The FTX case changed the face of the cryptocurrency industry forever. The tidal wave caused by the fall of FTX precedes a questioning of centralized exchange platforms to maintain investor confidence. For this, a tool has emerged: the Proof of Reserves. Overview of the origins of this concept, its functioning, its strengths and its weaknesses.

What is Proof of Reserves?

The Evidence of Reservesor Proof of Reserves in English, is a concept that gained popularity in November 2022, after the fall of the FTX exchange platformwhich follows other bankruptcies such as those of Celsius Network or Voyager Digital.

The FTX implosion had dramatic consequences on the cryptocurrency industry. Investor confidence in such centralized platforms is rightly drying up. Many investors then wonder how they can trust to a centralized platform to secure their cryptocurrencies.

Platforms that are still operating have need a way to gain investor confidence to avoid losing them. This is where the concept of Proof of Reserves comes into focus.

This is a method that addresses transparency concerns on cryptocurrencies held in the reserves of centralized platforms.

Proof of Reserves uses cryptographic evidence and ownership of public wallet addresses in combination with periodic auditing to certify that a platform holds enough cryptocurrencies to cover the deposits and withdrawals of its customers.

This helps in particular to fight against the fractional reserve banking system which allows not to hold all of their customers’ deposits in their reserves. This approach also gives the possibility to each client to verify for themselves that the balance of their account is included in the Proof of Reserves.

Concretely, a trading platform uses a third-party auditor whose mission is to ensure that the platform indeed holds the cryptocurrencies that it claims to hold on behalf of its customers. This ensures that customers’ cryptocurrencies are not used dishonestly and that there are real cryptocurrencies backing users’ assets.

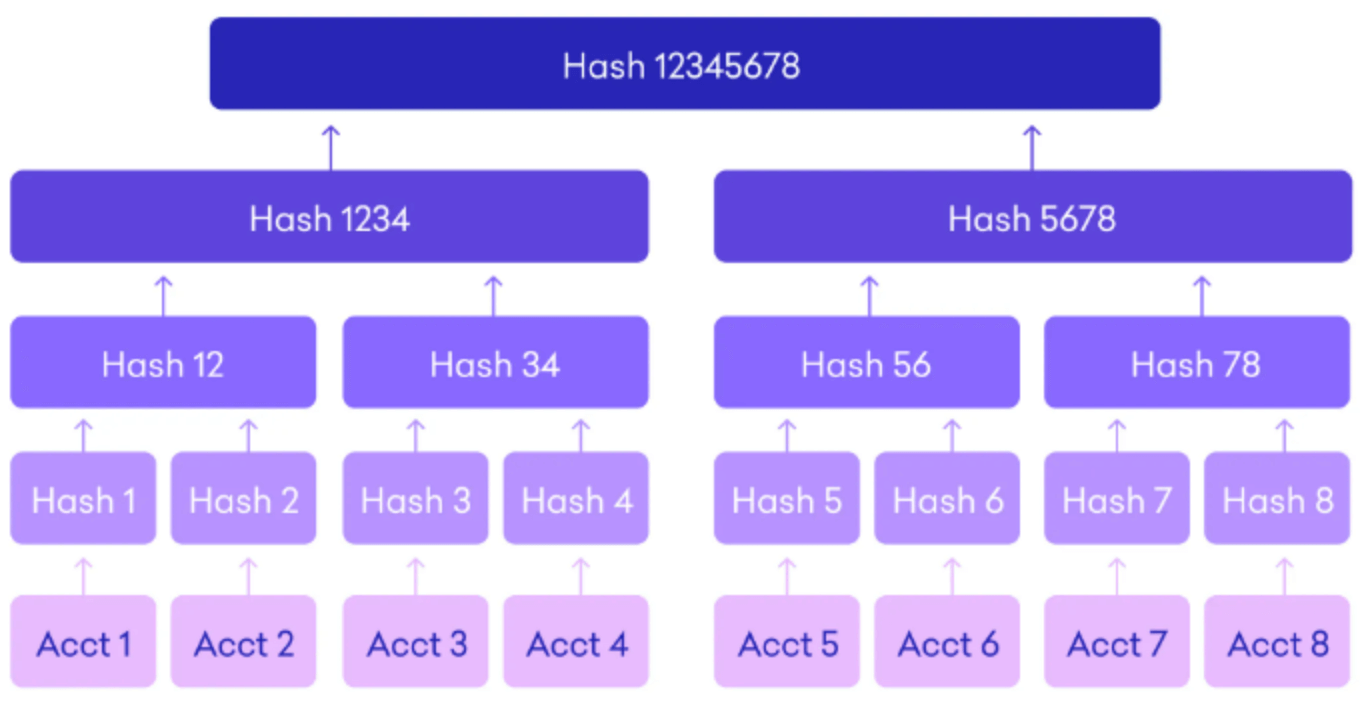

At the process level, the auditor takes an anonymous snapshot (capture) of all the balances held by the trading platform and aggregates them into a merkle tree (Merkle tree), a structure for consolidating very large volumes of data. A Merkle Root is then obtained, which identifies and combines all platform user balances into a hash.

Of course, snapshot anonymity is crucial so that no one can link an account balance to a user.

Figure 1: Illustration of a Merkle Tree

These balances are then verified on the public blockchains where the cryptocurrencies are held by the platform. For this, the latter must carry out a digital signature of her wallets to prove that she holds the funds.

Once verified, these numbers should balance out like this:

Total client account balances on the platform = amount of assets held by the platform on blockchains.

Any user can then see if their account balance is included in the Merkle Tree. For this, it suffices to “hash” their account balance and unique identifier, then look it up in the Merkle Tree.

Note that any data tampering will affect the Merkle Root, potentially indicating that the data has been manipulated or tampered with.

The Proof of Reserves thus allows, via the Merkle Tree, to check the integrity and consistency of all data. The objective is to provide transparency as to the cryptocurrency reserves of an exchange platform and therefore to restore investor confidence.

Any user can consult the Proof of Reserves and thus ensure that his balance is included therein.

Note that some trading platforms did not wait for the FTX affair to be as transparent as possible with their customers. Thereby, Kraken introduced its first Proof of Reserves in December 2021the French platform StackinSat in June 2022 and Coinbase, being a NASDAQ-listed company, regularly publishes its financial documents.

The table below summarizes the situation, at the time of writing, of the major exchanges regarding Proof of Reserves:

| Major exchange platform | Evidence of Reserves | Audited |

| kraken |  |

|

| Coinbase |  |

|

| Gate.io |  |

|

| Binance |  |

In progress |

| Crypto.com |  |

In progress |

| OKX |  |

In progress |

| Bitfinex |  |

|

| Huobi |  |

In progress |

| KuCoin |

Announced |

|

| ByBit |

Announced |

|

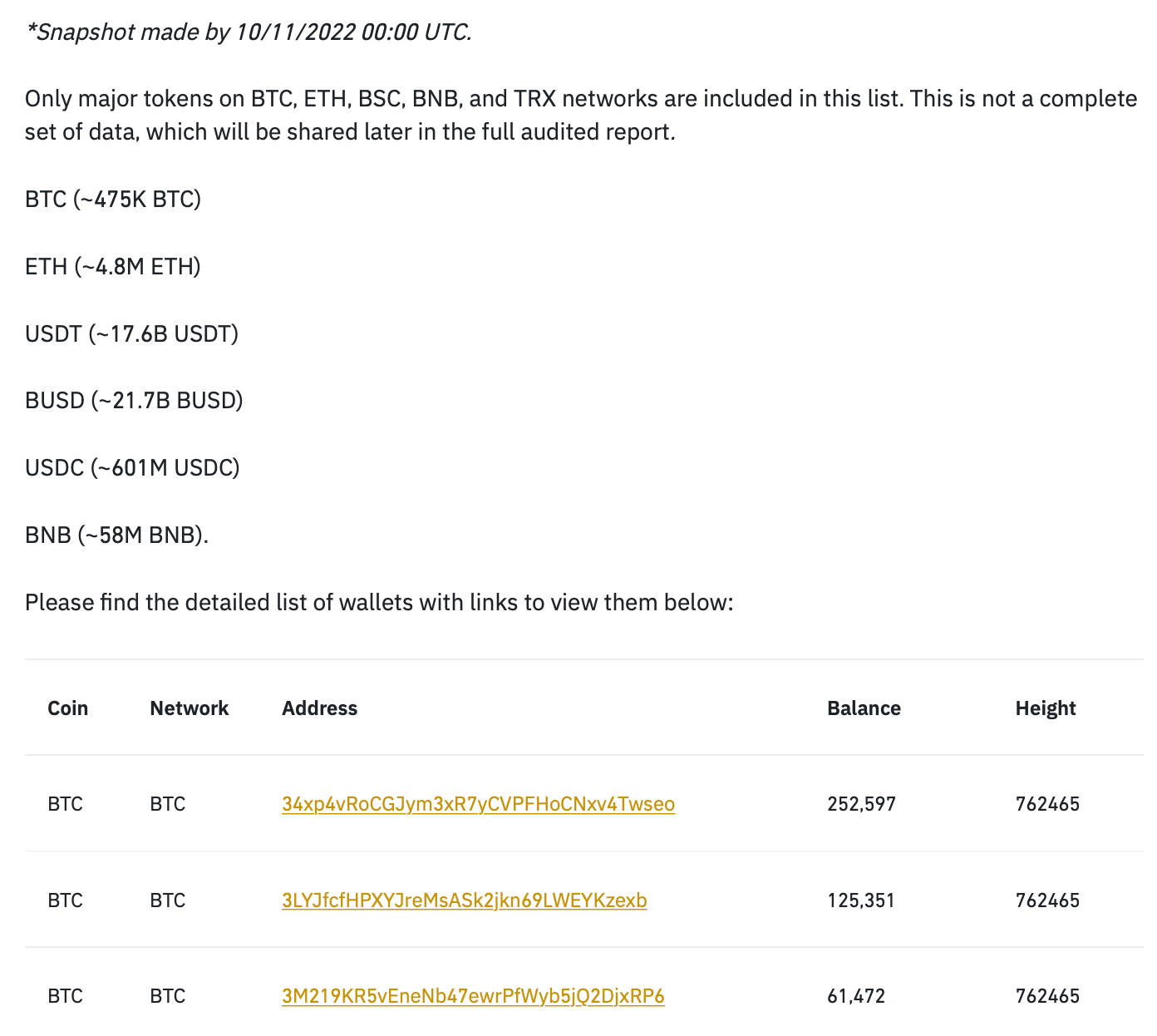

After the FTX case, Binance announced on November 10, 2022 its intention to use Proof of Reserves to be more transparent with its users. Note that this is not yet audited as of November 16, 2022, but here is an example:

Figure 2: Evidence of Binance Reserves (unaudited as of November 16, 2022)

Other exchange platforms have committed to implementing Proof of Reserves such as KuCoin, Crypto.com, Bitfinex, Huobi or ByBit.

Can the Proof of Reserves prevent the next fall of an exchange?

The Proof of Reserves thus aims to establish a relationship of trust between investors and trading platforms. Nevertheless, This method is not without flaws. and can provide a false sense of security.

Indeed, the choice of an independent auditor is crucial to ensure the validity of the Proof of Reserves. Thereby, a potential collusion between the auditor and the trading platform could distort this method. Both entities, however, put their reputations on the line by submitting to the Proof of Reserves.

In addition, such an audit only offers an image of the cryptocurrencies held by the platform, but company debts are ignored here. A platform can thus use the Proof of Reserves to appear solvent without revealing the true solvency risk it may face.

A combination with a concept of proof of debts would then be able to reveal a more transparent picture of the true solvency of a centralized platform.

There can also be inconsistencies if a platform has been the victim of theft or if it has lost the keys to some of its wallets. Moreover, it is not not possible to determine with Proof of Reserves whether funds held were borrowed just to pass auditwhich remains a significant risk since the audits cannot be carried out in real time.

So it’s not the perfect solution. to the problem of transparency, it is possible that an exchange falls in the manner of FTX even if the latter has published a Proof of Reserves apparently proving its solvency.

It’s a nevertheless effective method to ensure that an exchange does not, a priori, do anything with the cryptocurrencies of its customers.

Conclusion on Proof of Reserves

Despite its imperfections, Proof of Reserves offers a new way of standardization which is welcome in the cryptocurrency industry. The fall of FTX and Binance’s ensuing initiative propelled Proof of Reserves into a real necessity. If a platform wishes to remain attractive for its users, it must be transparent.

Most major exchanges have already announced their intention to provide Proof of Reserves, and some have already done so. We are thus witnessing a real change promoting transparency and security of users’ cryptocurrencies.

From now on, the new centralized platforms that will emerge will probably submit to the Proof of Reserves, under penalty of not being able to find a place on the market, because obtaining the confidence of investors is more essential than ever for this type of business.

Sources – Figure 1: Kraken, Figure 2: Binance.

Newsletter

Receive a summary of crypto news every Monday by email

Newsletter

Receive a summary of crypto news every Monday by email

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.

;Resize=(1200,627)&hash=147e8459165a188ca9d98ec07d1347726383b4bcda495c28afe794711f4256da)