The Tron (TRX) blockchain, boosted by the growing activity of stablecoins established there and memecoin launcher Sun.pump, has just recorded a record quarterly turnover of $577 million. What do we know about this blockchain that is currently in the spotlight?

Tron blockchain sets new record

The Tron blockchain, founded by the sulphurous and controversial Justin Sun in 2017, is one of the rare blockchains created at that time which still attracts significant liquidity, as evidenced by its new record of $577 million in revenue last quarter.

No offense to its detractors, the blockchain has been able to reinvent itself and offer popular services, like memecoin launcher SunPump following the dazzling success of its quasi-homonym Pump.fun on the Solana network.

The Tron blockchain is also very popular, particularly in Latin America and Africa, for stablecoin payments. Indeed, the network is very light in terms of fees when compared to Ethereum. Many people therefore choose to use the Tron network for micropayments.

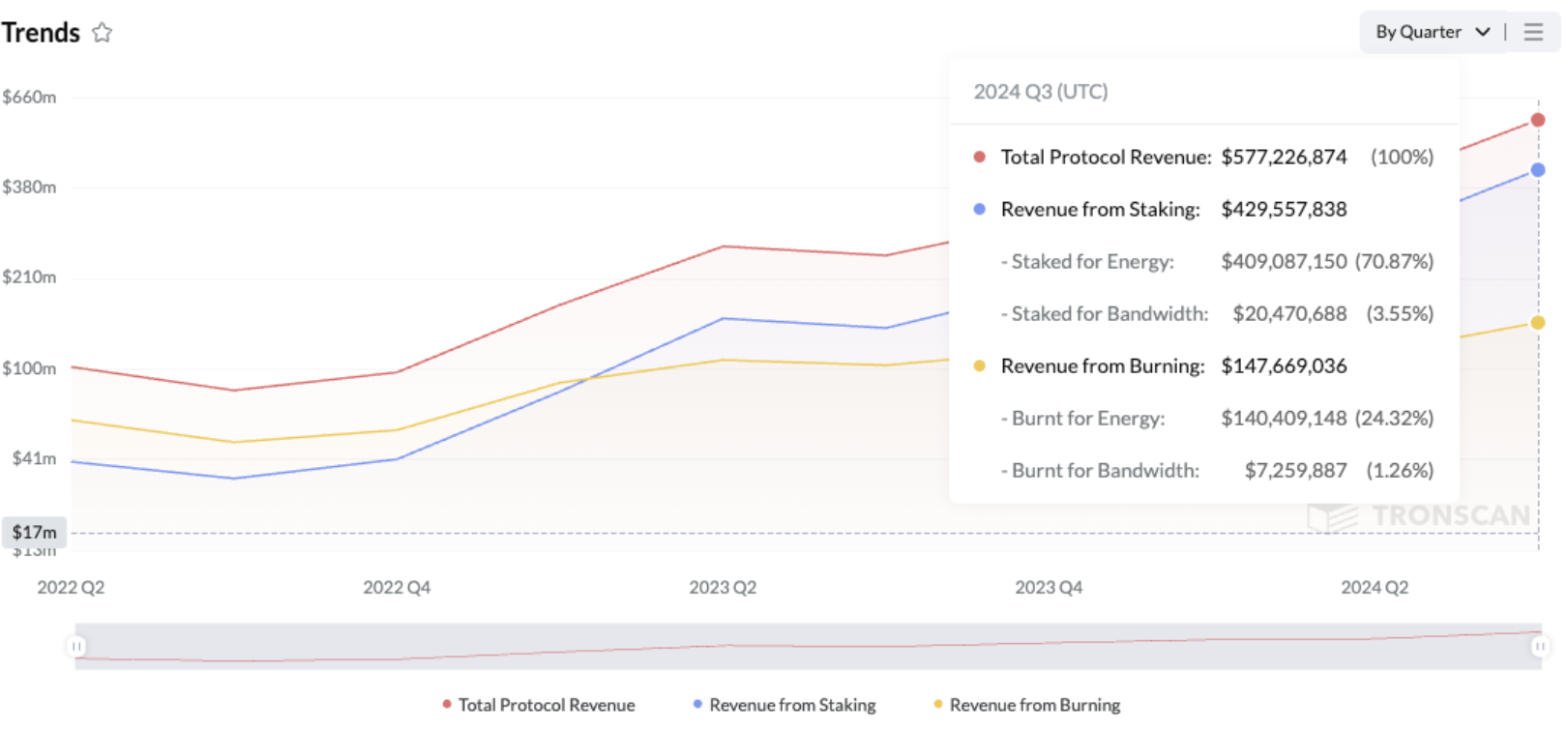

Tron network revenues for the 3rd quarter of 2024

Tron network revenues for the 3rd quarter of 2024

Tron generated $577 million in revenue in Q3 2024, 74% of which came from staking and 26% from token burn.

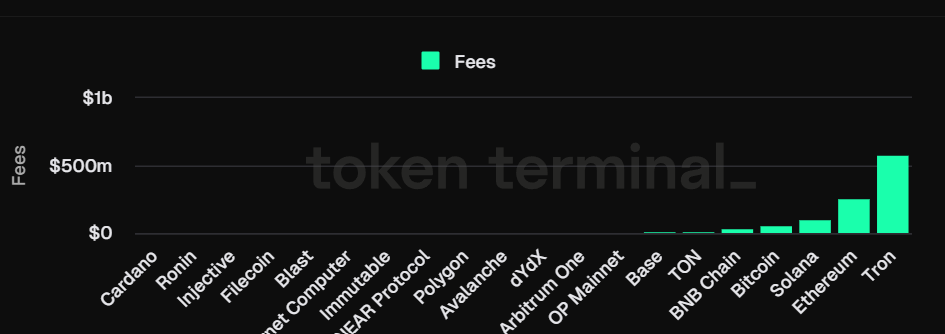

According to Token Terminal data, Tron fees were twice as high as on Ethereum over this period:

Fees on different blockchains during the last quarter

Indeed, as we can see in the graph above, the Tron blockchain significantly outperformed all other blockchains in terms of fees over the last quarter.

However, if we look at this same graph since the start of 2024, Ethereum remains first in this metric with more than $500 million ahead of its main challenger, Tron.

Binance: the benchmark crypto exchange platform

Tron's stablecoin market cap increased by nearly $13 billion

Since the start of 2024, the Tron blockchain has recorded strong capital inflows in stablecoins.

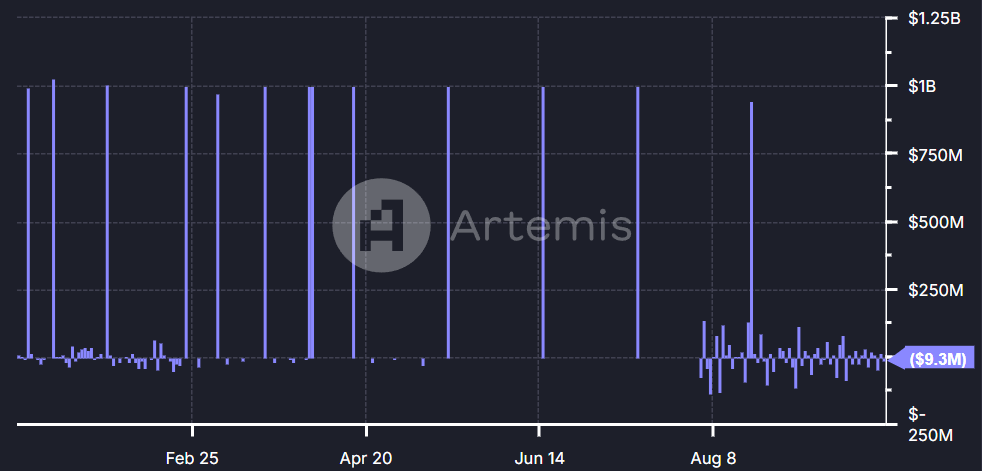

Indeed, according to data from Artemis Terminal, we can see significant inflows, regularly of the order of a billion dollars :

Stablecoin inflows/ouflows on the Tron blockchain

Stablecoin inflows/ouflows on the Tron blockchain

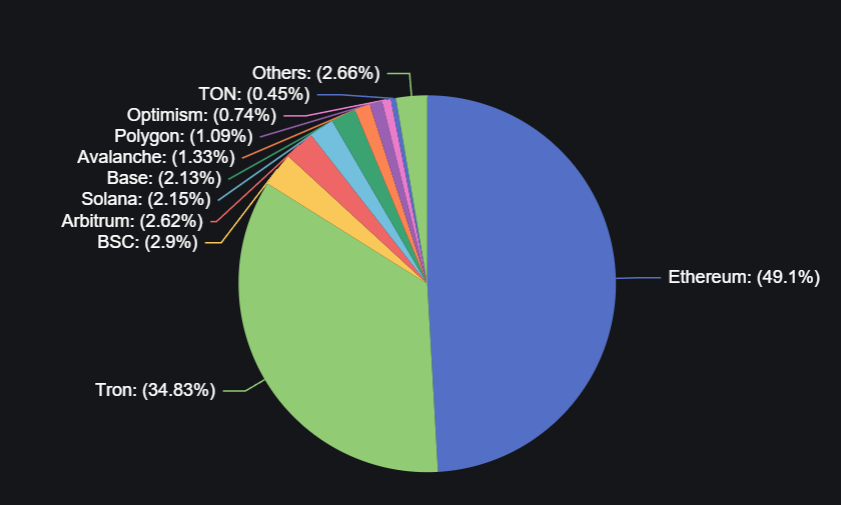

Thus, Tron is undeniably taking an increasingly dominant role in terms of market cap for stablecoins, although Ethereum remains the leader in this sector:

Distribution of stablecoins between different blockchains

Distribution of stablecoins between different blockchains

Since the launch of the Tron blockchain, daily active addresses that use stablecoins are significantly increasing. They have regularly been between 500,000 to 700,000 since the start of 2024 :

Number of daily active addresses for using stablecoins on Tron

Although all of this data is quite positive for the Tron blockchain, it does not fully explain its revenue. Indeed, memecoin launcher Sunpump would also be partly responsible for Tron's record as it would have brought in more than $5 million since its launch in August.

The price of the Tron blockchain cryptocurrency, TRX, increased by more than 2% in the last 14 days.

Cryptoast Academy: Don’t waste this bull run, surround yourself with experts

Sources: DefiLlama, Artemis Terminal

The #1 Crypto Newsletter

Receive a summary of crypto news every day by email

What you need to know about affiliate links. This page may feature assets, products or services relating to investments. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.