Last January, the US Securities and Exchange Commission (SEC) gave the green light for the launch of a series of spot Bitcoin ETFs on American stock exchanges. Today, we have the necessary perspective to measure the impact of these new products on the market and compare them to their Hong Kong equivalents.

Higher transaction volumes in the United States

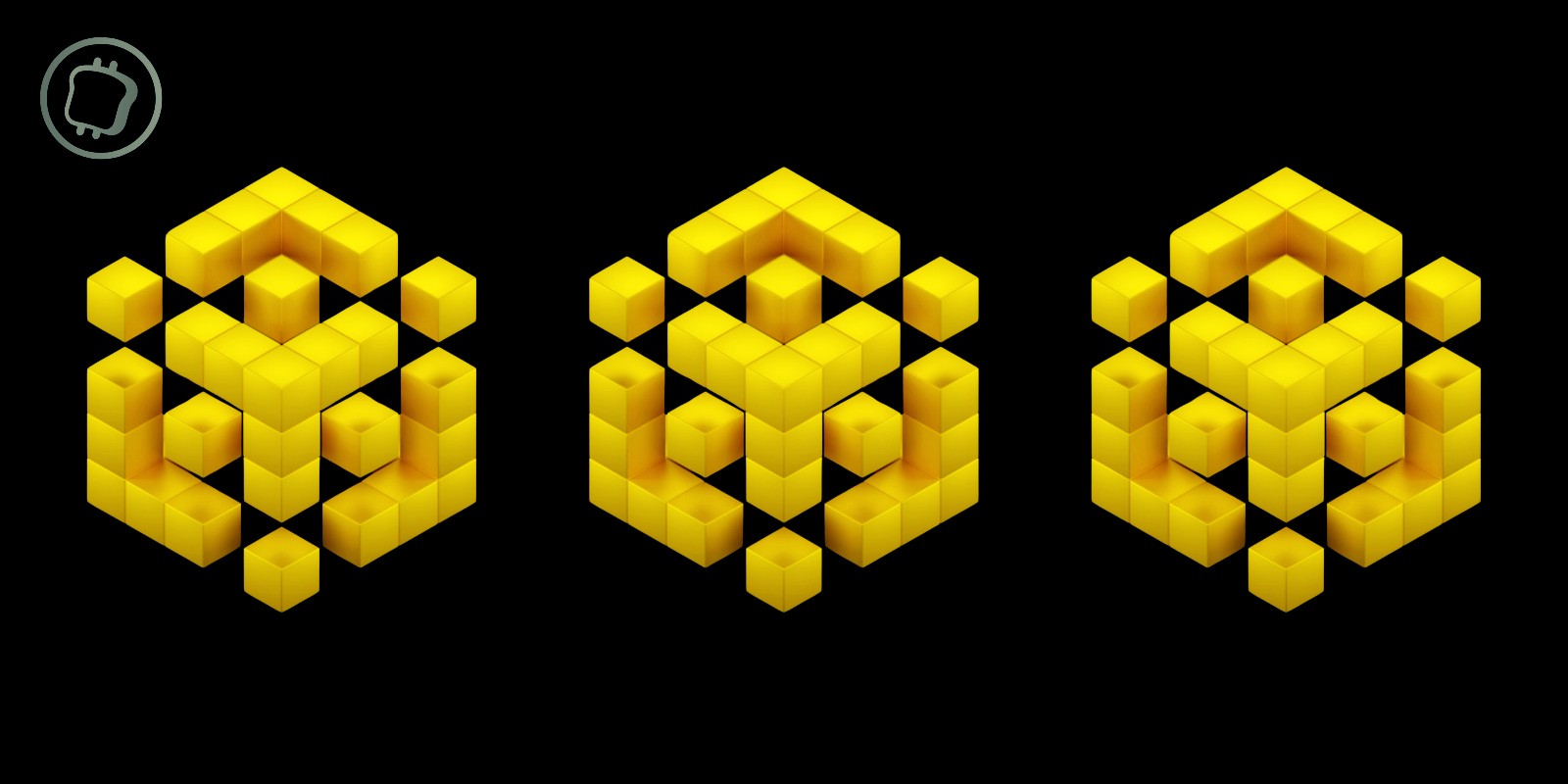

With the approval of spot Bitcoin ETFs in the United States in January, BTC trading volume has increased significantly. According to the analysis company Kaiko, this is explained by a Global market euphoria but also by a rather favorable macroeconomic environment for risky assetsthat is, for cryptocurrencies.

Figure 1 – Daily Bitcoin volume traded

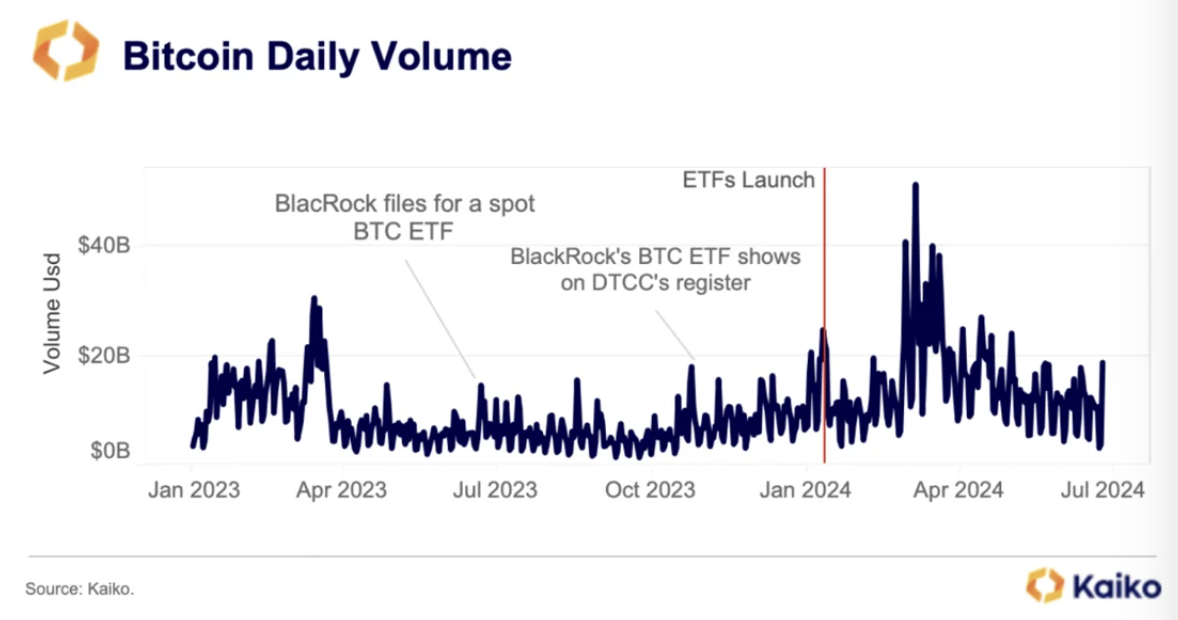

However, this trend has not had the same effect on the introduction of Bitcoin ETFs. Hong Kong, with a more tenuous impact on the markets.

A difference that can be explained by the fact that Hong Kong is a significantly smaller market than the United States. It must also be understood that the economic situation was not optimal in April, with a significantly more bearish market than at the beginning of the year and an ETF that arrives at the same time as the 4th halving of Bitcoin.

Figure 2 – Trading volume at closing of the Hong Kong market

👉 How to invest in a Bitcoin ETF in France?

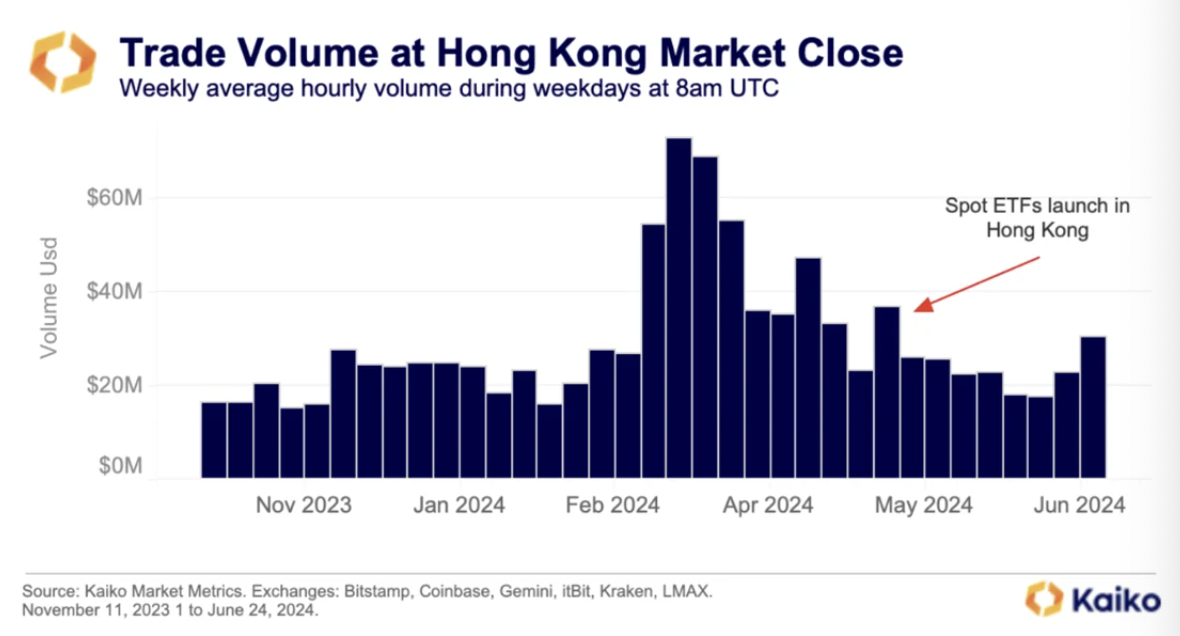

It is also worth noting that this The impact was more pronounced on U.S.-regulated exchanges. Indeed, Binance, which is not regulated in the United States, sees its trading volume focused solely on trading between stablecoins and Bitcoin.

A very different situation for Coinbase, which is regulated in the United States and sees an average volume increase of $220 million at market close.

Figure 3 – Hourly Bitcoin trading volume on Binance and Coinbase platforms

To understand this trend, we must also understand that ETFs offer a cost-effective hedging alternative for market makers.

This is why American companies authorized by the SEC, namely JP Morgan, Jane Street and DRW, will put all their resources into place to optimally arbitrate the differences between the actions of the Bitcoin ETF and its price on the markets. This will thus allow to improve liquidity conditions and thus demonstrate the market's growing capacity to handle large orders.

20 € offered when you register on Bitvavo

A change in market dynamics

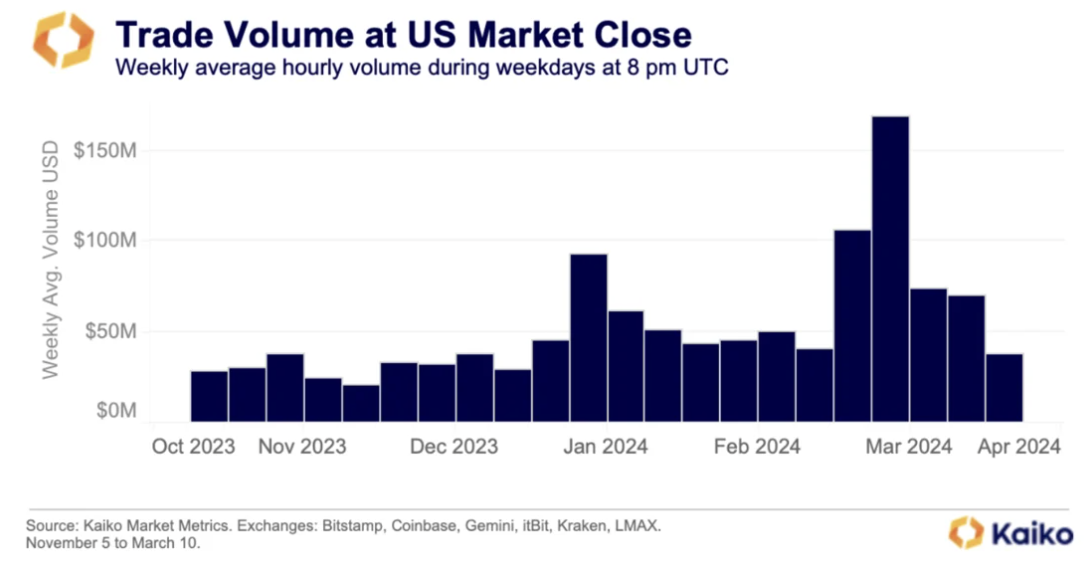

When we look at the details, we see that Activity is particularly intense at the close of the New York market. This period corresponds to what is called the ” fixing window “. The latter constitutes the ideal moment since by reflecting as faithfully as possible the reference price of Bitcoin, It comes to set the price of ETFs.

Therefore, transaction volumes naturally increase during this period.

Figure 4 – Trading volume on the US market at its closing

For this reason, commercial activity will be concentrated on this pricing window (between 5pm and 6pm Paris time). The second most popular hour is between 10pm and 11pm, with over $17.6 million in volume traded during this time slot.

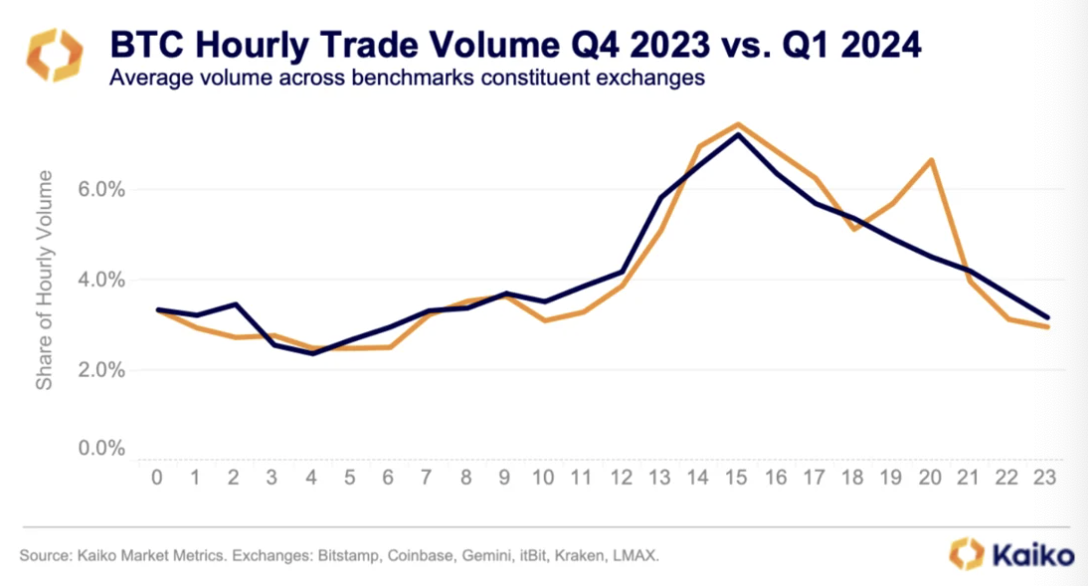

Figure 5 – Difference in hourly trading volume between Q4 2023 and Q1 2024

👉 In the news – Ethereum spot ETF: towards approval as early as July 4 by the United States SEC?

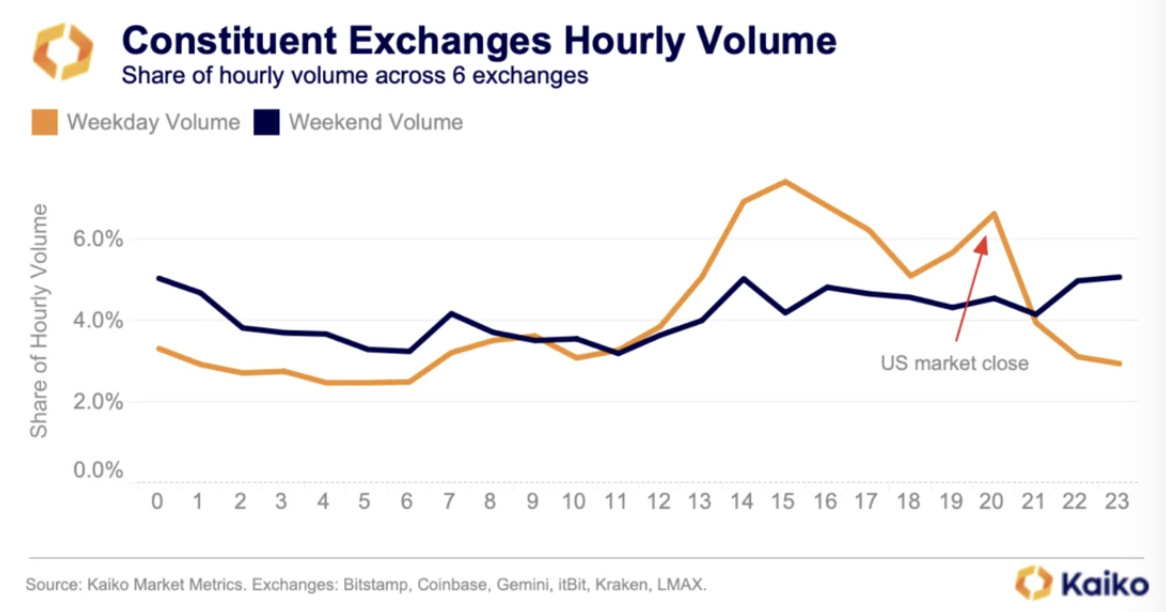

To note that The share of BTC transaction volumes during weekends has been steadily decreasing since 2021. This downward trend has been exacerbated since the introduction of cash ETFs, with weekend trading volume down 12 percentage points since its all-time high in 2019, according to Kaiko data.

Figure 6 – Hourly volume of Binance and Coinbase platforms

In short, The overall impact of ETFs on the Bitcoin spot market has been positive. All the signals discussed above indicate that the market is enjoying a certain maturity, allowing it to flourish peacefully.

Download Bitstack and earn €5 in Bitcoin with the code CRYPTOAST5 *

* After activating a savings plan and accumulating at least €100 in BTC purchases

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.