In this article, Insurance Business examines how this crucial financial tool works in the different regions that we cover, what types of benefits it brings, who needs coverage the most, and when the best time is to purchase one. If you’re an industry professional searching for ways to help life insurance clients find the best policies, this article can serve as a useful guide. Just click the share icon on the top left of the screen.

Life insurance is a type of insurance policy that provides a tax-free lump-sum payment to the beneficiaries once the policyholder dies or after a set period. Because of the financial benefit it offers, life insurance has become one of the most popular forms of coverage among consumers.

Policies remain in-force as long as the policyholder continues to meet premium payments. Some types of plans end after a set term while others provide lifetime coverage and accumulate cash value.

Life insurance works almost exactly the same in different regions, although the policy names may vary. Coverage comes in different forms, with each offering different levels of financial protection.

United States & Canada

These North American neighbors operate the same systems when it comes to life insurance, with coverage generally falling into two categories.

1. Term life insurance

As the name suggests, this type of policy covers the policyholder for a set term. It pays out a death benefit if the insured dies within a specified period, meaning they can only access the payment in the years when the plan is active. The most common terms last for 10, 20, or 30 years.

Term life insurance policies come in several variations. These include:

- Decreasing term life insurance: A renewable policy with coverage decreasing over the policy’s term at an agreed upon rate.

- Convertible term life insurance: Can be converted into permanent life insurance.

- Renewable term life insurance: Premiums increase annually that the policy is in-force, with rates typically the cheapest in the year it was purchased.

2. Permanent life insurance

Unlike term life insurance, a permanent policy does not expire. Coverage comes in two main types, each combining the death benefit with a savings component.

- Whole life insurance: Offers coverage for the entire lifetime of the insured and the savings can grow at a guaranteed rate.

- Universal life insurance: Uses different premium structures, with earnings based on how the market performs.

You can read the profiles of the largest life insurance companies in the US and the top life insurers in Canada in our updated rankings.

United Kingdom

Life insurance policies in the UK also come in two major categories, which work the same way as those in the US and Canada. These are:

1. Term life insurance

This type of policy also runs for a fixed term but only pays out a death benefit if the policyholder dies within this period. Otherwise, the insurance company keeps all the premiums paid. There are three kinds of term life insurance policies:

- Level term life insurance: Pays out a lump sum if the policyholder dies within the agreed term, with the level of cover remaining the same throughout.

- Decreasing term life insurance: The death benefit amount reduces each year. Such policies are designed to be used with repayment mortgages, where the loan balance likewise decreases over time.

- Increasing term life insurance: The death benefit amount rises throughout the policy’s term to keep up with inflation.

2. Whole-of-life insurance

Similar to permanent life insurance in Canada and the US, this type of policy provides lifetime coverage, with payouts given to the beneficiaries after the policyholder’s death. Because of the level of coverage, whole-of-life policies have more expensive premiums than term insurance. it has been noted with this type of policy that if the policyholder lives longer than expected, they can actually end up paying more than they will get out of the policy.

UK citizens can also access over-50s plans, which provide coverage for individuals aged between 50 and 85, without requiring them to submit medical information. Premiums are often based on the plan holder’s age and the amount of cover. Rates, however, tend to be higher as there is no way for insurers to predict the planholders’ risk level.

The sum assured is also usually capped at around £20,000, while waiting periods can last between 12 and 24 months. Additionally, the beneficiaries will not receive a benefit if the policyholder dies due to natural causes during this period, but the premiums they paid will be returned.

Australia

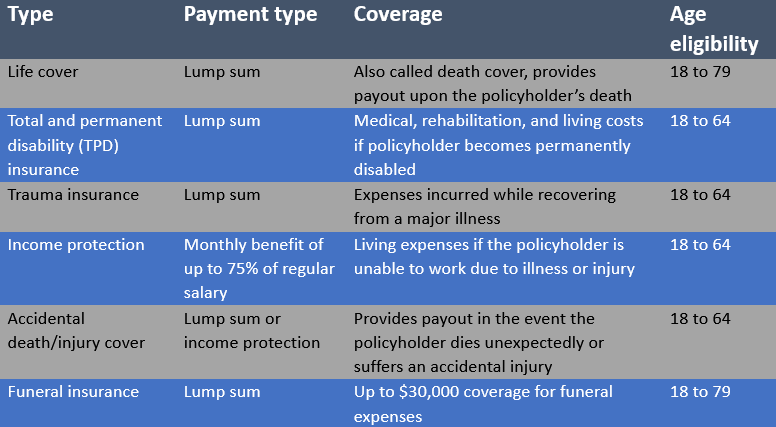

Apart from providing a death benefit, life insurance policies in Australia offer financial protection should the policyholder become seriously ill or disabled. Policies are grouped into six main categories, with the level of coverage summed up in the table below.

Each life insurance plan also comes with built-in features and benefits, which vary from insurer to insurer. The key to finding the right policy is to review the product disclosure statement (PDS). Here are some benefits Australians may want to keep an eye out for when buying life insurance:

- Terminal illness benefit: Pays out 100% of the death cover in advance if the policyholder is diagnosed with a terminal illness or given less than 12 to 24 months to live.

- Funeral advancement benefit: Benefit ranges from $10,000 to 10% of the sum insured but the policyholder’s family must provide a valid death certificate and full claim forms to receive the payout.

- Financial advice benefit: Reimburses the cost of financial advisory services up to a specific limit, usually ranging from $2,000 to $5,000.

- Future insurability benefit: Allows the policyholder to increase their level of cover without the need to provide additional medical information.

- Premium freeze option: Lets the policyholder freeze their premiums, so instead of their stepped premiums increasing each year, their benefit amount decreases instead.

- Indexation: The level of cover rises by a set percentage between 3% and 5% or the consumer price index (CPI), depending on which is greater, to keep up with inflation.

- Interim cover: Provides a lump-sum payment should the policyholder die because of an accident during their policy assessment. The benefit is usually the lesser of $1 million or the sum insured at the time of application.

Here’s what the leading life insurance providers in Australia offer in terms of coverage.

A person’s age and health status are the two biggest factors impacting both their eligibility for and the premium prices of life insurance. Because of this, some industry experts say that the best time to take out this form of coverage is while a person is young and healthy. They add that as people get older, health issues also begin to develop, which can disqualify them from coverage and make premiums more expensive. Others compared the “economic impact” of missing out on buying life insurance while younger to delaying saving for retirement.

There are those, however, who argue that younger people tend to be faced with more expenses, including mortgage, car loans, student debt, and childcare costs that can benefit them to put off buying coverage. They may also be uncertain of the term duration they need as renewing a policy 10 or 20 years down the road is guaranteed to be more expensive.

The bottom line is, just like in other types of policies, there is no one-size-fits-all life insurance that can cater to every need – and the answer to the question of when the best time is to take out coverage all boils down to a person’s unique situation and preferences.

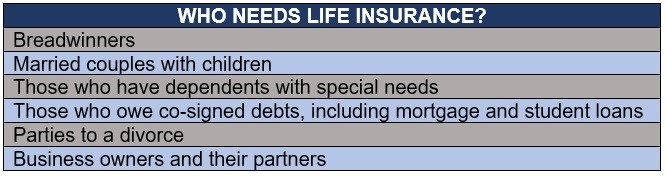

While life insurance can play a vital role in providing some level of financial security to a family after a tragic loss, not everyone has a need for this type of coverage. Those who have built up enough wealth and assets to care for their family’s needs after they die can forego purchasing life insurance. However, there are also certain groups of people who experts say will benefit greatly by taking out this form of financial protection. These include:

Different life insurance policies offer different benefits. Permanent plans in the US, for example, can be used as a financial tool that enables the policyholder to accumulate wealth. Life insurance, however, also provides several practical benefits. These include paying for:

- Funeral, and cremation or burial costs

- Medical bills not covered by health insurance

- Estate settlement costs

- Outstanding debts, including mortgage, and student and car loans

- Replacement income

- Federal or state taxes

- Inheritance

- Charitable donations

A life insurance policy covers almost all types of death, including those due to natural and accidental causes, suicide, and homicide. Most policies, however, include a suicide clause, which voids the coverage if the policyholder commits suicide within a specific period, usually two years after the start of the policy date.

Some life insurance providers may also deny a claim if the policyholder dies while engaging in a high-risk activity such as skydiving, paragliding, off-roading, and scuba diving.

In addition, an insurer may reject a claim based on the circumstances surrounding the death. For instance, if the beneficiary is responsible for or involved in the policyholder’s death.

Are you in search of the right life insurance policy? Which features and benefits do you think are essential? Should you take out life insurance while you’re young or should you wait until you’re a bit older? Use the comments section below to share your thoughts.