Binance has suffered a media turmoil in recent days, amid a legal investigation and suspicions of insolvency. While the publication of the exchange’s reserve proof did not meet with unanimous approval, the firm CryptoQuant carried out its own analysis: the behavior of Binance’s reserve has nothing abnormal or in common with that from FTX in the past.

CryptoQuant takes a look at Binance

Blockchain data analytics firm CryptoQuant has released a report analyzing Binance’s proof of reserve audit done last week. As a reminder, this had been supported by the firm Mazars and had been questioned by many players in the ecosystem.

What does Binance’s Proof of Reserve (PoR) report tell us from an on-chain perspective?

A short thread 👇@binance @cz_binance pic.twitter.com/2vAoOmFb63

— CryptoQuant.com (@cryptoquant_com) December 15, 2022

To anyone wondering whether to trust Binance’s proof reserve or not, CryptoQuant simply replies: no need, since all information is available in the blockchain. Concretely, the audit of the exchange was carried out on November 22, 2022, at 11:59 p.m. That corresponds to block 764327 of the Bitcoin blockchain.

At that time, CryptoQuant indicators estimated that Binance’s bitcoin reserves were 591,939 BTC. In comparison, the Mazars audit report indicated 597,602 BTC. This therefore means that CryptoQuant’s measurement strategy 99% valid audit data:

“The report shows that Binance’s BTC liabilities (customer deposits) are 97% backed by the exchange’s assets. Collateralization increases to 101% when BTC lent to customers is counted. »

👉 To go further – How to buy Bitcoin in 2022? Get guided step by step

The platform that simplifies trading

Buy crypto in minutes

Binance has nothing to do with FTX

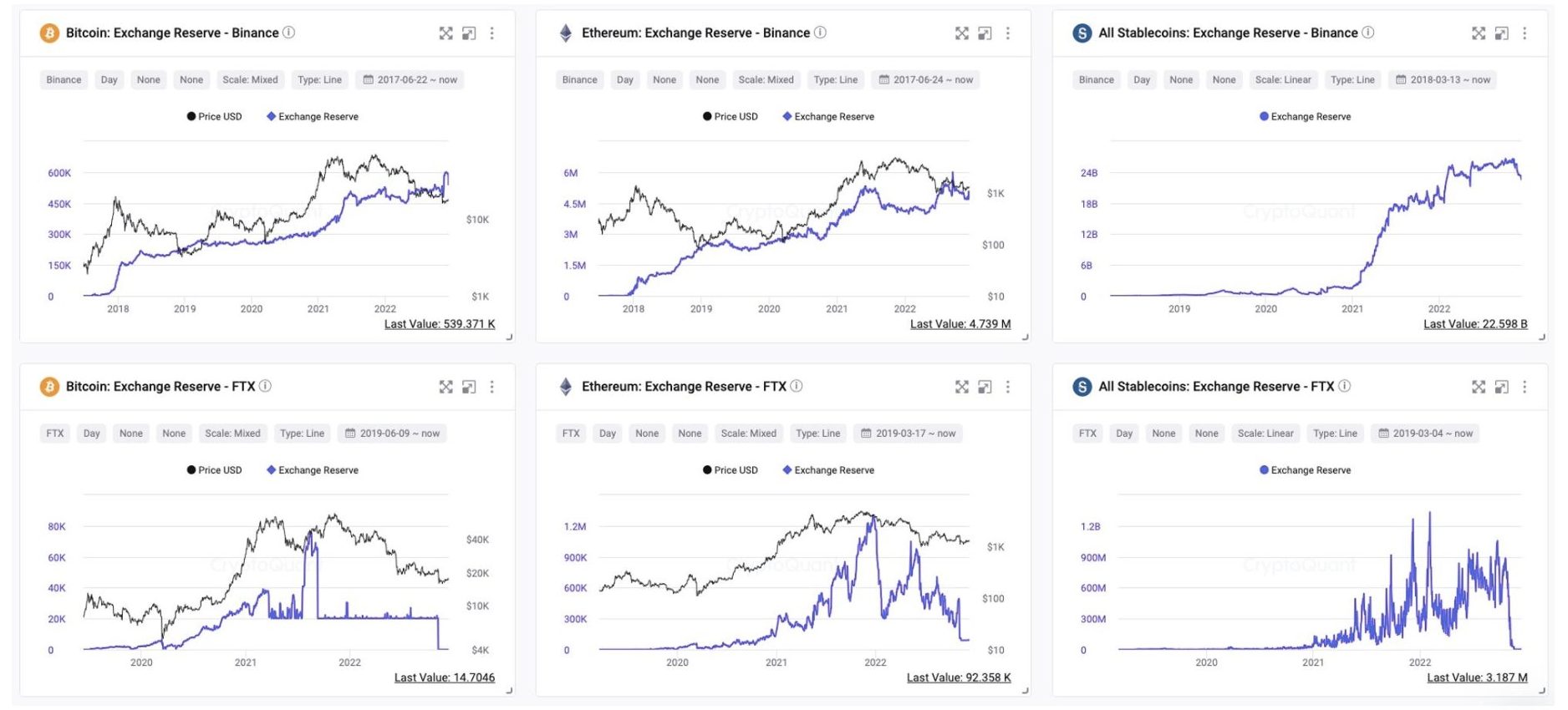

In addition, the analysis firm looked at Ether (ETH) and stablecoins. As evidenced by the graphs below, Binance reserves do not show abnormal behavior. At least, they have nothing to do with those of FTX, whose manipulations are one of the reasons for the collapse.

Comparison of Binance and FTX Reserves

Finally, CryptoQuant analyzed an important piece of data: the proportion of the native token of its own platform in its reserves. As a reminder, it is partly because of its overexposure to its own token, the FTT, that FTX precipitated its fall. At this game, Binance is doing pretty well with a health indicator of 89% :

Comparison of the health indicators of the main exchanges

Concretely, this means that Binance holds just over 10% of its cash in Binance Coin (BNB), its own token. Of $60.4 billion in assets, around 6.2 billion are in BNB. This figure is considered as “acceptable” by CryptoQuant.

👉 Find our complete tutorial on Binance, the world’s leading crypto platform

The No. 1 exchange in the world – Regulated in France

10% off your fees with code SVULQ98B 🔥

An audit that reassures Binance

Following the fall of FTX, centralized exchanges were forced to comply with an audit to ensure that their reserves match customer funds. This is the case of Binance, whose expertise revealed that the number of Bitcoin (BTC) held is higher than estimated: it is 101% over-collateralised.

However, these disproportionate figures were not enough to reassure customers. In addition, many major and recognized players in our ecosystem questioned the audit processjudging that the procedure was agreed in advance and that it is not a thorough and complete study.

After the strange timing chosen by Reuters to reveal exclusive content on the judicial investigation around Binance, the FUD continued with a questioning of the solvency of the platform and its audit. This new CryptoQuant study comes to calm the storm as the entire cryptocurrency market retreats on Friday, December 16.

Update: the Mazars platform, recognized throughout the world for its tax expertise, has announced that it will cease all activities with cryptocurrency exchange platforms this Friday, December 16.

👉 On the same topic – Binance audit: the Bitcoin (BTC) held by the platform is over-collateralized

Progress in the world of cryptocurrencies with Cryptoast experts 📘

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky in nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.