Would investors be discouraged by the fall of cryptocurrencies? While companies in the ecosystem multiplied fundraising during the bull run of 2021, the trend seems to have reversed in the year 2022, when the sums raised fell by 42%. What can we learn from this data?

Falling funding compared to 2022

While 2022 was marked by falling prices and the collapse of the biggest players in the cryptocurrency ecosystem, the euphoria of the previous year gave way to greater vigilance and restraint on the part of investors. Indeed, funding fell by 42% between 2021 and 2022, from $37 billion to $21 billion.

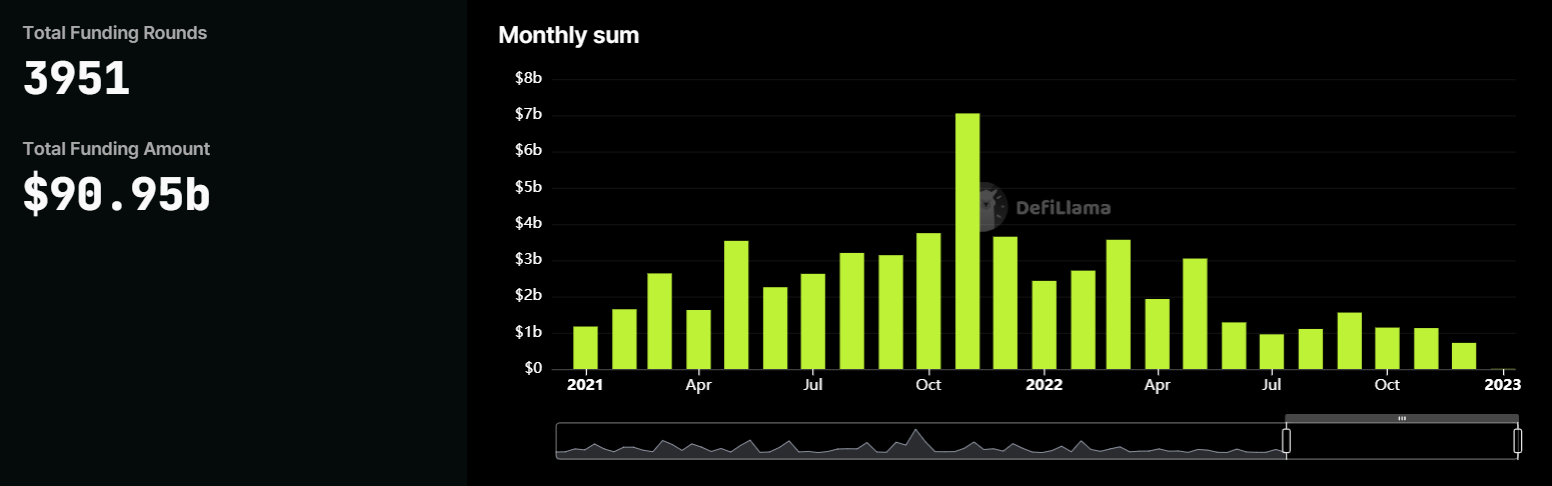

This information, from the data aggregator DeFiLlama, shows us that a strong correlation exists between the price of Bitcoin (BTC) and the sums collected during the various rounds.

Thus, in the last quarter of 2021, when the Bitcoin price touched $68,000, the amounts of money obtained by companies were at their highest. : more than 17 billion dollars had been raised in the last three months of 2021, i.e. the equivalent of 4/5 of the 21 billion dollars raised during the whole of 2022.

Figure 1 – Monthly funding in the cryptocurrency sector between 2021 and 2022

Still following this correlation, we can note the slow drop in funding between the first and last quarter of 2022, from $8.7 billion to $3 billion respectively. At the same time, the price of Bitcoin fell from $47,000 to $16,000: investor interest therefore follows the performance of the queen of cryptocurrencies.

👉 How to buy Bitcoin in 2023: follow our guide

The No. 1 exchange in the world – Regulated in France

10% off your fees with code SVULQ98B 🔥

Investments don’t know the crypto winter

Despite the fall in prices and the pessimistic rhetoric that resulted from it, investors are far from having abandoned ship. Referring to amounts raised in the previous cryptocurrency market cycle, we notice a significant difference between the investments made following the bull market of 2017-2018, and those made in 2022 :

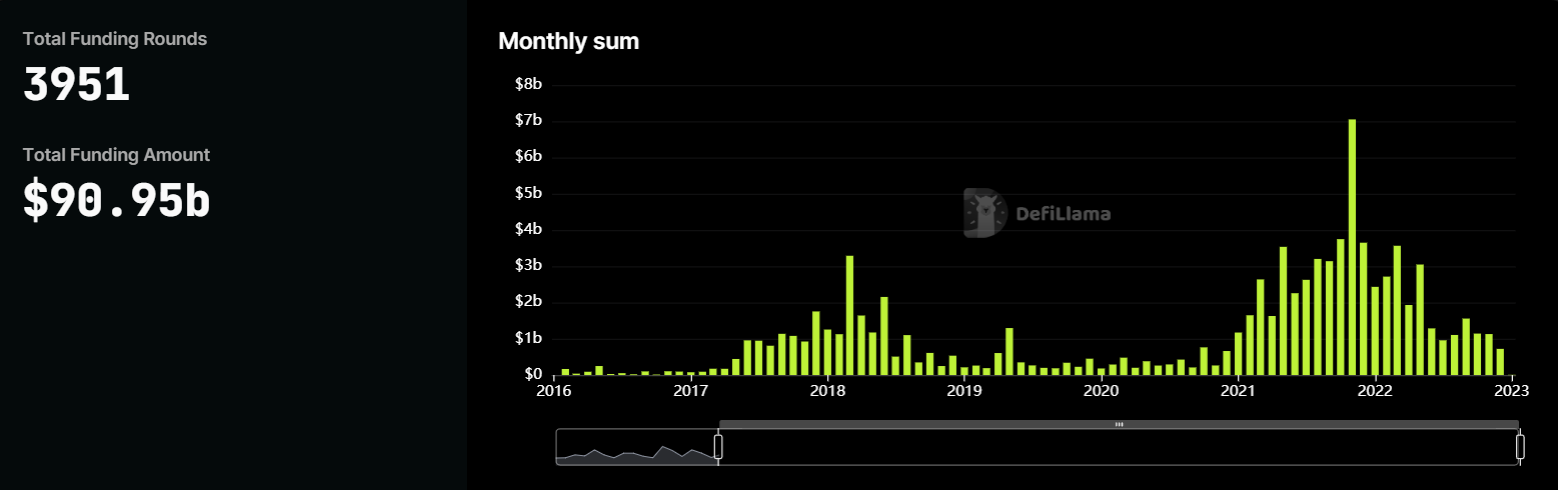

Figure 2 – Monthly funding in the cryptocurrency sector between 2021 and 2022

During the previous cycle, after reaching a total of 3.3 billion dollars raised in March 2018 aloneinvestments declined until March 2019, when only $190 million had been raised.

Regarding the current cycle, while the funding record stands at 7 billion dollars for the month of November 2021fundraising gradually reduced over the following year: in November 2022, fundraising had accumulated $1.13 billion.

Furthermore, despite the cryptocurrency market capitalization increasing from $3 trillion to $800 billion, the financing carried out in 2022 remains well above that of previous years, 2018 included. Now, it remains to be seen whether investors will still be there in 2023.

👉 To know the evolution of Bitcoin during an economic recession

Progress in the world of cryptocurrencies with Cryptoast experts 📘

Source: Figure 1 and 2 – DeFiLlama

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.