Following the rise of EigenLayer, the Symbiotic protocol brings a new perspective to the concept of ETH retaking on the Ethereum blockchain, emphasizing the flexibility of its system. With the support of Lido’s co-founders, Symbiotic offers an innovative method to strengthen blockchain security, while also giving users the opportunity to earn additional rewards through retaking. Learn how Symbiotic promises to transform the management and valuation of ETH and other tokens with retaking.

What is Symbiotic?

Symbiotic is an ETH retaking protocol for the Ethereum blockchain and its ecosystemIn the blockchain world, new networks often face a major problem: raising enough capital to ensure robust protection of their infrastructure and users can be difficult.

To answer this problem, The EigenLayer protocol introduced the concept of retaking to the Ethereum blockchainThis mechanism gives users the ability to reuse their staked ETH, such as Lido's stETH, to earn additional rewards by restaking them on different blockchains.

This retaking process not only strengthens the security of the main blockchain by increasing the volume of staked cryptos. It also allows this security to be extended to other protocols and applications through a shared security model.allowing them to benefit from the security and reliability of the main blockchain without needing their own security infrastructure.

👉 Our article to understand everything about the restaking mechanism

Unlike EigenLayer which focuses exclusively on ETH retaking, Symbiotic protocol plans to expand its retaking process to include a variety of ERC-20 tokensthus providing greater flexibility and opening the door to other crypto assets outside of ETH.

Symbiotic logo, styled by Cryptoast

With this innovative restaking mechanism, the Symbiotic protocol offers several advantages:

- Flexibility and modularity : Symbiotic gives projects the freedom to fully configure their own (re)staking systems. They have the ability to select the assets used as collateral, establish the selection criteria for operator nodes, or customize their reward and penalty structures. This customization capability allows projects to create security solutions that precisely match their needs;

- Risk management : Symbiotic uses smart contracts on Ethereum that are immutable, removing governance risks and single points of failure;

- Capital efficiency in retaking : Symbiotic uses an inter-network reputation system to optimize capital allocation. This system evaluates the reliability and performance of Symbiotic operators, which helps projects choose the most reliable operators.

Symbiotic recently made headlines with the announcement of a partnership with Mellow and Lido Finance to offer a retaking solution specific to stETH (Lido's liquid staking token).

In June 2024, Symbiotic Protocol raised $5.8 million in a funding round led by Paradigm and cyber.Fund (an investment fund led by Konstantin Lomashuk and Vasiliy Shapovalov, the co-founders of Lido).

What is the Symbiotic restaking protocol based on?

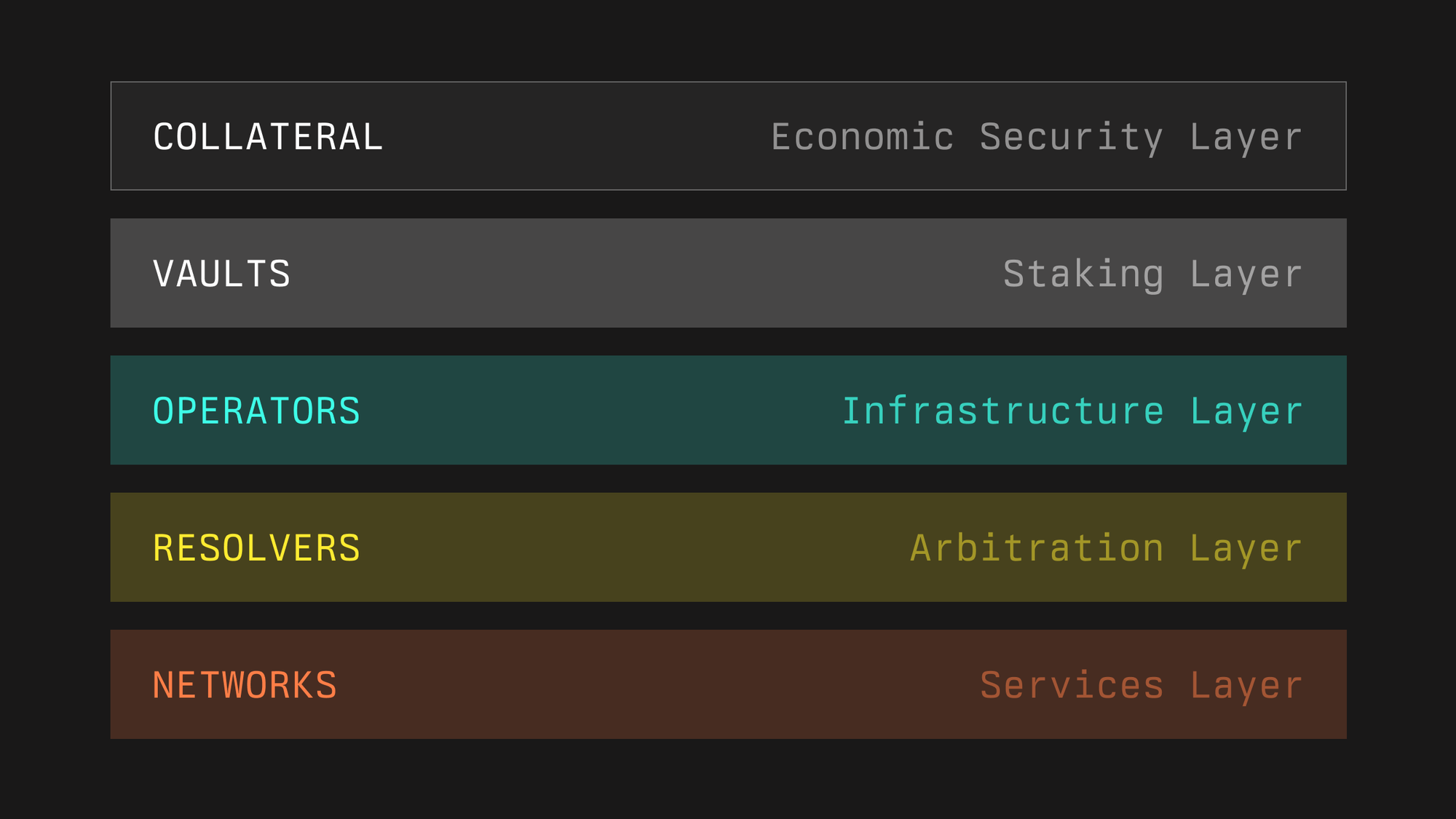

The Symbiotic protocol is based on 5 key components that structure its ecosystem.

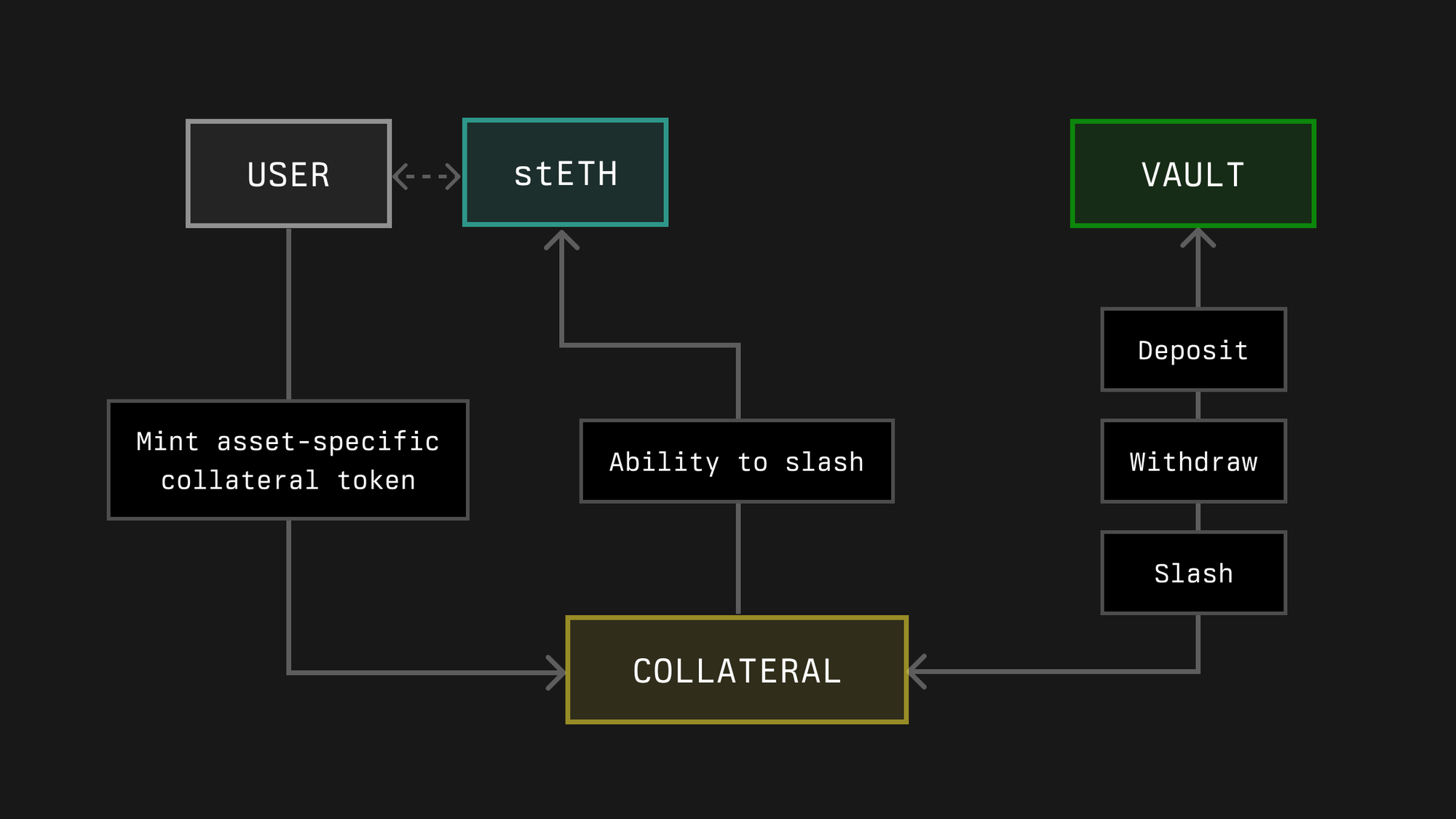

The collateral

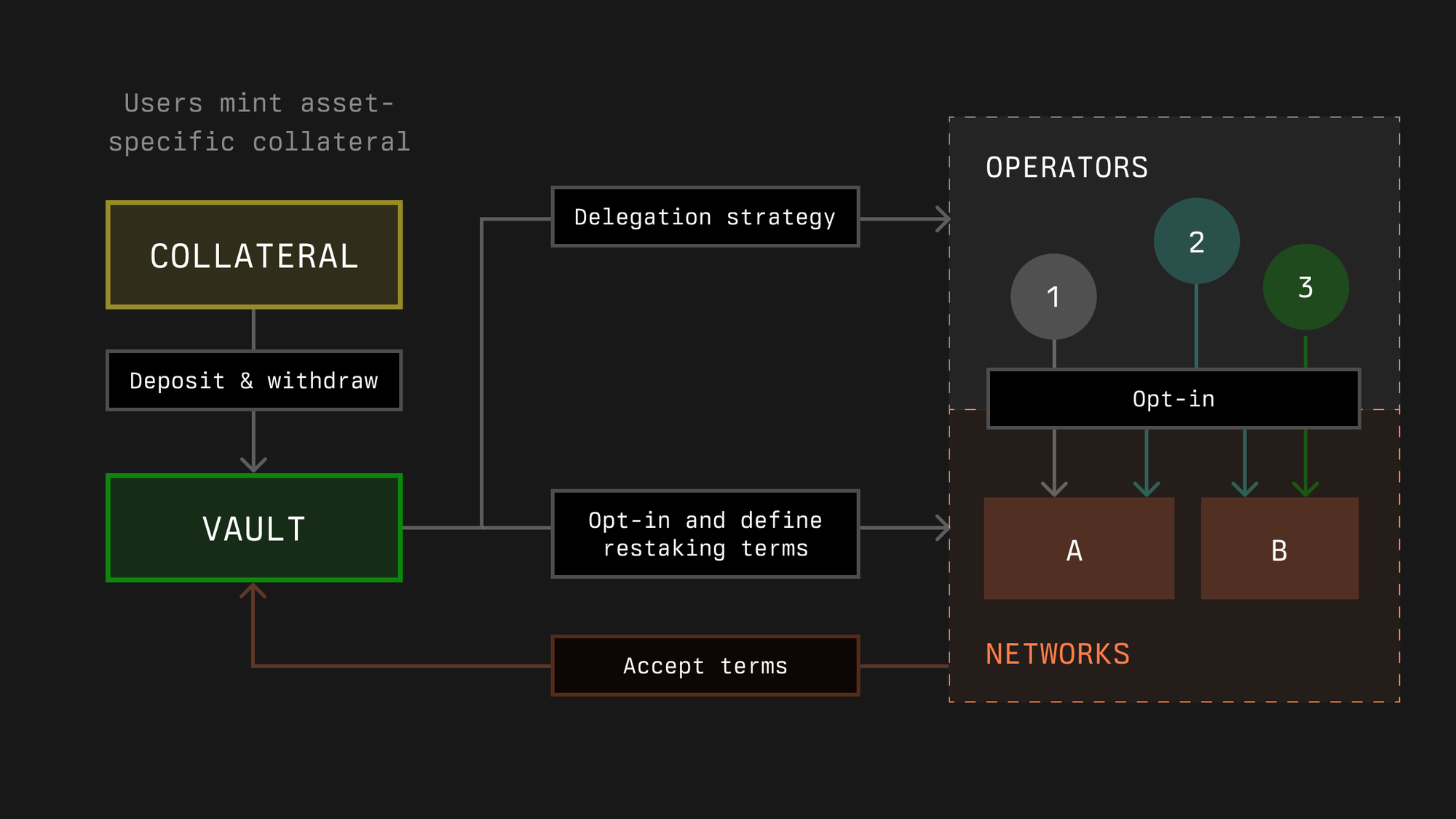

Traditionally, cryptos placed in stake or used as collateral are kept directly in the protocol that manages the staking. However, Symbiotic innovates by allowing these cryptos to be placed in decentralized finance (DeFi) products on blockchains other than EthereumThis provides more flexibility to liquidity providers.

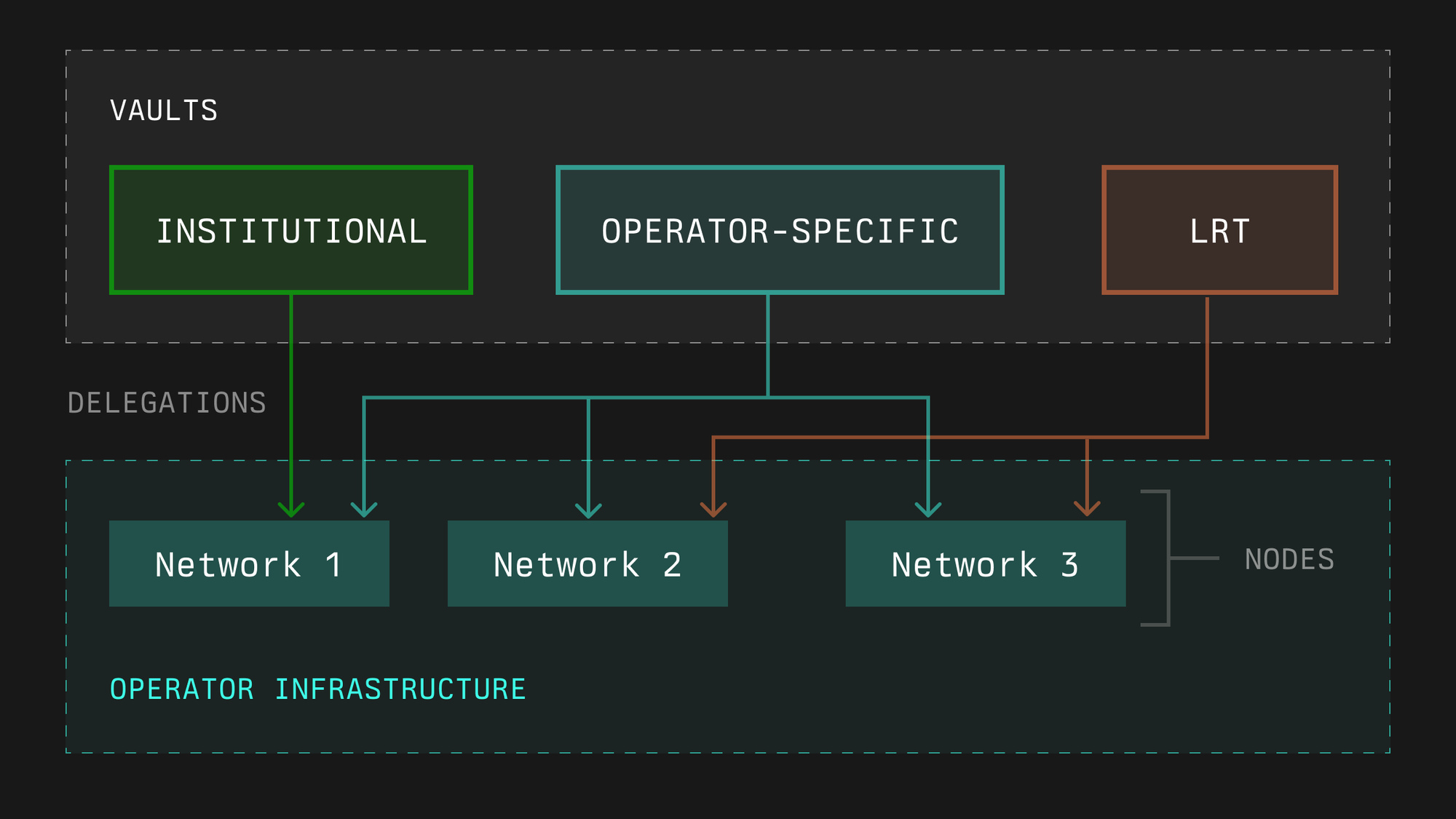

The vaults

This is the layer that handles the management of Symbiotic delegation and restaking. Vaults manage 3 essential aspects:

- Accounting : Vaults handle deposits, withdrawals and penalties applied to collateral as well as underlying assets;

- Delegation strategies : Vault owners set specific rules to delegate and restake crypto to operators on various networks. These strategies define how and where assets are invested in order to maximize returns while ensuring their security;

- Distribution of rewards : Chests also distribute staking rewards.

The networks

In the context of Symbiotic, a network refers to any Web3 project that uses Symbiotic technology to protect its infrastructure via retaking. Thanks to its modular structure, Symbiotic allows each network to adapt and customize its own architecture according to its specific needs.

The operators

Operators are the actors who manage the infrastructure necessary for the functioning of decentralized networks..

The Solvers

Symbiotic uses mechanisms called resolvers to handle incidents. A resolver is a smart contract or entity responsible for responding to issues reported by networks.

Each network using Symbiotic defines its own criteria for choosing these resolvers. These criteria must be approved by the Symbiotic coffers that finance the operators. This system ensures that incident management complies with the expectations and rules established by each network.

Does Symbiotic have a cryptocurrency?

Currently, we have no information about a possible Symbiotic token.

However, looking at the functionality of tokens from other projects like EigenLayer, we can imagine the roles of a potential Symbiotic cryptocurrency:

- Governance : A Symbiotic token would allow its holders to participate in the governance of the protocol to vote on improvement proposals and other strategic decisions;

- Network Security : The token could be used to improve the security of the protocol through staking and restaking;

- Collateral : It is possible that in the future, the Symbiotic token will be used as collateral on the platform.

Regarding the distribution of a potential Symbiotic token, it is very likely that this will be in the form of an airdrop. To increase your chances of receiving this possible airdrop, join our premium Cryptoast Research community 👇

Cryptoast Research: Complete guides to farming airdrops

Who develops Symbiotic?

As we write these lines, The team behind the development of Symbiotic is not publicly known.

On the other hand, we know that the project is strongly supported by the co-founders of Lido Finance, Konstantin Lomashuk and Vasiliy Shapovalov through their investment fund Cyber Fund.

Our opinion on the Symbiotic protocol

Symbiotic is a promising protocol in the shared security and retaking sector on Ethereum. Thanks to the support of Lido Finance, the leader in ETH staking, Symbiotic has everything it needs to become a key player in this market.

In addition, this protocol has managed to quickly secure significant funding from big names in the industry, which demonstrates their confidence in its innovation potential.

Furthermore, Symbiotic clearly stands out from other solutions such as EigenLayer or Karak thanks to its modular architecture.It will be exciting to see how Symbiotic will evolve in the restaking sector in the face of these two competitors and the needs of the market.

The possible introduction of a Symbiotic token via airdrop could play a crucial role in its positioning in the race for the leading retaking protocol.

👉 Check out our other analyses on blockchains, protocols and cryptocurrencies

What is your opinion on Symbiotic?

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.

;Resize=(1200,627)&impolicy=perceptual&quality=medium&hash=0016bc374c4f8f16f359894f72948d8f4ee614ffb8b3aa0b814c19c887cd9a7a)