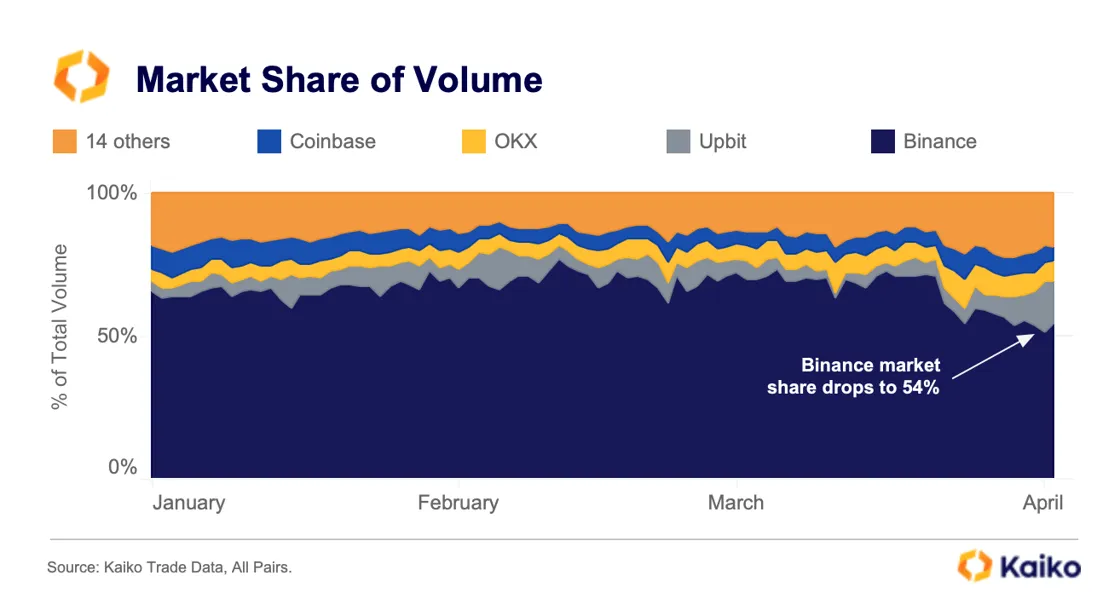

A report by French startup Kaiko indicates that Binance has lost around 16% market share in the past 2 weeks due to rumors, CFTC actions and the end of its free trading program. However, Binance still leads the market with 54% share, followed by Upbit. The Coinbase exchange also lost more than 10% of its market share in the United States.

Binance in decline

A recent report from Kaikothe French start-up that compiles and analyzes data for institutions and professionals, highlights the recent loss of ground of the Binance cryptocurrency exchange platform.

Thus, given the on-chain data, Binance would have lost around 16% market share in the last 2 weeks. A loss of momentum attributable on the one hand to recent rumors mixed with the actions of the Commodity Futures Trading Commission (CFTC) against it, but also to the end of its “Zero fee trading” program (trading free of charge).

However, as we can see from the graph below, Binance still has a 54% dominance in the crypto exchange market, far ahead of its main competitor Upbit. A second place vacated by the former giant FTX last November, when Sam Bankman-Fried’s platform was then the only one able to overshadow Binance.

Figure 1 – Share of market share between the main cryptocurrency exchanges

The ground gain we can observe regarding Upbit, a South Korean exchange, is part of a locally located frenzy among South Korean traders actively betting on XRP, the cryptocurrency of Ripple, the outcome of the lawsuit against the company approaching. Thus, this trend is also visible on the Bithumb exchange, also South Korean.

👉 Browse safely with ZenGo Wallet

Discover ZenGo

$10 Bitcoin bonus from $200 deposit 🔥

The particularly fragile American market

The giant Coinbase has also found itself reeling lately, mainly due to the Wells notice issued against it by the United States Securities and Exchange Commission (SEC) last month. Thus, according to Kaiko, Brian Armstrong’s exchange reportedly lost more than 10% share in the US market :

“Even Coinbase, which has historically pushed very hard with regulators, received notice from Wells focused on its staking service, while Kraken was forced to shut down its service earlier this year. Throughout the first quarter, the market share [américaine] Coinbase fell from a weekly average of 60% to just 49%. »

However, Binance.US, the American subsidiary of Binance, seems to be seriously doing well in this section of the market, since its share has been multiplied by 3 since the beginning of this year.

The current regulatory limbo in the United States does not seem ready to stop: while Kraken, one of the oldest cryptocurrency exchange platforms, was fined $30 millionit also found itself forced to stop its staking services last February.

Lately, it is the Bittrex platform that has decided to end its activities in the USAalso citing the prevailing regulatory uncertainty.

👉 In The News – Paxful Announces Marketplace Closure – What Happened?

The best way to secure your cryptocurrencies 🔒

🔥 The world leader in crypto security

Source: Kaiko

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.