Despite the sanctions suffered by Tornado Cash, the cryptocurrency mixer is far from having said its last word. Indeed, several statistics still show regular activity on the protocol. Let's take a closer look.

Tornado Cash is far from admitting defeat, despite the sanctions

Just a few days ago, we returned to the troubles of 2 of the Tornado Cash developers with justice. On this occasion, we also highlighted the fact that despite all the measures put in place to discourage the use of the protocol, it was far from being abandoned.

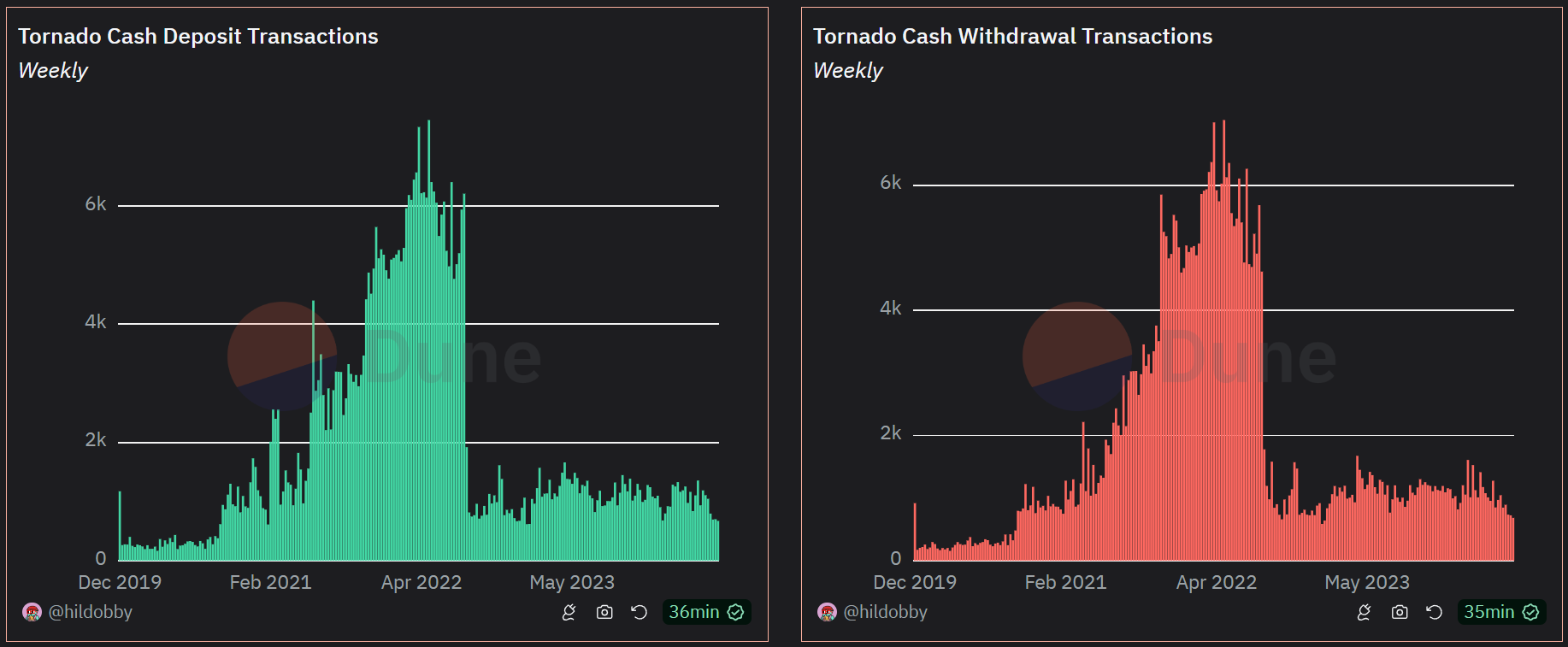

Although the amount of withdrawals and deposits has decreased significantly since the 2021-2022 period, the cryptocurrency mixer still shows decent activity, with these deposits and withdrawals regularly exceeding the number of 1000 per week:

Figure 1 — Number of weekly deposits and withdrawals on Tornado Cash

For example, at the time of writing, a 1 ETH deposit on Ethereum into the protocol could be likened to over 60,000 different deposits, and nearly 32,000 deposits for 0.1 ETH.

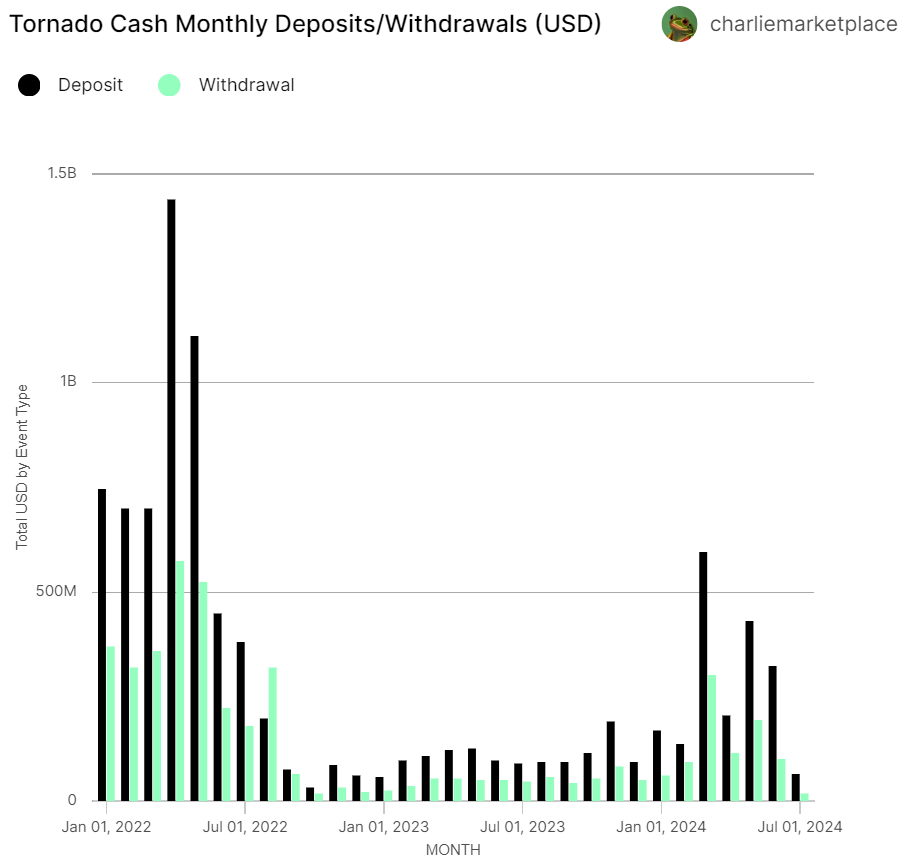

In terms of volumes, Tornado Cash has seen nearly $1.92 billion in deposits since January 1 as well as $880 million in withdrawals over the same period:

Figure 2 — Tornado Cash Monthly Volumes

As for the liquidity present on the protocol, Tornado Cash Records Total Value Locked (TVL) of Over $570 Million. By comparison, that value is higher today than it was when the Office of Foreign Assets Control (OFAC) cracked down on the mixer:

Figure 3 — Tornado Cash TVL

👉 Also in the news — WazirX: North Korean hackers behind the $235 million hack?

However, despite a protocol that is far from having said its last word, the TORN token is for its part sailing at the bottom of the cryptocurrency ranking. With a unit price of $2.63, the asset records a total capitalization of barely $10 million.

Ledger: the best solution to protect your cryptocurrencies 🔒

Sources: Dune, Flipside, DefiLlama

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.