The year 2022 is coming to an end and many investors may find themselves in losses. In this context, Waltio has developed a tool aimed at people who have sold cryptocurrencies, to enable them to reduce or even cancel their possible taxation.

Waltio’s new solution to reduce its taxation

Every year no one escapes the tax return, and taking into account your cryptocurrency income is not always easy. To do this, Waltio has developed a tool to facilitate the calculation of its taxation.

But the bear market having marked the year 2022, many portfolios are currently in losses. The problem is that French law calculates the tax from the moment the disposal of assets has been completed.

This means that a person who sold at a profit at the start of the year, but was in a loss on December 31, 2022, will still have to pay the flat taxbecause it had realized a gain on its taxable disposal.

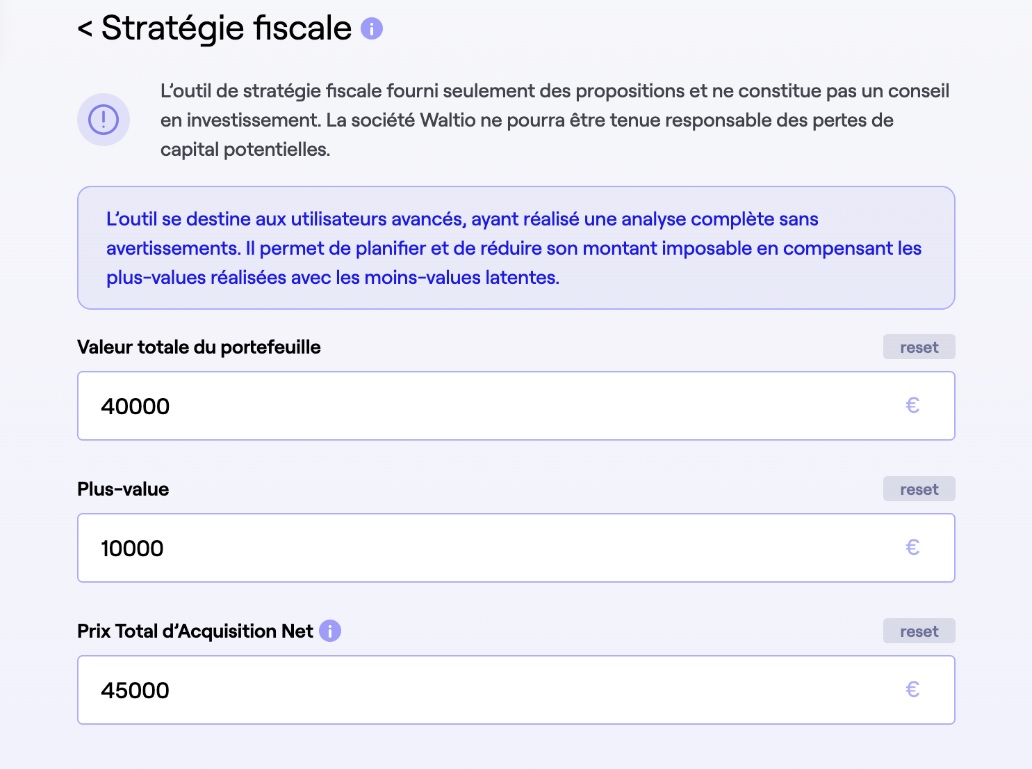

It is in view of this observation that Waltio has enriched its tool to enable it to propose a strategy aimed at optimizing its taxation:

Overview of Waltio’s imposition optimization tool

👉 To go further – Discover Waltio’s solution for your tax declaration

Discover the Waltio tax assistant

💡 The tool that simplifies the declaration of your cryptocurrencies

Costed practical case

Tax optimization is all the more important this year given the market contextas Pierre Morizot, CEO of Waltio, pointed out:

“For many cryptocurrency owners, this is the first year of the bear market. Some have even experienced the disappearance or blocking of their funds on certain trading platforms such as FTX. With this feature, we want to enable crypto-asset owners to reduce their losses. We wanted to make this functionality accessible to as many people as possible, including within our free offer. »

Indeed, let’s go back to the example of this person who made a sale in capital gains at the beginning of the year and now in losses. Let us apply for this a numerical demonstration proposed by Waltio, with an initial investment of 6,000 euros.

If, for example, a taxable sale of 2,500 euros was made in March 2022 when the portfolio was valued at 10,000 euros, this represents the equivalent of 300 euros of taxes to be paid.

Indeed, in this case, it is necessary to calculate the share of profits present in the 2,500 withdrawn. The initial 6,000 euros constitute 60% of the new valuation of the portfolio at the time of the sale, which means that in the 2,500 euros, there are 1,000 euros in profit. Taxes providing for a flat tax of 30% on profits, this represents a good 300 euros.

To legally avoid being taxed when you are in losses, it is possible to make an assignment in euros to reinvest them immediately after, to generate a tax loss.

If we consider that today this person’s portfolio is valued at 3,000 euros because of the fall in the market, a loss sale of 2,000 euros of cryptocurrencies, which will be redeemed behind, will cancel the capital gain of 1000 euros realized earlier in the year.

It is therefore an interesting strategy to take into account, which everyone can focus on according to their assets in order to reduce their tax burden after a year of bear market.

👉 Find all of our articles on law and taxation

Discover the Waltio tax assistant

💡 The tool that simplifies the declaration of your cryptocurrencies

Source: Waltio

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.