Do you want to invest in gold using the blockchain? There are tokenized gold solutions that can have advantages over traditional investment solutions. Let’s review different methods for gaining exposure to the price of gold via cryptocurrencies.

In financial markets, gold is often referred to as the safe haven par excellence. Indeed, if the adage that “past performance is not indicative of future performanceis to be kept in mind, the precious metal tends to outperform so-called “risky” asset classes during difficult economic times.

As a result, whether in physical form or through exchange-traded funds (ETFs), gold is an investment tool regularly chosen by some investors to diversify their portfolio. The means of exposing oneself to the course of this metal are varied, and blockchain is one way to do this.

To expose yourself to the price of gold, several possibilities are available to you, although we will tend to favor solutions related to the cryptocurrency ecosystem in this article. Nevertheless, people wishing to favor physical gold can turn to the services of GOLD AVENUE.

👉 Consolidate your savings by mixing gold and Bitcoin (BTC) with GOLD AVENUE

So when it comes to tokenized gold on the blockchain, one cryptocurrency stands out: the PAXG of Paxos. This stablecoin is notably available on the Binance platform.

Discover Binance

10% off your fees with code SVULQ98B 🔥

PAXG is a stablecoin designed to follow the price of gold. Thus, it implies that the tokens issued on the blockchain are collateralized by physical gold. The advantage of the blockchain is that it helps reduce costs for the end investor: there are no gold storage costs, for example. In addition, it allows for quick resale when needed.

Although there are other gold-backed stablecoins, it is better to give preference to the PAXG of Paxosbecause this company is more transparent than others about its reserves.

The Bitpanda platform also offers a digital gold solution collateralized with physical gold, however users will not be able to withdraw this asset to an external wallet. The table below presents a summary view of the different possibilities mentioned:

| Product | kind of gold | Costs | Platform |

| PAXG of Paxos | Stablecoin | 0.02% on the PAXG/USDT pair + fees for blockchain withdrawals and USDT account funding | Binance |

| Bitpanda | digital gold | 0.5% on purchase, 1% on sale, and 0.0125% per week for insurance over 20g (1 token = 1g) | Bitpanda |

| GOLD AVENUE | physical gold | Variable costs according to each product and storage costs above 10,000 euros | GOLD AVENUE |

Paxos’ PAXG: a stablecoin collateralized by physical gold

Introducing the Paxos PAXG

The Paxos PAXG is probably the most transparent tokenized gold solution on the blockchain today. Fully collateralized with physical gold at a one-to-one ratio, this stablecoin is the largest capitalization in its category at the time of writing, at over $485 million.

For each PAXG token, one ounce of gold, i.e. a unit of measurement of 31.1 gis stored in vaults of the London Bullion Market Association (LBMA), a globally recognized institution for over-the-counter gold trading.

For its part, Paxos is a company regulated by the New York State Department of Financial Services. In the event of a possible bankruptcy of the company, the funds of these are quite distinct from the assets of the customerswhich protects them even against this eventuality.

Each month, the Paxos gold reserves linked to the PAXG tokens are certified by the firm Withum. To date, PAXGs are only issued on the Ethereum blockchain.

How to buy PAXG with Binance?

Tokens or fractional PAXG tokens can be purchased on Binance through the PAXG/USDT pair.

First is having a verified Binance account.

👉 How to create an account on Binance?

Discover Binance

10% off your fees with code SVULQ98B 🔥

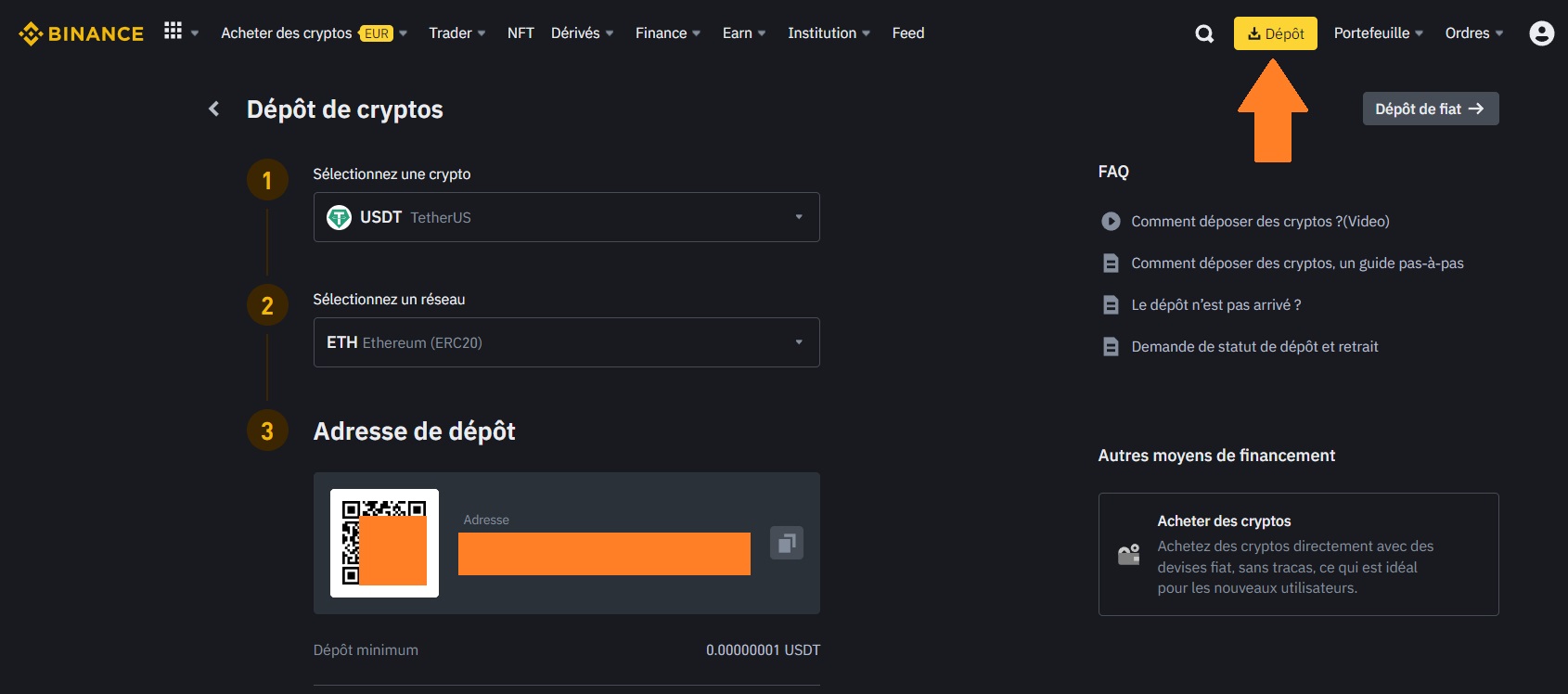

Then one must either have an account funded with USDT or acquire some, for example by depositing USDT from an address outside of Binance. To do this, you will need to click on “Deposit”, and select the stablecoin and the network from which to fund your Binance account:

Figure 1 — Depositing USDT on Binance

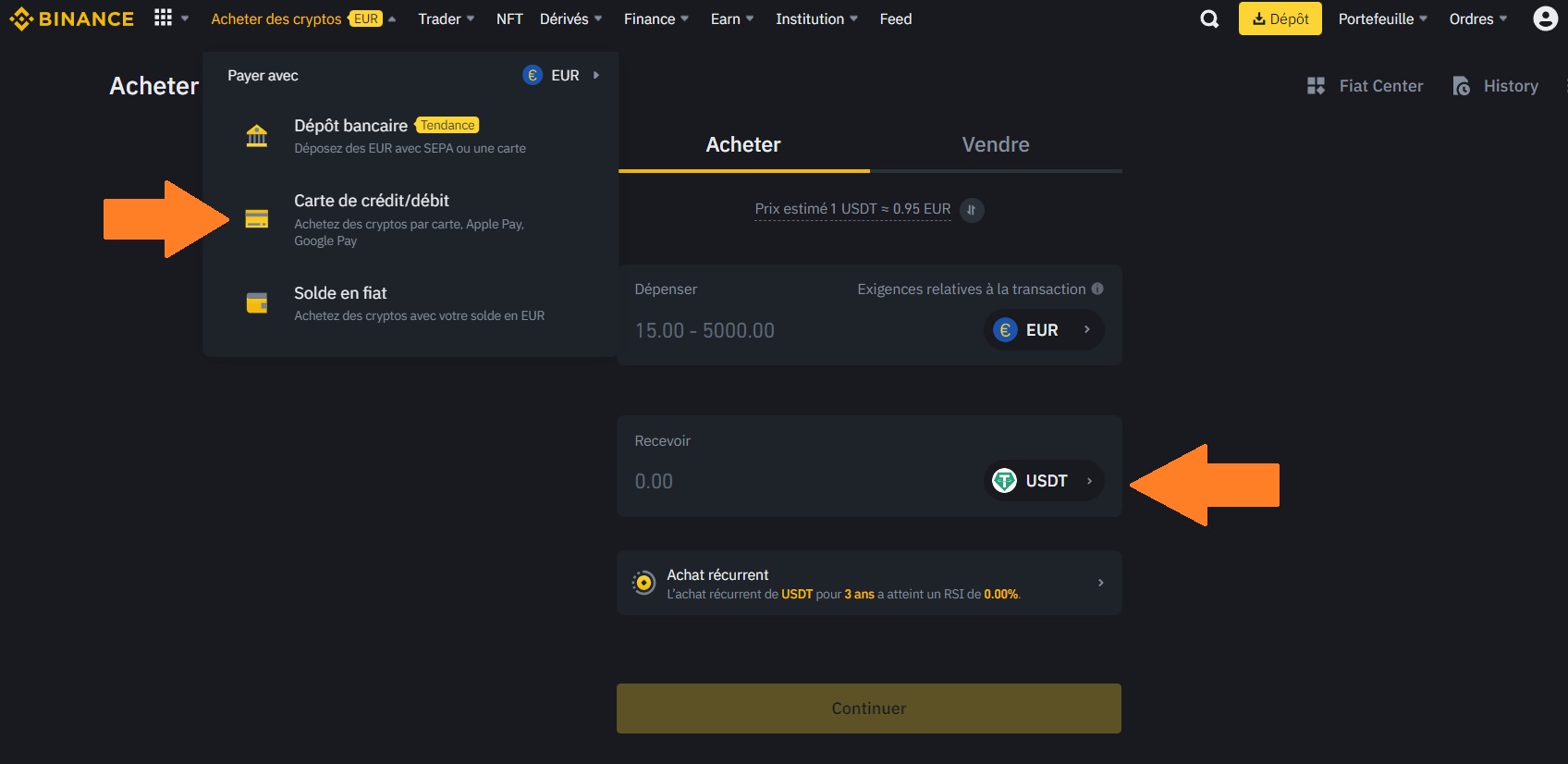

It is also possible to buy USDT directly with euros. The example below shows how to do it by credit card, but the SEPA transfer is also a possibility:

Figure 2 — Buying USDT by credit card on Binance

Afterwards, it will be necessary to exchange these USDT against PAXG. Note that the procedure described below is also valid for exchanging another cryptocurrency for USDT beforehand.

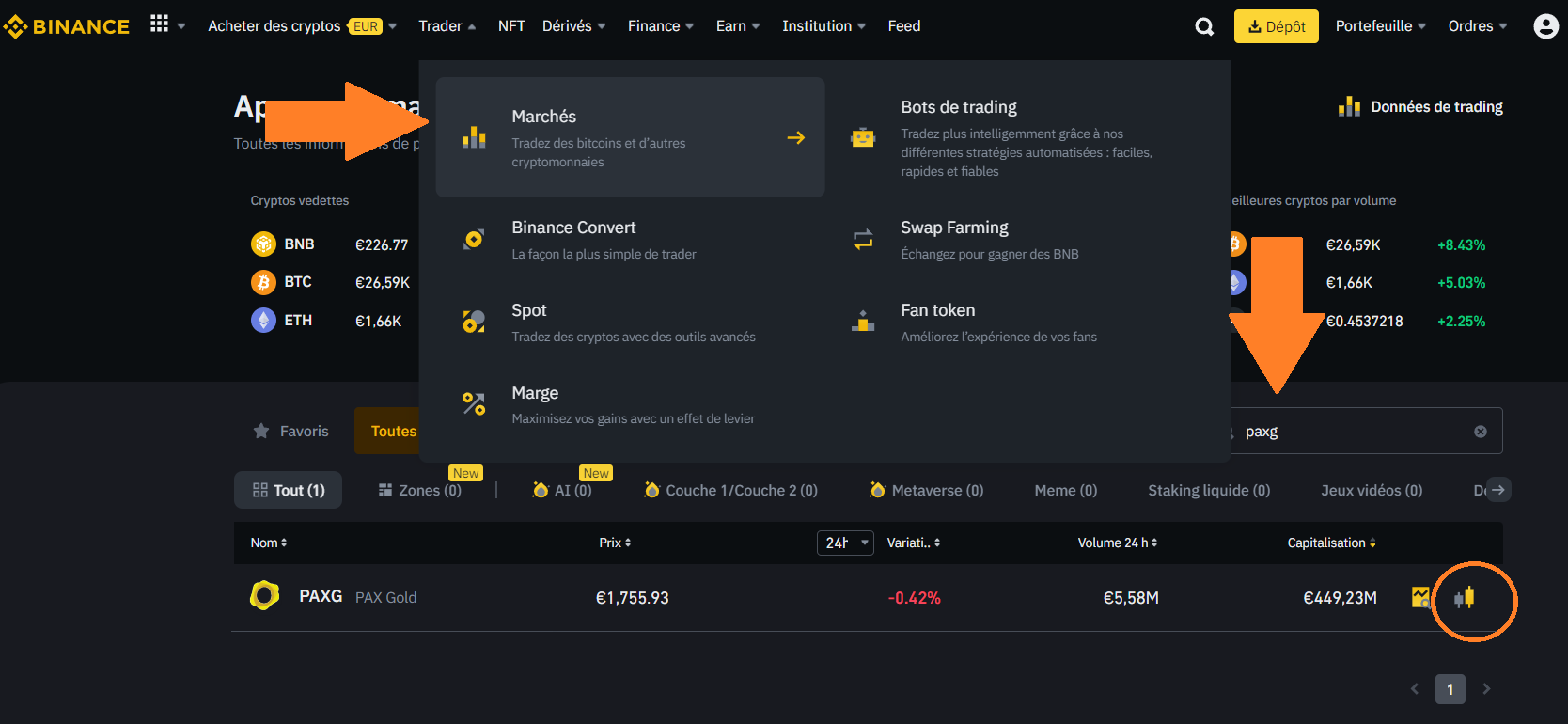

To acquire PAXG, you must go to the top menu and click on “Markets”, a button found in “Trader”. Once on the page, enter “PAXG” in the search box then click on the small Japanese candlestick symbol to go to the trading interface:

Figure 3 — Buying PAXG on Binance

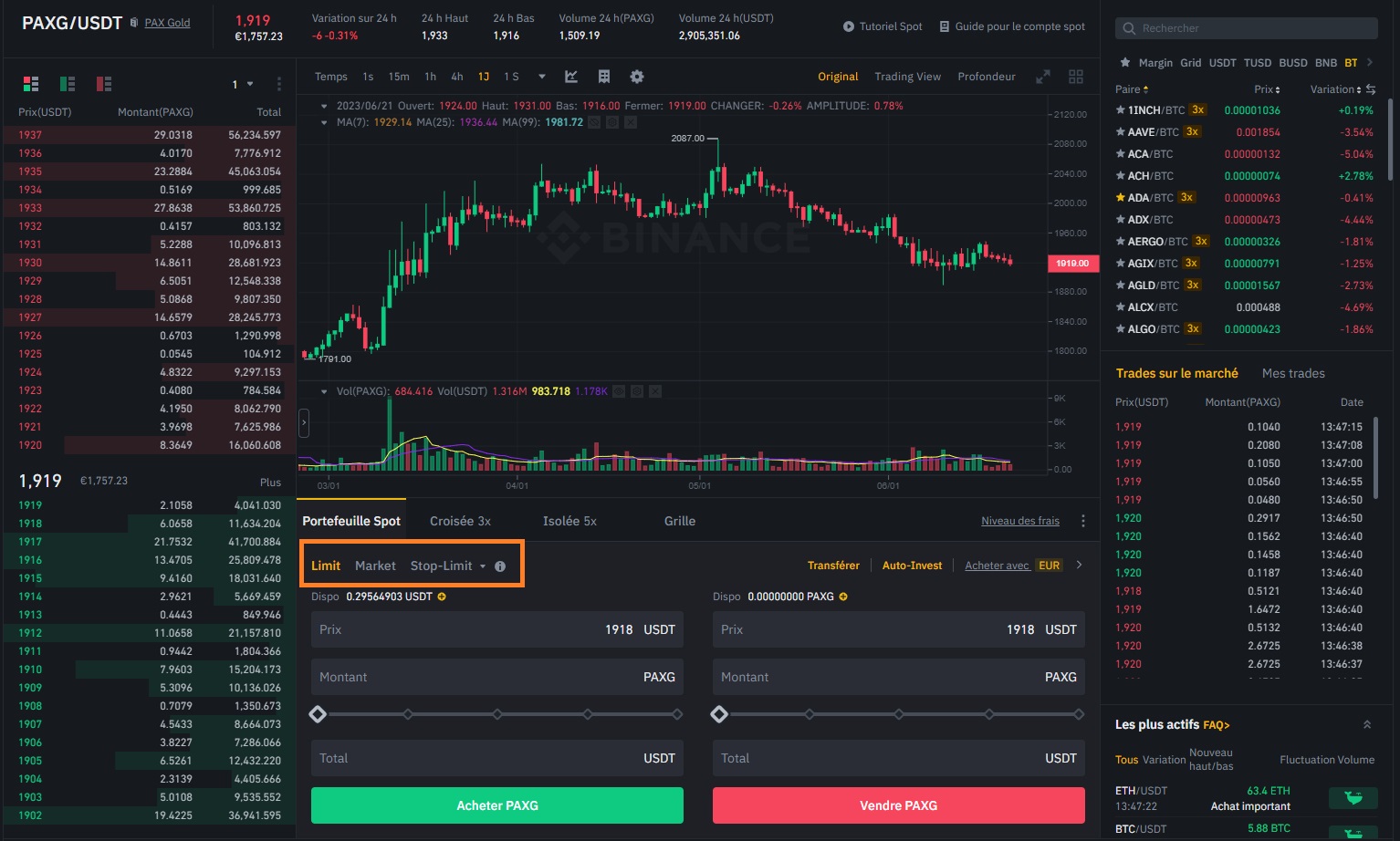

Once this is done, you can select the buy order of your choice, as shown in the orange box, in order to buy the quantity of PAXG desired :

Figure 4 — PAXG trading interface

On a smartphone, the steps of the 2 previous screenshots are even simpler, because it will only be a question of searching for “PAXG” in the search box at the top of your application, to be redirected to the trading interface.

Discover Binance

10% off your fees with code SVULQ98B 🔥

Other exchanges to buy PAXG

The gold stablecoin PAXG is also present on other platforms than Binance.

For example, it is also listed on Crypto.com, which is the 2nd platform holder of the PSAN registration. For people who prefer to buy it decentralized, PAXG is present on the decentralized exchange (DEX) Uniswap on the Ethereum (ETH) blockchain.

In addition, the fees, ease of handling and available liquidity will be specific to each of the different methods presented.

Confused and overwhelmed by cryptocurrencies? 🤔

Spot opportunities and make informed investment decisions 🔎

FAQ – Frequently asked questions about the PAXG gold stablecoin

Where to take the PAXG course?

You can follow the price of the asset on services like CoinGecko or CoinMarketCap, but also directly from our website.

How to Control Paxos Reserves

The issuer of this gold-pegged stablecoin publishes transparency information on its own website. Among this information, you can find the quantities issued as well as the monthly certificatesFor example.

How to secure your PAXGs?

In order to guard against the risks of hacks or bankruptcies of the centralized platforms on which you will buy your tokenized gold on the blockchain, the use of a hardware wallet like those of the Ledger brand is recommended. So you can withdraw your PAXG to a secure external wallet to keep them for the long term.

The best way to secure your cryptocurrencies?

? Buy, trade, grow and manage over 5,500 cryptos

Which wallets support PAXG?

The PAXG being exclusively present on the Ethereum blockchain (ETH) to date, any wallet compatible with the Ethereum Virtual Machine (EVM) can be used to pair a hardware wallet and withdraw your tokenized gold. This includes wallets like MetaMask, Frame, Phantom, XDEFI or Trust Wallet for example.

👉Find our complete tutorial on the MetaMask wallet

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.