The Jimbos Protocol project, hosted on Arbitrum (ARB), was hacked shortly after its second version was rolled out, resulting in the theft of $7.5 million in the form of Ether (ETH). The hacker exploited a slippage control flaw using a flash loan to manipulate the price of the JIMBO token, which lost 40% in the process.

Jimbos Protocol suffers $7.5 million hack

Only a few days after the deployment of its second version, the Jimbos Protocol project hosted on the layer 2 Arbitrum (ARB) was siphoned 4,090 Ethers (ETH)or approximately $7.5 million at the time of the event, i.e. May 28.

#PeckShieldAlert Tea @jimbosprotocol exploit has bridged the stolen funds (4,048 $ETH valued at ~$7.5M) to Ethereum and they are located at https://t.co/vMMZPfJwKI pic.twitter.com/Rek199sQbF

—PeckShieldAlert (@PeckShieldAlert) May 28, 2023

At the time of writing, the funds are still at the same address in the form of ETH, which has also been tagged by the Etherscan explorer accordingly.

Regarding the methodology used by the hacker, the latter would have simply exploited a lack of slippage control on the protocol by repeating swaps several times thanks to a flash loan of 5.9 million dollars. A method often acclaimed by hackers, which has notably led to the hacking of the Platypus or Nereus Finance protocols, among others.

Once the funds were in his possession, the hacker then forwarded them via the Stargate and Celer bridges.

Price of JIMBO, the native token of Jimbos Protocol

In his latest tweet, Jimbos Protocol has enlisted the help of several on-chain investigators in order to keep track of the movements of the hacker’s funds, in particular ZachXBT, samczsun or Mudit Gupta. None of them seem to have responded yet.

Taking some codes from the Olympus protocol, Jimbos Protocol aimed to solve some problems of liquidity and volatility, one being mechanically and intrinsically linked to the other.

👉 How to store and secure your cryptocurrencies?

Discover ZenGo

$10 Bitcoin bonus from $200 deposit 🔥

Hacks down at the start of 2023

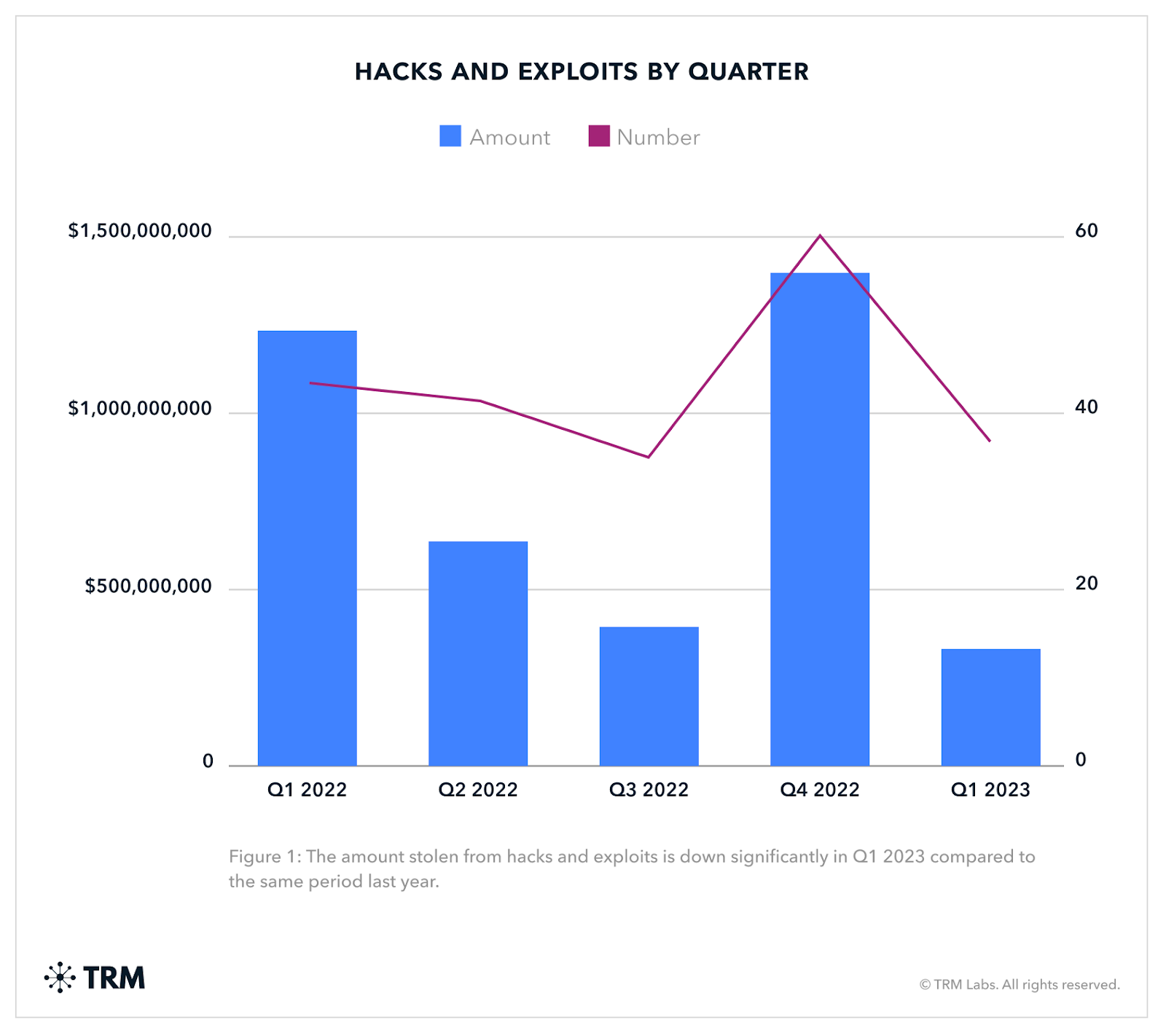

According to a report by TRM Labs, approximately $400 million was stolen through around 40 hacks for the first quarter of the year 2023, which constitutes a drop of more than 70% compared to the same period in 2022.

Of course, since a few hacks make up the bulk of the funds stolen over a period of time due to the amounts involved, the situation in the first quarter does not predict what might happen for the rest of the year. . As such, just 10 hacks accounted for 75% of funds stolen in all of 2022according to TRM Labs.

According to the firm specializing in blockchain security CertiK, it is also to be expected that bridges are once again prime targets for malicious hackers for this year 2023.

Indeed, due to the way they work, bridges are very important sources of liquidity in the ecosystem of decentralized finance (DeFi), as proven, among others, the now infamous 624 million ronin hack last year.

👉 On the same subject – Exit scam: the DF Fintoch rug pull project 32 million dollars and no longer gives any sign of life

Our service dedicated to cryptocurrency investors. Get real-time analytics and optimize your crypto portfolio.

Source: TRM Labs

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.