Tomorrow, the Crypto market will have its eyes on the figures of CPI inflation, published at 2:30 p.m. This report has the potential to act as a major trigger, in a context where Bitcoin (BTC) has oscillated in a key range between 91,000 dollars and $ 108,000 for several weeks. If a bullish recovery had to materialize, this figure could play a decisive role.

Bitcoin lower bias leaves traces

We are the Monday February 11, 2025and the price of Bitcoin (BTC) is currently evolving around $ 98,000. Our latest Bitcoin analysis dates back to February 3, 2025while its price was located $ 95,000. Since then, the BTC continues to evolve under the psychological barrier of $ 100,000thus testing the mental resilience of investors.

Even though the fundamental framework never seemed so favorable to the development of crypto assets, the market feeling particularly pessimistic. However, the institutional continue their investments in Bitcoin, gradually consolidating its status asrecognized financial tool. Each day, the BTC has crossed new steps towards broader adoption and increased legitimacy in the overall economic landscape.

Trade cryptos on binance, exchange n ° 1 in the world

On the side of derivative marketsTHE Open interests (OI) have now returned to the Range area worked in 2024. THE post-electoral excess seem to have been gummésallowing to find a more stable base. This step was necessary to consider a Structured prosecution Haussier development initiated two years ago. Return to more balanced levels on derivatives reflects a certain normalization of the market, a crucial step to build a lasting dynamic.

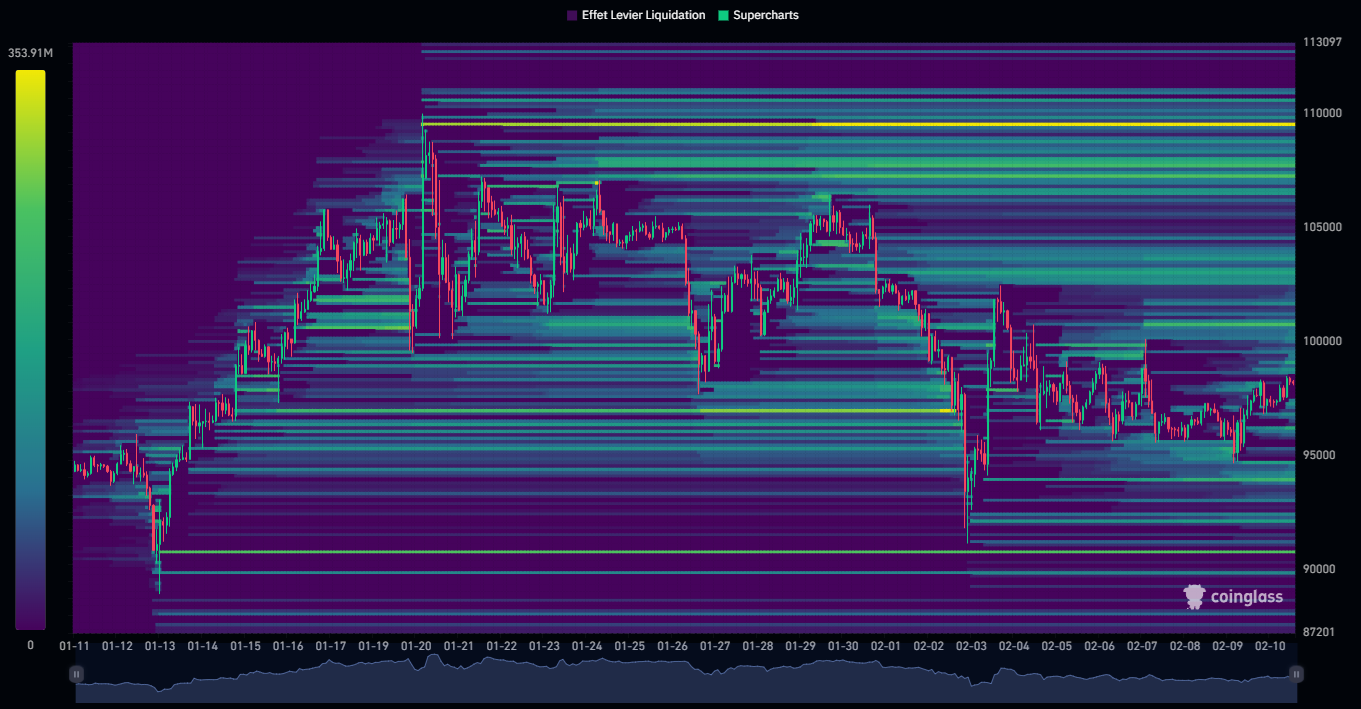

THE financing costs (Funding Rates) found a cruise areawithout apparent excess, marking a certain temporary balance Between buyers and sellers. The most striking fact for the Bitcoin Resides in his liquidity map.

Since its last historic summit reaching mid-Januarythe asset has continued to align lower peaks than the previous onesstrengthening the short -term downward dynamics. With a Pessimistic market feelingmany speculators have taken Selling positionsespecially during the striking decreases of January 26 and 27followed by Historical fall in early February.

This speculative activity led to a massive accumulation of North liquidityoffering a Potential catalyst short -term. A Hunting for these liquidity could trigger a technical rebound movementespecially if the market decides to surprise the sellers excessively exposed. This does not guarantee a Back to historical heightsbut it's a key factor to take into account. This dynamic could complicate a sustainable break in the downward rangeunless these liquidity areas were first revisited.

At southa liquidity zone is also identifiable, although more discreet And less dense than that located to the north. This area is located under the hollow of February 3, 2025 and could potentially be the subject of a liquidity hunt by the market before a significant movement. However, theisolation of this area makes such a hunt less likely.

Liquidity on Bitcoin, period from January 11 to February 10, 2025

In terms of capitalization, the Bitcoin (BTC) remains, without surprise, the undisputed king of the crypto ecosystem, occupying the First place in the ranking with a capitalization of $ 1,947 billion.

| Pairs with Bitcoin | 24 hours | 7 days | 1 month |

| Bitcoin / USDT | +0.60 % | -0.20 % | +4.30 % |

| Eth / bitcoin | +2.10 % | +0.70 % | -19.70 % |

📈 Surf the Bull Run by surrounding you with experts! Join us now on Cryptoast Academy

Do not miss the Bullrun, join our experts on Cryptoast Academy

Advertisement

Bitcoin, still in his range, what scenarios to get out of it?

BTC Prize always evolves in a tidy Located $ 91,000 And $ 108,000. If you follow us regularly, you already know the key areas of this lateral consolidation phase:

- $ 104,000 : THE Upper quarter of the Rangemarking the balance zone for the upper part of this development;

- $ 100,000 : L'balance of the Range, which represents the middle of this structure and a major psychological level;

- $ 95,500 : Her equivalent in the lower areaplaying a similar role as a balance level for the lower quarter of the rang.

This Range structure has already known 2 excessboth upwards and downwards. This suggests that the market could have sufficiently worked this areaand that the next outing could be decisive. A downward crossing of $ 89,000 or, conversely, a up to 109,000 dollars could act as the trigger of a new scale.

As always, the technical probabilities remain favorable to a continuation in the sense of the primary trend,, which remains, to date, upward.

Try Dydx now: the favorite DEX of Crypto traders!

Thus, we could rely on the liquidity zones previously defined to develop our scenarios. A South hunting movementaimed at recovering liquidity located under the hollow of February 3could precede a vigorous upward recovery. This dynamic would then seek to recover the Selling liquiditywith a potential objective around $ 110,000 and beyond. As mentioned above, a Range durable downstream break Without having first carried out a North liquidity hunting would seem unlikely in the current configuration.

In addition, in recent days, the BTC showed a real Defense of the level of $ 95,500a key support point. If the price action manages to form a major hollow On this level, it could open the way to a new upper dynamic.

This scenario would be confirmed by a Crossing $ 100,000which represents not only the Range middlebut also a confluence With the Mobile average at 20 days and the Last Daily Summit.

However, if the low point currently under development were to yield, the BTC could go down to a lower level and try again to rebuild a low point in the Zone from 91,000 to $ 93,000.

The next macroeconomic eventsin particular the publication of Inflation figure planned for Wednesday 12 at 2:30 p.m.could act as a Key catalyst. This event could allow get out of bitcoinand more broadly the whole Crypto market, of its Current stagnation phase.

Graphic of the Bitcoin Daily course

👉 Do you want to discover more technical analyzes on Bitcoin or on Altcoins? Join our Premium Cryptoast Academy group in which we share altcoin analysis graphics every week!

In summaryTHE Bitcoin always evolves inside his tidy. In this context, although the BTC be in negative polarityhe demonstrates a good resilience around Key support of $ 95,500. In addition, a accumulation of liquidity in the north remains to work, which could serve as catalyst To push prices above $ 100,000helping to revive an upward dynamic.

The next hours will be decisive to provide an answer to this question. So, do you think the BTC can resume the $ 100,000? Do not hesitate to give us your opinion in the comments.

Have a nice day and we meet next week for a new Bitcoin analysis.

Trade cryptos on binance, exchange n ° 1 in the world

Sources: tradingview, quince, glassnod

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital