In response to concerns over Coinbase’s reserves, BlackRock has filed an amendment requiring Bitcoin withdrawals within 12 hours. The move aims to allay investor concerns and make the process of returning funds more reliable.

Rumors That Put Coinbase in Trouble

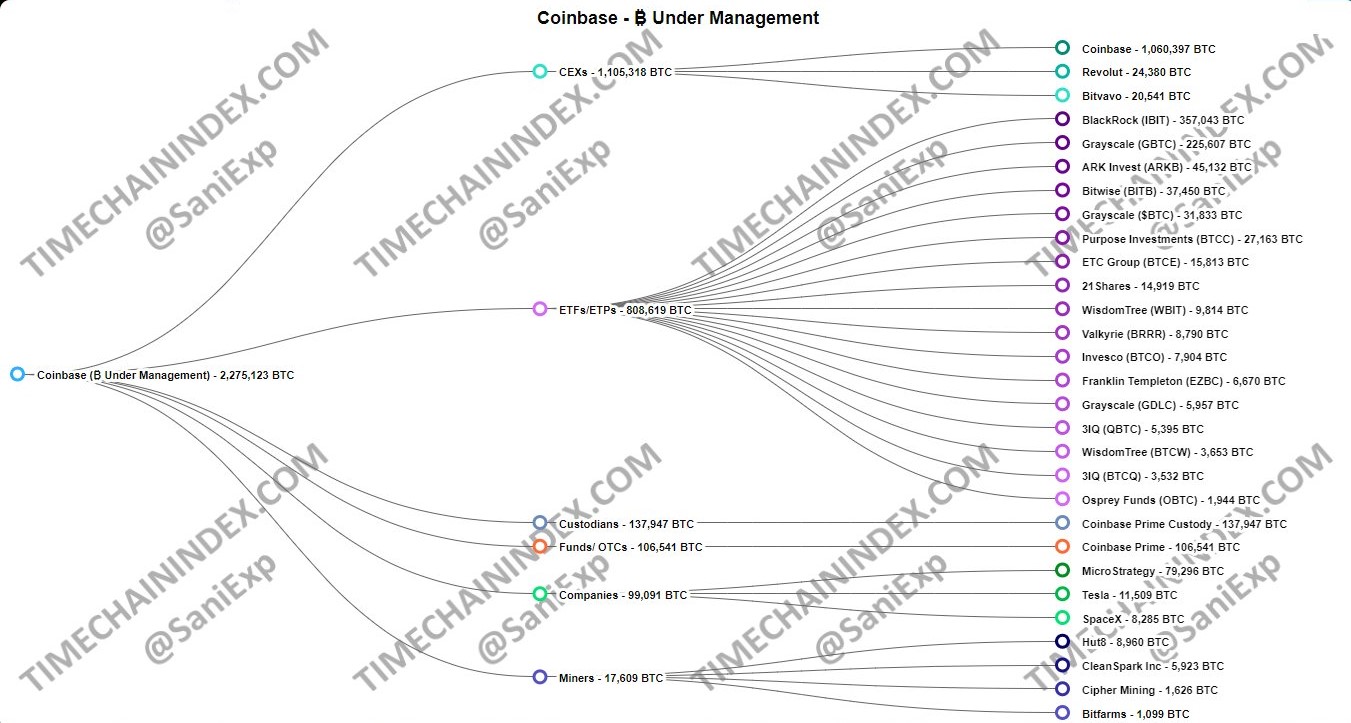

Bitcoin spot ETFs in the US now manage over 930,000 BTC, or nearly $60 billion. This represents a 50% increase in BTC held in these new financial products since the beginning of the year, taking into account that GBTC managed nearly 620,000 BTC before its conversion to a spot ETF.

In addition to the fact that the use of Bitcoin spot ETFs goes against the initial idea of BTC, their concentration, with Coinbase as the main custodian, is a weakness for the ecosystem. In the event of a hack or loss of funds by the platform, this could lead to a significant drop in prices.

📈 Everything you need to know about Bitcoin spot ETFs

A week ago, Rumors began circulating on social media accusing Coinbase of manipulating the price of BitcoinThe accusations, made by a user under the pseudonym Tyler Durden, alleged that Coinbase was issuing IOUs for Bitcoin held on behalf of ETF issuers.

In response to the allegations, Coinbase CEO Brian Armstrong vigorously denied the allegations, noting that the company's accounts are regularly audited by Deloitte. However, some skeptics have countered by comparing the situation to that of Lehman Brothers and FTX, which collapsed despite audits.

Ledger: the best solution to protect your cryptocurrencies 🔒

BlackRock Responds to Rumors About Coinbase Reserves

In response, BlackRock, the world's largest asset manager and responsible for IBIT, the Bitcoin spot ETF with the most BTC under management, recently filed an amendment with the Securities and Exchanges Commission (SEC), requiring that withdrawals of funds be made within 12 hours of the request.

BlackRock's amendment states:

“Subject to confirmation of the minimum balance required above, Coinbase Custody shall process a withdrawal of digital assets from the custody account to a public blockchain address within 12 hours of receiving an instruction from the customer or the customer’s authorized representatives.”

📰 Also read in the news – Largest US custodian bank gets controversial SEC approval for cryptocurrency custody

Today, Coinbase is seen as a “too big to fail” company, managing more than 2 million Bitcoins, or nearly $130 billion, including about $44 billion for issuers of Bitcoin spot ETFs.and holding a total of $270 billion in assets for its retail clients.

Distribution of Bitcoins held by Coinbase

A Coinbase collapse or hack would have far-reaching consequences for the cryptocurrency ecosystem, potentially blocking funds for a long period of time, as was the case with FTX, whose funds are still frozen nearly 2 years later, or Mt. Gox, whose funds only began to be redistributed this year, 10 years later.

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

Source: SEC

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.