A modular blockchain is a type of blockchain whose architecture is divided into several layers, which makes it possible to increase scalability without compromising decentralization and security. The whole industry seems to be gradually moving towards a modular architecture, including the Ethereum blockchain. So why and how is this possible? How is it different from a classic blockchain? Overview of the modular blockchain.

The blockchain trilemma, starting point

A modular blockchain is a type of blockchain that relies not on a single layer like monolithic blockchains, but on a architecture divided into several independent layers.

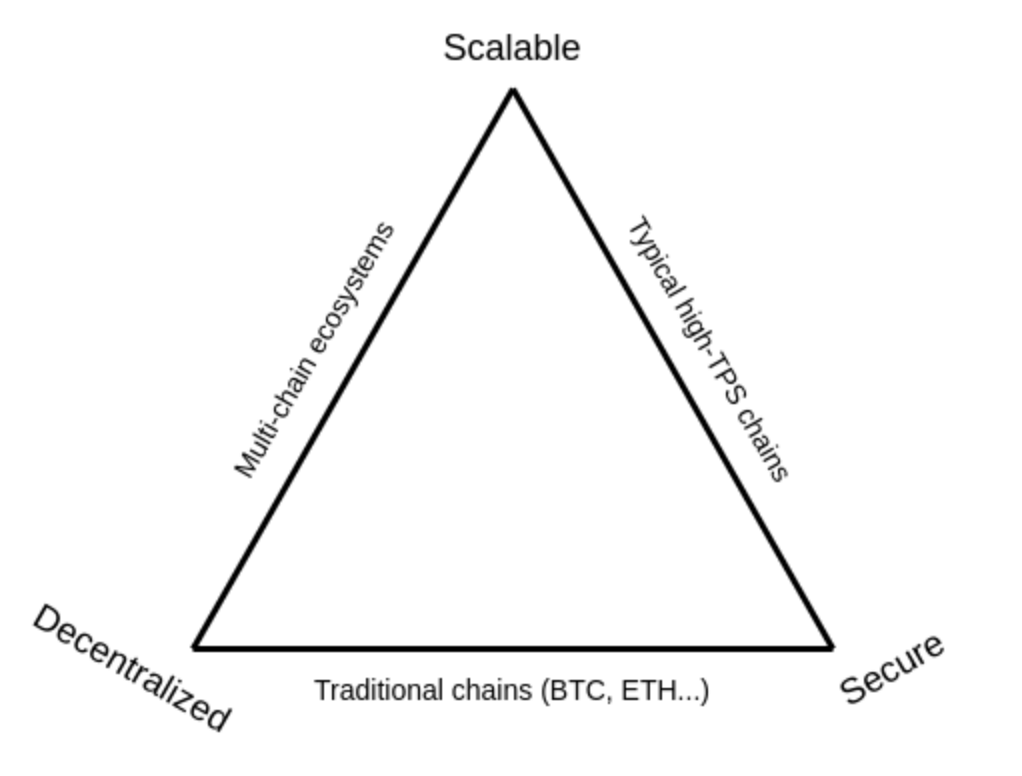

To better understand what we are going to talk about, it is worth returning to the famous blockchain trilemmasince the evolution of blockchain technology is closely related to it.

This trilemma states that a blockchain cannot achieve both a high level of scalability, decentralization and security. Indeed, when developing a new blockchain, developers must then compromise on one of these three pillars to achieve the other two.

Figure 1 – The blockchain trilemma

Thus, there are scalable blockchains, which are in return little decentralized and secure like the BNB Chain. Others are decentralized and secure, but not very scalable, like Ethereum.

For more than 10 years, this trilemma has been the major obstacle to the design of a classic blockchain, also called monolithic blockchain.

Let’s first focus on what a monolithic blockchain is and the three fundamental concepts underlying the blockchain:

- Consensus : the process by which all the nodes of a network agree on the validity of the content of a new block and the new state of the blockchain;

- Data storage : transaction data published by block producers in a block, with the guarantee that this data is available to all network participants;

- Trade Execution.

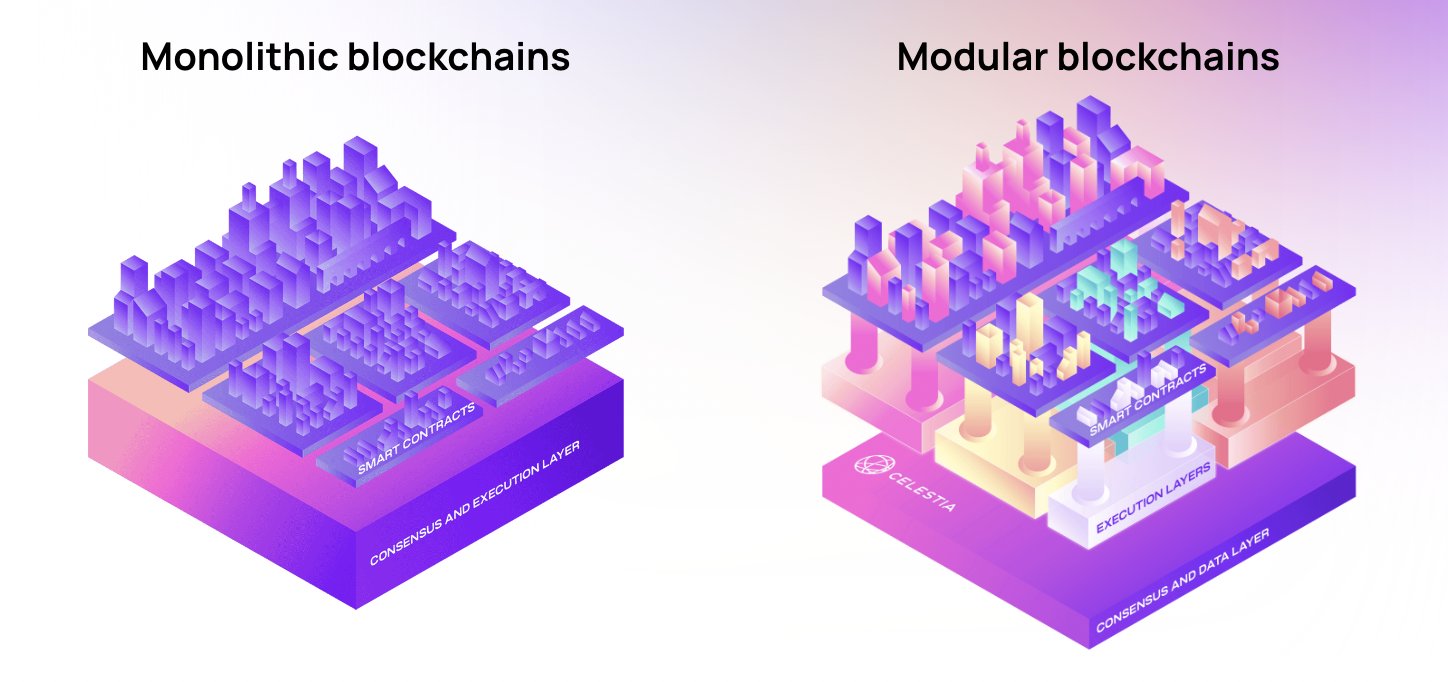

Monolithic Blockchains

Monolithic blockchains have been around since the creation of Bitcoin in 2009, and the vast majority of blockchains created after that are too. These handle consensus, information storage and transaction execution on the same networkin other words, on a single layer.

Such a blockchain therefore has nodes that process the three fundamental concepts in a single block, and this involves concessions.

In recent years, however, the goal of many blockchains is to achieve a high level of scalability without compromising decentralization and security.

If you want a monolithic blockchain to be more scalable, block size needs to be increased to publish more transactions in a single block. If the nodes are unable to follow by increasing their storage capacity, they are then cut off from the network. The consequence is a decrease in the level of decentralization and therefore in security.

As well, reduce the number of nodes allows the network to handle a higher throughput of transactions. The fewer nodes, the faster it is to commit transactions since nodes reach consensus faster, but this lowers the level of decentralization and security.

The Solana blockchain, for example, took this direction to solve the scalability problem. But as we just explained, this does not solve the trilemma since there are always concessions to be made.

What is a modular blockchain?

By trying to make the three fundamental concepts work on a single layer, a monolithic blockchain is limited by the trilemma.

Thereby, modular architecture offers a new way to design blockchains in an attempt to resolve this trilemma.

The key point to note about this type of blockchain is that the fundamental concepts are separated into several layersor blockchains, instead of dealing with them all at once on a single layer.

For example, a modular blockchain may have an execution layer independent of the consensus layers and data storage. Concretely, this allows nodes to execute transactions separately, which increases scalability and simplifies the design of the blockchain.

It’s about a fragmentation of tasks. Assigning a single task to each layer increases the scalability of the network.

The second layer and third layer solutions, respectively called layer 2 and layer 3are perfect examples to illustrate the contribution of a separation of layers, as can be Lightning Network for Bitcoin and Polygon for Ethereum.

Just like layers 2 and 3, side chains are also used to compensate for the compromises taken by the main blockchain by optimizing and focusing only on the execution of transactions for example.

Figure 2 – Representation of the structure of a monolithic blockchain and a modular blockchain

Here are some examples of modular blockchains.

Layer 0 Cosmos

Cosmos is a independent blockchain ecosystem and interoperable decentralized applications.

Developers creating an application on the Cosmos network can use open-source modules to easily create a blockchain specific to their needs.

Thus, the modulus Cosmos SDK allows the development of an application-specific blockchain. The module Tendermint Core is the consensus layer that allows a layer of decentralization to be integrated into it, and theIBC is an inter-blockchain communication protocol.

Finally, with Interchain Securitythe independent blockchains (sidechains) of the Cosmos network can, to ensure their security, borrow validators from the network’s main chain, Cosmos Hub.

Celestia’s Modular Ecosystem

Celestia’s Modular Ecosystem is developed on the Cosmos network, which allows its blockchain to get rid of the execution layer.

Indeed, Celestia chooses to develop only the consensus and data storage layers : nothing can be executed there since there is no execution layer.

So projects that focus only on the runtime layer can plug into Celestia. In this sense, the Celestia blockchain serves as the foundation to those projects that don’t need to worry about the consensus and data storage layers.

👉 Find our in-depth analysis of the Celestia blockchain

Ethereum sharding

Sharding, or partitioning, is a data management technique that could allow Ethereum to achieve a high level of scalability by separating the data storage layer from the other two layers.

It is split the Ethereum network into multiple shards, each with its own validators. These can then operate a node for their shard and function as thin clients for other shards on the network.

Data storage is therefore divided into several chunks, which increases the available data space and provides higher transaction throughput. Sharding will allow the Ethereum network to accelerate its transition to a modular blockchain to solve the trilemma.

👉 To go further – What will the future of Ethereum look like after The Merge?

Conclusion on modular blockchains

The modular architecture is the logical evolution of the blockchain to free itself from the famous blockchain trilemma mentioned for the first time by Vitalik Buterin.

Second layer solutions combined with rollups are becoming increasingly popular and used. The Ethereum blockchain aims to use sharding in the near future. Other major blockchains like Tezos and NEAR Protocol have similar plans.

Finally, with the evolution proposed by projects like Celestia, the future of blockchain technology is certainly modular.

Monolithic blockchains have had their day, and the best developers in the industry are trying to solving the blockchain trilemma with modular architecture.

So it might just be a matter of time, and it would be a real win for the industry as a whole.

👉 Discover more than 100 summary sheets on cryptocurrencies

Sources – Figure 1: Vitalik.ca; Figure 2: Celestia

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.