Imagine you’ve found the car of your dreams, but there’s a catch—it’s a salvage. While some might see a red flag, others see a blank canvas for a dream project. However, what does transforming this diamond in the rough mean for your insurance values? Let’s shift gears into the intriguing world of car salvage and its impact on insurance, where the road is as winding as it is fascinating.

Legislation and Regulation

Another layer to the salvage story is the evolving landscape of legal regulations. Different jurisdictions view salvage vehicles through various legal lenses, affecting everything from registration processes to insurance policies. Staying informed about these laws and advocating for rights to restore and insure salvage vehicles could significantly impact the community’s future.

For those considering parting with their damaged vehicles, rather than navigating through the restoration process, some services can simplify the transition. Engaging with platforms like Rusty’s Auto Salvage can offer a convenient alternative, providing a method to responsibly recycle cars while potentially benefiting financially.

Market Value vs. Sentimental Value

In the realm of salvage, market value, and sentimental value often find themselves at a crossroads. Insurers crunch numbers, but for many car enthusiasts, a salvage project is a labor of love, with its value far exceeding the sum of its parts. This emotional investment can drive a wedge between an owner’s perception and the insurer’s valuation.

The Role of Restoration

Restoring a salvage vehicle is akin to polishing a hidden gem. The journey from wreck to roadworthy can dramatically alter an automobile’s insurance narrative. Well-documented restorations, showcasing meticulous craftsmanship, can sometimes nudge insurance values in a favorable direction, challenging preconceived notions about salvage vehicles.

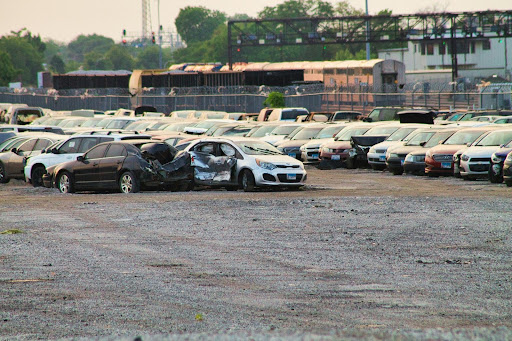

The Salvage Stigma

At the mention of salvage vehicles, many imagine a graveyard of cars, battered and bruised, telling tales of disasters. However, the truth is often less dramatic, involving cars that have been given a second chance at life after being deemed economically impractical to repair. This stigma can significantly steer the insurance values, often veering into unpredictable territory.

Understanding Insurance Values

Insurance values are like the heartbeat of an automobile’s financial health. For salvage cars, this heartbeat might skip a few beats as insurers weigh the reconstructed reliability against the historical scars. Valuing these automotive phoenixes requires a blend of art, science, and, admittedly, a bit of guesswork.

Salvage Equals Salvaged Insurance?

Does a salvage title relegate a car to the shadows when it comes to insurance? Not necessarily. While insurers might approach with caution, flashing their hazard lights, the story doesn’t end there. Comprehensive and collision coverages might still embrace a salvage vehicle, albeit with a careful calculation of premiums, reflecting the vehicle’s resurrected status.

Future Forecast

As the automotive landscape continues to evolve, so too does the narrative surrounding salvage vehicles. Advances in technology and a growing community of restoration enthusiasts are slowly shifting perceptions. This evolution could pave the way for a more nuanced approach to insuring these once-branded outcasts, potentially making the road less bumpy for future salvage revivals.

Community and Culture

Beyond the nuts, bolts, and cold numbers, the salvage vehicle community thrives on a culture of creativity, resilience, and shared stories of transformation. This community, bonded by a passion for bringing life back to what was once considered lost, stands as a vibrant testament to the human spirit. It’s a factor that, while intangible, profoundly influences the market and insurance values in ways that numbers alone cannot capture.

Environmental Impact

Salvage vehicles also have a unique position in the environmental dialogue. By restoring and repurposing what many consider to be waste, enthusiasts contribute to a reduction in the manufacturing demand and, consequently, a smaller carbon footprint. This aspect could begin to play a larger role in insurance considerations as the industry increasingly incorporates environmental sustainability into its calculus.

Conclusion

The journey of a salvage vehicle is fraught with misconceptions and insurance challenges. Yet, it remains a beacon for those who see potential where others see peril. As we navigate through the complexities of car salvage and insurance values, it’s clear that every salvage story is as unique as the vehicles themselves. Despite the hurdles, the journey of transforming a salvage into a roadworthy masterpiece is an enduring testament to the resilience of both cars and their custodians. So, the next time you eye a salvage, remember, its story is only beginning.

Interesting Related Article: “Leasing vs. Financing a Car for Your Business“