In its latest report, CoinGecko looks back on the major statistics of the 2nd quarter such as the performance of Bitcoin (BTC). The fall in volumes of NFTs, centralized platforms and the decline of stablecoins are also notable points in this study.

Evolution of the crypto market in the 2nd quarter: BTC exceeds $30,000

CoinGecko posted its retrospective analysis of the 2nd quarter of 2023, taking up the highlights of the cryptocurrency ecosystem such as the passing of $ 30,000 in the price of Bitcoin (BTC). Indeed, it was on April 11 that this symbolic threshold was exceeded for the first time since June 10, 2022.

Since then, the asset has paused as it ranged, ending the quarter up 6.9%, outperforming the change in total crypto market capitalization which rose 0.14% over this same period.

BTC quarterly high was reached on June 15 at $30,694when announcing the filing of BlackRock’s ETF application.

👉 To go further — Find our guide to buying Bitcoin (BTC)

Buy crypto on eToro

Stablecoins retreat and ETH staking explodes higher

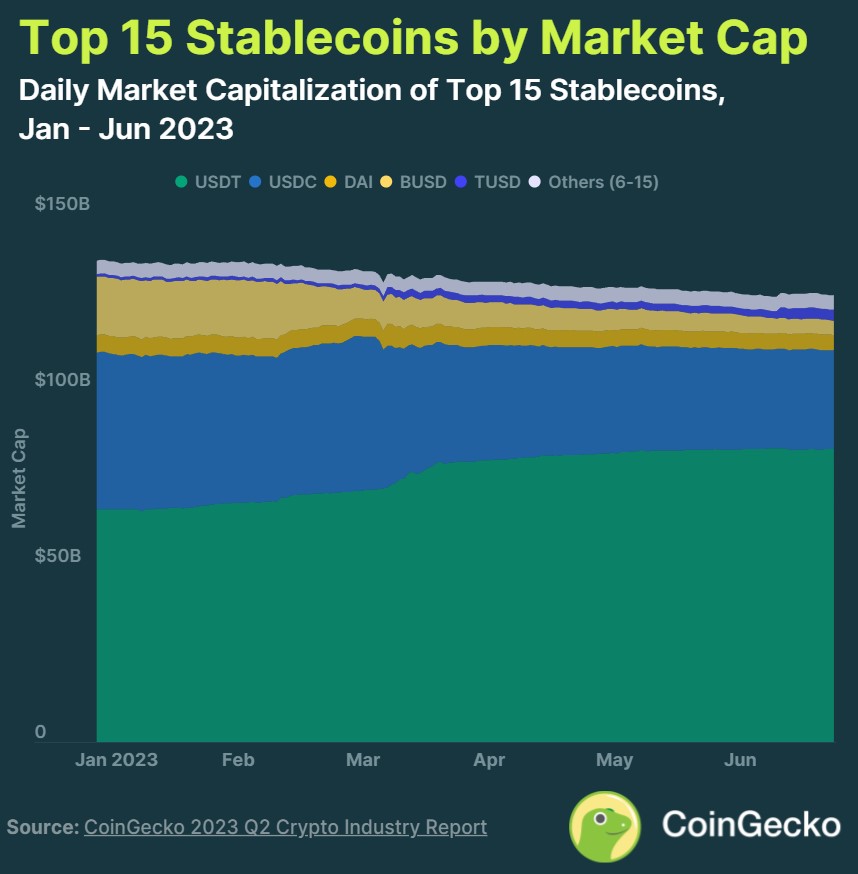

During the past quarter, the capitalization of stablecoins fell slightly by 3.5% :

Figure 1 — Evolution of the capitalization of stablecoins in the 2nd quarter of 2023

In the continuity of its temporary difficulties in March, Circle’s USDC fell 15.9%, with a loss of $5.18 billion on its total amount in circulation. The BUSD continues its agony with $3.43 billion less and a drop in its capitalization of 45.4%.

Tether’s USDT came out on top, rising 4.4% to an additional $3.48 billion, and lesser-used stablecoins particularly stood out like Gemini’s GUSD or Paxos’ USDP, with respective gains of 44.4% and 30%.

On the Ethereum staking side, all lights seem to be green with a 30.3% increase in the amount of ETH staked, in the wake of the success of the Shapella update.

Lido remains at the head of this sector with 31.9% market sharewhile the Kraken platform is the biggest loser of the last 3 months with a loss of 36.2% of ETH staked from one quarter to another due to its setbacks with the Securities and Exchange Commission (SEC).

Coinbase also conceded ground by 3.5%, and now manages 9.6% of ETH staking.

The NFT bear market and the flight from centralized platforms

While in 2022, the non-fungible token market had resisted the bear market rather well, the dynamic is now quite different. This results in particular in volumes down 35%despite the arrival of Ordinals on Bitcoin, which CoinGecko considers here as NFTs despite being a totally different technology:

Figure 2 — Comparison of NFT volumes between the first and second quarters of 2023

As an example, Ethereum saw its volumes grow from over $1.48 billion to $840 million between March and June.

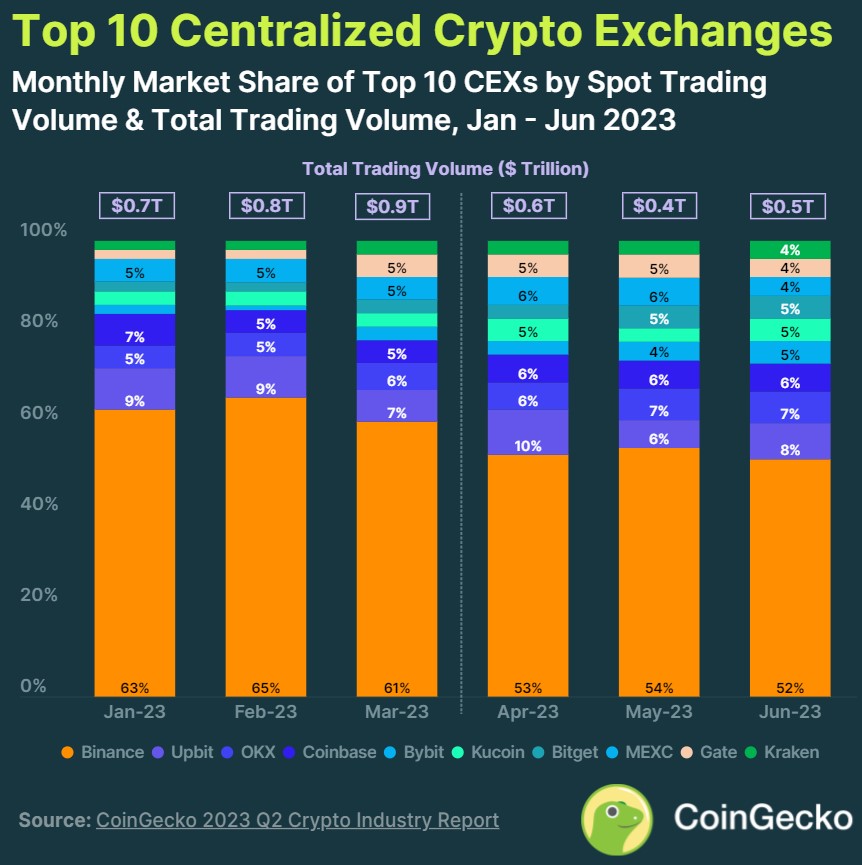

Concerning the centralized exchange platforms (CEX), the regulatory difficulties dealt a serious blow to their volumes. And for good reason, these are down 43.2% and Binance sees its dominance drop from 61 to 52% :

Figure 3 — Comparison of CEX volumes between the first and second quarters of 2023

Despite a generally positive first part of the year for the cryptocurrency market, it will therefore be appropriate to remain attentive to the few signs of slowing down of this second trimester.

👉 Also in the news — ETF Bitcoin spot: SEC begins reviewing latest requests, first response expected in August

Confused and overwhelmed by cryptocurrencies? 🤔

Spot opportunities and make informed investment decisions 🔎

Source: CoinGecko

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.