In a little over a month, Republican Donald Trump will once again take the reins of the United States, with a relaxation of regulations for cryptocurrencies. World Liberty Financial (WLFI), the project of his sons, begins to place its pawns by purchasing ETH as well as LINK and AAVE tokens.

World Liberty Financial (WLFI) invests in LINK, ETH and AAVE tokens

According to on-chain data, World Liberty Financial (WLFI), the crypto project of Donald Trump and his sons, is starting to organize its portfolio. On Wednesday, a wallet identified as belonging to WLFI bought $5 million worth of ETH by swapping stablecoins, which come from the sale of project tokens.

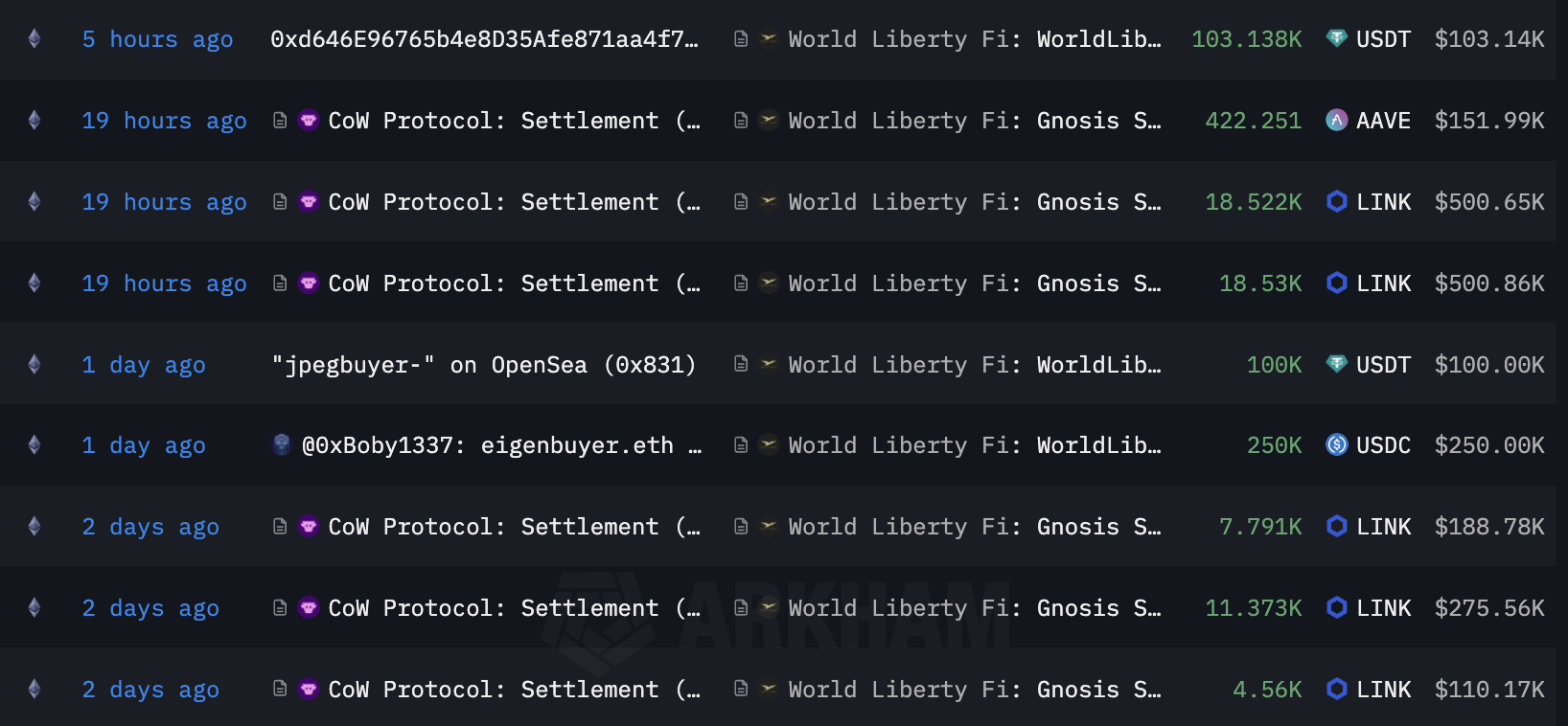

But these were only the first real on-chain movements of World Liberty Financial, the project having subsequently Swap its stablecoins on numerous occasions to obtain AAVE and LINK tokens. It is interesting to note that, whether for its most recent transactions or for those dating back several weeks, WLFI only uses CoW Protocol to carry out its operations.

Screenshot of some of World Liberty Financial's recent transactions

At the time of writing, addresses associated with World Liberty Financial only hold $3.4 million in stablecoins.

The latter hold $57.8 million in Ether, $10.36 million in cbBTC (Coinbase's Bitcoin), $2.2 million in LINK tokens and $1.48 million in AAVE tokens, as well as smaller amounts of other altcoins.

📍 How to buy Chainlink (LINK) crypto?

It was enough for the price of AAVE and LINK to catch fire. The first rose 30% following the news, going above $371, while the second experienced roughly the same increase, briefly touching $30.

Try Hyperliquid: a decentralized trading platform!

Could this just be the beginning for the Trump family's project?

But these purchases are not just a spotlight: they are most likely part of a substantive strategy. Chainlink, known for its oracles and cross-chain infrastructure, has become a key partner of WLFI by providing its infrastructure. Recent investments of $1 million in LINK tokens further strengthen this partnership.

Another central player: the Aave protocol, one of the pillars of DeFi, with which WLFI will soon launch a dedicated instance on Ethereum. This initiative, already approved by the WLFI governance community, will make it possible to lend and borrow assets such as ETH, Wrapped Bitcoin (WBTC) and stablecoins (USDT, USDC), while redistributing a portion of the revenue. to liquidity providers.

✍️ In the news — Giant BlackRock recommends holding up to 2% Bitcoin in your portfolio

According to Zach Rynes, a spokesperson for the Chainlink community, “ the collaboration between WLFI and Chainlink paves the way for mass adoption of DeFi, especially with the regulatory advances expected under the new Trump administration. »

With a cash flow of more than $57 million worth of ETHas well as stablecoins and tokens like AAVE and LINK, WLFI seems ready to expand its influence, a month before Donald Trump comes to power.

For the moment, WLFI has managed to sell $66.6 million worth of its token, still far from the 300 million dollars hoped for before the launch of the project.

🗞️ Pre-order our newspaper n°5 with exclusive content, including Cryptoast21

Source: Arkham Intelligence

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital