The transition between the end of the current down cycle and the upcoming uptrend works very similarly to previous bear markets. The current supply momentum in profit from short-term holders indicates that the conditions conducive to a market reversal are visibly developing. On-chain analysis of the situation.

Bitcoin continues its recovery

Continuing its bullish recovery, Bitcoin (BTC) price exceeds $22,000 and erases the fall caused by the collapse of FTX in November 2022.

While the short-term BTC holder and the average holder have lifted their heads above water, the current market structure shows signs of a transition from the end of a bear market to the beginnings of a bull market highly anticipated.

Figure 1: Daily price of BTC

In order to visualize this passage between bear market and bull run, we study today the dynamics of the supply in profit held by the cohort of short-term holders through Bitcoin’s last three bear cycles.

Prof Chaîne intervenes every week on our private group

The dynamics of supply in favor of STH

Observing closely the data of the Bitcoin blockchain, an observation is formed: BTC market cycles, while not identically repeating, rhyme significantly.

The study of the supply of BTC held in profit makes it possible to clearly illustrate this periodicity while providing a clear visualization of the dynamics of profitability of the market during its downtrends.

Typically, the supply of BTC in circulation tends towards a profitability of 100% during the end of the bull runwhen mania and bullish volatility put almost all participants in a state of latent profit.

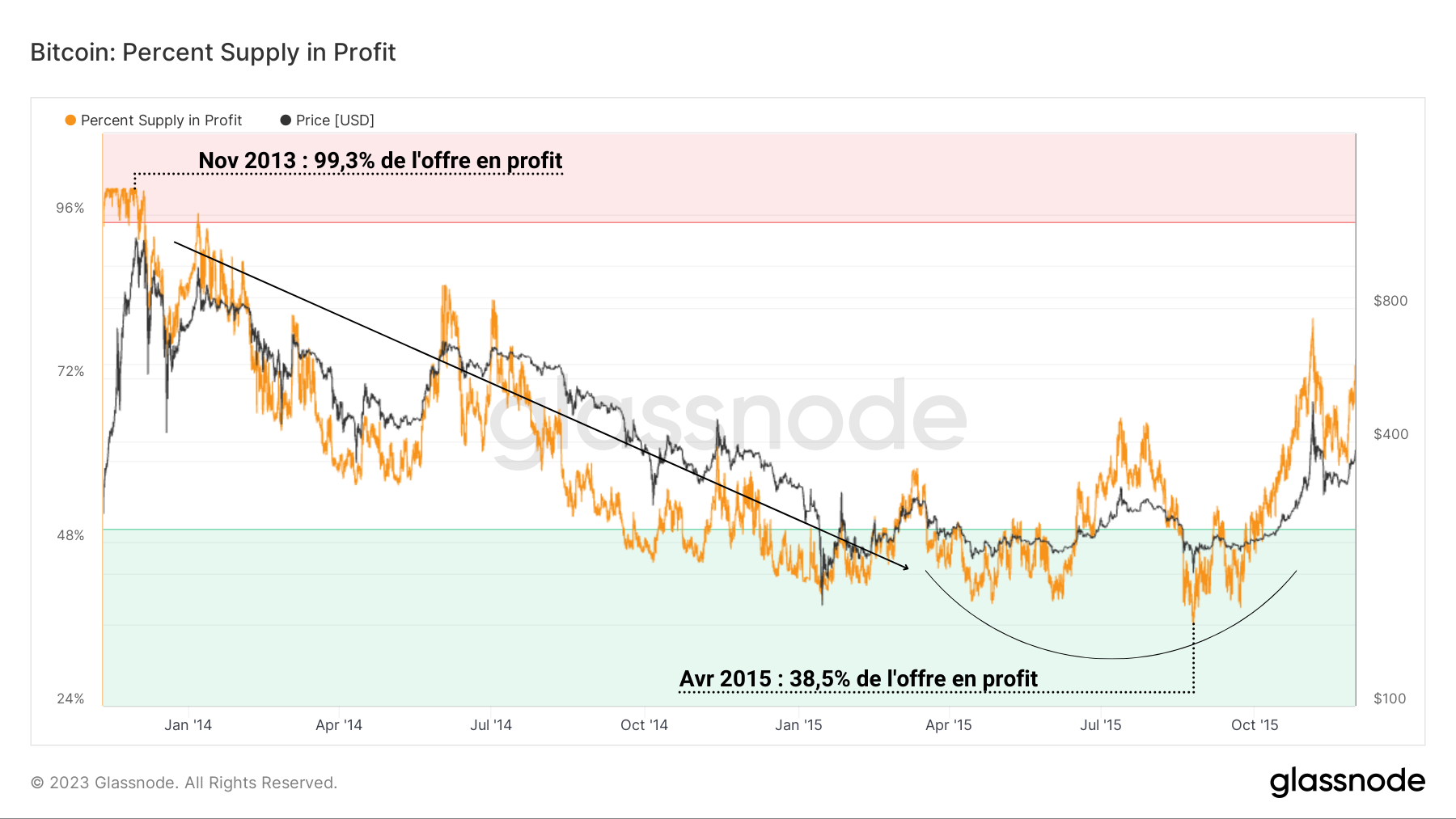

Figure 2: Percentage of supply in profit (2014 – 2015)

Then follows a slow fall in the profitability of all holdersuntil a floor reached following the formation of the “technical” low point of the BTC spot price which gives rise to a marked trend reversal.

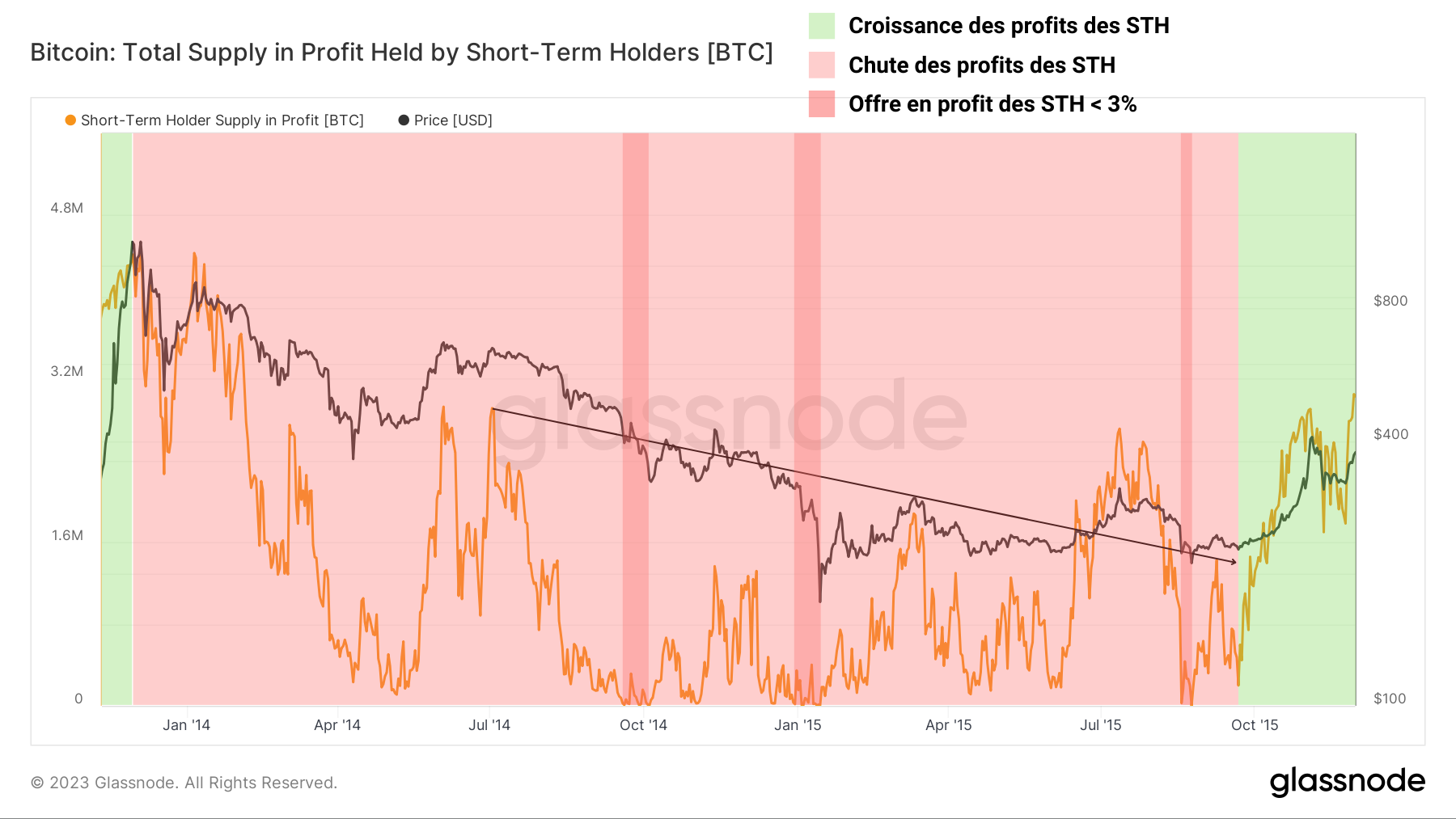

From the perspective of short-term holders (STH), after a period of sustained growth in the supply profits of this cohort (in green), the end of the bull run is characterized by the continuous and gradual fall in the profitability of STH positions (in light red).

It was during this period that they actively participate in the redistribution of capital at a loss during bear markets, when events of Notable loss-taking takes place as the STH profit offer reaches a critical threshold below 3% (in dark red), as during the bear market of 2014 – 2015.

Figure 3: Offer in profit of STH (2014 – 2015)

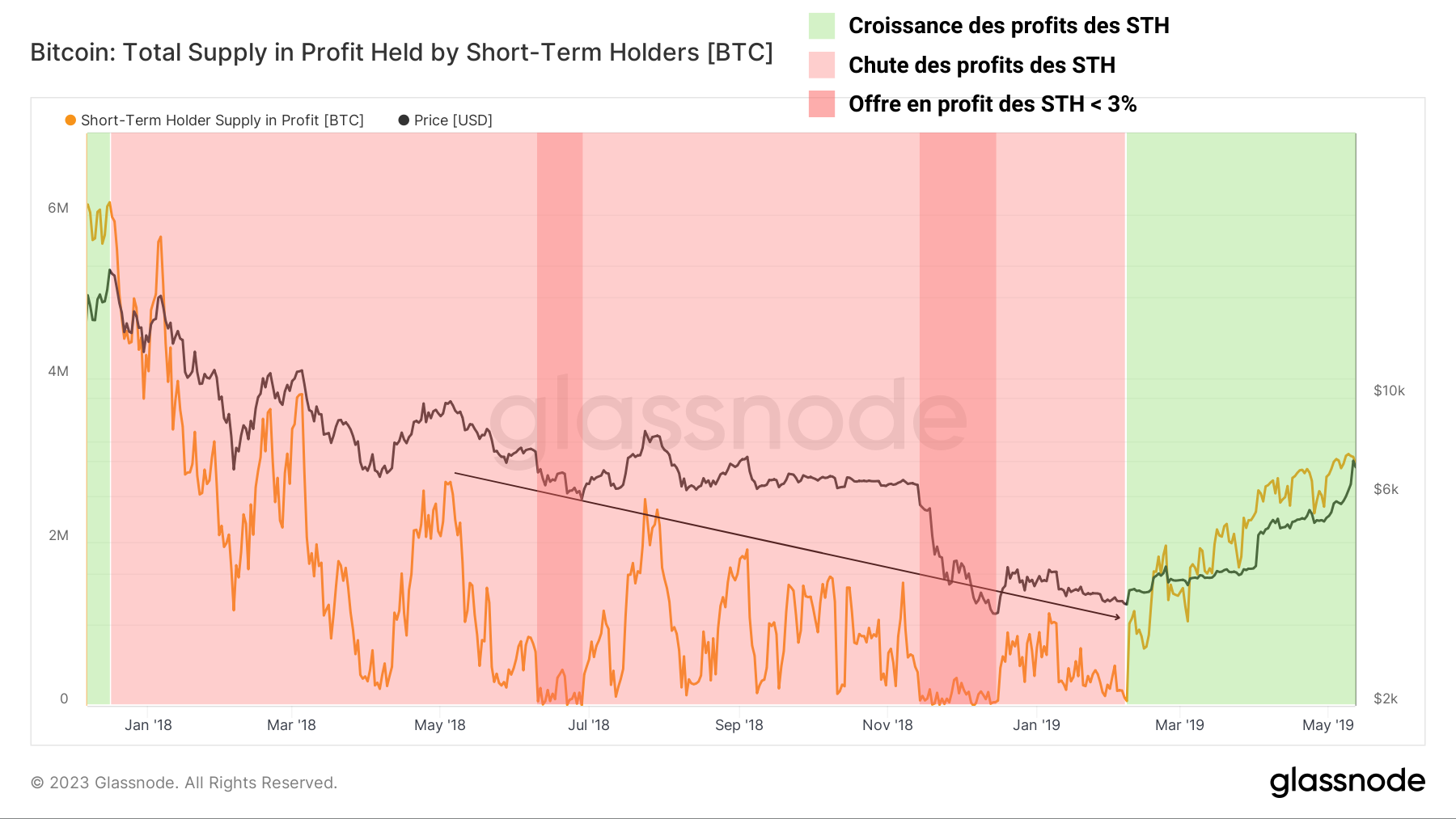

The same observation can be made for the bearish cycle of 2018 – 2019where the profitability of short-term positions fell for more than a year before a bullish impulse reversed the balance in April 2019.

Again, we can see a significant supply contraction in STH profit throughout the bear market, the expansion of which then signals a long-term trend reversal.

Going from almost 6 million BTC in profit to around 30,000 BTC in profit before the April transition, this cycle illustrates particularly well the loss suffered by short-term BTC holders during the bear markets.

Figure 4: Supply in profit of STH (2018 – 2019)

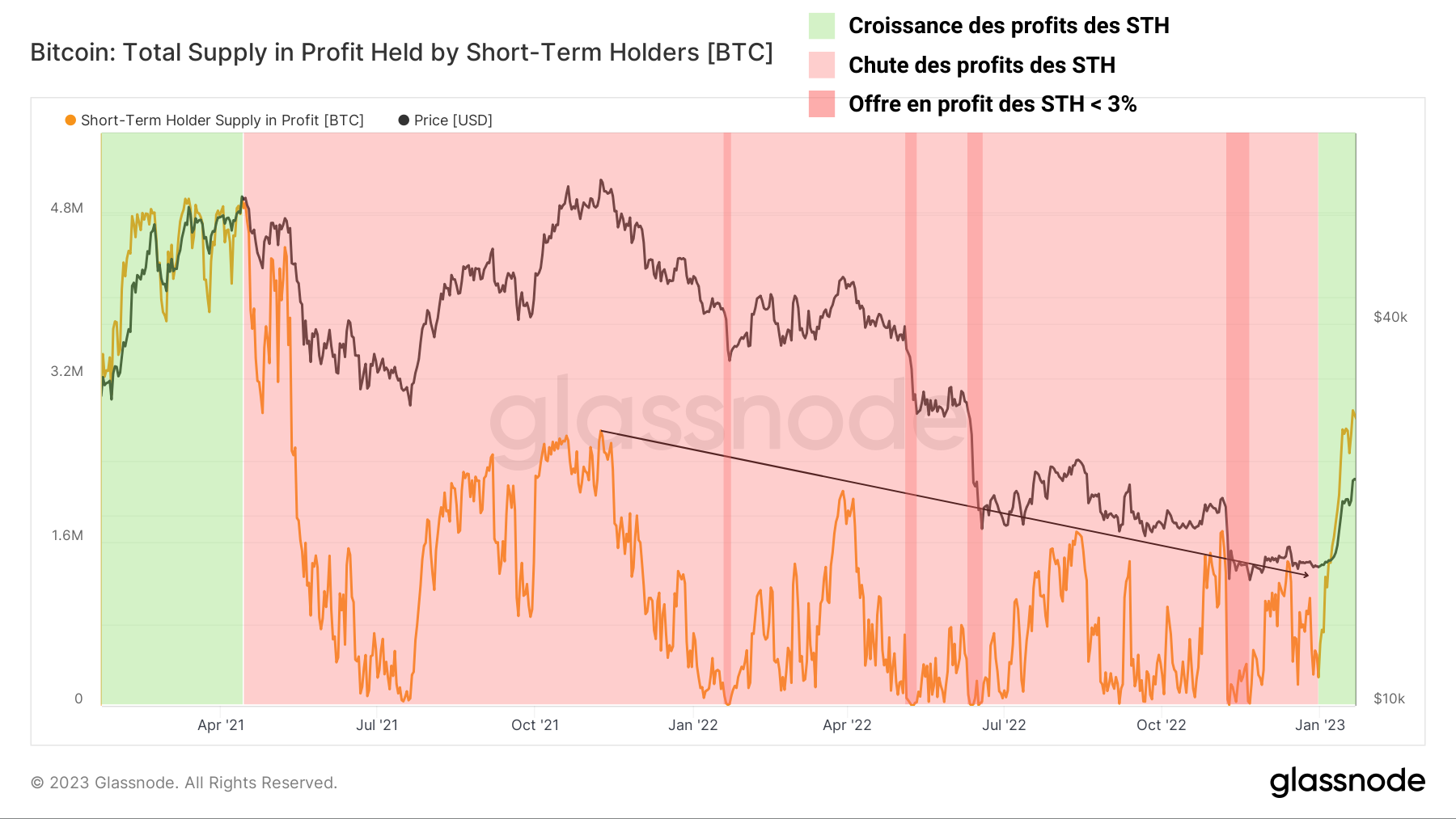

Currently, we can observe a very similar conformation taking placeindicating that the conditions for a market reversal are developing.

After a rapid and powerful loss of profitability following the April 2021 capitulation, the STH cohort saw the profitability of their holdings gradually decline until January 2023, with the following four occurrences:

- January 2022: purge of leverage on derivatives;

- May 2022: Terra/LUNA collapse;

- June 2022: bankruptcy of Celsius;

- November 2022: Collapse of FTX and Alameda Research.

Since the recent rise in the price of BTC, the supply in profit of the STH registers a new increase and now exceeds the levels known during the second peak of November 2021.

Figure 5: Supply in profit of STH (2021 – 2023)

Summary of this on-chain analysis of BTC

In sum, this week’s data tells us that despite appearances, the transition between the end of the current bear cycle and the beginnings of the uptrend to come operates very similarly to previous bear markets.

The comparative study of the supply in profit of short-term holders indicates that the recent rise in price has caused a significant boost in unrealized profitability within this cohort, even allowing the levels recorded during the second ATH in November 2021 to be exceeded.

The current conformation of the offer in profit of the STH indicates that the conditions for a market reversal are visibly developing.

The all-in-one crypto app

0 fees for your 1st crypto purchase

Sources – Figures 1 to 5: Glassnode

Newsletter

Receive a summary of crypto news every Monday by email

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky in nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.