While Bitcoin stagnated and Ethereum disappointed in December, some altcoins were able to buck the trend. Discover the 5 cryptos that performed exceptionally well this month, the stories that propel them, and the reasons behind their success.

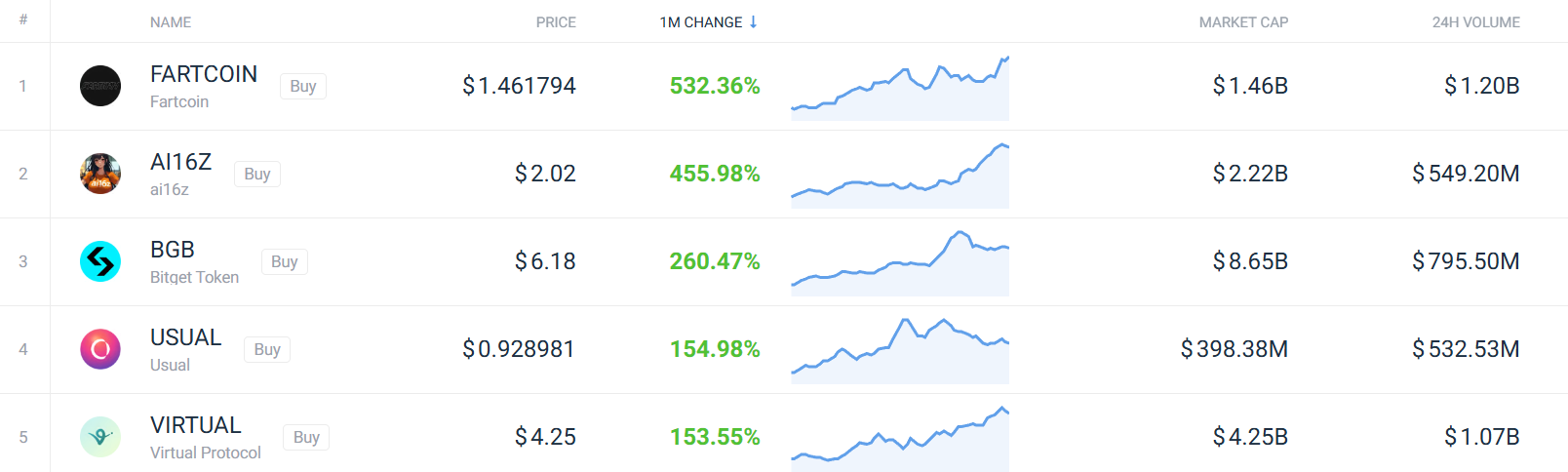

The 5 cryptos that performed the best in December

While Bitcoin recorded zero performance for the month of December, Ether continues to put investors' nerves to the test with a performance of -7% over this period.

Nevertheless, some altcoins show exceptional performance. Indeed, these cryptocurrencies, anchored in narratives that generate the attention of part of the crypto community, ignore macroeconomic conditions.

🏦 Discover the best platforms to buy your cryptos

Let's find out together what these cryptocurrencies are and the potential reasons that explain this performance.

The 5 cryptos that performed the best in December

Open an account on Binance, the world's #1 crypto platform

5 – SPX6900 (SPX): + 85%

With an increase in 85% in the last 30 daysthe SPX token set a new price record (ATH) located at $1.23. SPX enjoys great popularity within the crypto community, notably because Murad Mahmudov, the “prophet” of memecoins, regularly promotes it on X.

👉 Everything you need to know about the thesis of a memecoin hypercycle

Thus, the famous motto of the latter “ stop trading, believe in something » proves fruitful for those who believe in the vision of a token that “ will be more capitalized than the S&P500 because the figure of 6900 is higher than that of 500 “. Indeed, the price of SPX6900 had corrected significantly, going from $0.88 to $0.49 during the month of November.

4 – Virtuals Protocol (VIRTUAL): + 144%

Virtuals Protocol's VIRTUAL token has seen a meteoric rise in 144% in the last 30 days. The Virtuals protocol allows anyone to launch their own autonomous artificial intelligence (AI) agent in exchange for a few VIRTUAL tokens.

We have spoken to you about the VIRTUAL token on several occasions, notably by citing it in the top 5 projects to watch on the Base blockchain but also in our last article talking about the narrative of autonomous AI agents.

It does indeed seem that the narrative around AI agents is in full swing, mobilizing a large part of the attention of the crypto community at the moment on social networks.

Discover the analysis of the Virtuals project by Cryptoast Academy experts 👇

Benefit from exclusive analysis from crypto experts by joining Cryptoast Academy

Advertisement

3 – Bitget Token (BGB): + 284%

BGB is the token of the centralized exchange (CEX) Bitget. It offers its holders discounts on trading fees within the platform and exclusive advantages such as access to launchpads among others. The price of the BGB token exploded upwards by 284% in the last 30 days.

The reasons for this pump could not be more explicit: Bitget announced a drastic reduction in the BGB supply. This reduction represents 40% of the total supply or 800 million BGB tokens.

Bitget also plans quarterly token burns by allocating 20% of its profits to the buyback and burn of BGB, in order to maintain deflationary pressure on supply.

Stop block

Bitget is a cryptocurrency exchange platform blacklisted by the AMF.

👉 How to buy crypto safely?

2 – ai16z (AI16Z): + 416%

ai16z is the first venture capital decentralized autonomous organization (DAO) run by AI agents. The project is led by an AI agent (@pmairca) and aims to leverage AI and collective intelligence to make investment decisions.

Info block

ai16z has no connection with the Andreessen Horowitz investment fund, also known as a16z

Initially deployed on the Solana blockchain, ai16z recently announced plans to launch its own layer 1 blockchain. This development aims to offer an infrastructure more suited to the specific needs of AI agents.

Over the last 30 days, the price of the AI16Z token recorded a spectacular increase of 416%. Just like the VIRTUAL token, the AI16Z token currently benefits from strong visibility on social networks.

👉 Find out everything about autonomous agents with our explanatory sheet

1 – Fartcoin (FARTCOIN): + 588%

At the head of our monthly ranking of the best performing cryptocurrencies we find… FARTCOIN. With an exceptional performance of 588% in the last 30 daysmemecoin has managed to climb among the top 100 most capitalized cryptos.

Although this token is not based on anything concrete, or rather on wind, it enjoys strong popularity due to its origin. Indeed, the Terminal of Truth (ToT) AI, an AI developed by Andy Ayrey with the aim of studying the phenomenon of “ memetic contagion ”, suggested that “ fartcoin would be the ideal name for a crypto likely to resonate with the public “.

An anonymous developer then brought this idea to life by creating FARTCOIN on the Pump.fun platform. ToT is particularly popular within the crypto community for having, with the same process, indirectly given birth to the GOAT memecoin, which also had its moment of glory.

GMGN: the platform to buy meme coins easily

The top 200 cryptos that performed the best

Our previous ranking was based on the 100 most capitalized cryptocurrencies, not all the cryptocurrencies having offered exceptional performances in the month of December are necessarily included there.

Generally, when we extend our search field to the top 200 cryptos in this same metric, sometimes higher performances can be highlighted.

The 5 cryptocurrencies in the top 200 that performed the best in December

The 5 cryptocurrencies in the top 200 that performed the best in December

In this case, even if we broaden our search to the top 200 cryptocurrencies, 4/5 of the cryptocurrencies presented above are found in our current ranking. Indeed, the performance of the cryptos in the top 100 is so significant that only 1 crypto in the top 200 managed to climb to 4th place in this ranking.

This cryptocurrency in question is USUAL, from the eponymous protocol, which displays 156% increase in last 30 days.

Usual is a protocol at the crossroads between decentralized finance (DeFi) and real-world assets (RWA). The protocol offers several products: USD0, USD0++, USUAL token and USUALx.

💡All you need to know about RWAs with our explanatory sheet

USD0 differs from traditional stablecoins by being collateralized, among other things, by US Treasury bills.

On paper, the mechanisms for generating returns for users are relatively similar to those of Ondo Finance except that unlike the latter, Usual redistributes part of the protocol's revenues to holders of the governance token: the USUAL token.

Launched in July 2024, the protocol already has more than $1.7 billion in total value locked (TVL).

Discover the Usual protocol and its stablecoin in video 👇

https://www.youtube.com/watch?v=https://youtu.be/piB8NZCjl8w

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital