In just a few days, the cryptocurrency market plunged, causing Bitcoin to fall by around 15%. This correction also caused record liquidations. Between economic cycles, decisions of the Federal Reserve and strategic actions of investors, what elements really explain this movement?

More than $2.4 billion liquidated in 3 days

The market is the place where supply and demand, that is to say where sellers and buyers, meet. This may seem trivial, but if the price of Bitcoin fell by almost 15% in a few days, it is quite simply because there were more sellers than buyers. However, several factors can explain the presence of so many sellers.

First of all, the price of BTC had increased sharply in recent months, going from $52,600 in September to $108,200 last Tuesday, an increase of 105% in less than 4 months. After such a surge, a correction becomes inevitable: it is a sign of good market health.

👛 Discover our top 12 of the best wallets for your Bitcoins

This recent decline also resulted in the liquidation of over $2.4 billion of positions on futures markets over the last 3 daysmarking the largest liquidation spike since breaking through $75,000 resistance.

These futures positions are often taken with significant leverage, allowing investors to open positions that are more lucrative in the event of gains, but also more risky.

The liquidation of these leveraged positions represents an opportunity for certain actors, such as whales (investors with significant capital), market makers and exchange platforms. These latter profit from the fees charged for each order execution, but also from the losses of the smallest investorsoften acting in haste.

For these players, it may be more advantageous to sell part of their capital, thus anticipating and amplifying the fall in pricesin order to benefit from the costs generated by liquidations or to repurchase at more attractive prices the positions of more emotional investors who often sell at a loss.

Ledger: the best solution to protect your cryptocurrencies 🔒

The Federal Reserve (FED) is more pessimistic than expected

Another element that could explain the fall in prices of all cryptocurrencies, with a loss of almost 18% of market capitalization over the last 3 days, is the recent speech by Jerome Powell, Chairman of the Federal Reserve ( FED).

Although the FED has, as expected, lowered its key rates from 4.75% to 4.5%Powell's comments were not particularly reassuring.

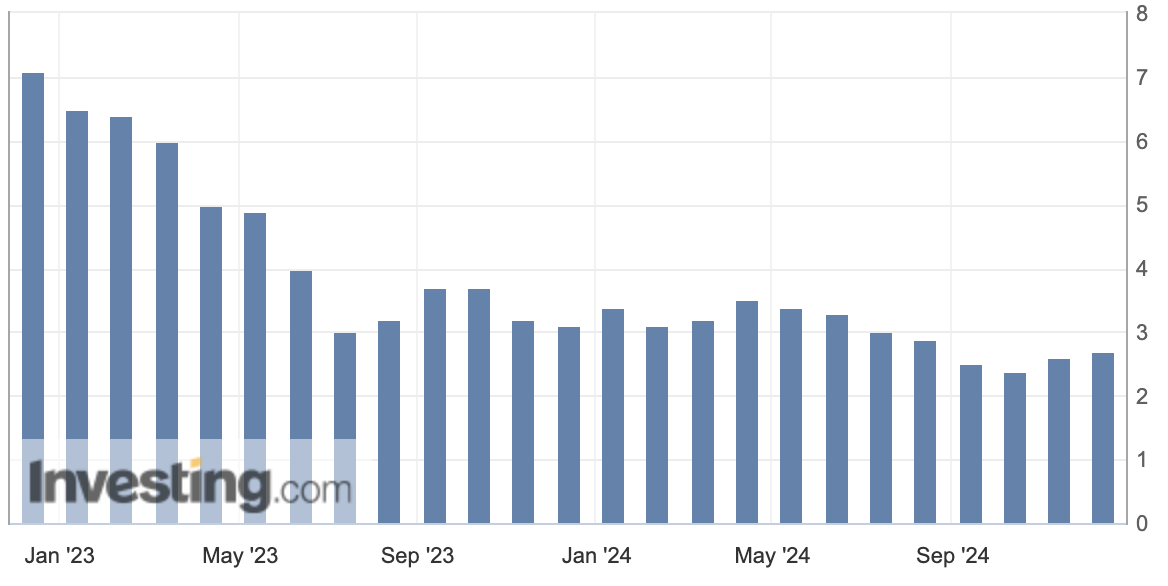

He did not, in fact, express no optimism about dollar disinflation, due to a 0.3 point rise in annual inflation since Septemberwhich remains above the set objective.

Evolution of the Consumer Price Index (CPI) in the United States

According to its president, the FED will adopt a more cautious posture than expected, delaying the next rate cut in order to favor a more observant approach. By 2027, the FED is targeting a rate cut to 3% and inflation under control at 2%.

📈 Discover the latest analysis of the cryptocurrency market by Vincent Ganne

Cryptocurrencies, being risky assets, generally react poorly to periods of high or increasing rates, which limit the diversification of investors preferring to hold cash.

Alone Bitcoin could stand out in such a contextthanks to its characteristics as a store of value and anti-fragile currency. For example, its price rose from $15,500 to $31,800 when the FED's key rates rose from 4% to 5.5%, before reaching almost $74,000 during the period when these rates increased. been maintained at 5.5%.

Download Bitstack and earn €5 in Bitcoin with code CRYPTOAST5*

* After saving for €100 of BTC purchase

Promises of strategic Bitcoin reserves seem to be fading away

During his speech, Jerome Powell emphasized that the Federal Reserve was not authorized by law to create a strategic reserve in Bitcoin. Although this information was already known, his comments appear to have upset some investors and may have also contributed to the drop in the price of BTC.

The subject of strategic reserves in BTC is nevertheless becoming a global political subject, especially since Donald Trump included it in his campaign promises, many countries such as Russia and Japan have recently spoken about it.

📰 Also read in the news – Craig Wright, the man who claimed to be Satoshi Nakamoto, sentenced to prison

Furthermore, a recent event marked a turning point in relations between the International Monetary Fund (IMF) and the Salvadoran government of Nayib Bukele.

Indeed, in September 2021, El Salvador, the smallest country in America, granted Bitcoin the status of legal tender alongside the dollar thanks to the “Bitcoin Ley”.

However, the IMF announced this Thursday that it had reached an agreement with Bukele's government for a loan of $1.4 billion, in exchange for changes to this law. These adjustments include ending the requirement for large businesses to accept Bitcoin payments, stopping paying taxes in BTC, and limiting government purchases of Bitcoin.

Although this may be seen as a failure to some outside observers, in reality, these changes have a limited impact on the adoption of Bitcoin in the country, affecting only a very restricted segment of BTC users. El Salvador will continue to be as involved in the evolution of Bitcoin.

Cryptoast Academy: 75% off before Black Friday to celebrate the bullrun

Advertisement

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital