Unichain is an Ethereum Layer 2 designed for decentralized finance (DEFI). Developed by Uniswap Labs, Unichain provides native cross-chain experience, user protection, as well as inexpensive and almost instantaneous transactions. Find out how Unichain wishes to stand out in the flourishing ecosystem of Layer 2 of Ethereum.

What is Unichain?

Unichain is an Ethereum Layer 2 designed for decentralized finance (DEFI). It is developed by Uniswap Labs, the entity behind the development of Uniswap, the famous decentralized Exchange (DEX).

The Unichain Network was launched on Mainnet Ethereum on February 11, 2025. This Ethereum Layer 2 promises improved user experience thanks to rapid transactions, transparent cross-chain interactions and user protection while emphasizing the decentralization of its network.

Developed in collaboration with Flashbots, Unichain is based on the OP Stack, a blockchain framework that caused many Layer 2 such as Base, Optimism, or Mode. Unichain is therefore a Layer 2 type ” Optimistic Rollup », A Layer 2 technology that has proven itself due to its reliability and its effectiveness.

What are the particularities of the Layer 2 Unichain?

A layer 2 designed for decentralized finance

Unichain was designed specifically to become the central place of the DEFI market. In order to achieve this objective, Unichain emphasizes 4 main points: the effectiveness of transactions, cross-chain interactions, user protection and decentralization.

Almost-instant transactions with low costs

Unichain produced on average 1 block per second while offering 95 % lower costs than on Ethereum blockchain. These performances allow users of the Unichain blockchain to enjoy a faster and low cost experience.

Transparent cross-chain interactions

The Layer 2 Unichain is part of the superchain, an interconnected network of Layer 2 of Ethereum based on the Op Stack framework. Thanks to the Superchain, Unichain offers its users an access to extended liquidity on several blockchains, while guaranteeing a fluid and transparent cross-chain experience.

Protection against sandwich attacks

Unichain has native features within its network to protect users from sandwich attacks, a type of attack which consists in extracting value from the transaction of a user. Thanks to a new block production mechanism, Unichain protects users against this type of attack.

Increased decentralization

Decentralization is at the heart of the concerns of the Layer 2 Unichain. As proof, Unichain is one of the rare layer 2 to obtain the status of ” Internship 1 On L2Beat, a status which testifies to a certain decentralization of its network.

User protection against MEV via the verifiable block building

When a user interacts with Defi protocols, he is exposed to the impacts of the extractable Value (MEV) maximum, and more particularly sandwich attacks.

Indeed, the MEV, defined by all the profits that can be made including, excluding or changing the order of transactions in a blockchain block, can represent a significant shortfall for users.

Unichain protects the funds of its users against sandwich attacks thanks to a mechanism called ” Local Block Building (Construction of a verifiable block in French). This innovative mechanism makes it possible to build blocks so that users are protected against the impacts of the MEV.

Thus, unlike the majority of Layer 2 of Ethereum, Unichain builds its blocks in a component separate from the sequencer called ” Verifiable Builder Bloc ». Within this component, the blocks are created in a trusted execution environment (TEE), guaranteeing compliance with the rules concerning the order of transactions, thus protecting the user from sandwich attacks.

The Verifiable Block Building mechanism is not yet available on the Mainnet, but should be in the coming months following its launch.

In addition, when it is launched, the Verifiable Block Building mechanism will also lower the block creation latency to 250 ms per block thanks to a new type of block called “Flashblocks”, ensuring almost instant transactions.

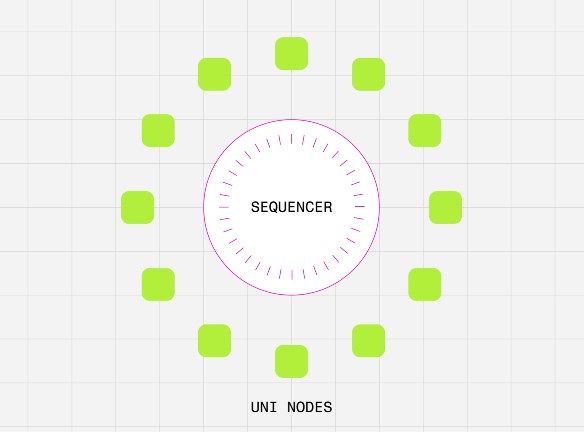

The Unichain Validation Network (UVN), the Unichain decentralization mechanism

The UVN is a decentralized network of validators nodes designed to strengthen the security and the purpose of transactions on the Layer 2 Unichain. This mechanism responds to the problems of Layer 2 in a cross-chain environment with a single sequencer that can lead to invalid or conflicting blocks, while improving the decentralization of the network.

To become a validator on the UVN, a node operator must stake united tokens on the Ethereum blockchain. Then, he is authorized to validate the state of Unichain's blockchain. Validators with a large amount of large stake tokens are considered to be “active” and can publish validity certificates on the network.

These validity certificates are then verified by a smart contract, which redistributes the rewards in Token united according to the amount stake by the validator on the Ethereum blockchain. These awards are made up of 65 % of the net income generated by Unichain.

UVN is not yet available on Unichain's Mainnet, but should be in the coming months.

What is the unichain token for?

At the time of writing these lines (February 2025), the UNI token has no use yet within Unichain.

However, the team behind its development has announced that the UNI token will be used as a staking token for the validation of transactions when the UVN is deployed on the Mainnet.

Then, users and validators will then be able to stake their Tokens united on the Ethereum Mainnet in order to generate a passive income. Thus, validators and stakers will receive 65 % of the net income from Layer 2 Unichain in return for their contribution to the security of the network.

The united token is available on many cryptos platforms such as Bitpanda, Bitvavo or Coinbase. In addition, it is also available on decentralized exchanges (DEX) like Uniswap through several blockchains like Ethereum, Base or Unichain.

If you want to use a centralized platform, we recommend that you go through Bitpanda, a regulated platform in France.

Receive € 50 in $ PSG by creating an account on Bitpanda and investing at least € 300

Here are the steps to follow to buy united tokens on Bitpanda:

- Create an account on Bitpanda (affiliate link) and confirm your kyc

- Place euros on Bitpanda via a bank card or a transfer;

- As soon as your euros are on Bitpanda, click on “Trader” then on the “Buy” button;

- Look for the united token then enter the amount of your purchase before clicking on “go to the summary”;

- If everything is correct, click on the “Buy” button to buy the UNI Crypto.

Who develops the Layer 2 Unichain?

The Layer 2 Unichain is developed by Uniswap Labs, the UNISWAP entity, the most popular Dex in the Ethereum ecosystem.

With nearly 200 employees, Uniswap Labs is led by its founder and CEO Hayden Adams, a renowned personality in the Crypto ecosystem in particular thanks to its development of automated market makers (AMM).

Other important members are Mary-Catherine Lader, director of operations at Uniswap Labs. With significant experience in the financial sector, she held management positions at Goldman Sachs and Blackrock before joining Uniswap in June 2021.

Our opinion on Unichain

Unichain is a new Layer 2 of Ethereum emphasizing decentralization and user experience. Equipped with mechanisms to reduce the harmful impact of the MEV and drastically improve the purpose of transactions on its network, Unichain is as a layer 2 dedicated to the more secure, fast and decentralized defi.

Based on OP Stack of Optimism, Unichain also benefits from a native interoperability with all the Layer 2 of the Superchain, allowing users to access additional liquidity transparently on several blockchains.

In addition, the presence of UNISWAP Labs behind its development and its close link with the UNISWAP DEX gives Unichain a prior notoriety which could accelerate its adoption.

Finally, the Layer 2 Unichain finally brings new utilities to the UNI token, which until then played only a role in the governance of Uniswap.

Despite everything, Unichain will have to continue his efforts to find a place in the very competitive ecosystem of the Layer 2 of Ethereum.

What is your opinion on the Layer 2 Unichain?

👉 Read more than 100 other analyzes on cryptocurrencies

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital