With the ambition of offering an alternative to classic leveraged trading, InfinityPools is launching today with its new decentralized exchange. What are its particularities?

InfinityPools arrives with a new way to trade with leverage

In leveraged trading, the usual operation determines a price at which a position will be liquidated based on the leverage selected and the amount posted as collateral.

Be careful with leverage

Be careful, using leverage involves high risks and is mainly suitable for experienced traders. It is important to note that, while offering the possibility of making exponential profits, leverage can also lead to significant losses, potentially leading to a complete liquidation of the capital involved.

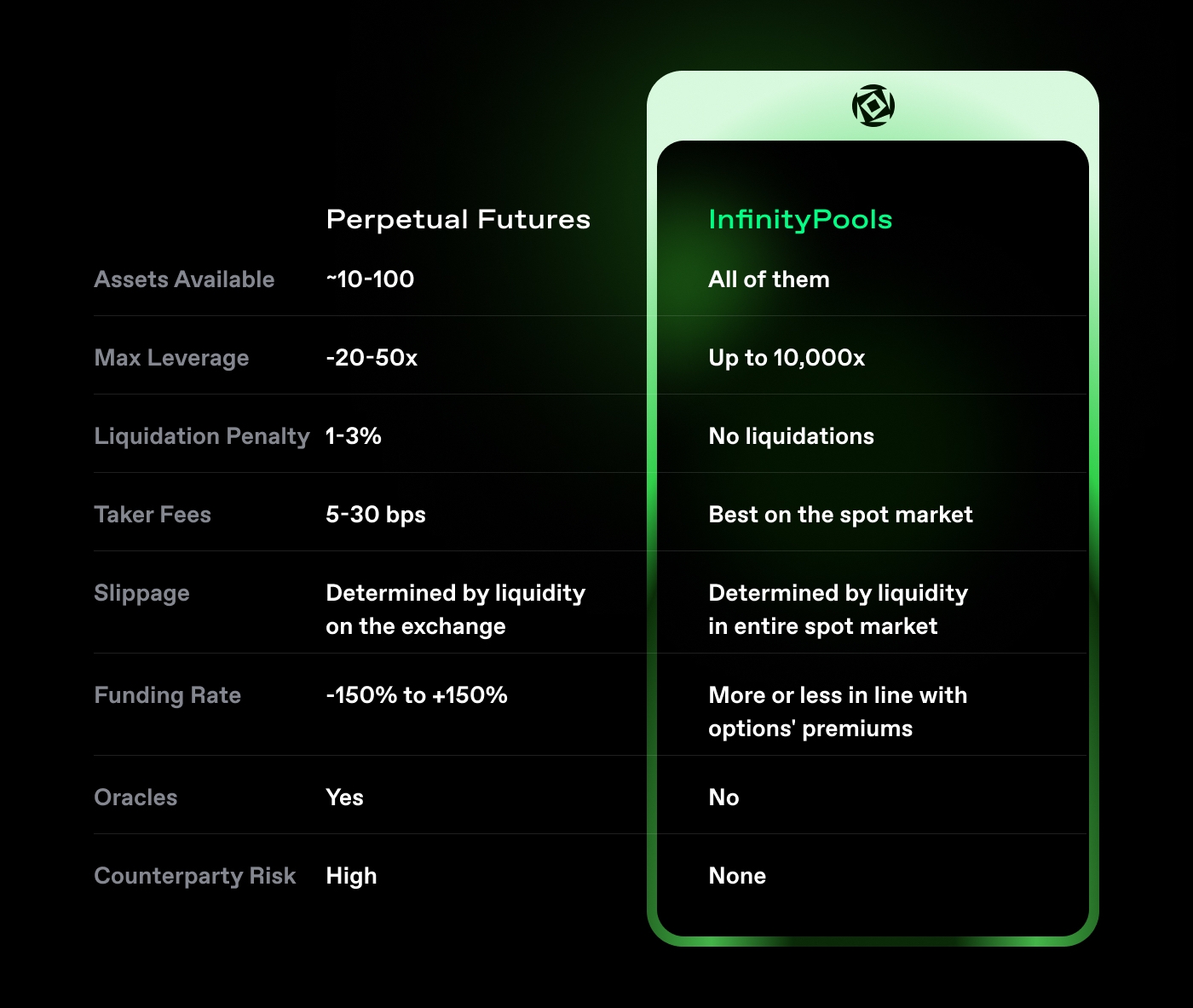

While this method sometimes has some limitations, InfinityPools hits the market today with a new promise : unlimited leverage without any position liquidation:

Curious what no liquidations actually means? Want a sneak peak at some of our partnerships? Want free alpha?

Take a look at our demo

pic.twitter.com/RnK4UW7Esg

— InfinityPools (@InfPools) January 10, 2025

Before explaining how this concept works, it is appropriate to review what pushed the InfinityPools teams to build this new generation decentralized exchange (DEX). This comes from the inefficiency of traditional liquidation systems which, during periods of high volatility, may not work as expected. Indeed, the sale or purchase order necessary for a liquidation may be missing when prices move too quickly.

Faced with this observation, InfinityPools offers a mode of operation with some similarities to options trading. Thus, the trader will borrow the funds necessary to open his position from a liquidity pool, and these loans are sized according to market environments.

InfinityPools aims to reinvent “classic” trading

For example, the “unlimited leverage” discussed here is only reserved for extremely low-volatility pairs, such as USDC/USDT or stETH/ETH, and can go up to x1,000. For memecoins in particular, the leverage will effectively be limited.

For its launch, InfinityPools will include wstETH/sUSDe and sUSDe/USDC pairs on Base through a partnership with Ethena. However, after a few months, adding trading pairs will be completely permissionless. Note that for the first week, only cash deposit will be possible. Trading will only be available after this period.

Try dYdX now: the preferred DEX for crypto traders!

Then, the loan taken out to open the position will generate interest, which will be paid by the guarantee. It is from this that the maximum duration of a position can be calculated, while the unrealized gains from a winning position can also be used to pay interest:

If a position is short of collateral and unrealized profits to pay interest, and it is not closed by the trader, it will be closed without liquidation penalties.

Through this operating mode which predetermines the position in advance, InfinityPools thus seeks to eliminate counterparty risk. By extension, the protocol's returns should also be more profitable for lenders, compared to traditional DEXs.

For example, for the first 2 pools offered on Base with Ethena, liquidity providers will be able to combine native rewards, staking yields and InfinityPools earnings in a single pool.

The protocol having only been launched yesterday, it will however be necessary to keep in mind the possible risks of hacking in the event of a breach and judge its robustness in real conditions. However, it will be interesting to follow its development against classic leveraged DEXs like Hyperliquid or dYdX.

Launched by former members of 0x, Goldman Sachs, Uber, Google, Facebook and Microsoft, InfinityPools received support from Dragonfly, Standard Crypto, Coinbase Ventures, Wintermute and Nascent as part of a seed round in 2021.

Try Hyperliquid: a decentralized trading platform!

Source: InfinityPools

The #1 Crypto Newsletter

Receive a summary of crypto news every day by email

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital