The decline in Bitcoin price and the rise in hashrate between August and November 2022 caused considerable stress among the cohort of miners. It looks like some of them have been forced to liquidate some of their cash and unplug their ASICs to weather the storm. On-chain analysis of the situation.

Fierce competition in the depths

Bitcoin (BTC) pricee is recovering to hover around its 20-period moving average at the $17,000 level.

While participants are torn between loss taking and intensive accumulation, the miner cohort is not indifferent to the current powerful price depreciation.

Figure 1: Daily price of BTC

Many signals indicate that the various firms and mining pools are barely enduring the turmoil of the 2021-22 bear cyclewhich caused the most resilient participants to bow down, while engaging in fierce competition.

Today, we will observe the situation of the cohort of miners through the study of their contribution to the security of the network (hashrate), their income and the flows of their wallets.

Prof Chaîne intervenes every week on our Premium Group

The game of the last survivor

Following the meteoric rise achieved by the hashrate of the Bitcoin network between August and November, the total hash rate allocated to the discovery of the header of the new block increased from nearly 200 ExaHash/s to an ATH of 272 ExaHash/s on November 12.

The adjustment of the mining difficulty then pushed the competition further so that the income of some miners no longer allows them to participate.

One followed -16.3% drop in hashratesignaling a gradual withdrawal of ASICs and the (temporary or permanent) abandonment of entities no longer wishing to contribute to network security.

Figure 2: Bitcoin hashrate

Since November 27, this measure has retraced nearly 50% of its fall, located around 260 ExaHash/s, whilea bearish mining difficulty adjustment finally manifests.

Drop in miners’ income

The financial pressure on miners has grown steadily since November 2021, finally pushing them to their limits.

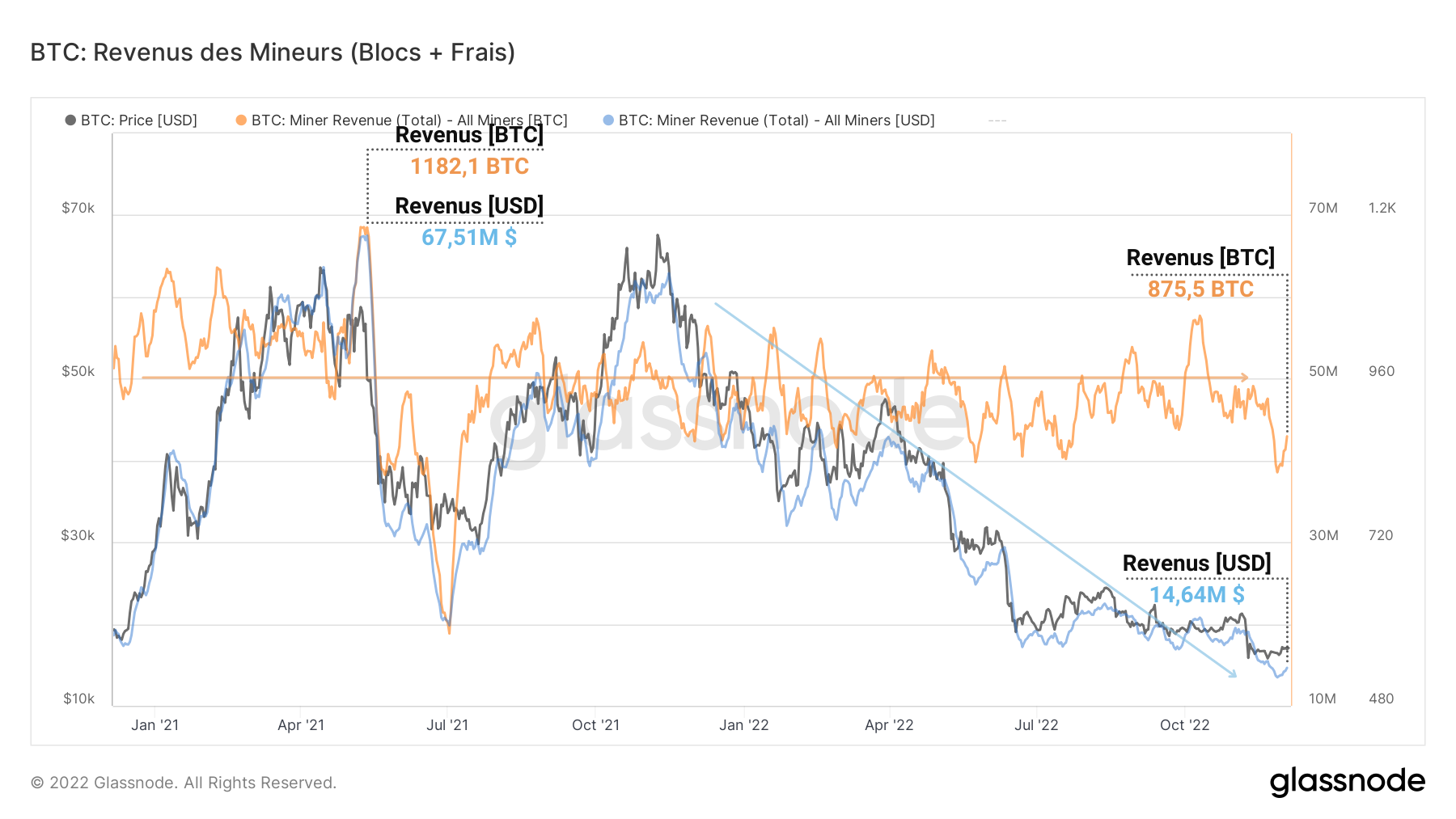

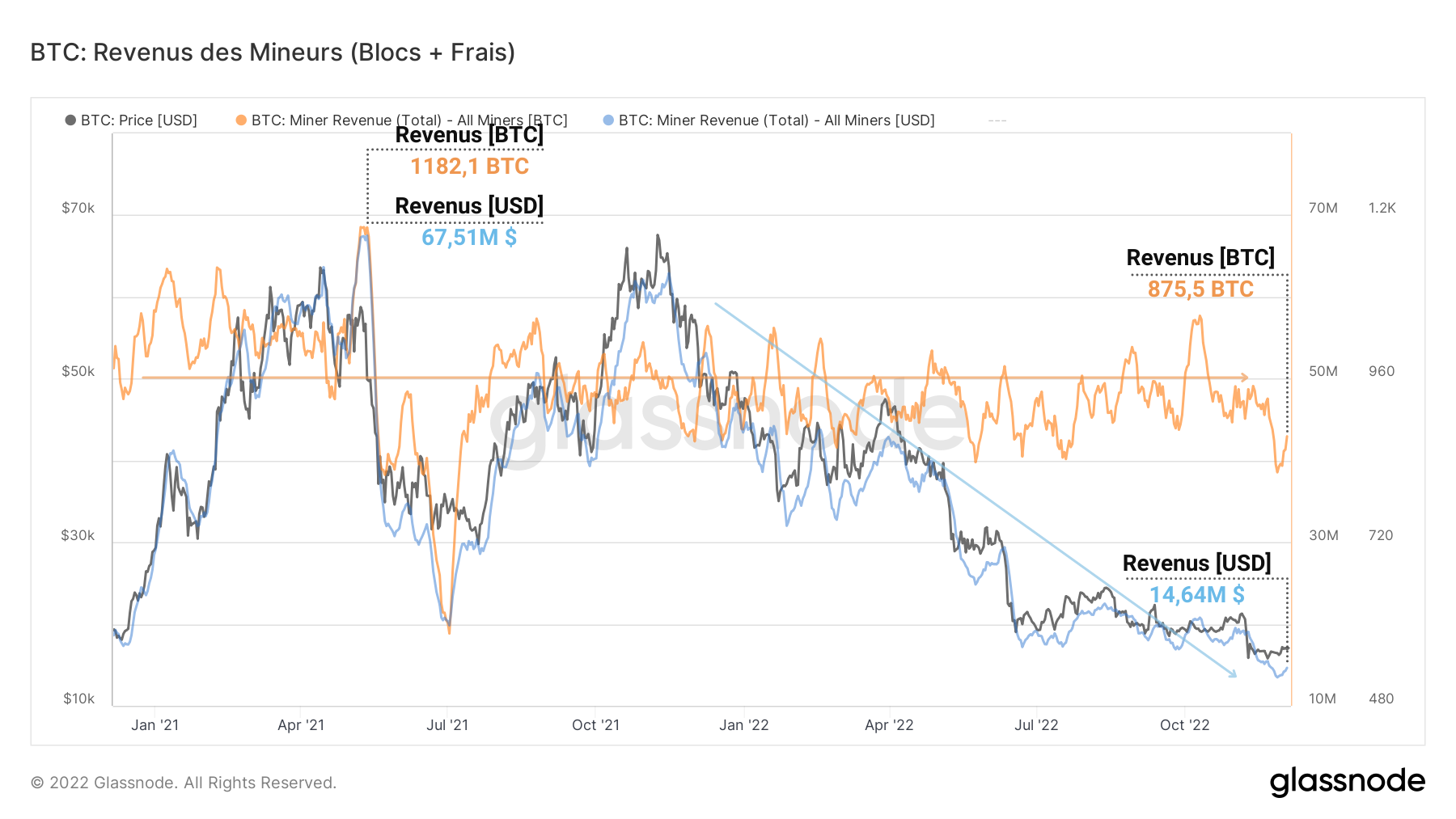

At first glance, the USD value of daily miner revenue (block rewards and fees) has fallen in line with the price of BTCgoing from $67 million (May 2021) to almost $14 million now.

Figure 3: Miner revenue (BTC & USD)

This 4.5 split in block forger revenue allows fewer and fewer of them to meet their CAPEX and OPEX costs and is part of the reason machines go unplugged.

Furthermore, in terms of BTC, miners also experienced a drop in profitability of around 15% between the months of October and Novemberalthough the underlying trend remains broadly stable.

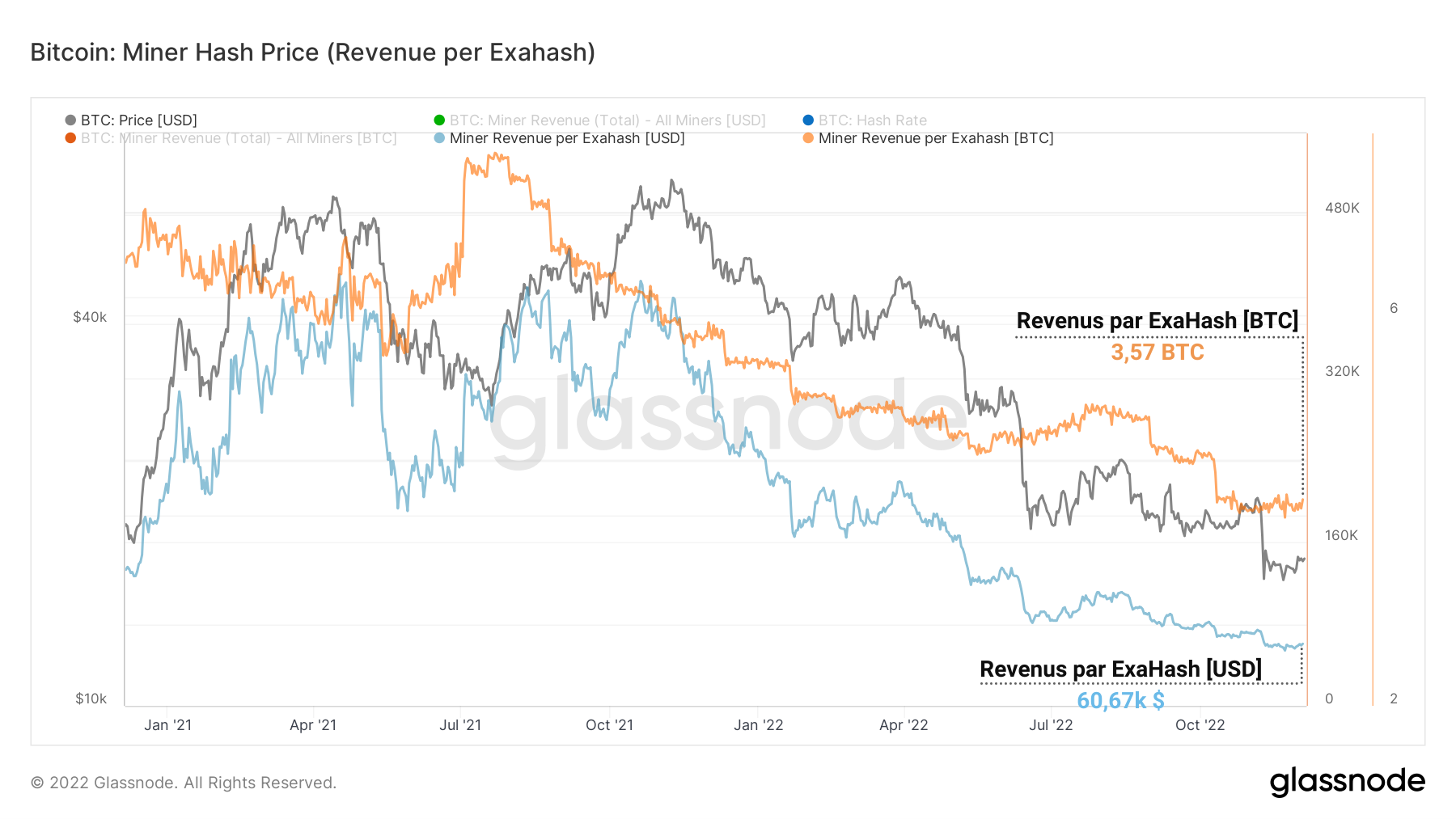

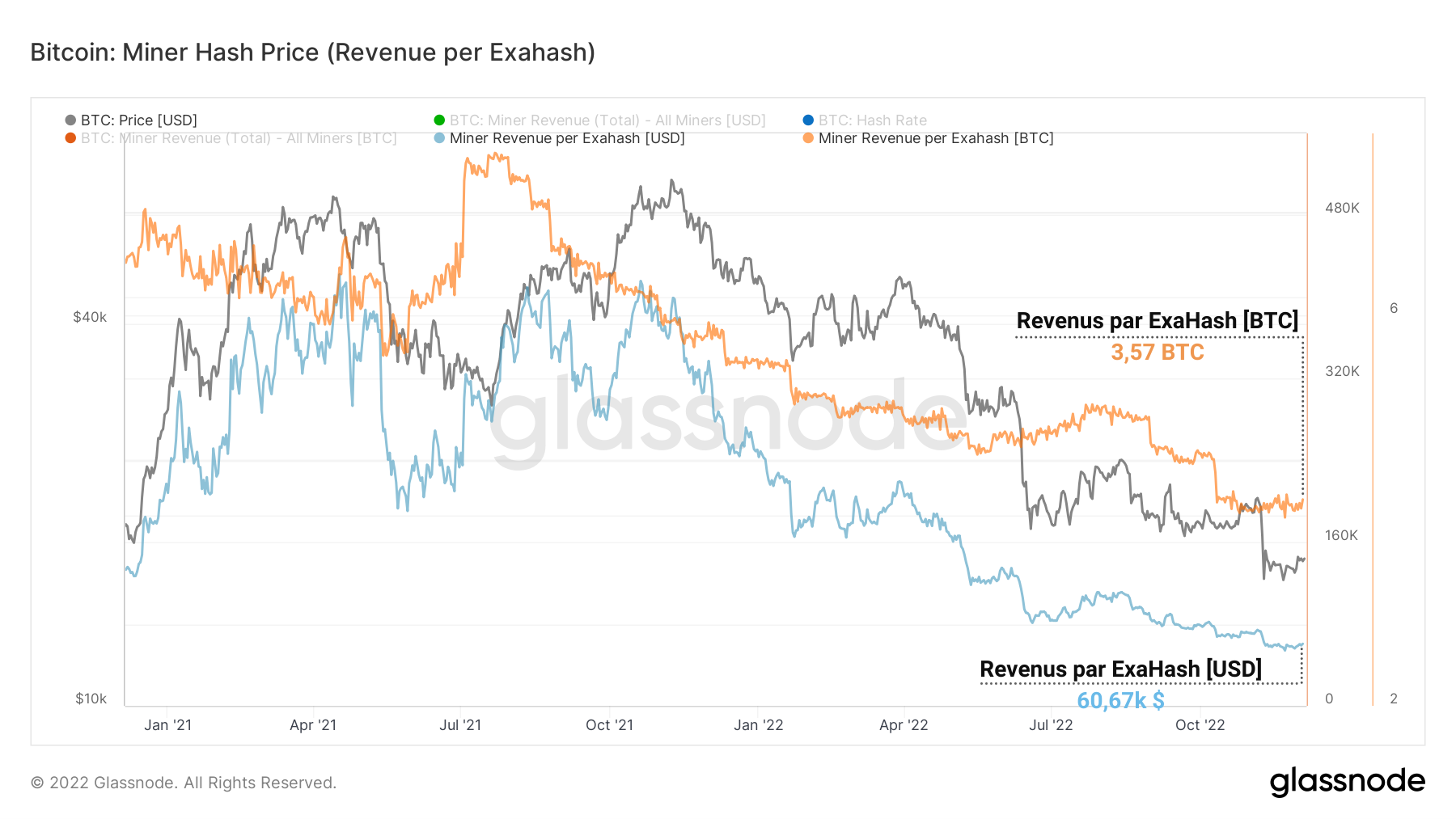

By measuring the revenue of miners based on the amount of ExaHash produced, we can see that their revenue has been dropping significantly since the middle of 2021, both in terms of USD and BTC.

Figure 4: Miner revenue per ExaHash (BTC & USD)

This multi-cyclical downtrend tends to be accentuated during bear markets and the volatile declines in the price of BTC place miners in financial stress difficult to bear.

Currently, if you offer one ExaHash/s to the network for one day, you can withdraw almost 3.5 BTC, or $60,600 at the current price. This is 1.8 times less than it a year ago.

The reference platform to buy and trade more than 600 cryptos

10% off your fees with code ZWUFE2S1

Miners drop ballast

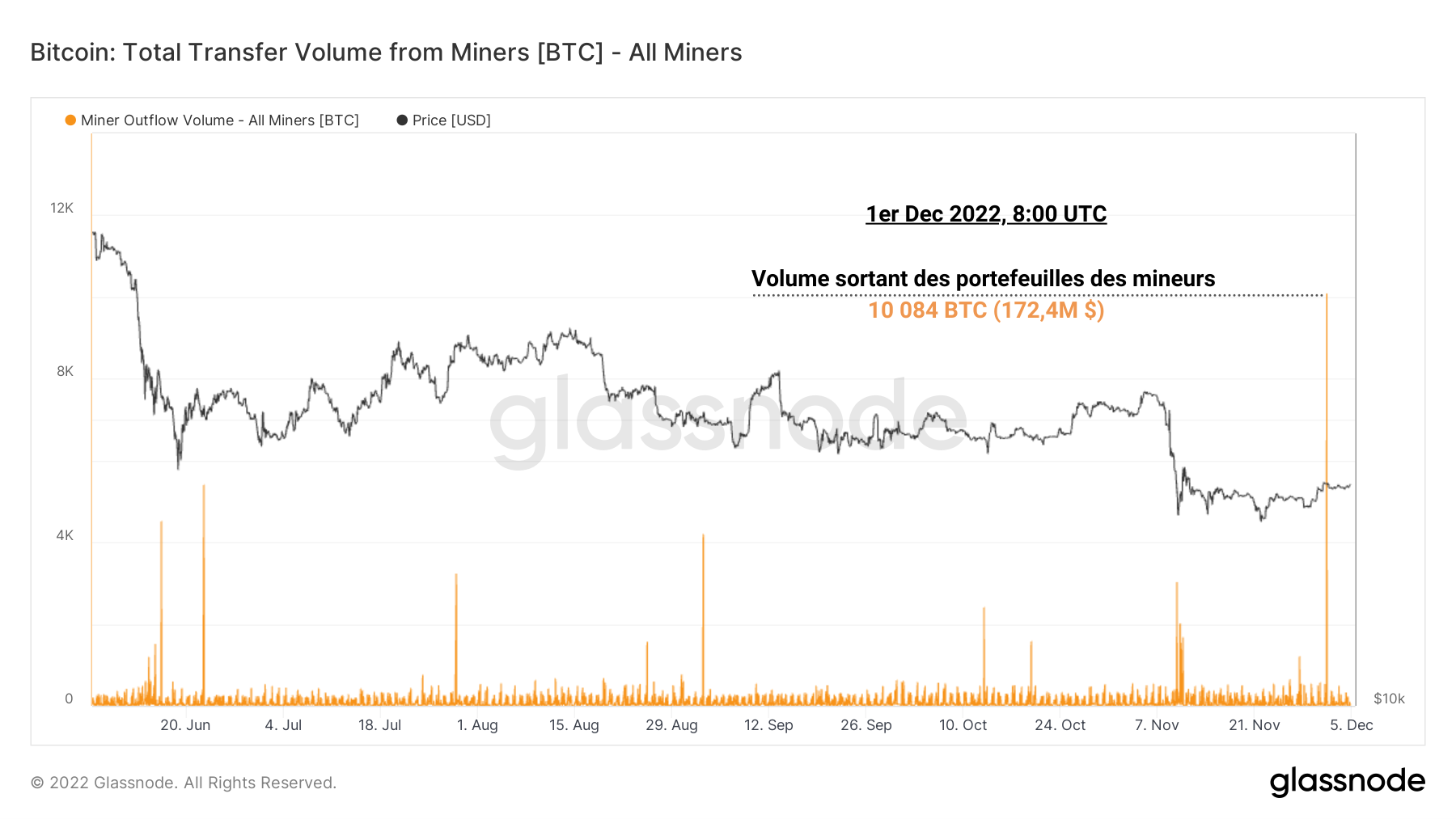

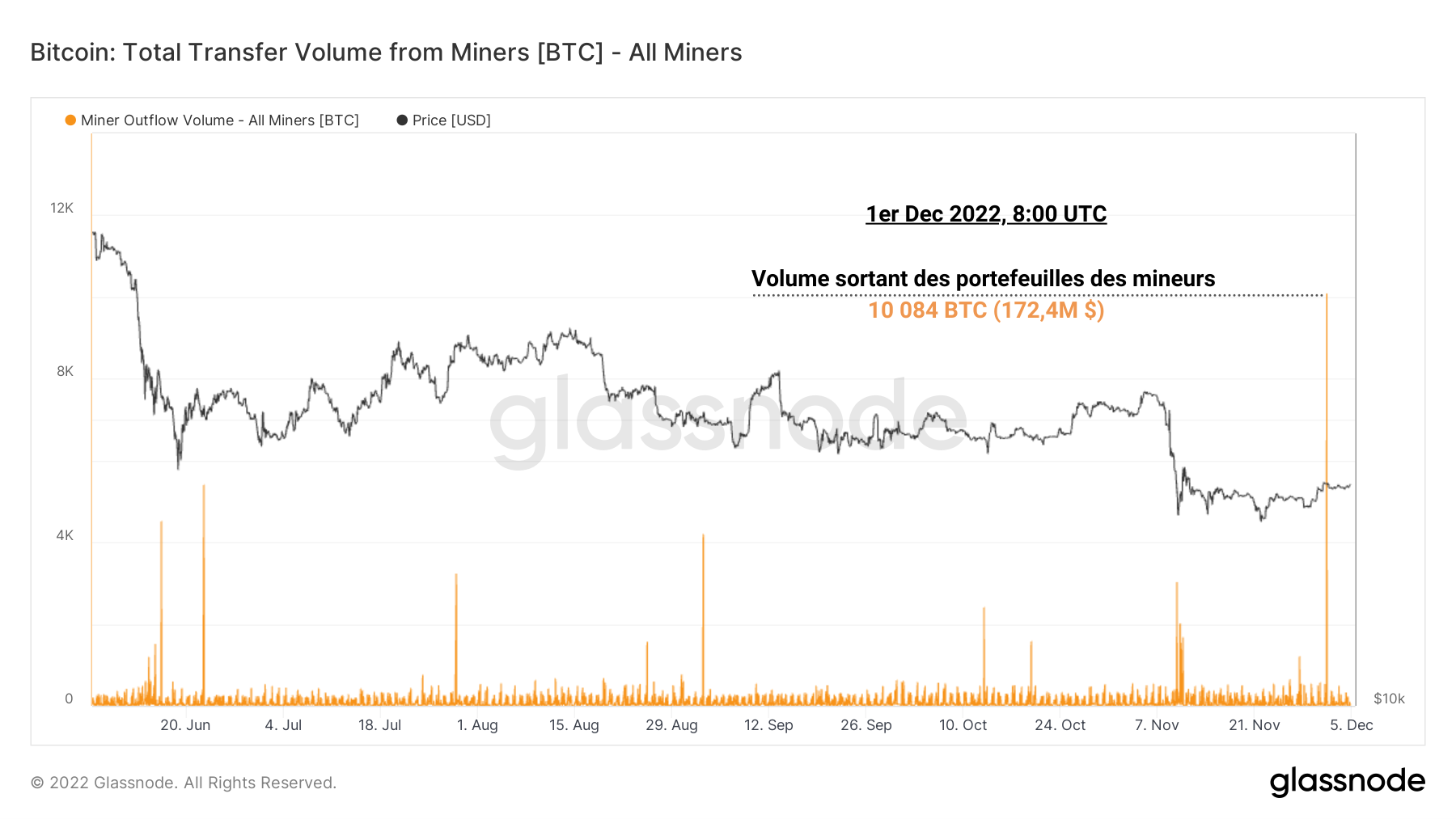

The responses of miners to this adverse context are visible through the flows of wallets associated with this cohort. Here, BTC mined by Satoshi in the early life of Bitcoin have been excluded as they do not participate in the current miner economy, until proven otherwise.

In almost 6 months, the total balance of the miners’ wallets decreased from almost 750,000 BTC to around 722,000 BTCwith two notable load shedding episodes.

While the early November drop appears to be concurrent with the price dropping below $18k, the December 1 drop occurred even as the hashrate began to flow on the network again.

Figure 5: Supply held by miners and daily variation

The latter is also on the same scale in terms of intensity as the fall recorded following the profit taking at the end of 2020, with a peak in daily withdrawals of nearly 10,000 BTC.

It seems that some miners have decided to use some of their cash in response to rising difficulty and falling prices.

Note, however, that it is difficult to accurately measure the sales and simple transfer shares represented by this volume of BTC leaving the wallets of miners.

Figure 6: Outgoing flows from miners’ wallets (BTC)

The December 1st movement was particularly visible, registering an outgoing volume of 10,084 BTC, or nearly $172 million in one hour.

This is the largest pullback of this bearish cycle, even far exceeding all outflow values recorded since 2021 except for the January 2021 profit-taking.

This says a lot about the overall savings/spending dynamics of miners, who have tendency to part with part of their assets when the financial stress reaches the limit of the bearable.

Summary of this on-chain analysis

In sum, this week’s data tells us that miners are placed under considerable financial stresswhich could push the least resilient players to liquidate part of their BTC holdings.

The recent drop in hashrate testified to this stress by signaling thata significant number of ASICs have had their hash power removed (temporarily) from the network.

Studies of earnings in terms of dollars (USD) and bitcoins (BTC) indicate a drastic decrease in miners’ revenuejeopardizing the financial viability of the operations of several entities in the cohort.

Finally, outflows from miners’ wallets show a significant transfer phase (potential sale)with a record withdrawal on December 1.

Prof Chaîne intervenes every week on our Premium Group

Sources – Figures 2 to 6: Glassnode

Newsletter

Receive a summary of crypto news every Monday by email

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky in nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.