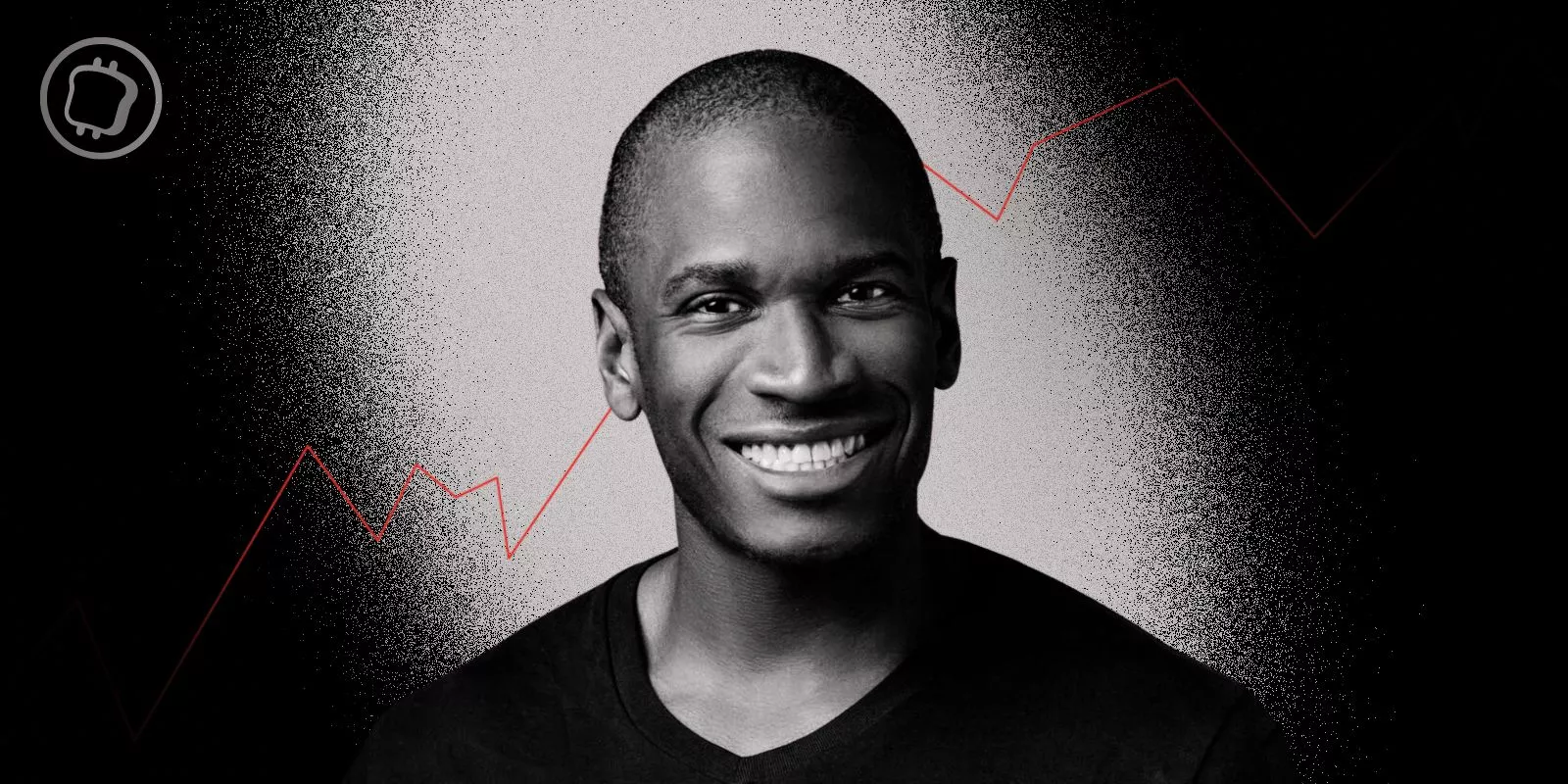

With the United States Federal Reserve (Fed) planning to cut rates this Wednesday, former BitMEX CEO Arthur Hayes expects the announcement to have a negative impact on cryptocurrency prices.

Arthur Hayes: By lowering rates, the Fed will cause a fall in the price of cryptocurrencies

This Wednesday, The United States Federal Reserve (Fed) will begin its monetary easing cycle and initiate a rate cut, 4 years after the previous decline. According to Arthur Hayes, the co-founder of BitMEX, The Fed's official announcement is expected to impact the price of risk assets, including cryptocurrencies.

💡 Don't miss our guide to buy cryptocurrencies simply

For Maelstrom's investment director, The launch of this monetary easing cycle is a mistake that will cause a fall in cryptocurrencies and a strengthening of the yen, Japan's fiat currency:

Lowering Rates Is a Bad Idea

because inflation is still a problem in the United Stateswith the government being the main contributor to persistent price pressures. If you make borrowing cheaper, it contributes to inflation.. […] Also, the interest rate gap between the United States and Japan will be reduced with the Fed's rate cut. This could lead to a strong appreciation of the yen and trigger the unwinding of carry trades on the yen.

“The USD/JPY pair [dollar américain/yen, ndlr] is the only thing that matters in the short term ” for Arthur Hayes. The American entrepreneur then referred at the outcome of the highly prized yen carry trade which took place at the beginning of last month.

So, The Bank of Japan raised its benchmark interest rate last July from 0% to 0.25%.. As Arthur Hayes points out, it was during this period that the bitcoin price The price of BTC has gone down dropping from around $64,000 to just $50,000.

Buy crypto on eToro

Is the era of central banks over?

Former BitMEX CEO also tends towards a weakening of demand for tokenized Treasury bonds, the latter being seen as products sensitive to variations in interest rates.

Following this, Arthur Hayes returned to analyst Russell Napier's commentsThe latter has repeatedly stated that governments of developed countries, focused on reducing the debt/gross domestic product ratio, have taken control of the money supply, thereby making central banks ” useless » in the near future.

👉 Also in the news – Imminent tax increases? Recommendations from the Governor of the Bank of France to get things back on track

For Russel Napier, by targeting certain sectors such as manufacturing, governments will generate strong liquidity while keeping inflation high. Arthur Hayes claimed to be ” 100% agree with this prediction » and specifies:

The era of central banks is over. Politicians are going to take over and ask banks to create liquidity in specific sectors of the economy. So you're going to see loose and tight capital controls in different places, meaning that cryptocurrencies are the only asset you can own that is globally portable and allows you to exit this system.

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

Source: CoinDesk

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.