The price of bitcoin was shaken this winter this winter by the trade war and the fall of the US equity market. Is a macreconomic anticipations of the United States on Wednesday evening, is a scenario of “Fed Put” credible for this spring?

The BTC needs the “Fed Put” to recover this spring

Risky stock market assets were under pressure this winter against the backdrop of trade war and pending possible trade agreements, and institutional investors retain strong expectations vis-à-vis the federal reserve to lower volatility on the financial markets.

While the Fed has updated its macroeconomic projections, is the “Fed Put” credible by the end of spring?

The “Fed Put” is a term used on the financial markets to designate the perception that the Federal Reserve (Fed) will intervene to support the markets in the event of a sharp decline, by softening its monetary policy (drop in interest rates, revival of quantitative relaxation, etc.). The term “PUT” refers to the sales options (put options) used to protect itself against a drop in prices.

Invest in Bitcoin and secure your wealth

The “Fed could” therefore suggests that the Fed acts as a kind of implicit insurance for investors when the equity market is under pressure as well as cryptos, by correlation.

The federal reserve has therefore updated its macroeconomic projections during the monetary policy decision on Wednesday, March 19. The resumption of the drop in the interest rate of federal funds is credible if and only if the trade war does not threaten the disinflation which has resumed since February.

The Fed remains confident in its ability to lower rates 2 times this year and has also announced the drop in speed of reduction in its balance sheet, good news for net liquidity in the United States. The next PCE inflation update will take place on Friday March 28.

📈 What are the best trading platforms of perpetuals crypto?

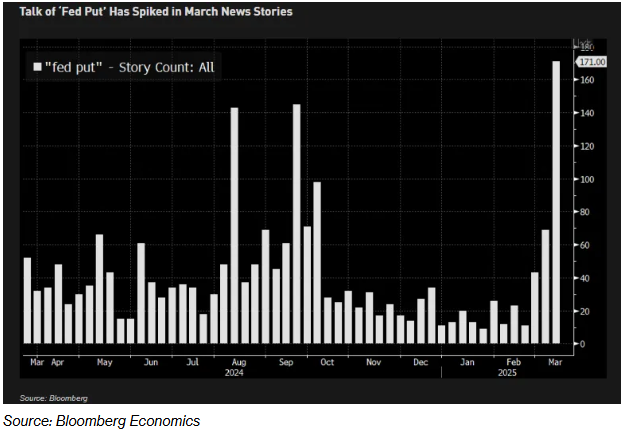

Histogram of the appearance of the term “Fed could” in US financial news

Trade crypto volatility decentralized with Dydx

Bitcoin prices could bounce back in April thanks to global liquidity

In my previous article published in cryptoast columns, I showed you positive correlation (with a temporal lag of around 710 days) between the trend of global liquidity and the tendency of the Bitcoin course.

M2 global liquidity is calculated by aggregating the monetary masses of the main economies, including the United States and China, by converting them into US dollars (USD). The evolution of the dollar directly influences this measure: a strong dollar reduces the value of world M2 in USD, while a low dollar increases it, affecting capital flows and overall financial conditions.

The Fed's prospects play a key role: a restrictive policy (increase in rates, balance sheet reduction) slows down M2 and strengthens the dollar, while a accommodating policy stimulates liquidity and can weaken the greenback.

Buy Bitcoin crypto With Swissborg

Since the beginning of the year, it is mainly thanks to China and Europe that the world money supply has rebounded. For the BTC to take advantage of this rebound from April, the US money supply must contribute more to the general rebound in the monetary offer.

So we come back to the famous “Fed Put”.

Finally, I finish this article with a graphic known as “hope” to consider a rebound in Bitcoin's course this spring.

📈 Join Vincent Ganne on Cryptoast Academy to take advantage of his daily analyzes

Graphic that exposes Japanese candles in weekly data from Bitcoin course and based on a logarithmic scale

Graphic that exposes Japanese candles in weekly data from Bitcoin course and based on a logarithmic scale

Transform crypto crashes into opportunities 🚀 Receive 7 exclusive tips to succeed where 90% fail!

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital