MetaPlanet, the Japanese company, raises $61 million via bonds to buy more Bitcoins. Inspired by MicroStrategy's strategy, the firm wants to strengthen its holdings in BTC, confirming the growing enthusiasm of businesses for the currency.

MetaPlanet adopts Saylor’s method: buy more and more Bitcoins

Since 2020, MicroStrategy, a US company specializing in business intelligence, mobile software and cloud services, has invested heavily in Bitcoin. This strategic choice relegated its main activities to the background, transforming its action into a way for foreign investors in Bitcoin to gain exposure to the value of BTC without directly holding it.

Today, MicroStrategy is the public company with the most Bitcoins. In less than 5 years, it spent $27 billion to acquire 439,000 BTC, now valued at nearly $42 billion, realizing a capital gain of around $15 billion.

In 2024, Bitcoin has attracted increased attention, notably thanks to the launch of spot Bitcoin ETFs in the United States. This popularity led to imitation of Michael Saylor's strategy by other companies, including MetaPlanet, a Japanese company specializing in finance, real estate and trading.

👉 Have you ever wondered: Who has the most Bitcoins? Discover our top 10 entities richest in BTC

Just 4 days after announcing the issuance of a 4.5 billion yen ($28.7 million) bond intended for the purchase of new Bitcoins, MetaPlanet said it issued a 5th bond of 5 billion yen ($31.9 million) to further strengthen its BTC acquisitions.

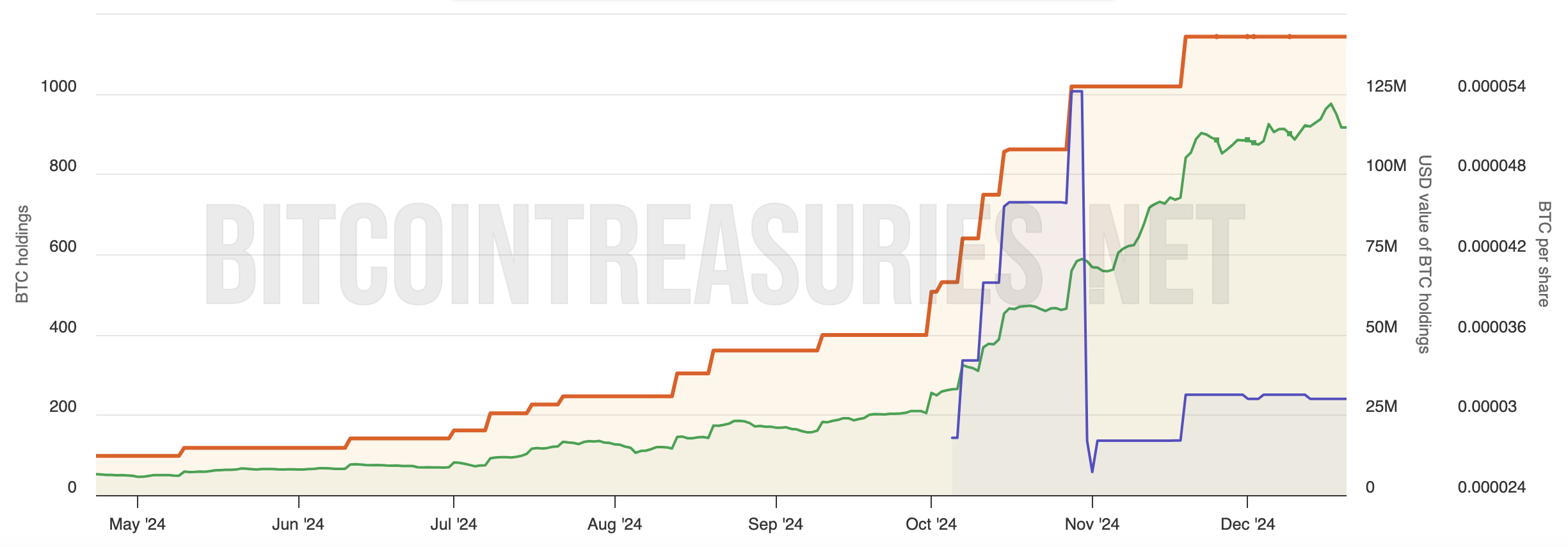

Since October, MetaPlanet acquired over 741 BTC and now holds 1,142 BTC, purchased at an average price of $65,900 per unit. The current value of these assets is $109 million.

Evolution of Metaplanet’s Bitcoin holdings

In total, MetaPlanet just raised $60.6 million, which will allow it to acquire approximately 637 BTC at the current price. This transaction is expected to increase the company's Bitcoin holdings by 55%.

Download Bitstack and earn €5 in Bitcoin with code CRYPTOAST5*

* After saving for €100 of BTC purchase

After companies, states want to create their strategic reserves in Bitcoins

The year 2024 has undeniably established itself as that of the politicization of Bitcoin. Initially introduced in electoral campaign debates, the subject became essential in July, when Donald Trump and Wyoming Senator Cynthia Lummis proposed the creation of a strategic reserve of 1,000,000 Bitcoins.

Many political leaders then took up this theme, joining the few Bitcoiners or crypto-enthusiasts who occasionally debate it. Bitcoin is now a central topic of political discussions in the United States, El Salvador, Argentina, Switzerland, and even Europe.

📰 Also read in the news – Salvador: Bukele buys $1 million in Bitcoins 24 hours after his agreement with the IMF

However, these projects for strategic reserves in BTC for States go against the founding principles of Bitcoin.

Indeed, the creation and initial use of BTC aimed to separate currency from the state, in offering each individual a personal reserve and a digital and independent bank account.

While the creation of such reserves by governments will likely drive up the price of Bitcoin, it would also introduce a form of Trojan horse within the centralized structures of Stateswhich, over time, could become accustomed to the use of a decentralized currency.

Ledger: the best solution to protect your cryptocurrencies 🔒

Sources: MetaPlanet, BitcoinTreasuries

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital