Cryptocurrencies are developing and are a subject of increasing importance in the public sector. A new report from Chainalysis, a company specializing in blockchain analysis, aims to determine what people around the world think about cryptocurrencies.

Perceptions about cryptocurrencies

A new survey from blockchain analytics firm Chainalysis shows that more than half of its survey respondents agree that cryptocurrencies represent a valid form of money.

However, the majority see these cryptocurrencies as objects used primarily by malicious and criminal actorseven if we observe a geographical distinction with certain Western countries that are more moderate on the issue.

It is also interesting to put this response into perspective, since half of the people questioned paradoxically think that crypto would have a positive impact on our financial system and are confident in the future growth potential of the sector.

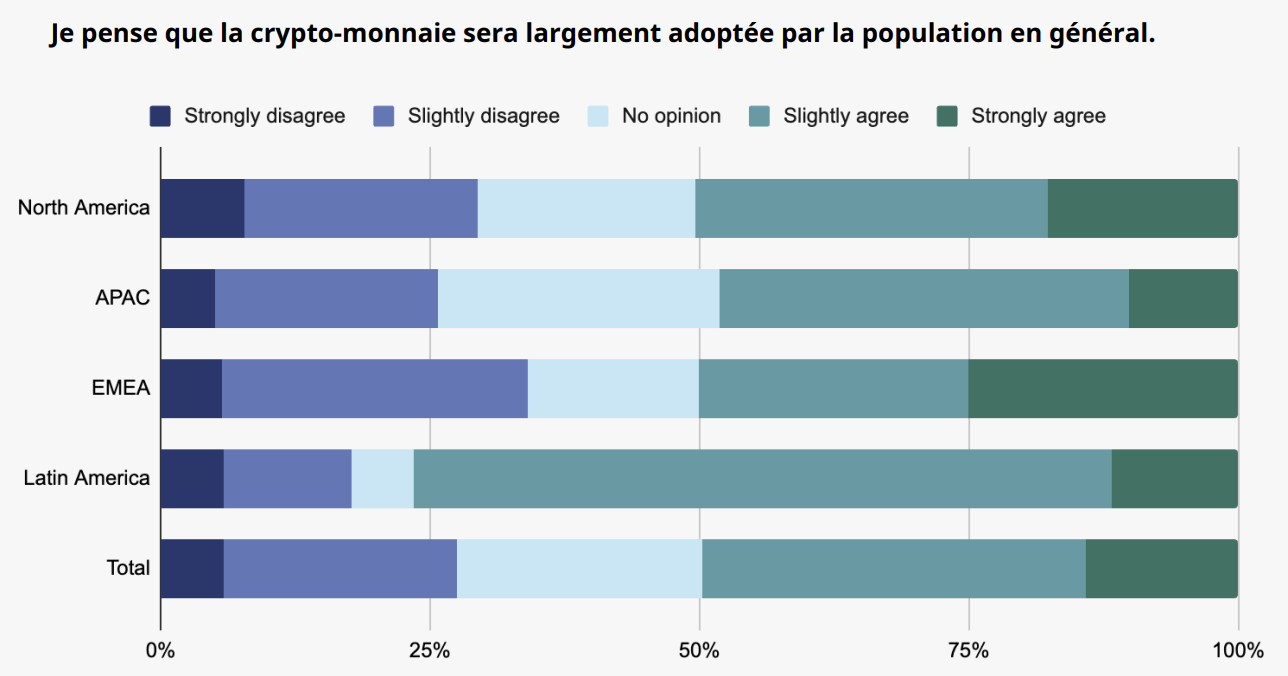

Figure 1 – Sentiment on the adoption of cryptocurrencies in society

It should also be noted the optimism that distinguishes Latin America from other regions on these issues, a reflection of the harsh economic realities facing countries in this region. This thus underlines the potential of cryptocurrencies to provide viable financial solutions in challenging environments.

👉 Info point – How to secure and store your cryptocurrencies?

It is also interesting to understand that in regions with a strong pessimistic tendency, the level of understanding about the validity and role of cryptocurrencies remains quite low.

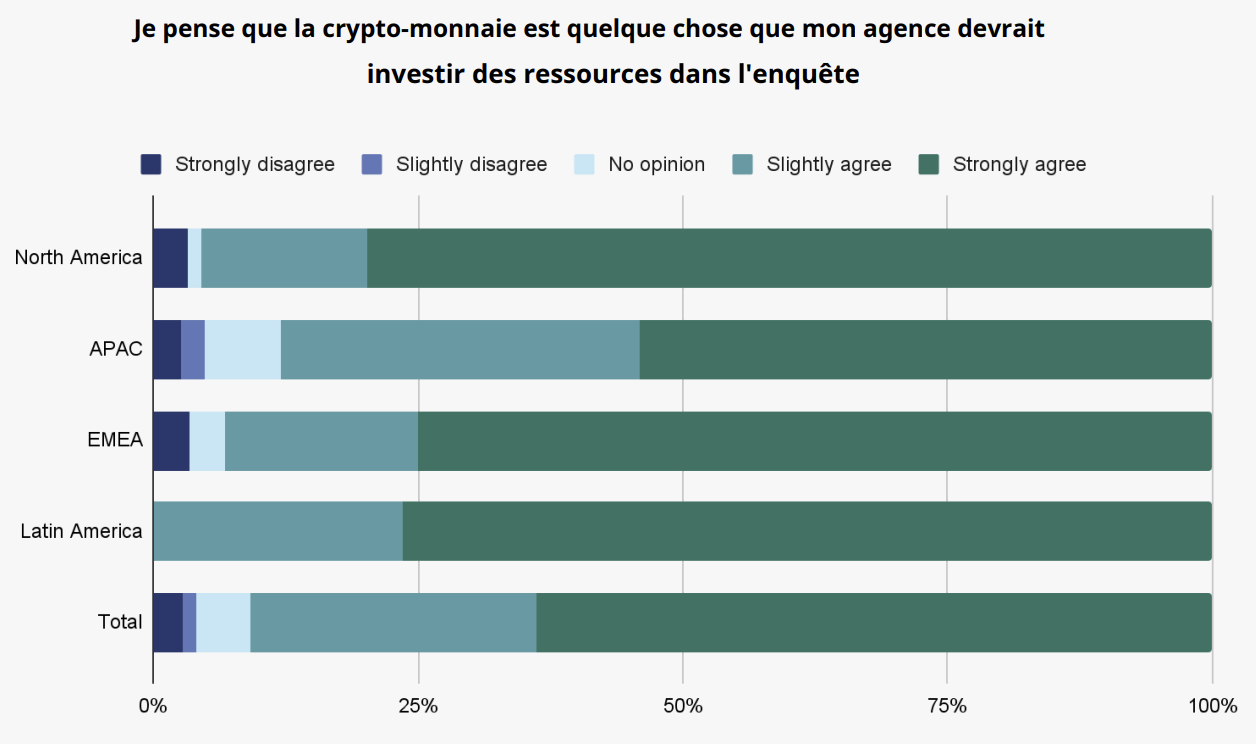

Figure 2 – Sentiment on the importance of investing resources in cryptocurrencies to carry out investigations

Despite these rather personal feelings, the vast majority of respondents demonstrate pragmatism by agreeing that cryptocurrencies are a relevant topic for surveys and that more resources need to be invested to develop greater investigative capabilities in this area.

Download Bitstack and earn €5 in Bitcoin with code CRYPTOAST5*

* After activating a savings plan and accumulating at least €100 in BTC purchases

Public bodies in cryptocurrency investigations

Globally, Cryptocurrency cases take longer to resolve than traditional financial or criminal cases. On average, investigations related to cryptocurrencies take 8.5 months due to their complexity, compared to 7.3 months for traditional cases.

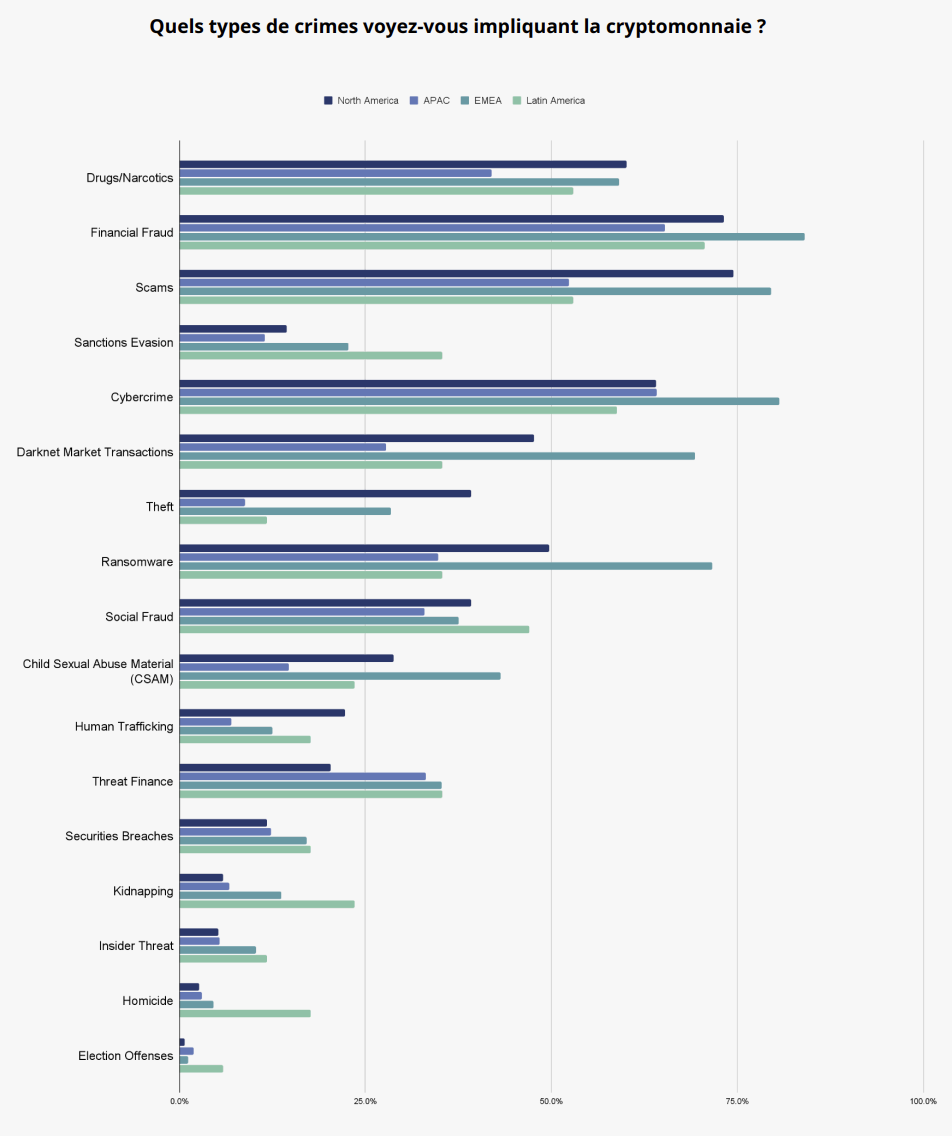

Figure 3 – Typologies of crimes involving cryptocurrencies

In this category, it is very interesting to note the different forms of crimes linked to cryptocurrencies noted by public agents depending on their location.

In North America and Europe, fraud, scams and cybercrime stand out the most. Whereas in Latin America, given the socio-economic landscape (inflation and monetary instability), there is illicit use rather linked to fraud with tax benefits, violations of real estate values or even in the context of homicides or electoral crimes.

Figure 4 – Share of surveys including cryptocurrencies in different regions of the world

Besides these few particularities, All regions have seen the involvement of cryptocurrencies in various forms of crime grow in recent years.

👉 In the news – Crypto-crime: this type of scam cost $374 million in 2023

The problem being that the majority of respondents declare themselves dissatisfied with the human and technical resources available to respond to this dynamic. There is a real need for recruitment and specialization but also for regional consultation, in order to understand the specific challenges faced by different regions of the world.

This survey shows the importance for public agencies to remain attentive and invest human and technical resources in cryptocurrencies so as not to be left behind by disruptive technologies that are evolving at dizzying speed.

€20 offered when you register on Bitvavo

Source: Chainalysis

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.