size, with the best earning the title of IBA Top Insurance Employers for 2024.

-

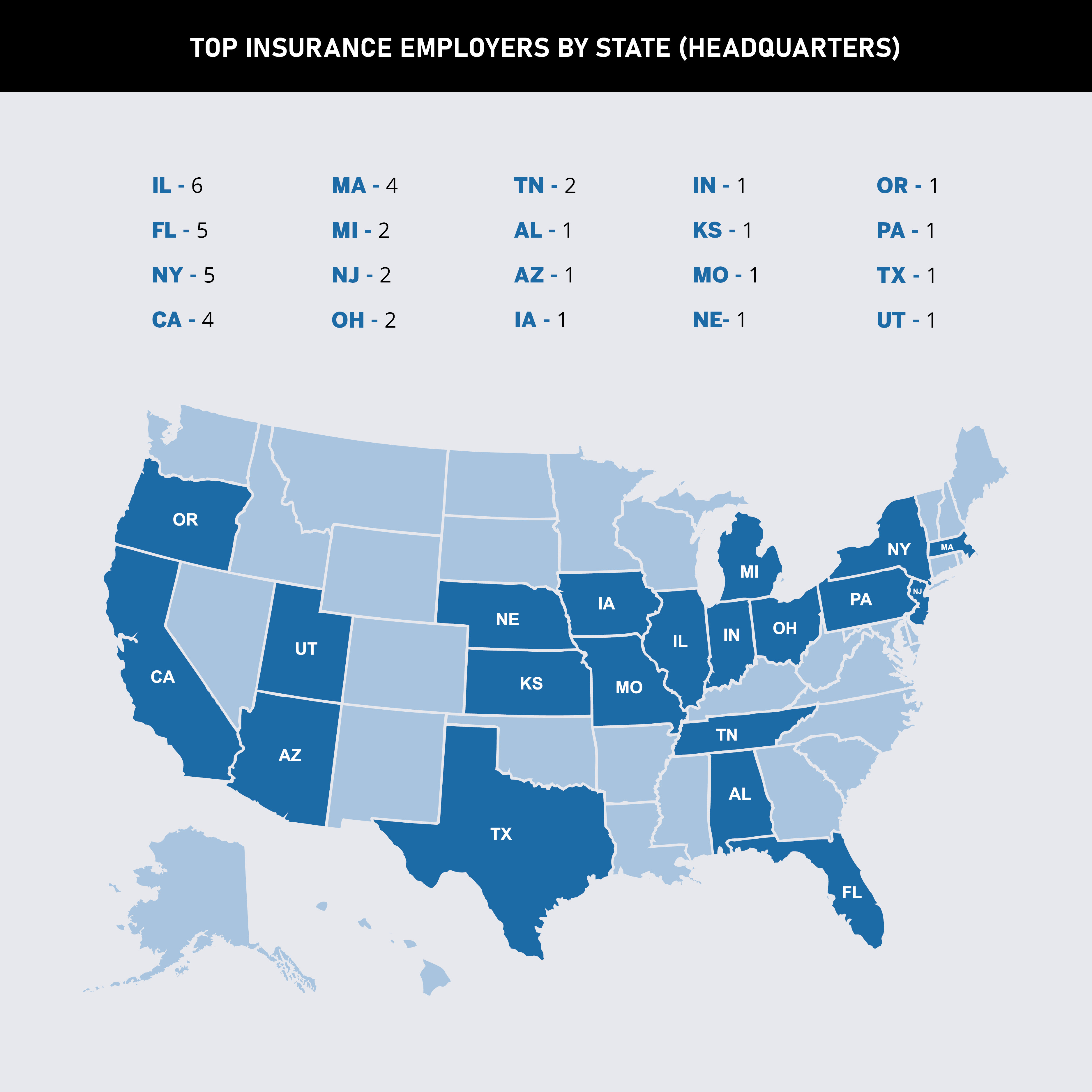

Illinois is the most successful state with six winners.

-

Five winners are based in Florida and New York, and four are from California.

One criterion for rating the Top Insurance Employers 2024 is a concerted commitment to diversity, equity, and inclusion.

This is echoed in the 2024 Global Insurance Outlook by Deloitte, which states:

“Leaders should make an ongoing commitment to ensure diversity, equity, and inclusion (DE&I), both in their workforce and the customer demographics they serve. Demonstrating such commitment could help close the trust gap that has often undermined the industry’s credibility with key stakeholders, including regulators, legislators, and rating agencies, as well as society at large, and even their own employees. This could not only prove to be a differentiator in the market, but also help resolve societal issues such as the insurance protection gap.”

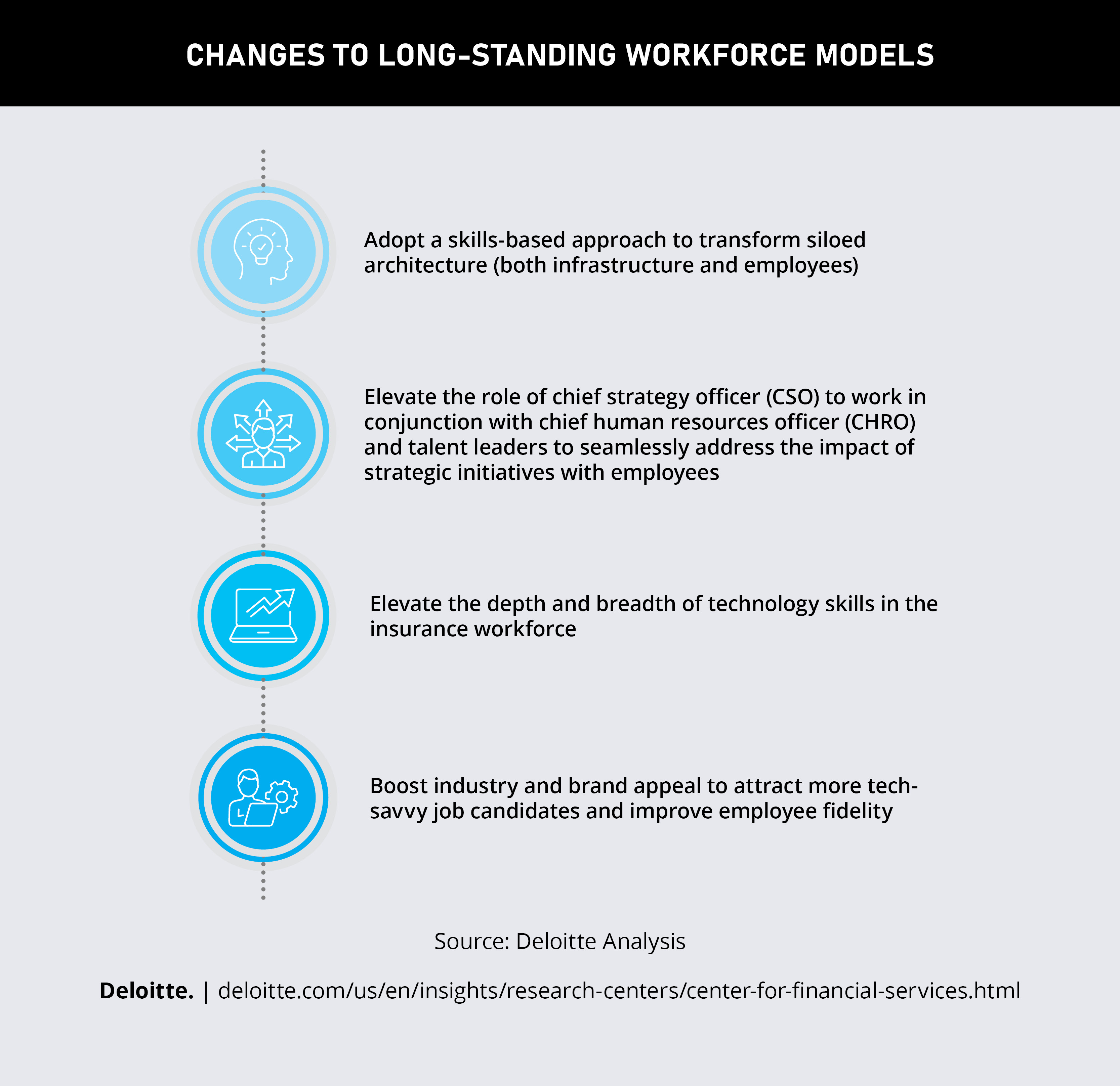

All of IBA’s winners are also innovating and seeking ways to engage their workforces. This is highlighted as a key priority for those in the insurance sector in Deloitte’s report, with IBA’s winners implementing its recommendations, such as introducing enhanced technology, boosting their firm’s brand, and removing siloed internal structures in favor of collaborative environments.

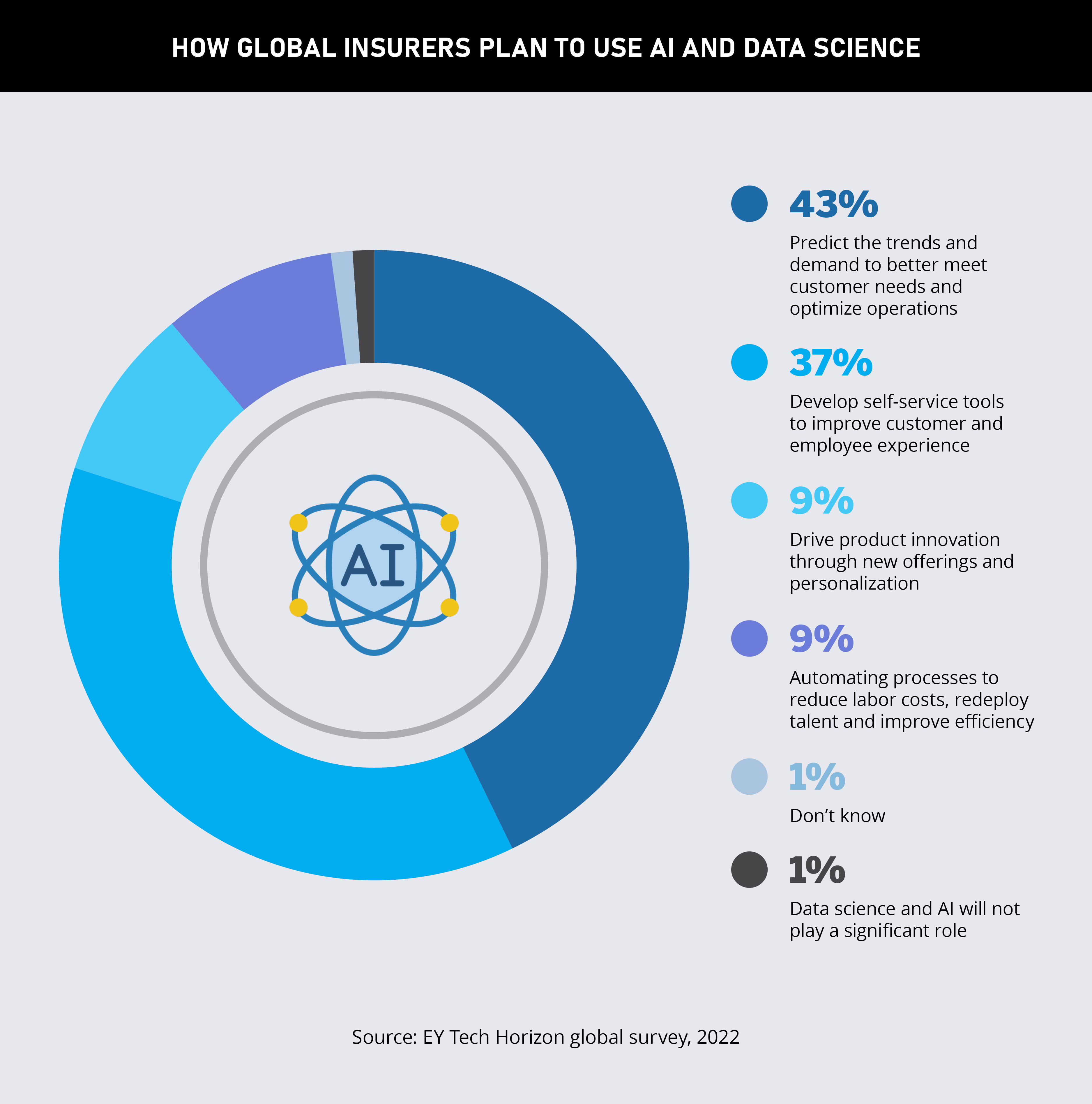

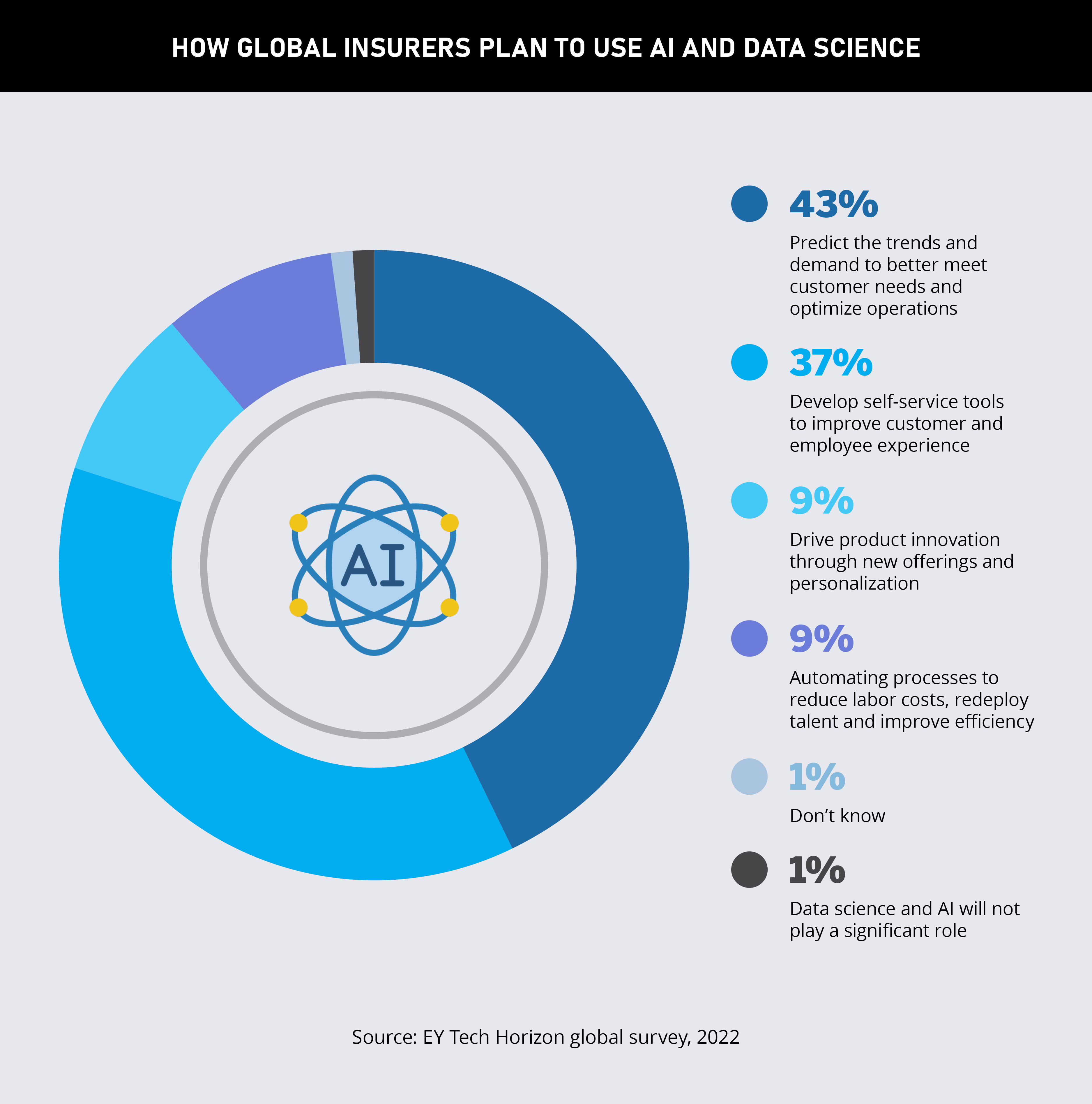

Further strengthening the case for firms to strive to be better employers is illustrated in EY’s 2024 Global Insurance Outlook:

“As competition for workers remains intense, insurers must look to engage talent in all its forms. By aiming to become ‘post-bias’ employers and leveraging unique attributes, insurers will foster competition in the workplace and help all individuals progress, regardless of their starting points. And they should not overlook how diverse hiring may have financial implications in terms of reduced turnover and lower recruiting costs.”

There is also a clear emphasis within the industry to respond to this need, even with the adoption of AI.

“With training and clear communication regarding permitted use, making AI tools generally available will instill a sense of competence and agency among workers, as well as promoting accountability for work products,” says Frank Schmid, chief technology officer of General Reinsurance Corporation (Gen Re).

“This is how AI can amplify workers’ problem-solving skills, adaptability and creativity, as well as their emotional intelligence, good judgment, and leadership.”

Best Insurance Employers’ recipe for success

Headquarters: Melbourne, FL

Type of company: Carrier/Insurer or Reinsurer

Organization size: 101–500 employees

Employee satisfaction rating: 87 percent

The firm continues to make significant strides in such a short period of time, as it has won back-to-back IBA Top Insurance Employers awards.

Established in 2018, Orion180 has grown exponentially in recent years. From a workforce of 19 employees in 2020, the company now has 135 employees.

Founder and CEO, Ken Gregg, has steered Orion180 through this tremendous organic growth, and the proof is in the pudding, by crossing the $200 million threshold in top-line premium in April 2024.

“It’s the culture here that’s a big driver of what we have to offer, and a lot of people are excited about our growth”

Ken GreggOrion180

Gregg credits Orion180’s success to:

-

culture

-

customer service

-

transparency

-

attracting best in class

“At the executive level, we view our employees like customers, and we think, ‘What are we doing to make sure they have a great experience?,’” he says. “We collaborate with all the members of the company. Everyone gets to have a say, and we listen to feedback, which I believe is appreciated. With every decision, we are mindful of the impact to all stakeholders.”

The organization provides competitive benefit plans to all employees in the form of:

-

full medical and dental cover

-

matching 401(k) dollar-for-dollar on the first four percent, and 50c on the dollar for the next two percent

-

educational reimbursement

“The employees are recognized and have an opportunity to even grow themselves. We give people vertical opportunity to move within the organization,” he adds.

Headquarters: Springfield, MO

Type of company: Retail Agency/Brokerage

Organization size: 26–100 employees

Employee satisfaction rating: 87 percent

Giving autonomy to its employees has instilled a positive attitude among Ollis/Akers/Arney’s workforce.

Located in southwest Missouri, the company – originally founded as Ollis and Co. in 1885 and merged with Akers & Arney in 2015 – is 100 percent employee-owned.

On top of ownership in the organization, which earns 8–10 percent a share per annum, employees are also afforded an impressive benefit package that includes:

“For our wellness program, we will pay 100 percent of the employee’s medical benefits and we offer two or three plan options,” says director of operations, Joe Gaunt. “If you participate in the program, we’ll pay for the premium and we have all the voluntary pieces for vision, dental, and various other things. They can have their family on a voluntary basis, too.”

“We have awesome people who care a lot about what they do and care about our clients”

Joe GauntOllis/Akers/Arney Insurance & Business Advisors

The firm strives to provide a flexible work environment with a positive culture.

“I am a firm believer that culture starts with your hiring process. With targeted selection interviewing, we’re trying to get an idea of how a person is going to fit our company from a culture perspective, because you can really throw all that off with just one bad hire,” comments Gaunt.

“There’s a shortage of talent across the industry, even with the insurance companies for underwriters and claims representatives and that can put a strain on service.”

There is also a clear commitment to DE&I and a focus on helping minority groups.

“We provide a paid day for employees to volunteer with organizations. This year, we’re sponsoring the Student African American Brotherhood and participating in their program. We actively look for opportunities to engage with organizations in our community.”

Headquarters: Akron, OH

Type of company: Retail Agency/Brokerage

Organization size: 101–500 employees

Employee satisfaction rating: 81 percent

A blend of flexibility, generous PTO, and an uber-friendly environment has led the firm to become one of the best insurance companies to work for in America.

Founded in 1910, SeibertKeck operates 19 offices throughout Ohio and Kentucky, and has a presence in Florida. The company’s culture emboldens employees to bring their best selves to work.

“Some of my colleagues are my best friends, and I go to them for life advice,” says marketing manager, Leah Schrock. “Sometimes, we take little breaks during the day to have a chat, go for a coffee before work, or go out to eat during lunch, just to decompress from work.”

“It’s very family-oriented. We like an open-door policy for clients and staff”

Leah SchrockSeibertKeck Insurance Partners

SeibertKeck’s hybrid work model sets them apart from other insurance companies through the following features:

“Everybody loves that we have a fun committee. Each office has a representative, and they try to have little parties in the office, just to bring joy and team bonding,” Schrock reveals. “Someone brings in donuts on National Donut Day, ice cream for National Ice Cream Day, any of those fun holidays as well as all the religious holidays.”

The company’s attitude toward DE&I is also hugely impressive, as up to 67 percent of the workforce are female.

“We have 210 employees, which is rather big for an independent insurance agency, but it’s so rewarding to say that majority of our staff are women. We have several women in upper management positions, too.”

Headquarters: Gainesville, FL

Type of company: Retail Agency/Brokerage

Organization size: 501–1,000 employees

Employee satisfaction rating: 80 percent

The firm’s continued success is straight out of a Hollywood movie.

Founder, chairman, and CEO Bill Johnson is no stranger to the awards circuit as he has produced many critically acclaimed films, such as The Kids Are All Right, starring Annette Bening, which was nominated for four Oscars, including Best Picture, in 2011.

He has also produced over 30 films with stars such as Brad Pitt, Tom Hanks, Keanu Reeves, Dwayne ‘The Rock’ Johnson, Nicole Kidman, and Margot Robbie, among others.

Johnson founded The Liberty Company in 1987 before stepping away in 2003 to focus on producing films before returning to the helm in 2018, and since then, the organization has enjoyed extraordinary growth.

“We want to create opportunities, inspire a special culture, and help our people be healthier and happier”

Bill JohnsonThe Liberty Company Insurance Brokers

“The movie business is very transitory. When you’re developing a script, you pull the big team together, you make a movie, but then after, everybody goes their separate ways,” says Johnson.

“But in the insurance business, there’s long-term relationships and the opportunity to give service, create opportunities for people, and inspire a special culture by helping people be healthier and happier by providing a platform to pursue their entrepreneurial dreams.”

The Liberty Company’s culture is built on eight core values:

-

caring

-

excellence

-

fun

-

fairness

-

good feelings

-

integrity

-

kindness

-

teamwork

“Our goal is having the best work experience and environment in the industry so that we can attract and retain talent and help people be their best, healthiest, and happiest selves, because that’s going to translate into them being their most successful selves,” he continues. “We like our acronyms here, and one we have is JOB, which stands for ‘joy of being.’”

By bringing all these ingredients to boil, Liberty has become an attractive destination for the industry’s best and brightest.

“Bill and I constantly get messages on LinkedIn from people looking to see if they can join our organization,” says COO Adam Baillie.

“We have a very entrepreneurial platform that creates a lot of positive energy, that attracts positive people, and that starts to snowball, where people want to be part of the winning team.”

Headquarters: Skokie, IL (operates in all 50 states)

Type of company: Retail Agency/Brokerage

Organization size: 26–100 employees

Employee satisfaction rating: 83 percent

Fostering a supportive work environment, employee education, and leveraging technology to enhance the employee’s experience continues to reap rewards.

Despite being a relatively small group, Worthy Insurance empowers employees through forward-thinking initiatives, as it tends to hire people from a service background.

“We care about employees and like to do things together with fun events and summer outings”

Halima CegurWorthy Insurance

“We take the time to really come together as a group,” says director of human resources, Halima Cegur. “We’re a young group overall, so we really care about growth and opportunity. As our company grows, we want to give that advancement and opportunity to people here.”

She adds, “We focus on education and training and being mentors to one another. We have a lot of people that are new to the insurance business, which is great to see. So, we focus a lot on them getting licensed and learning from the bottom up.”

The organization has a strong employee benefits scheme in place, which features:

-

company-sponsored life insurance

-

full medical coverage

-

generous PTO policy, with four weeks’ vacation

-

401(k) matching contributions

“We care about work-life balance. There is a hybrid option; however, we like the presence to be in person, so we are flexible within the workday. We want people to be in the office to collaborate and train,” explains Cegur.

“It’s a great place to work because every one of us has an important role. When you come here, you have an amount of respect and credibility, and you’re able to have a seat at the table immediately. That is something that sets us apart from other larger organizations.”

The firm embraces technology to improve its efficiency in HR.

“We’re agile, we try different software and programs to see if they’ll work for us, to work for our clients’ needs. We have software for auto-renewals and we’re open to any tech advances, but we want to ensure that the foundation is working smoothly,” she states.

“We have done a lot of these things in-house, as we don’t have huge corporate backing and a corporate IT department. We want to make things more automated or streamlined for our employees.”

Worthy Insurance’s DE&I strategy is organic and reflects the community in which it operates. Its headquarters are on the outskirts of Chicago.

“We’re very lucky that we live in a city of seven million people, and that creates an organic, diverse workforce. We look for the best candidate for the job and to fill the role. But we try to ensure our company is at least 60–65 percent women.”

Headquarters: Dallas, TX

Type of company: Retail Agency/Brokerage

Organization size: 101–500 employees

Employee satisfaction rating: 89 percent

The awards keep rolling in for Brown & Riding, following its 5-Star Wholesale Brokers and MGAs win, by being recognized as one of IBA’s Top Insurance Employers of 2024.

The firm has enjoyed tremendous success since its inception in 1980 in North California, through the leadership of Peter Brown and David Riding, as the top company now has 20 offices throughout the country.

Operating in all major cities, the organization has maintained a happy workforce through many exciting employee initiatives.

“We try to provide world-class opportunities for our employees to grow and develop into whatever they want to be in this industry”

Christopher WeltyBrown & Riding

“We are expanding our support positions in the production side, and so that’s very important because as we’ve grown, our teams have drastically expanded and become more complex,” says chief human resource officer, Christopher Welty.

“We want to give people more opportunities to expand their career and grow. We’ve added some leadership positions within the team, so that the broker can delegate some of their authority in managing and leading the day-to-day operations of the team.”

The company is 100 percent employee-owned and operated internally, which gives all workers an opportunity to grow. On top of that, the company has a rich benefit plan with programs such as:

-

health reimbursement arrangement for anyone who can stay in-network, when their health care provider signs an agreement with the carrier to accept a discounted rate

-

a holistic work-life balance through wellness programs

“We’re very proud of our medical benefits and what we’re able to provide for our employees. We have the richest medical plan that exists in the market,” comments Welty. “We’re continually re-evaluating our benefits to try to make sure they are rich and valuable for our employees.”

The firm is devoted to improving employees’ capabilities through internal training, with the option for upskilling outside the company.

“Each individual on the support staff ranks of our broker teams is given professional development periodically, where we are, in conjunction with their broker evaluating where their skills are at,” he reveals.

“We then start an action plan to help develop those skills further. We find that really helps individuals move along their careers and become experts. The only way we can stay independent long-term is if we have individuals developing throughout the firm into the future.

“We reimburse for licensing, courses, and designations. We find it so valuable because it helps to grow an individual’s knowledge in a relevant area.”

Brown & Riding embraces HR technology to simplify the working day, which enables its team to:

“We provide a tool where people can manage all of those things electronically,” says Welty.

The firm has a strong attitude toward DE&I and strives to employ people from all backgrounds.

Brown & Riding is also a founding sponsor of Insurance Transformation, which aims to create certificate programs in historically Black colleges and now aims to expand to community colleges.

“We’re trying to help young people throughout the country, who have less opportunity financially, realize that insurance is a great industry. Our company, historically, has provided far better opportunities for a much wider range of people than any other company in our industry,” he explains.

“It’s one of the biggest initiatives that we’ve helped launch and that’s also turned into our first class of graduates, who graduated this year. We have also connected every one of those graduates with an internship. We have many interns not just in our company, but also in other companies.”

Headquarters: Farmington Hills, MI

Type of company: Wholesaler (Brokerage, MGA, MGU, etc.)

Organization size: 1,000+

Employee satisfaction rating: 80 percent

As a family-owned and operated organization, Burns & Wilcox has the freedom and flexibility to make substantial investments for the benefit of associates, clients, and partners.

The company, which was founded in 1969 by the late Herbert W. Kaufman, has 60+ offices spanning the US, Canada, the UK, Europe, South America, and the Middle East.

“We are aggressively pursuing the industry’s best talent, who are attracted to the company’s culture, grounded in family values, and how we encourage associates to operate with a growth mindset”

Danny KaufmanBurns & Wilcox

Representing the third generation of family leadership, Herbert’s grandson Danny, who is president, is responsible for the company’s North American business. In addition to his leadership of Burns & Wilcox, he is executive vice president of its parent company, H.W. Kaufman Group, overseeing operations, sales, marketing, and technology.

“We have invested more than $100 million to transform our technology capabilities, which will enable our associates to make faster, smarter, and more data-driven decisions,” Kaufman says. “We are already realizing the benefits. As a nimbler organization that operates with significant speed, we are delivering an improved experience for our clients and driving even greater financial results.”

Burns & Wilcox aims to leverage that investment into HR technology, which strengthens employees by analyzing:

-

employee feedback

-

HR metrics

-

market trends

This elicits valuable insights that shape talent strategies and optimize programs.

“Our HR team has revolutionized the talent experience by implementing cutting-edge initiatives that prioritize the well-being, growth, and engagement of our workforce based on data,” states Kaufman.

Burns & Wilcox aims to foster a workplace for all through its DE&I initiatives.

“Our associates are encouraged to participate in designated ERGs that align with a multitude of communities represented by our associates. Together they are leaning into their diverse backgrounds, experiences, and perspectives to tackle complex business challenges and ensure that Burns & Wilcox is always a place where associates can thrive,” adds Kaufman.

“Talent remains an issue across the industry. Of course, we see limitless potential via a career in insurance and have made it a priority to elevate the industry overall.”

Headquarters: Tucson, AZ

Type of company: Retail Agency/Brokerage

Organization size: 26–100

Employee satisfaction rating: 82 percent

Through its tagline – Famously Friendly Humans – the organization remains one of the best insurance companies to work for in America.

Since forming in 2007, RightSure has been steered by its president Jeff Arnold, whose passion for insurance fed through to employees.

A two-time bestselling author, Arnold credits the importance of culture and a positive employee experience to the company’s continued success.

“When a real company culture exists, you can feel it the minute you call them, the minute you walk into the headquarters, the minute you walk into retail. It’s an energy that transcends time and space, and you feel very welcomed by these people who love what they do,” says Arnold.

The organization aims to attract people who exhibit qualities in their extensive hiring process.

“People feel that anytime they talk to anyone in our firm, the energy is high and the vibe is great”

Jeff ArnoldRightSure Insurance Group

“It is people that have high energy and passion. They can be reserved and well-spoken, but they have an energy, an attraction, a charisma about them that you can feel, maybe not see, but it’s palpable,” he comments.

“This firm keeps winning all these awards by getting the right people, hiring, recruiting, training, re-recruiting them. I can’t just stand in my little office here, beat my chest, and make it happen. It has to be embraced by everyone. Our long-term goal is not only to be North America’s most awarded insurance firm, but to become a global brand.”

The company’s benefits program rewards employees for their hard work through the following:

-

generous PTO, including 24 days annual leave

-

100 percent life insurance

-

dental and vision cover

-

50 percent health insurance

-

on-site gym

-

meals catered two days a week

“We don’t want our people burned out. We work hard, we’re not a 40-hour week firm, we’re a ‘get it done’ firm. I’m trying to eliminate decision fatigue, because thinking about food when it’s crazy busy can be a distraction,” he says.

“We also provide company-branded gear, because deciding what you’re going to wear every morning can also cause decision fatigue, plus we all look aligned.”

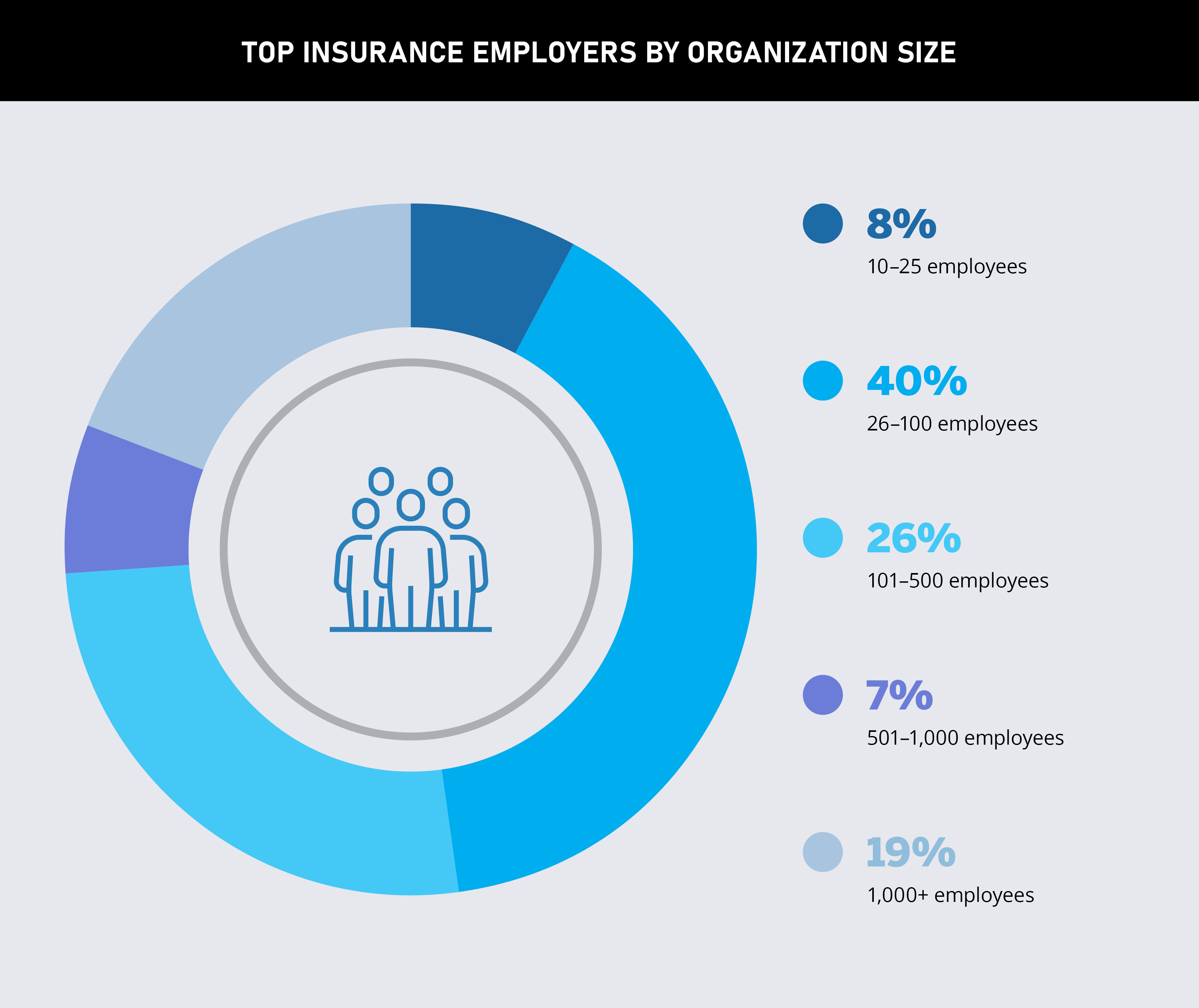

1,000+ employees

- HUB International

- PURE Insurance

501–1,000 employees

- DUAL North America

- Shepherd Insurance

101–500 employees

- Bamboo Insurance

- Clearcover

- Commercial Insurance Associates

- Golden Bear Insurance Company

- HawkSoft

- Jimcor Agency

- Savoy Associates

26–100 employees

- Allied Trust Insurance Company

- America’s Choice Insurance Partners

- Chris-Leef General Agency

- Deland, Gibson Insurance

- Ellerbrock-Norris

- Euclid Transactional

- General Indemnity Group

- Great Lakes

- Harmon Dennis Bradshaw

- MountainOne Insurance Agency

- Ollis/Akers/Arney Insurance & Business Advisors

- Provident Insurance Programs

- The Bulow Group

10–25 employees

- Continental Underwriters

- Morrison Insurance Services

- RPR Insurance

- Shomo-Madsen Insurance