Canada’s property and casualty insurers are starting to discuss a ‘Plan B’ for an earthquake backstop, given the federal government’s slow progress on establishing a national flood insurance program.

Insurance Bureau of Canada president and CEO Celyeste Power talked about the urgent need for an earthquake backstop at the IBC’s Financial Affairs Symposium last Wednesday. She raised the matter after the federal government’s 2024 budget committed $15 million towards establishing a subsidiary company at the Canada Mortgage and Housing Corporation, a government agency that would be responsible for administering the proposed national flood insurance program.

The P&C insurance industry, including IBC, has widely commented that the $15-million is not enough. And the 2024 budget announcement has insurers starting to think about alternate strategies for a quake backstop.

“So last year, in the 2023 budget that announced the national flood insurance program, the federal government also committed to undertake work on following that up with earthquake resolution,” Power said at the symposium, one day after the federal government released its 2024 budget. “And so our strategy was, ‘Okay, well, let’s focus on getting the national flood insurance program up and running, and then be ready to expand that out — while [requiring] very different mechanisms for what is needed — to the earthquake risk as well.

“Obviously, given we’re not quite in the place we hoped to be today after the federal budget…that makes me nervous that we’re pushing the earthquake piece off a little further. So the team [at IBC] is meeting on May 1.

“We’re going to re-strategize, because earthquake risk is a significant risk for our country, for our customers, and for our industry. And so we have to look at ways that we can make sure that we have the right resolution in place.”

Related: Where the feds stand with an earthquake backstop

The 2023 federal budget earmarked $31.7 million for a government flood backstop and hinted a quake backstop could follow the same model. “In parallel, the Department of Finance and Public Safety Canada will engage with industry on solutions to earthquake insurance and other evolving climate-related insurance market challenges,” the 2023 budget said.

Power didn’t elaborate on what kinds of options might discussed at the team meeting, or what an alternate quake backstop might look like. But she did note Peter Routledge, superintendent of the Office of the Superintendent of Financial Institutions (OSFI), Canada’s solvency regulator, agrees with the industry that some sort of federal backstop is required for earthquake.

Canada’s P&C insurance industry has conducted several studies of what kind of insured damage to expect if a major earthquake happened in Canada.

For example, a 2016 research study by Property and Casualty Insurance Compensation Corporation (PACICC) — which provides claims funds for policyholders in the event an insurer goes bankrupt — says Canada’s P&C industry would face a systemic risk of “contagious” insurer insolvencies if a Canadian earthquake causes more than $35 billion of insured damage.

And in 2019, a study by the Institute for Catastrophic Loss Reduction (ICLR) said a severe earthquake in the Montreal area could cause between $10 billion and $30 billion in economic losses from fire damage. “This loss would be virtually fully insured and would have a very significant impact on the Canadian insurance industry,” said the ICLR report.

“Fire losses would come on top of shaking and other losses, which would be insured to a lesser extent. A leading global reinsurer has stated that losses of this magnitude would likely result in failure of some insurers, would entail secondary and contingent losses, and could conceivably lead to financial contagion.”

It is estimated the Canadian P&C insurance industry has a total of $50 billion in capital to cover all claims of all types in Canada, including auto, home and business insurance.

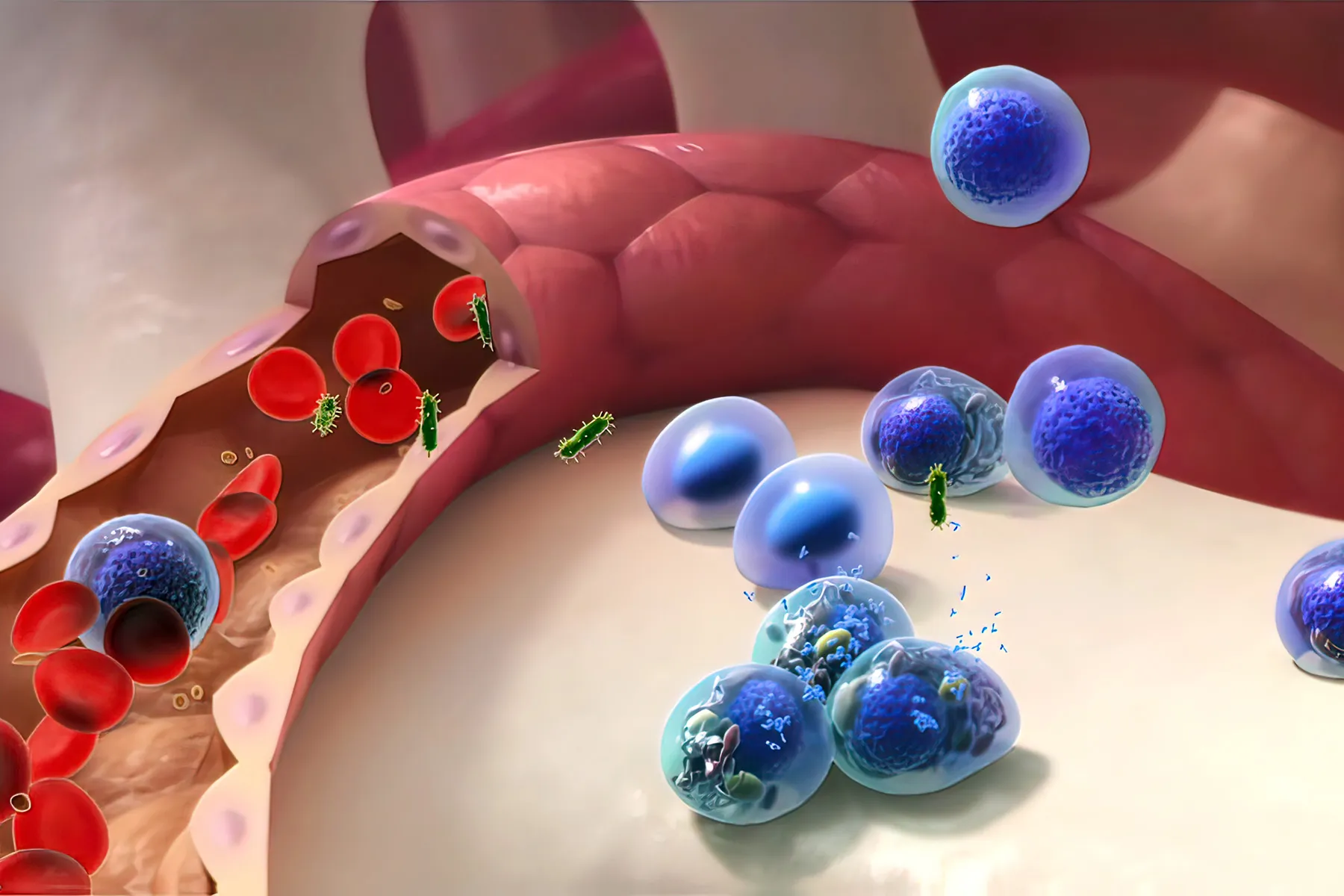

Feature image courtesy of iStock.com/SteveCollender